Table of Contents

Introduction

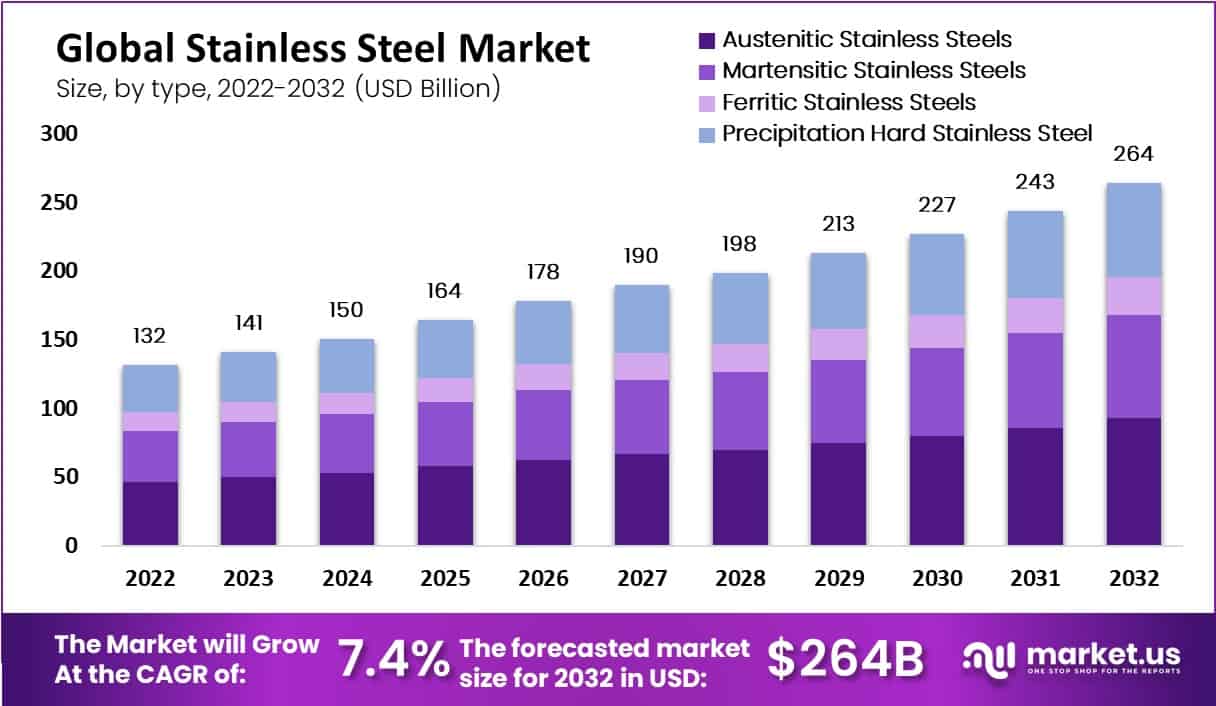

The Global Stainless Steel Market size is expected to be worth around USD 264 billion by 2032 from USD 131.5 billion in 2022, growing at a CAGR of 7.4% from 2023 to 2032.

A family of alloy steels, stainless steel has a 10–30% chromium content. Some elements, such as nickel, molybdenum, titanium, aluminum, niobium, copper, nitrogen, sulfur, or selenium, improve oxidation resistance, increase corrosion resistance in particular environments, and confer unique properties. Stainless steels are polished in various steelmaking vessels after melting in an electric arc or a basic oxygen furnace to reduce the carbon content.

A mixture of oxygen and argon gas is added to the liquid steel during the argon-oxygen decarburization process. The response for stainless steel will likely increase due to residential housing, and private and public infrastructure investments. In industrial settings like infrastructure, automotive production and transportation, railroads, building and construction, and process industries, stainless steel is crucial.

Because it combines abilities like strength, aesthetic qualities, an average product life cycle low maintenance costs, and corrosion resistance flexibility, stainless steel (SS) has a distinct advantage over carbon steel. These features and rising application penetration are predicted for the stainless steel market expansion.

