Table of Contents

Introduction

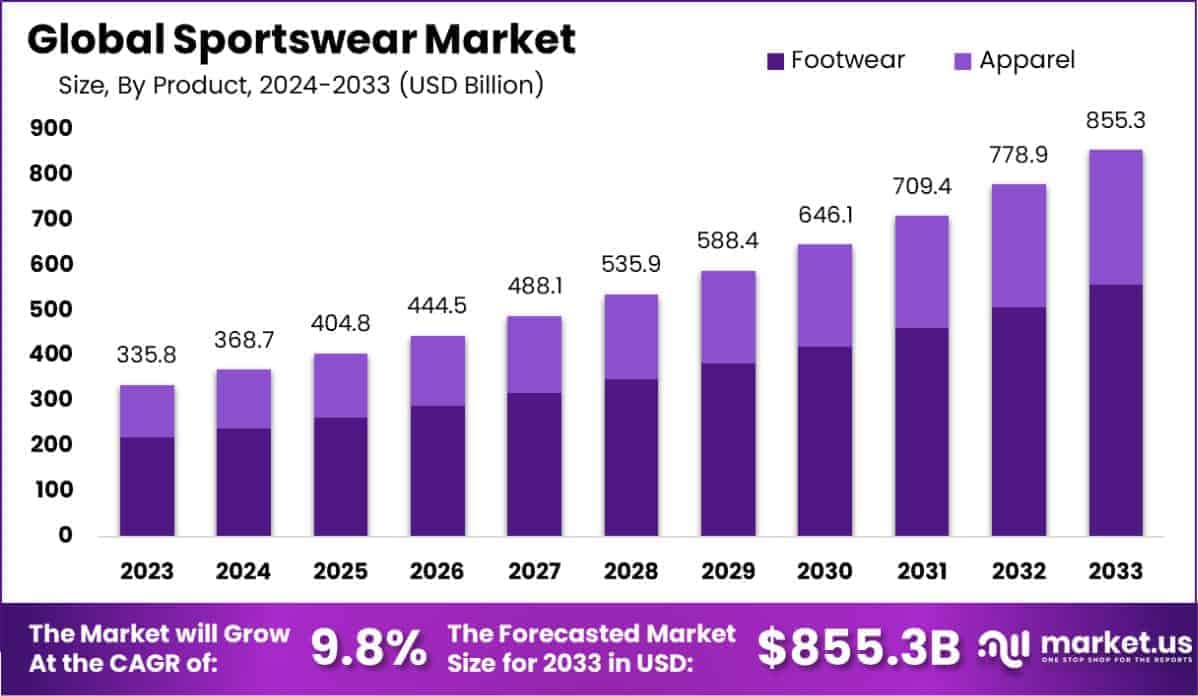

The Global Sportswear Market is projected to reach approximately USD 855.3 billion by 2033, up from USD 335.8 billion in 2023. This growth represents a robust compound annual growth rate (CAGR) of 9.8% over the forecast period from 2024 to 2033.

Sportswear refers to apparel, footwear, and accessories designed to enhance performance and comfort during physical activities, including sports, fitness, and leisure. These products are crafted using specialized materials and technologies, such as moisture-wicking fabrics, breathable meshes, and ergonomic designs, to optimize functionality and durability. Beyond athletic use, sportswear has evolved to cater to everyday fashion needs, blending style with practicality in what is commonly referred to as “athleisure.”

The sportswear market encompasses the global industry dedicated to the production, distribution, and retail of athletic clothing and footwear. This market is characterized by its diverse consumer base, ranging from professional athletes to casual fitness enthusiasts and fashion-conscious individuals.

Major players in this sector include global brands like Nike, Adidas, and Under Armour, alongside numerous regional competitors. The market spans various segments, including performance wear, athleisure, and sports-specific gear, reflecting a dynamic landscape shaped by consumer preferences, technological innovations, and shifting lifestyle trends.

