Table of Contents

- Introduction

- Editor’s Choice

- Sports Tourism Market Overview

- History of Sports Tourism

- Global Sports Participation Statistics

- Sports Tourism Related Travel Volume Statistics

- Sports Tourism Events Statistics

- Sports Tourism Spending Statistics

- Sports Tourism Funding Statistics

- Economic Impact of the Sports Tourism Sector Statistics

- Regulations for Sports Tourism Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Sports Tourism Statistics: Sports tourism, is a vibrant segment of the global tourism industry. Revolves around travel for both participating in and spectating sports events.

Major international tournaments like the Olympics and FIFA World Cup attract millions annually. Stimulating local economies through spending on accommodation, dining, and leisure activities.

Beyond spectatorship, participants engage in activities such as training camps, marathons, and adventure sports, contributing to destination appeal.

The sector’s growth is bolstered by digital engagement, health and wellness trends, and sustainability initiatives aimed at enhancing event experiences and environmental responsibility.

Despite challenges like infrastructure demands and seasonal fluctuations, sports tourism is poised for continued expansion. Driven by global sports enthusiasm and evolving travel preferences.

Editor’s Choice

- The global sports tourism market revenue reached USD 598.0 billion in 2023.

- By 2032, the market is projected to reach USD 2,327.0 billion, with football/soccer contributing USD 884.3 billion, and cricket USD 558.5 billion. Motorsport USD 325.8 billion, tennis USD 302.5 billion, and other sports USD 256.0 billion.

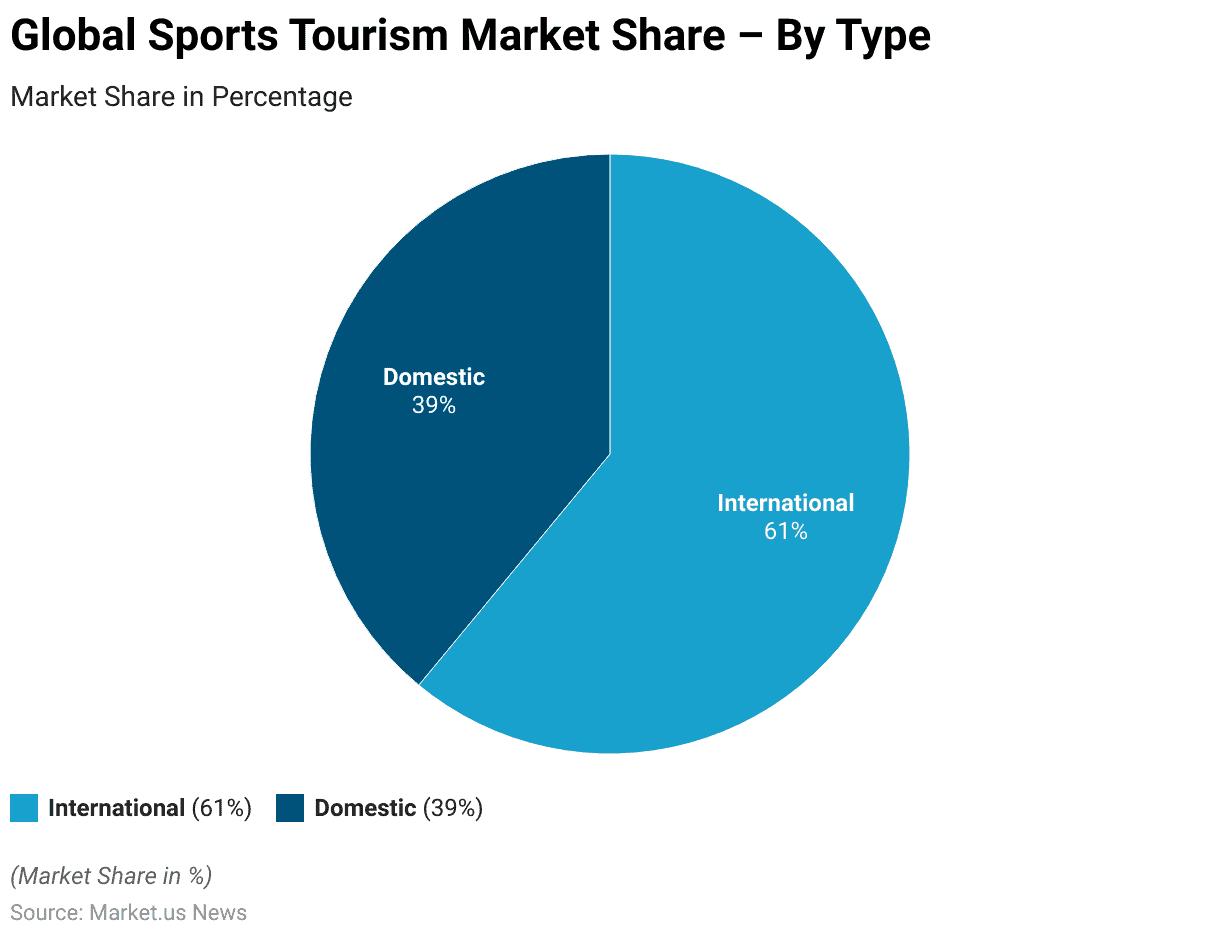

- A significant division between international and domestic segments characterizes the sports tourism market. International sports tourism holds a predominant market share, accounting for 61% of the total market.

- Norway leads with a Bloomberg Health Index of 89.09, an impressive 83.9% of the population practicing sports, and 10.31 medals per 100,000 people. Resulting in a high overall score of 90.3. Football (soccer) is the most popular sport.