Acerinox S.A. in 2023, Acerinox S.A. acquired a 100% stake in the Spanish company Hidrocantábrico, enhancing its production capacity and strategic market position. Acerinox announced plans to invest approximately €200 million in a new cold-rolling mill at its facility in Spain, aiming to boost its production capacity and meet rising demand for high-quality stainless steel products.

Aperam Stainless Steel In 2024, Aperam introduced a new range of high-performance stainless steel grades designed for the aerospace and automotive industries, featuring enhanced strength and corrosion resistance. Aperam has invested €50 million in expanding its stainless steel recycling facilities in Belgium, aiming to increase its use of recycled materials and reduce its carbon footprint.

ArcelorMittal acquired Essar Steel’s stainless steel division in a deal valued at $5 billion in 2022, significantly expanding its market share in the stainless steel sector. In 2023, the company announced plans to invest $300 million in modernizing its stainless steel production facilities in the United States to enhance efficiency and product quality.

Baosteel unveiled a new series of stainless steel products with advanced anti-corrosion properties in early 2024, aimed at the construction and marine industries. Baosteel committed to a $400 million investment in green technology upgrades for its production plants in China, focusing on reducing emissions and increasing energy efficiency.

Stainless Steel Statistics

- In 2022, Waste, or scrap, of stainless steel was the world’s 412th most traded product, with a total trade of $9.62B.

- Between 2021 and 2022 the exports of Waste or scrap, of stainless steel grew by 1%, from $9.52B to $9.62B.

- Trade in Waste or scrap, of stainless steel represents 0.041% of total world trade.

- In 1932, Sandvik acquired an exclusive Nordic license related to the cold rolling of steel tubes using the filtering method for 60,000 dollars.

- China imported 123,600 mt of stainless steel in March, a month-on-month decrease of 34.05% and a year-on-year decline of 48.54%.

- The imports from Indonesia stood at 90,500 mt (including stainless steel scrap), a drop of 39.61% MoM and down 53.42% YoY.

- Among them, the import volume of hot-rolled coils doubled from the previous month, but the volume of semi-manufactured products crashed 75% from February.

- According to SMM statistics, the exports stood at 390,100 mt in March, a month-on-month increase of 35.1% and a year-on-year decline of 13.7%.

- The export volume to the top ten destinations accounted for about 85.67% of the total stainless steel exports. South Korea was still the largest consumer of Chinese stainless steel, and the export volume to the country soared about 41.47% month-on-month in March

- According to the General Administration of Customs, China imported 2.11 million mt of manganese ore in March, a month-on-month decrease of 22% and a year-on-year decrease of 4%. The exports in March stood at 10,000 mt.

- The imports totaled 7.28 million mt from January to March, up 15.92% on the year, and the exports were 22,400 mt. In March, the SiMn alloy sector which saw a decline in SiMn alloy prices made fewer inquiries on spot manganese ore.

- Increasing the chromium content beyond the minimum of 10.5% confers still greater corrosion resistance. Corrosion resistance may be further improved, and a wide range of properties provided, by the addition of 8% or more nickel.

- Ferritic stainless steels (eg 409 and 430) consist of chromium (typically 12.5% or 17%) and iron. These materials contain very little carbon and are non-heat treatable, but exhibit superior corrosion resistance to martensitic stainless steels and possess good oxidation resistance.

- Stainless steels with 8-9% nickel have a fully austenitic structure and exhibit superior welding and working characteristics to ferritic stainless steels.

- MEPS forecasts that global crude stainless steel production will reach 60 million tonnes, in 2023.

- US production in the fourth quarter of 2022 is estimated to be 450,000 tonnes.

- In South Korea, output in the final three months of 2022 reached only 161,000 tonnes.

- Production in 2023 is forecast to increase, year-on-year, by 7 percent, in Japan, and 8.5 percent, in Taiwan. Improving market sentiment in East Asia should support an upturn in stainless steel consumption, in 2023.