Several factors drive growth in the sportswear market. The increasing emphasis on health and wellness has spurred global demand, as more individuals integrate fitness routines into their daily lives. Additionally, technological advancements in material science have enabled brands to develop innovative products that offer superior performance and comfort.

The rise of digital platforms and e-commerce has also played a critical role, expanding market reach and enhancing consumer engagement. Furthermore, the growing trend of athleisure has blurred the lines between sportswear and casual wear, broadening the appeal of these products to a wider audience.

Demand for sportswear is bolstered by a confluence of macroeconomic and societal trends. The post-pandemic shift towards more active lifestyles has accelerated interest in fitness and sports, driving higher consumption of athletic apparel and footwear.

Additionally, younger demographics, particularly millennials and Gen Z, are shaping demand through their preferences for stylish, functional, and sustainable products. Seasonal events such as global sports tournaments also create spikes in demand, with consumers seeking branded merchandise and performance wear.

The sportswear market presents significant opportunities, particularly in emerging economies where rising disposable incomes and urbanization are fueling consumer spending on fitness and lifestyle products. Sustainability is another promising avenue, as consumers increasingly prioritize eco-friendly and ethically produced goods.

Companies that invest in sustainable materials and transparent supply chains stand to gain competitive advantage. Furthermore, digital transformation offers new growth frontiers, with advancements in virtual try-ons, personalized marketing, and direct-to-consumer (DTC) sales channels enhancing customer experiences and operational efficiency.

Key Takeaways

- The global sportswear market is projected to reach USD 855.3 billion by 2033, growing from USD 335.8 billion in 2023 at a robust CAGR of 9.8% during the forecast period (2024–2033).

- In 2023, footwear led the market with a commanding 65.2% share of the product segment, reflecting strong consumer preference and demand in this category.

- The men’s segment accounted for the largest share in 2023, comprising 56.3% of the market, highlighting a significant consumer base in this demographic.

- Offline sales channels dominated the distribution landscape in 2023, holding a 33.1% market share, underscoring the continued relevance of physical retail in sportswear sales.

- North America emerged as the leading region, capturing a 34.2% market share and generating USD 114.8 billion in revenue in 2023.

Sportswear Statistics

- 44% of activewear consumers preferred shopping in-store in 2023.

- Europe held a 25% share of the sports apparel footwear market.

- Nike led the UK sports brand market with 5.3 million consumers.

- Adidas’s brand value was estimated at £16 billion.

- Women’s activewear accounted for 35% of the overall market.

- Training apparel held a 66% global market share.

- Adidas captured a 6% market share in the U.S., while Nike held around 60%.

- 55% of athleisure revenue came from online shopping.

- 46% of top online apparel retailers sold athleisure products.

- Generation X spent 50% more on sportswear than Millennials.

- E-commerce sales of sports apparel were projected to grow by 9.2% annually.

- Logo Sportswear Inc. employed 176 people, with 61% women and 39% men.

- The average Major League Baseball (MLB) game lasted 3 hours and 10 minutes.

- The New York Yankees won 27 World Series titles.

- Babe Ruth’s home run record of 714 stood for 39 years.

- The longest professional baseball game lasted 33 innings.

- MLB used about 900,000 balls per season.

- The U.S. and China together accounted for over 50% of global eSports revenue in 2023.

- Columbia Sportswear had 8,900 employees, with 52% women, 48% men, and 8% identifying as Asian.

- Direct-to-consumer sales made up 40% of revenue for major sportswear brands.

- Premium sportswear brands saw a 15% increase in market share.

- Smart sportswear and wearable tech integration grew by 45% in 2023.

Emerging Trends

- Athleisure’s Dominance: The fusion of athletic and leisurewear, known as athleisure, continues to gain traction. Consumers increasingly favor versatile apparel suitable for both workouts and casual settings, reflecting a shift towards comfort and functionality in daily attire.