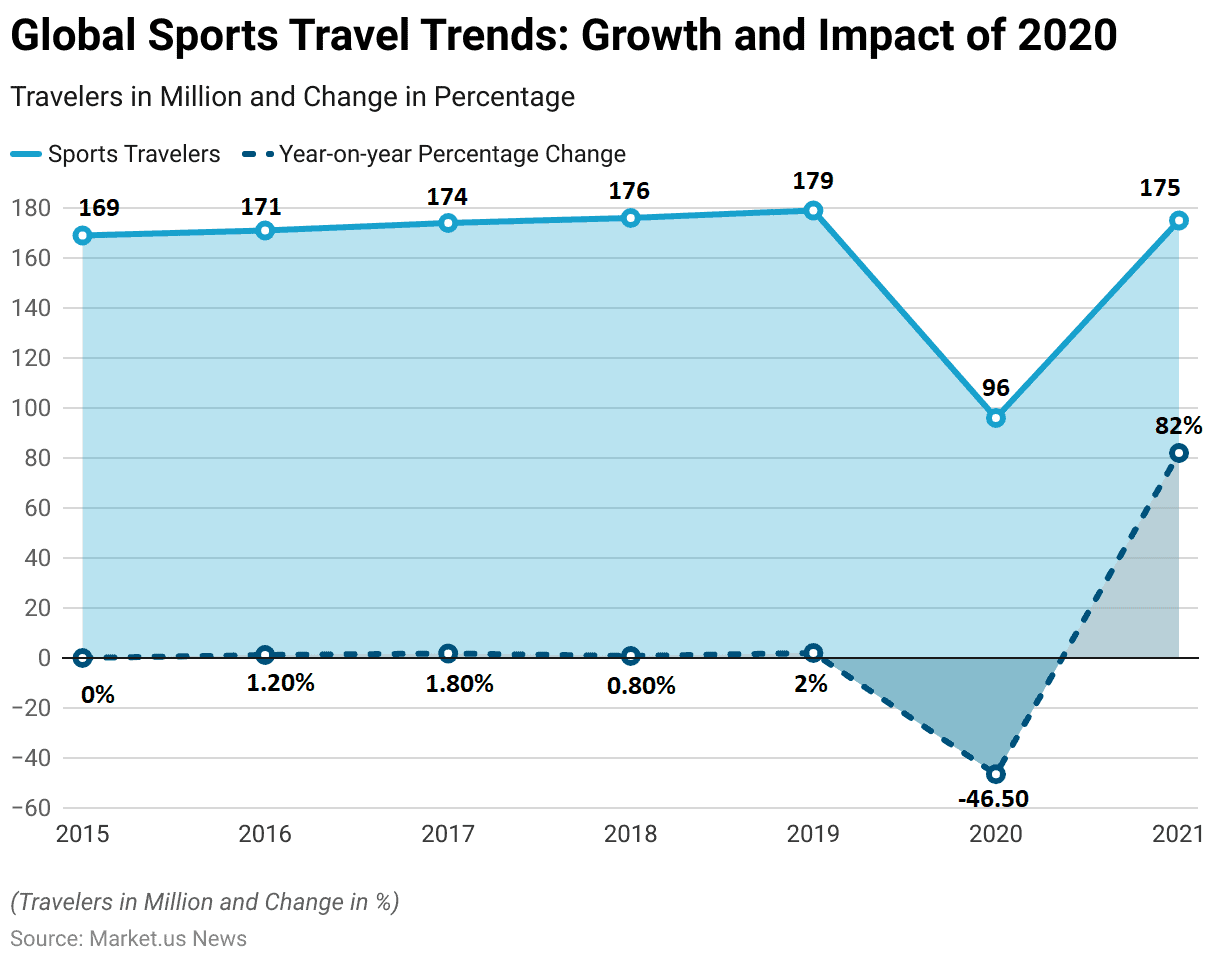

- The global sports travel industry exhibited a steady increase in the number of sports travelers from 2015 to 2019 before experiencing a dramatic decline in 2020 and a subsequent rebound in 2021.

- In 2021, a diverse range of sports tourism events were hosted across various destinations, reflecting the industry’s broad appeal. Youth events were the most prevalent, with 97% of destinations hosting such events, highlighting the strong focus on engaging younger athletes.

- The sports tourism sector’s direct expenditure of $39.7 billion leads to $22.0 billion in indirect spending and $30.1 billion in induced spending. resulting in a total economic impact of $91.8 billion.