Emerging Trends

Increased Focus on Sustainability: The stainless steel industry is increasingly shifting towards sustainable production practices. Companies are investing in energy-efficient technologies and recycling processes to reduce carbon emissions. The push for greener manufacturing is driven by stricter environmental regulations and growing consumer demand for eco-friendly products. For example, the use of scrap metal in stainless steel production is rising, as it significantly lowers the environmental impact compared to using virgin raw materials.

Growth in Demand from the Automotive Sector: The automotive industry is a major consumer of stainless steel, particularly for applications requiring durability and corrosion resistance, such as exhaust systems and structural components. The rise of electric vehicles (EVs) has further boosted demand for specialized stainless steel grades that are lightweight yet strong, helping to enhance the efficiency and range of EVs. As the global EV market continues to expand, so will the demand for advanced stainless steel materials.

Technological Advancements in Manufacturing: Innovations in manufacturing technologies, such as 3D printing and advanced alloy development, are transforming the stainless steel industry. 3D printing allows for more complex and customized stainless steel parts to be produced with greater precision and less waste. Additionally, the development of new stainless steel alloys with enhanced properties, such as higher strength and better corrosion resistance, is opening up new applications in sectors like aerospace, medical devices, and renewable energy.

Rising Demand in Emerging Markets: Emerging markets, particularly in Asia and Africa, are witnessing rapid urbanization and industrialization, leading to increased demand for stainless steel in construction, infrastructure, and manufacturing. Countries like India and Indonesia are seeing significant growth in stainless steel consumption as they expand their industrial bases and invest in new infrastructure projects. This trend is expected to continue, providing substantial growth opportunities for stainless steel producers.

Shift Towards Lightweight and High-Strength Grades: There is a growing trend towards the use of lightweight and high-strength stainless steel grades, particularly in industries such as automotive, aerospace, and construction. These materials help reduce the overall weight of vehicles and structures, leading to improved fuel efficiency and lower emissions in transportation, as well as enhanced performance in other applications. As a result, manufacturers are focusing on developing and offering stainless steel products that meet these evolving requirements.

Use Cases

Automotive Industry: Stainless steel is widely used in the automotive industry due to its durability, corrosion resistance, and strength. It is primarily used in exhaust systems, fuel tanks, and structural components. The material’s ability to withstand high temperatures and resist corrosion makes it ideal for these applications. As of 2022, approximately 12 million tons of stainless steel were used annually in the automotive sector worldwide, driven by the growing demand for electric vehicles and lightweight components.

Construction and Infrastructure: Stainless steel is a preferred material in construction, particularly for exterior cladding, roofing, and structural applications in bridges and buildings. Its aesthetic appeal, combined with its high strength and resistance to environmental factors like rust and pollution, makes it ideal for modern architecture. In 2021, the global construction industry consumed over 15 million tons of stainless steel, with significant use in high-rise buildings and public infrastructure projects like bridges and airports.

Medical Devices and Equipment: The healthcare industry relies heavily on stainless steel for the manufacture of surgical instruments, medical devices, and hospital equipment. Stainless steel is favored for its biocompatibility, ease of sterilization, and resistance to corrosion and staining. For instance, surgical instruments such as scalpels and forceps are typically made from stainless steel due to its hygiene properties. The global demand for stainless steel in medical applications was estimated at around 2.5 million tons in 2022, with growth expected as healthcare needs expand globally.

Food and Beverage Industry: In the food and beverage industry, stainless steel is essential for manufacturing equipment used in processing, storage, and transportation. Its non-reactive nature ensures that it does not alter the taste or quality of food products. Stainless steel tanks, pipes, and conveyors are common in dairy, brewery, and meat processing plants. The food industry consumed about 3 million tons of stainless steel globally in 2022, a number that is expected to rise with increasing food production demands.