- Sustainability and Eco-Friendly Materials: Environmental consciousness is reshaping purchasing decisions, with a growing demand for sportswear made from sustainable materials. Brands are responding by incorporating recycled fabrics and adopting eco-friendly production methods to meet consumer expectations for responsible manufacturing.

- Technological Integration: Advancements in fabric technology are enhancing sportswear performance. Innovations such as moisture-wicking, odor control, and temperature regulation are becoming standard, offering consumers improved comfort and functionality during physical activities.

- E-Commerce Expansion: The digital marketplace is becoming increasingly vital for sportswear sales. The convenience of online shopping, coupled with a broader product selection, is driving consumers towards e-commerce platforms, prompting brands to strengthen their online presence and direct-to-consumer strategies.

- Influence of Social Media and Celebrity Endorsements: Platforms like Instagram and TikTok are pivotal in shaping consumer preferences. Brands leverage these channels for marketing, utilizing celebrity endorsements and influencer partnerships to enhance visibility and appeal to younger demographics.

Top Use Cases

- Athletic Performance Enhancement: Sportswear designed for athletic performance incorporates advanced features such as moisture-wicking fabrics, compression technology, and ergonomic fits. These features help athletes improve endurance, reduce recovery time, and maintain comfort during high-intensity activities.

- Everyday Casual Wear (Athleisure): The rise of athleisure has positioned sportswear as a staple in daily wardrobes. Consumers now prioritize comfort and flexibility, wearing athletic-inspired apparel in both social and casual settings, reflecting a shift in lifestyle preferences.

- Professional Settings: With the growing acceptance of casual dress codes in workplaces, sportswear has found its way into professional environments. This trend highlights a demand for sportswear that offers a blend of comfort and polished aesthetics.

- Outdoor and Adventure Gear: Sportswear is increasingly used for outdoor activities such as hiking, cycling, and camping. Its adaptability to different climates and its durable nature make it an ideal choice for consumers engaging in active, adventurous lifestyles.

- Health and Recovery Applications: Specialized sportswear, such as compression garments, is being used in medical and therapeutic contexts. These products support injury recovery, improve circulation, and are commonly recommended for both preventive and rehabilitative care.

Major Challenges

- Intensified Market Competition: The industry is experiencing heightened competition due to the entry of new brands and the expansion of existing ones. Established companies like Nike and Adidas are contending with emerging brands such as On and Hoka, which have been rapidly increasing their market share.

- Supply Chain Disruptions: Global supply chain issues, including material shortages and logistical bottlenecks, have led to production delays and increased costs, affecting the timely delivery of products to the market.

- Shifting Consumer Preferences: There is a growing consumer demand for sustainable and ethically produced sportswear. Brands are under pressure to adopt eco-friendly materials and transparent manufacturing practices. For instance, Nike’s “Move to Zero” initiative aims for zero waste and zero carbon emissions, reflecting the industry’s response to these consumer expectations.

- Economic Uncertainties: Global economic fluctuations have influenced consumer spending patterns, with discretionary spending on sportswear being affected. Economic downturns can lead to reduced consumer spending, directly impacting sales and profitability within the industry.

- Technological Integration: The rapid advancement of technology necessitates continuous innovation in product development and marketing strategies. Brands are investing in digital platforms and smart apparel to meet consumer expectations, requiring substantial investment and adaptation to new technological trends.

Top Opportunities

- Rising Health Awareness: An increasing number of individuals are prioritizing fitness and well-being, leading to a surge in demand for sports apparel and footwear. This trend is evident across various demographics, including men, women, and children.

- Athleisure Trend: The blending of athletic and leisure wear has gained popularity, with consumers favoring comfortable yet stylish clothing suitable for both exercise and everyday activities. This shift has expanded the market beyond traditional sportswear, appealing to a broader audience.

- Technological Advancements: Innovations in fabric technology, such as moisture-wicking materials and temperature regulation, have enhanced the functionality of sportswear. These developments cater to consumer preferences for performance-enhancing and comfortable apparel.