Sports Tourism Market Overview

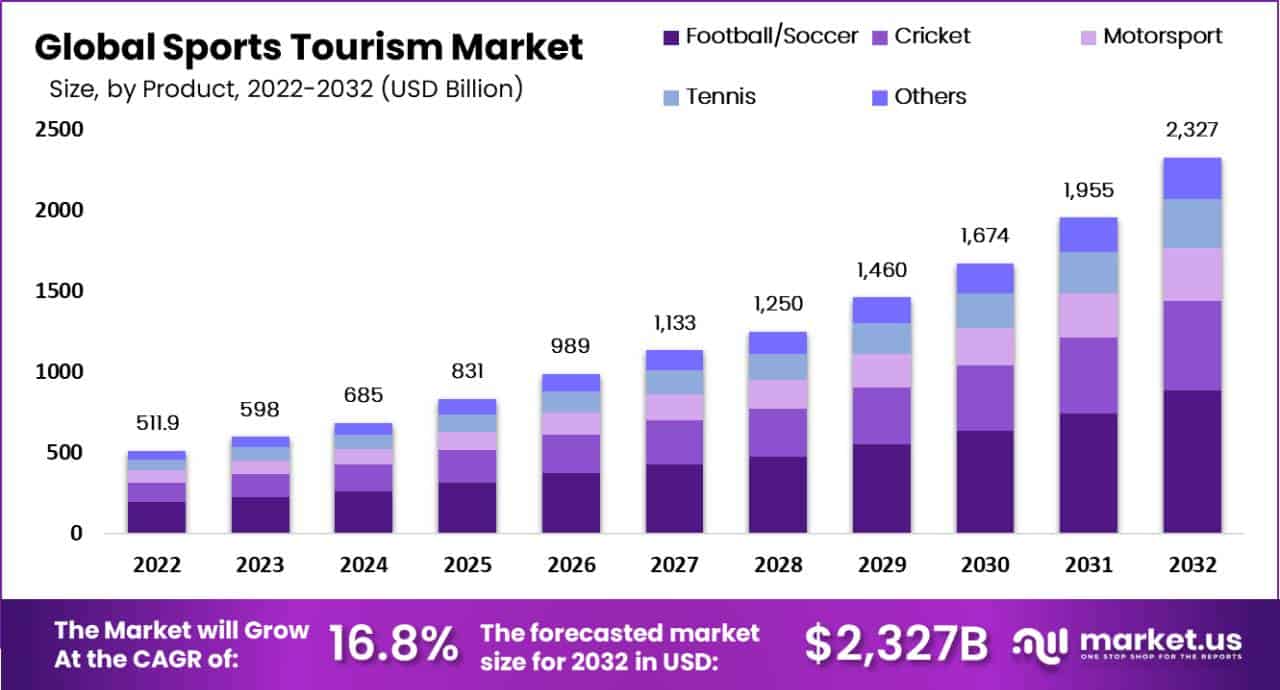

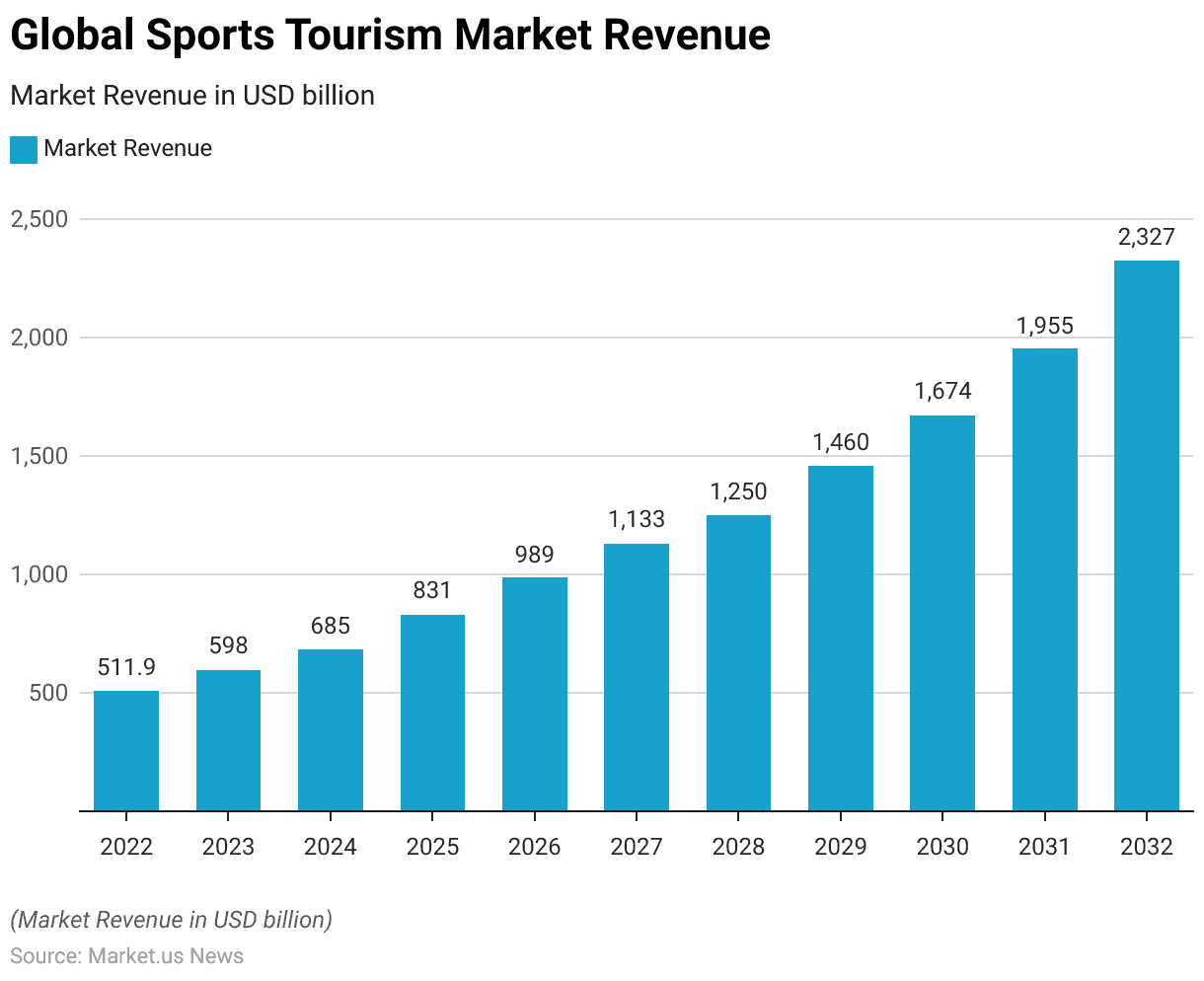

Global Sports Tourism Market Size Statistics

- The global sports tourism market has shown significant growth over the years at a CAGR of 16.80%, with revenue figures reflecting a robust upward trajectory.

- In 2022, the market revenue was recorded at USD 511.9 billion. This figure rose to USD 598.0 billion in 2023, marking a substantial increase.

- The growth continued in 2024, with revenues reaching USD 685.0 billion.

- A notable surge occurred in 2025 as the market expanded to USD 831.0 billion.

- The upward trend persisted, with revenues hitting USD 989.0 billion in 2026 and USD 1,133.0 billion in 2027.

- By 2028, the market had grown to USD 1,250.0 billion. Followed by a further increase to USD 1,460.0 billion in 2029.

- The momentum carried into 2030, with revenues reaching USD 1,674.0 billion.

- In 2031, the market soared to USD 1,955.0 billion, culminating in a projected revenue of USD 2,327.0 billion by 2032.

- This consistent growth underscores the expanding popularity and economic impact of sports tourism on a global scale.

(Source: market.us)

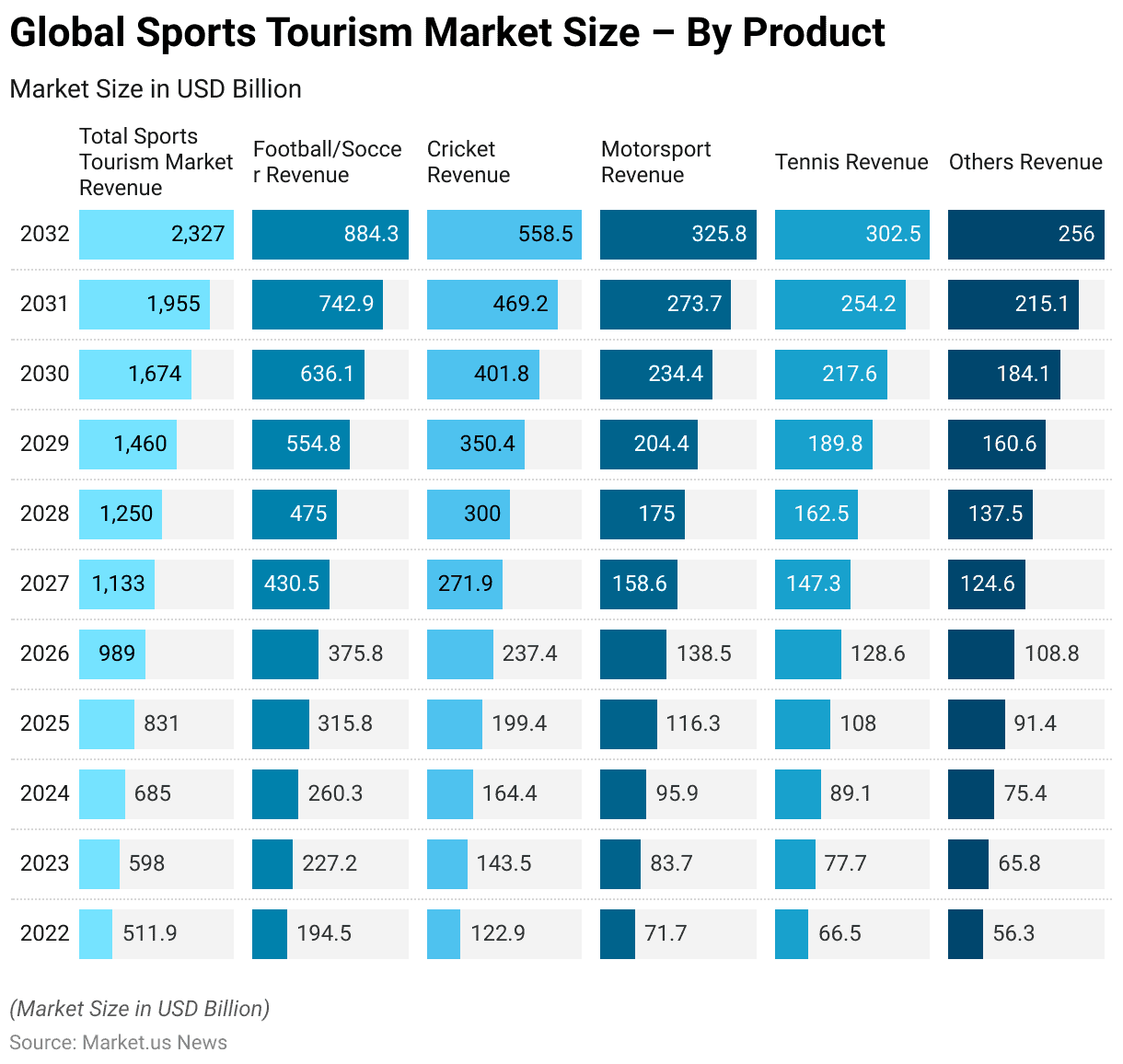

Global Sports Tourism Market Size – By Product Statistics

2022-2024

- The global sports tourism market has exhibited robust growth, with revenues distributed across various sports categories.

- In 2022, the total market revenue was USD 511.9 billion, with football/soccer contributing USD 194.5 billion, and cricket USD 122.9 billion. Motorsport USD 71.7 billion, tennis USD 66.5 billion, and other sports USD 56.3 billion.

- By 2023, the market increased to USD 598.0 billion, with contributions of USD 227.2 billion from football/soccer, and USD 143.5 billion from cricket. USD 83.7 billion from motorsport, USD 77.7 billion from tennis, and USD 65.8 billion from other sports.