Energy Sector: Stainless steel plays a crucial role in the energy sector, especially in the construction of nuclear reactors, power plants, and renewable energy installations such as wind turbines. Its resistance to extreme temperatures and corrosive environments makes it suitable for these high-demand applications. For example, in wind turbines, stainless steel is used in the construction of various components, including fasteners, gearboxes, and towers. The energy sector’s demand for stainless steel was around 1.5 million tons in 2022, reflecting the growth in renewable energy projects.

Major Challenges

Fluctuating Raw Material Prices: The stainless steel industry heavily relies on raw materials such as nickel, chromium, and molybdenum, whose prices can be highly volatile. Nickel, in particular, is a critical component, making up a significant portion of stainless steel’s composition. In recent years, nickel prices have fluctuated due to supply disruptions, geopolitical tensions, and varying demand, making it challenging for manufacturers to maintain stable production costs. For instance, in 2021, nickel prices surged by over 20%, directly impacting the cost of stainless steel production.

Environmental Regulations and Sustainability: The stainless steel industry faces increasing pressure to reduce its environmental impact. Manufacturing stainless steel is energy-intensive and contributes to greenhouse gas emissions. As global environmental regulations become stricter, companies are compelled to adopt cleaner technologies and reduce their carbon footprint. This shift requires significant investments in new technologies and processes, which can be cost-prohibitive, especially for smaller manufacturers. Additionally, the demand for sustainable practices is pushing the industry to increase recycling rates and reduce waste, adding another layer of complexity.

Global Overcapacity and Competition: The global stainless steel market has been grappling with overcapacity, particularly due to increased production in countries like China. This oversupply has led to intense price competition, driving down profit margins for producers worldwide. For example, in 2020, China’s stainless steel production accounted for more than 50% of the global output, leading to market saturation and pricing pressures in other regions. This overcapacity makes it difficult for producers in Europe and North America to compete, as they struggle to match the lower production costs seen in China.

Technological Advancements and Innovation: While technological advancements present opportunities, they also pose challenges for the stainless steel industry. Companies must continually invest in research and development to keep up with innovations in production methods, alloy development, and energy efficiency. Failure to adapt to these technological changes can result in lost market share and decreased competitiveness. However, the high costs associated with these advancements can be a barrier, especially for smaller players in the market.

Market Growth Opportunities

Increasing Demand in Emerging Markets: Emerging markets, particularly in Asia and Africa, present significant growth opportunities for the stainless steel industry. Rapid urbanization and industrialization in countries like India, Indonesia, and Nigeria are driving demand for stainless steel in construction, infrastructure, and manufacturing. For example, India’s infrastructure development plans, which include projects like smart cities and expanded transportation networks, are expected to significantly boost stainless steel consumption. The demand in these regions is expected to grow at a compound annual growth rate (CAGR) of around 5-6% over the next decade.

Growth in Renewable Energy Projects: The expansion of renewable energy projects, such as wind farms and solar energy installations, is creating new opportunities for stainless steel manufacturers. Stainless steel is essential in constructing wind turbines, solar panels, and associated infrastructure due to its durability and resistance to corrosion. As countries globally commit to reducing carbon emissions, the renewable energy sector is expected to see substantial investments, leading to increased demand for stainless steel. For instance, Europe’s Green Deal aims to significantly increase renewable energy capacity by 2030, which will likely boost the stainless steel market.

Advancements in Electric Vehicles (EVs): The rise of electric vehicles (EVs) represents a significant growth area for the stainless steel industry. Stainless steel is used in various components of EVs, including battery casings, structural parts, and exhaust systems. With the global push towards cleaner transportation and the rapid adoption of EVs, particularly in markets like China, the United States, and Europe, the demand for stainless steel in the automotive sector is expected to grow. The EV market is forecasted to grow at a CAGR of over 20% in the coming years, which will positively impact stainless steel consumption.

Innovations in Recycling and Sustainable Practices: As the stainless steel industry faces increasing pressure to adopt sustainable practices, innovations in recycling offer significant growth potential. The use of recycled stainless steel not only reduces production costs but also lowers the environmental impact. Companies investing in advanced recycling technologies and processes can tap into the growing demand for eco-friendly products. With global sustainability trends gaining momentum, the market for recycled stainless steel is expected to expand, creating new revenue streams for producers.