- E-commerce Expansion: The growth of online retail platforms has made sportswear more accessible to consumers worldwide. The convenience of online shopping, coupled with a wide range of product offerings, has contributed to increased sales in the sportswear sector.

- Sustainability Focus: Consumers are increasingly seeking eco-friendly and ethically produced sportswear. Brands that adopt sustainable practices and materials are likely to attract environmentally conscious customers, presenting a significant opportunity for market differentiation.

Key Player Analysis

- Nike Inc. : Nike, headquartered in Beaverton, Oregon, is the world’s largest supplier of athletic footwear and apparel. In the fiscal year 2023, Nike reported revenues exceeding $51.5 billion, maintaining its position as the industry leader. The company’s extensive product line and global reach have solidified its dominance in the market.

- Adidas AG: Based in Herzogenaurach, Germany, Adidas is a prominent player in the global sportswear market. In 2022, the company generated approximately $13 billion in revenue from its footwear segment alone. Adidas’ strong brand presence and innovative product offerings contribute to its substantial market share.

- Puma SE: Also headquartered in Herzogenaurach, Germany, Puma has shown significant growth in recent years. In 2022, Puma’s footwear segment revenue reached approximately $3.5 billion, reflecting the company’s expanding influence in the sportswear industry.

- Lululemon Athletica Inc. : Originating from Vancouver, Canada, Lululemon specializes in yoga and athletic apparel. In its 2023 fiscal year, the company reported global sales exceeding $9.5 billion, more than doubling its revenue from three years prior. Lululemon’s focus on high-quality, stylish athletic wear has garnered a dedicated customer base.

- Under Armour Inc.: Headquartered in Baltimore, Maryland, Under Armour is known for its performance apparel and footwear. While specific revenue figures for 2023 are not provided here, Under Armour remains a significant competitor in the sportswear market, continually innovating to meet consumer demands.

Recent Developments

- On April 23, 2024, Hibbett, Inc. (Nasdaq: HIBB) revealed its agreement to be acquired by JD Sports Fashion plc (LSE: JD) for $87.50 per share in cash. This deal values Hibbett at approximately $1.1 billion, reflecting a 21% premium to its closing price on April 22, 2024, and a 29% premium to its 120-day volume-weighted average. Hibbett will remain headquartered in Birmingham, with Mike Longo continuing as CEO and Jared Briskin stepping in as COO.

- In 2024, HanesBrands (NYSE: HBI) announced it will sell the Champion brand’s global intellectual property and select assets to Authentic Brands Group for $1.2 billion. An additional $300 million contingent payment could raise the deal’s total value to $1.5 billion, subject to performance milestones. This sale concludes HanesBrands’ strategic review of its Champion operations.

- On November 8, 2024, Vuori, a Southern California-based performance lifestyle brand, announced an $825 million investment led by General Atlantic and Stripes. The funding, structured as a secondary tender offer, boosts Vuori’s valuation to $5.5 billion, further solidifying its position as a leader in the activewear market.

- In 2023, Nike unveiled the Ultrafly Trail Racing Shoe, featuring a carbon Flyplate for enhanced speed and grip. Designed in collaboration with Vibram, the shoe combines Nike’s ZoomX foam with Vibram’s lightweight outsole and lug technology, offering trail runners a fast and durable option for competitive terrain.

Conclusion

The global sportswear market is poised for significant growth, driven by increasing health consciousness, the rise of athleisure, and technological advancements in apparel design. Consumers are seeking versatile, comfortable, and performance-enhancing clothing that seamlessly transitions between athletic activities and daily life. This trend is further amplified by the expansion of e-commerce platforms, making sportswear more accessible to a broader audience.

However, the industry faces challenges such as intensified competition, supply chain disruptions, and evolving consumer preferences toward sustainability. Brands that innovate in product development, embrace digital transformation, and commit to sustainable practices are well-positioned to capitalize on emerging opportunities and maintain a competitive edge in this dynamic market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)