- The growth continued in 2024, with total revenue reaching USD 685.0 billion, with football/soccer at USD 260.3 billion, and cricket at USD 164.4 billion. Motorsport at USD 95.9 billion, tennis at USD 89.1 billion, and other sports at USD 75.4 billion.

2025-2027

- In 2025, the market surged to USD 831.0 billion, driven by USD 315.8 billion from football/soccer, USD 199.4 billion from cricket, and USD 116.3 billion from motorsport. USD 108.0 billion from tennis, and USD 91.4 billion from other sports.

- By 2026, the market expanded to USD 989.0 billion, with football/soccer contributing USD 375.8 billion, and cricket USD 237.4 billion. Motorsport USD 138.5 billion, tennis USD 128.6 billion, and other sports USD 108.8 billion.

- The upward trend continued in 2027, with total revenue reaching USD 1,133.0 billion, including USD 430.5 billion from football/soccer, USD 271.9 billion from cricket, USD 158.6 billion from motorsport, USD 147.3 billion from tennis, and USD 124.6 billion from other sports.

2028-2030

- By 2028, the market had grown to USD 1,250.0 billion, with contributions of USD 475.0 billion from football/soccer, USD 300.0 billion from cricket, USD 175.0 billion from motorsport, USD 162.5 billion from tennis, and USD 137.5 billion from other sports.

- In 2029, the market revenue reached USD 1,460.0 billion, with football/soccer at USD 554.8 billion, cricket at USD 350.4 billion, motorsport at USD 204.4 billion, tennis at USD 189.8 billion, and other sports at USD 160.6 billion.

- The growth persisted into 2030, with total revenue of USD 1,674.0 billion, including USD 636.1 billion from football/soccer, USD 401.8 billion from cricket, USD 234.4 billion from motorsport, USD 217.6 billion from tennis, and USD 184.1 billion from other sports.

2031-2032

- In 2031, the market soared to USD 1,955.0 billion, driven by USD 742.9 billion from football/soccer, USD 469.2 billion from cricket, USD 273.7 billion from motorsport, USD 254.2 billion from tennis, and USD 215.1 billion from other sports.

- By 2032, the market is projected to reach USD 2,327.0 billion, with football/soccer contributing USD 884.3 billion, cricket USD 558.5 billion, motorsport USD 325.8 billion, tennis USD 302.5 billion, and other sports USD 256.0 billion.

- This consistent growth across all categories highlights the increasing economic significance of sports tourism globally.

(Source: market.us)

Global Sports Tourism Market Share – By Type Statistics

- A significant division between international and domestic segments characterizes the sports tourism market.

- International sports tourism holds a predominant market share, accounting for 61% of the total market.

- In contrast, domestic sports tourism represents 39% of the market share.

- This distribution highlights the substantial impact of international travel and events on the overall sports tourism industry. Underscoring the importance of global connectivity and cross-border sporting events in driving market growth.

(Source: market.us)

History of Sports Tourism

- The history of sports tourism dates back to ancient times, with its roots deeply embedded in early athletic competitions.

- The concept can be traced to the ancient Olympic Games in Greece. Which began in 776 BC and attracted participants and spectators from various regions. These games were not only athletic competitions but also significant cultural and religious festivals. Drawing large crowds and promoting travel and interaction among different Greek city-states.

- During the Roman Empire, sports tourism was also prominent. The Colosseum hosted gladiatorial contests that attracted vast numbers of spectators from across the empire. These events were social and political spectacles. Providing entertainment and serving as a means of demonstrating power and control.

- In the medieval and Renaissance periods, jousting tournaments, archery contests, and horse races continued to draw participants and audiences, fostering a tradition of sports-related travel.

- By the 19th and 20th centuries, the advent of modern transportation facilitated the growth of international sports tourism. Events such as the first modern Olympic Games in 1896 in Athens and the inaugural FIFA World Cup in 1930 in Uruguay marked significant milestones.

- The late 20th and early 21st centuries have seen exponential growth in sports tourism. Driven by globalization, increased disposable incomes, and advancements in media and communication.

- Major events such as the Olympic Games, FIFA World Cup, and various world championships in sports like tennis, cricket, and motorsport have become global spectacles. Drawing millions of international visitors and generating significant economic impact for host cities and countries.

- Today, sports tourism is a multi-billion-dollar industry, with destinations continuously investing in infrastructure to host major events and attract tourists.

- The increasing popularity of niche sports and adventure tourism further diversifies the sector. Contributing to its sustained growth and significance in the global travel industry.

(Source: Dr Prem, How and What)

Global Sports Participation Statistics

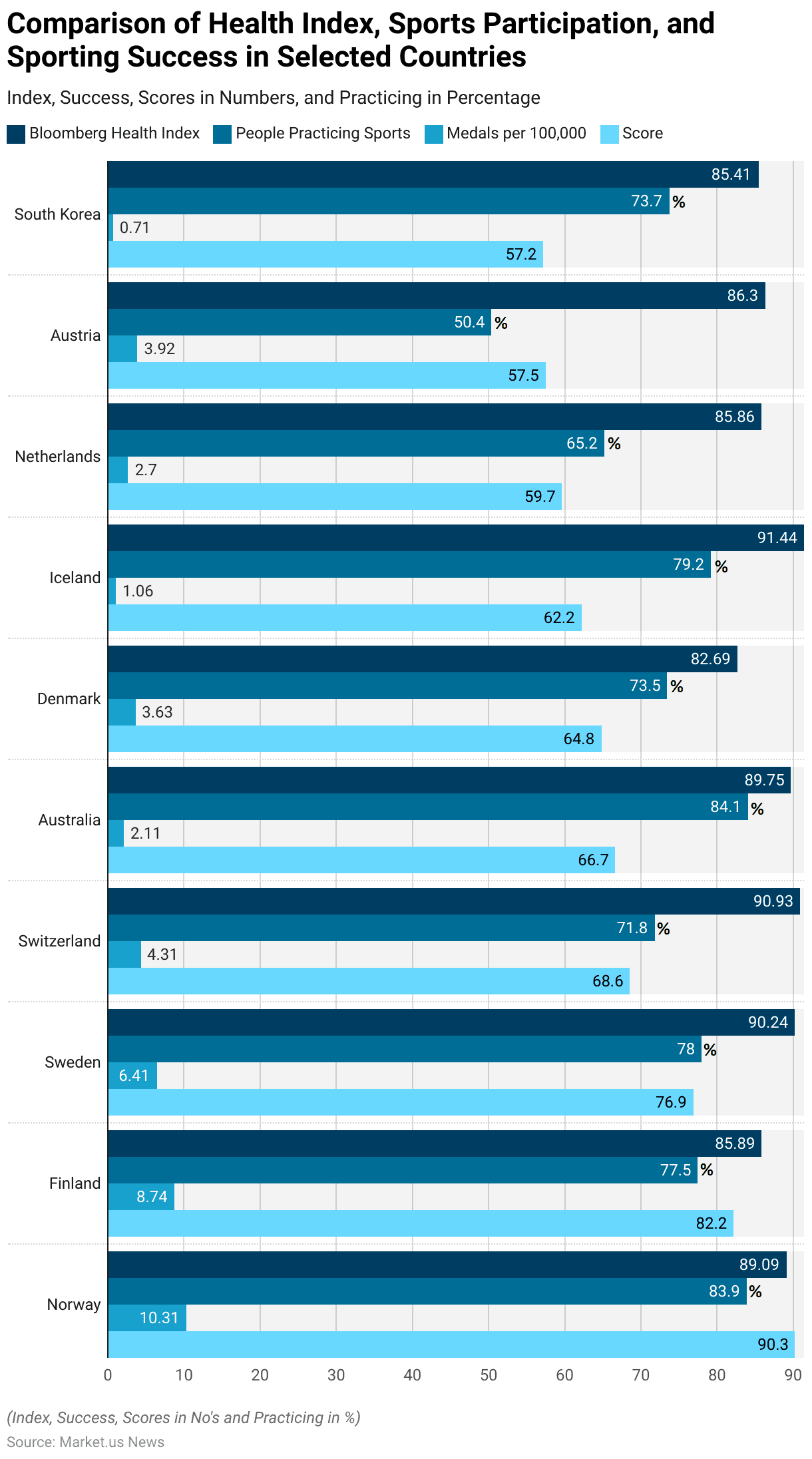

- A comparative analysis of health indices, sports participation rates, and sporting success among selected countries reveals interesting patterns.

- Norway leads with a Bloomberg Health Index of 89.09, an impressive 83.9% of the population practicing sports, and 10.31 medals per 100,000 people, resulting in a high overall score of 90.3. Football (soccer) is the most popular sport.

- Finland follows with an 85.89 health index, 77.5% sports participation, 8.74 medals per 100,000, and a score of 82.2, with ice hockey being the favorite sport.

- Sweden boasts the highest health index at 90.24, with 78% sports participation and 6.41 medals per 100,000, scoring 76.9, with football (soccer) as the most popular sport.

- Switzerland, with a health index of 90.93, sees 71.8% participation in sports and 4.31 medals per 100,000, scoring 68.6, while football (soccer) remains the favorite.

- Australia has a health index of 89.75, the highest sports participation rate at 84.1%, but only 2.11 medals per 100,000, resulting in a score of 66.7, and Australian football is the most popular sport.

More Insights

- Denmark scores 82.69 on the health index, with 73.5% participation in sports and 3.63 medals per 100,000, scoring 64.8, favoring football (soccer).

- Iceland achieves the highest health index of 91.44, with 79.2% sports participation but only 1.06 medals per 100,000, scoring 62.2, with football (soccer) as the leading sport.

- The Netherlands has a health index of 85.86, with 65.2% sports participation and 2.7 medals per 100,000, scoring 59.7, favoring football (soccer).

- Austria, with an 86.3 health index and 50.4% participation. Scores 57.5 with 3.92 medals per 100,000, and football (soccer) is the most popular.

- Lastly, South Korea has an 85.41 health index and 73.7% sports participation. But only 0.71 medals per 100,000, scoring 57.2, with football (soccer) as the preferred sport. These data highlight the varied success and popularity of sports across different countries.

(Source: PTPioneer.com)

Sports Tourism Related Travel Volume Statistics

- The global sports travel industry exhibited a steady increase in the number of sports travelers from 2015 to 2019 before experiencing a dramatic decline in 2020 and a subsequent rebound in 2021.

- In 2015, the number of sports travelers was 169 million, with no year-on-year percentage change.

- This number increased to 171 million in 2016, reflecting a growth of 1.20%, followed by 174 million in 2017, a 1.80% increase.

- In 2018, the number rose to 176 million, marking a slower growth rate of 0.80%, and in 2019, the figure reached 179 million, representing a 2% growth.

- The year 2020 saw a significant decline due to the COVID-19 pandemic. With sports travelers dropping to 96 million, a staggering 46.50% decrease.

- This sharp reduction underscored the pandemic’s severe impact on global travel and large-scale sporting events.

- However, in 2021, the industry showed a strong recovery, with the number of sports travelers surging to 175 million, an impressive 82% increase from the previous year.

- This rebound highlights the resilience and pent-up demand in the sports tourism sector, reflecting a rapid adaptation and recovery post-pandemic.

(Source: Sports Travel Magazine)

Sports Tourism Events Statistics

Destinations Hosting Different Types of Sports Tourism Events Statistics

- In 2021, a diverse range of sports tourism events were hosted across various destinations, reflecting the industry’s broad appeal.

- Youth events were the most prevalent, with 97% of destinations hosting such events. Highlighting the strong focus on engaging younger athletes.

- Adult and amateur events were also highly popular, taking place in 94% of destinations.

- Collegiate sports events were hosted by 83% of destinations, showcasing the importance of university-level competitions.

- Senior sports events were held in 53% of destinations, indicating a moderate engagement with this demographic.

- International events were organized by 43% of destinations, emphasizing the global appeal and reach of sports tourism.

- Events sanctioned by the United States Olympic & Paralympic Committee (USOPC) were hosted by 39% of destinations. Underscoring the significance of Olympic-related activities.

- Finally, other types of events accounted for 6% of the destinations, representing niche or specialized sporting activities.

- This distribution illustrates the wide-ranging nature of sports tourism and the varied interests it caters to.

(Source: Sports Travel Magazine)

Cancelled or Delayed Sports Events Due to COVID-19

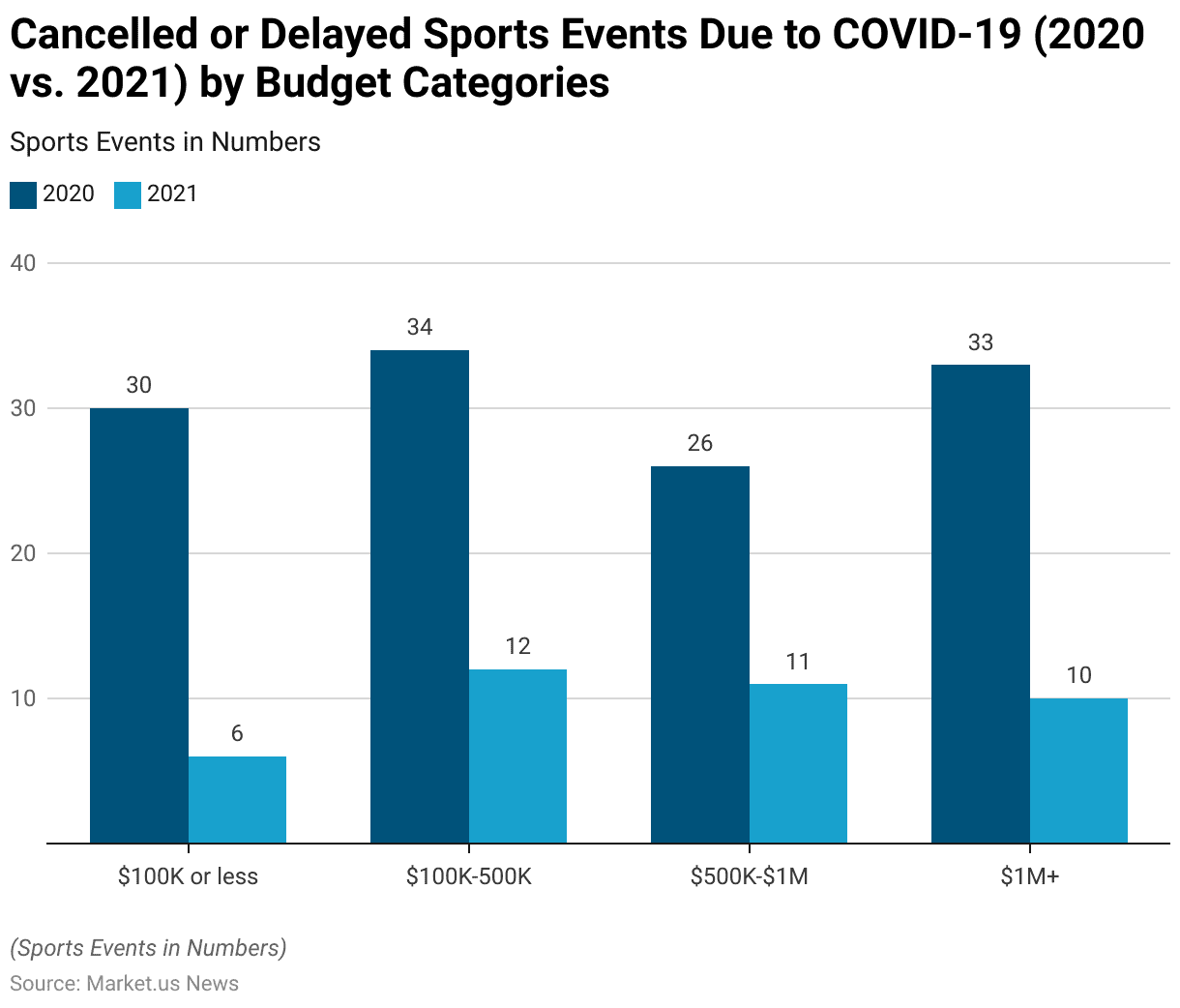

- The impact of COVID-19 on sports events was profound in both 2020 and 2021, with significant variations based on budget categories.

- In 2020, sports events with budgets of $100,000 or less saw 30 cancellations or delays. Which dramatically decreased to 6 in 2021.

- For events with budgets ranging from $100,000 to $500,000. There were 34 cancellations or delays in 2020, reducing to 12 in 2021.

- Events with budgets between $500,000 and $1 million experienced 26 cancellations or delays in 2020, which fell to 11 in 2021.

- The most substantial budget category, events with budgets exceeding $1 million, had 33 cancellations or delays in 2020, decreasing to 10 in 2021.

- This data indicates a significant recovery in the sports events sector in 2021 compared to 2020, although the effects of the pandemic were still evident across all budget categories.

(Source: Sports Travel Magazine)

Sports Tourism Spending Statistics

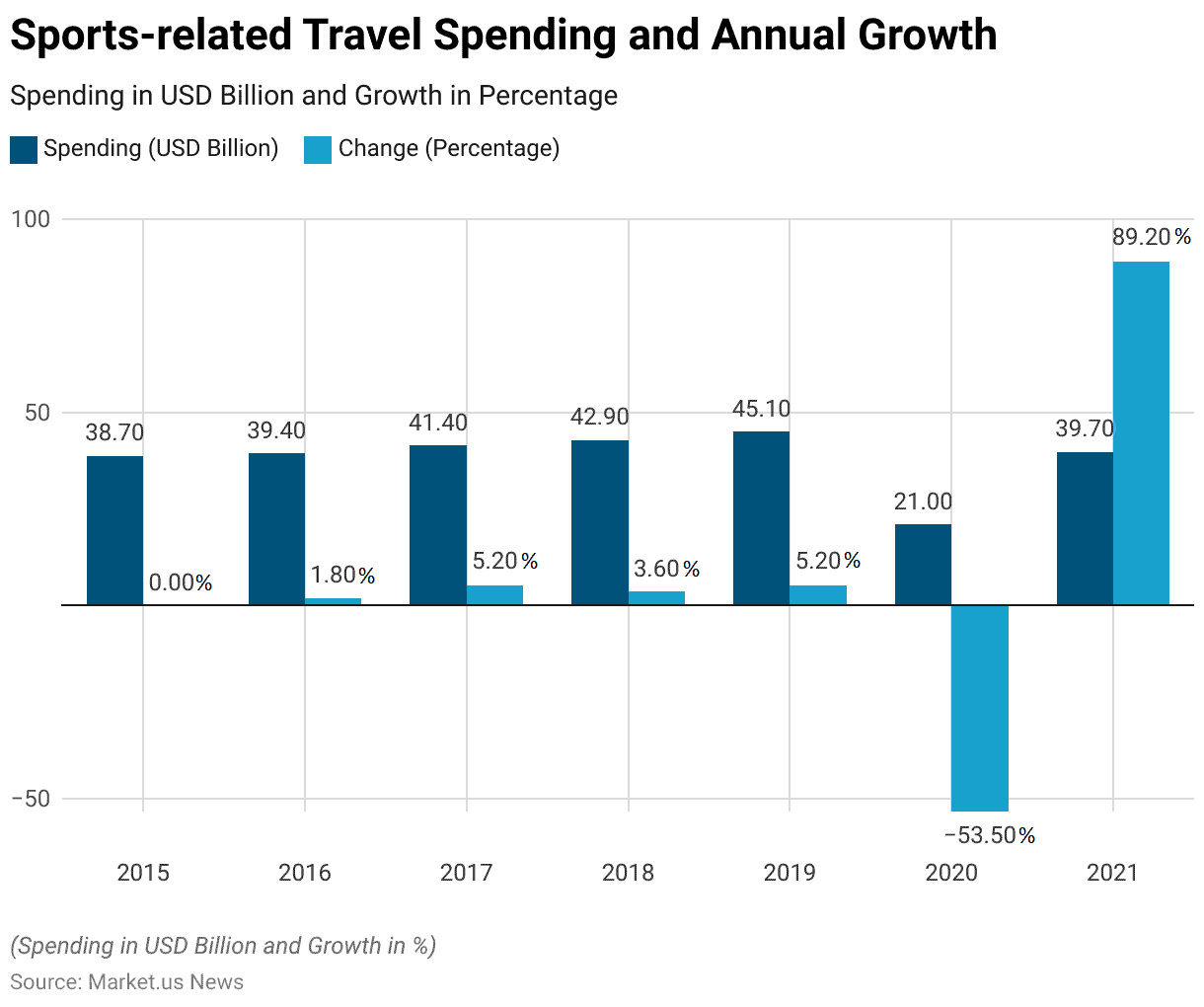

Sports-related Travel Spending and Annual Growth Statistics

- The global sports-related travel spending has shown notable fluctuations over the period from 2015 to 2021.

- In 2015, the spending was USD 38.7 billion, with no change from the previous year.

- This figure rose to USD 39.4 billion in 2016, reflecting a 1.80% increase.

- The upward trend continued more robustly in 2017. With spending reaching USD 41.4 billion, marking a 5.20% growth.

- In 2018, the growth rate slightly decreased, with spending at USD 42.9 billion, representing a 3.60% increase.

- The year 2019 saw another 5.20% rise, bringing the spending to USD 45.1 billion.

- However, 2020 witnessed a dramatic downturn due to the global COVID-19 pandemic. Which severely impacted travel and sports events worldwide.

- Sports-related travel spending plummeted to USD 21 billion. A significant 53.50% decline from the previous year.

- This sharp drop underscores the pandemic’s profound effect on the sports tourism sector.

- Despite this setback, 2021 saw a strong recovery. With spending rebounding to USD 39.7 billion, an impressive 89.20% increase from 2020.

- This recovery highlights the sector’s resilience and the substantial pent-up demand for sports travel post-pandemic.

(Source: Sports Travel Magazine)

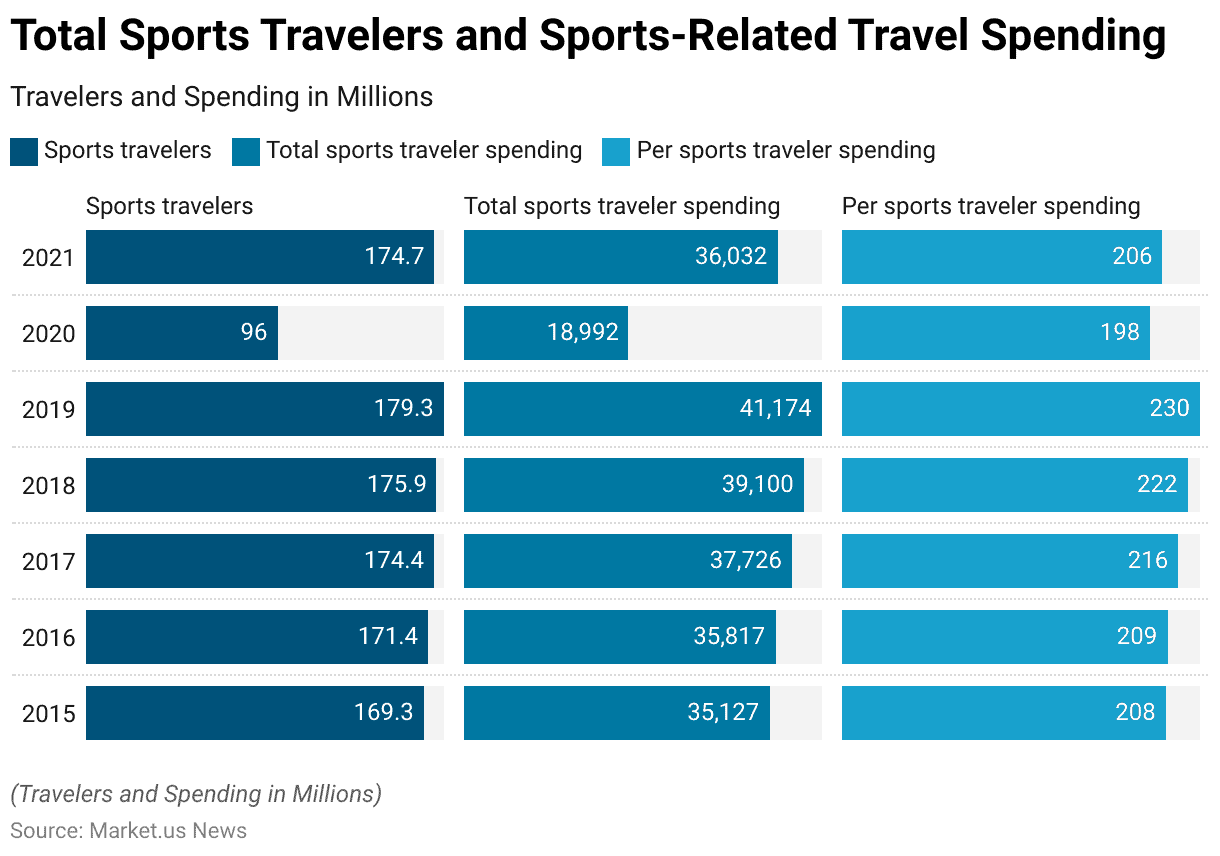

Total Sports Tourism Travelers and Sports-Related Travel Spending Statistics

- From 2015 to 2021, the sports travel industry experienced notable fluctuations in both the number of travelers and their spending patterns.

- In 2015, there were 169.3 million sports travelers. With total spending amounting to USD 35,127 million, resulting in an average spending of USD 208 per traveler.

- This number slightly increased in 2016 to 171.4 million travelers. With total spending rising to USD 35,817 million and per-traveler spending increasing up to USD 209.

- The trend of growth continued in 2017, with 174.4 million sports travelers spending a total of USD 37,726 million, which increased the average spending per traveler to USD 216.

- By 2018, the number of sports travelers reached 175.9 million. With total spending escalating to USD 39,100 million and per-traveler spending climbing to USD 222.

- In 2019, the industry saw further growth with 179.3 million travelers. Who spent USD 41,174 million in total, leading to an average of USD 230 per traveler.

- However, the COVID-19 pandemic in 2020 caused a dramatic drop in the number of sports travelers to 96.0 million. With total spending plummeting to USD 18,992 million and per-traveler spending decreasing to USD 198.

- The industry rebounded in 2021, with the number of sports travelers rising sharply to 174.7 million.

- Total spending also recovered to USD 36,032 million, though the average spending per traveler slightly decreased to USD 206.

- This recovery highlights the resilience of the sports travel sector and its quick adaptation to post-pandemic conditions.

(Source: Sports Travel Magazine)

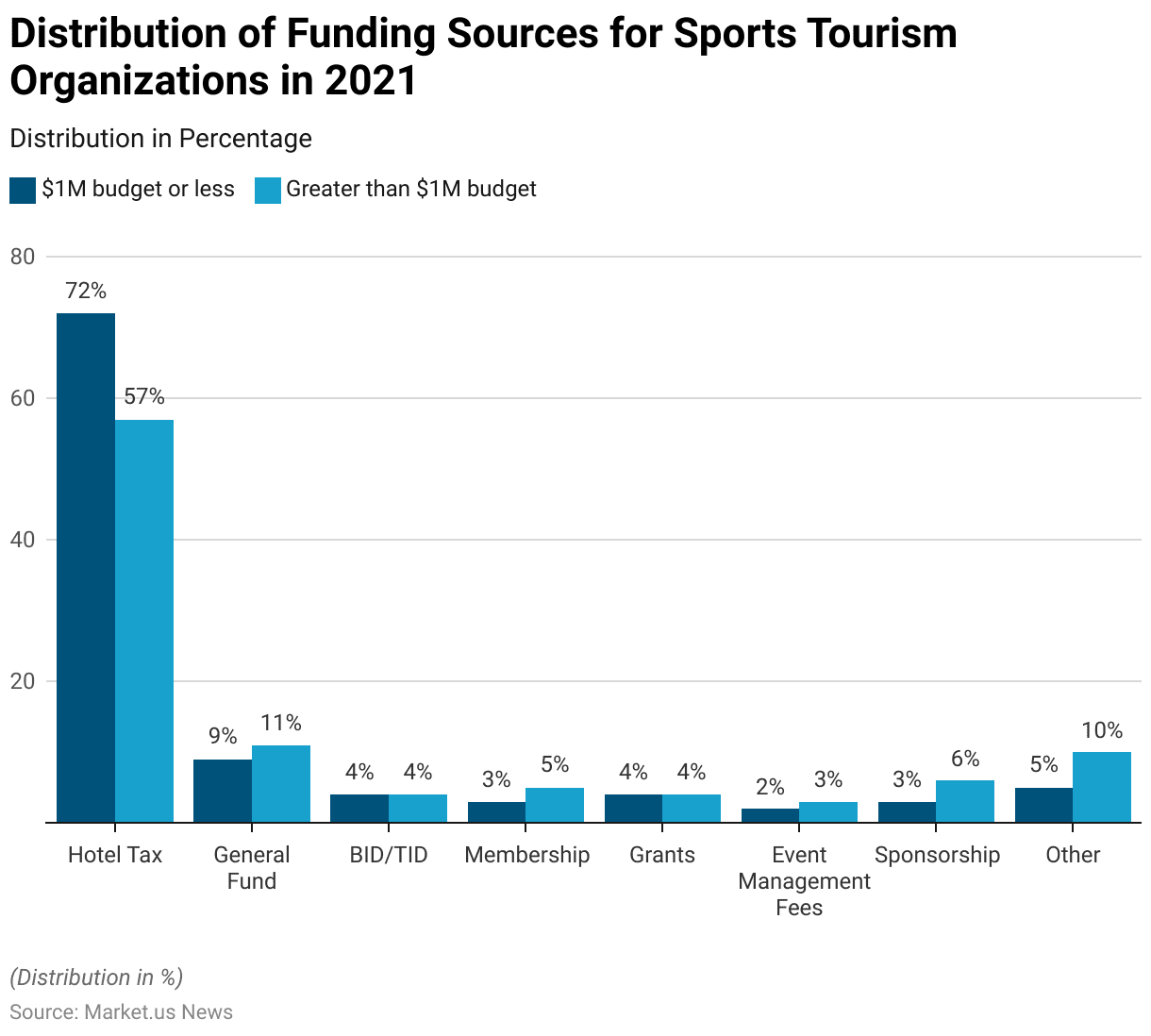

Sports Tourism Funding Statistics

- In 2021, the funding sources for sports tourism organizations varied significantly based on the size of their budget.

- For destinations with a budget of $1 million or less. The primary funding source was the hotel tax, which accounted for 72% of their funding.

- This was followed by contributions from the general fund at 9%. BID/TID (Business Improvement District/Tourism Improvement District) contributions at 4%, and grants also at 4%.

- Membership fees contributed 3%, event management fees 2%, sponsorships 3%, and other sources 5%.

- In contrast, destinations with budgets exceeding $1 million relied less on hotel tax, which provided 57% of their funding.

- The general fund contributed slightly more at 11%, while BID/TID contributions remained constant at 4%.

- Membership fees accounted for 5%, grants at 4%, event management fees at 3%, sponsorships at 6%, and other sources at 10%.

- This distribution indicates that larger-budget organizations have more diversified funding sources. Particularly in areas such as sponsorship and other unspecified sources, than smaller-budget organizations.

(Source: Sports Travel Magazine)

Economic Impact of the Sports Tourism Sector Statistics

- The sports tourism sector’s direct expenditure of $39.7 billion leads to $22.0 billion in indirect spending and $30.1 billion in induced spending, resulting in a total economic impact of $91.8 billion.

- Notably, while a significant share of sales occurs in industries directly serving travelers, the finance, insurance, and real estate (FIRE) sector benefits with $12.9 billion in sales.

- This is driven by tourism businesses like hotels and restaurants purchasing financial services and insurance from FIRE enterprises, termed as indirect sales.

- Furthermore, wages earned by FIRE sector employees due to sports tourism expenditures circulate back into the local economy through induced spending.

- Additionally, sectors such as business services ($9.6 billion) and manufacturing ($7.1 billion) also see substantial economic gains from sports tourism activities.

(Source: Sports Travel Magazine)

Regulations for Sports Tourism Statistics

- Regulations for sports tourism vary significantly across countries, aiming to ensure safety. Promote sustainable practices, and enhance the overall experience for participants and spectators.

- In the United States, regulations often include stringent safety protocols for events, environmental protection measures, and visa requirements for international visitors.

- The European Union emphasizes the importance of sustainability and environmental protection. Countries like Germany and the Netherlands implementing strict guidelines to minimize ecological impact and promote responsible tourism practices.

- In Thailand, the government has focused on enhancing infrastructure and services to support sports tourism. Including investments in health and wellness facilities to attract international sports tourists.

- The United Kingdom has implemented policies to support the development of local sports events and ensure the safety and security of participants and visitors.

- These regulations help foster a well-regulated and thriving sports tourism industry globally.

(Sources: UN Tourism, CBI- Ministry of Foreign Affairs, Panorama Destination, Destination Toronto)

Recent Developments

Acquisitions:

- Inspiresport’s Partnership with Cricket Scotland: In November 2022, Inspiresport, a UK provider of young sports development tours. Partnered with Cricket Scotland to launch new cricket events like The R66T Festival of Cricket and The R66T Dubai Cup. This partnership aims to expand their service offerings and enhance their market presence.

New Product Launches:

- The Launch of The Stoll Report on Canadian Sport Event Funding: In August 2023, Sport Tourism Canada (STC) launched The Stoll Report. Providing comprehensive insights into the Canadian sports event funding landscape. This report aims to support event organizers and rights holders in securing funding and improving the economic impact of sports events in Canada.

Funding:

- Canadian Tourism Growth Program: In 2023, the Government of Canada launched the Tourism Growth Program with $108 million in federal funding. This program aims to support Indigenous and non-Indigenous communities, small businesses, and not-for-profits, enhancing Canada’s appeal as a top sports tourism destination. Projects will focus on sustainable tourism, outdoor experiences, and tourism in rural and remote areas.

Market Growth:

- Global Market Expansion: The growth is driven by the increasing popularity of major sports events like the FIFA World Cup and the Olympics, and rising government initiatives to promote sports tourism.

- Regional Insights: Europe held the largest market share of 38.01% in 2022, with countries like Germany, France, and the UK being major contributors. The Asia-Pacific region is projected to grow at the fastest CAGR of over 18%. driven by the increasing popularity of international sports events and rising disposable incomes in countries like China and India.

Innovation and Trends:

- Integration of Technology: The sports tourism industry is increasingly integrating advanced technologies like virtual reality (VR) and augmented reality (AR) to enhance fan experiences. These technologies allow fans to virtually attend sporting events, making sports tourism more accessible and immersive.

- Emerging Sports: Sports like pickleball, badminton, and gravel racing are gaining popularity and contributing to the growth of sports tourism. Investments in facilities and events for these emerging sports are expanding the industry’s offerings.

Conclusion

Sports Tourism Statistics – Sports tourism has rapidly grown into a significant segment of the global tourism industry, driven by an increasing interest in both participating in and watching sports events.

This sector includes major international tournaments, local competitions, recreational activities, and adventure sports.

Despite the setbacks from the COVID-19 pandemic, which caused numerous cancellations and postponements in 2020, the industry showed resilience with a strong recovery in 2021.

Countries like the United States, the United Kingdom, and Thailand have developed specific regulations to support and enhance sports tourism, focusing on safety, sustainability, and infrastructure development.

Future trends point towards greater digital engagement and demand for eco-friendly practices, ensuring sports tourism’s continued growth and contribution to local economies and cultural exchange.

FAQs

Sports tourism refers to travel that involves either observing or participating in a sporting event, staying apart from the tourists’ usual environment. It includes travel for professional, amateur, or recreational sports events and activities.

Sports tourism includes a variety of events such as international tournaments (e.g., the Olympics, FIFA World Cup), local and regional sports competitions, recreational activities like marathons and golf tours, and even adventure sports like skiing, surfing, and rock climbing.

Sports tourism is significant due to its economic impact, which includes direct spending on event tickets, accommodation, and transportation, as well as indirect spending on food, souvenirs, and other services. It also promotes cultural exchange, boosts local economies, and enhances the global visibility of host destinations.

Host destinations benefit from sports tourism through increased economic activity, job creation, and infrastructure development. These events can enhance the global profile of a city or country, attract future tourism, and promote cultural heritage.

Popular sports for tourism include football (soccer), cricket, tennis, golf, and marathons. Major events like the FIFA World Cup, Wimbledon, and the Olympics are key attractions, drawing millions of spectators from around the world.