Key Player Analysis

Acerinox S.A. is a leading global manufacturer of stainless steel, recognized for its extensive production capabilities and innovative solutions. The company operates several production plants across Europe, the Americas, and Asia, focusing on producing flat products, long products, and alloys. Acerinox has been expanding its global footprint through strategic acquisitions and investments in advanced manufacturing technologies to enhance efficiency and meet growing demand. In recent years, Acerinox has focused on sustainability by increasing the use of recycled materials in its production processes.

Aperam Stainless Steel is a major player in the global stainless steel market, specializing in the production of flat stainless steel products and high-value-added alloys. With production facilities in Europe and Brazil, Aperam serves a wide range of industries including automotive, aerospace, and energy. The company is committed to sustainability, with a significant focus on recycling and reducing carbon emissions. Aperam has been actively investing in new technologies to enhance product quality and expand its portfolio of environmentally friendly products.

ArcelorMittal is the world’s leading steel and mining company, with significant operations in the stainless steel sector. The company produces a wide range of stainless steel products, including flat and long products, catering to industries such as automotive, construction, and energy. ArcelorMittal is known for its commitment to innovation and sustainability, focusing on reducing carbon emissions and increasing the use of recycled materials in production. The company continues to expand its global presence through strategic investments and technological advancements.

Baosteel Group, a subsidiary of China Baowu Steel Group, is one of the largest steel producers in the world and a significant player in the stainless steel market. The company specializes in producing high-quality stainless steel products used in various industries, including automotive, petrochemical, and shipbuilding. Baosteel is known for its advanced manufacturing capabilities and strong focus on research and development. The company is actively investing in green technologies and aims to lead in sustainable steel production by reducing its carbon footprint and enhancing energy efficiency.

Jindal Stainless is India’s largest stainless steel manufacturer and one of the leading players globally. The company produces a wide range of stainless steel products, including flat and long products, catering to industries such as automotive, construction, and consumer goods. Jindal Stainless is recognized for its state-of-the-art manufacturing facilities and its focus on innovation and sustainability. The company is expanding its global presence, with a strong emphasis on increasing capacity and adopting green manufacturing practices to reduce its environmental impact.

Nippon Steel Corporation, one of Japan’s largest steel producers, is a significant player in the stainless steel market. The company offers a wide range of stainless steel products, including high-performance materials for the automotive, construction, and energy sectors. Nippon Steel is known for its cutting-edge technology and commitment to quality, as well as its focus on sustainability. The company is actively investing in advanced manufacturing processes and green technologies to reduce carbon emissions and enhance its global competitiveness.

Outokumpu is a leading global stainless steel manufacturer headquartered in Finland. The company specializes in producing high-quality stainless steel products, with a strong focus on sustainability and innovation. Outokumpu’s offerings include a wide range of flat and long stainless steel products used in industries such as construction, automotive, and energy. The company is known for its advanced production processes and commitment to reducing carbon emissions, making it a key player in promoting sustainable practices within the stainless steel industry.

POSCO, based in South Korea, is one of the largest steel producers in the world and a major player in the stainless steel market. The company produces a diverse range of stainless steel products, including flat and long products, catering to industries like automotive, construction, and shipbuilding. POSCO is renowned for its technological innovation, high-quality products, and sustainability initiatives. The company is investing heavily in green steel production technologies and expanding its global footprint, aiming to lead in the transition towards more sustainable and efficient steel manufacturing.

Yieh United Steel Corporation (Yusco) is Taiwan’s largest stainless steel producer and a significant player in the global market. The company specializes in producing a wide range of stainless steel products, including coils, sheets, and plates, catering to various industries such as construction, automotive, and kitchenware. Yusco is known for its high-quality products and commitment to innovation, continuously investing in advanced manufacturing technologies to enhance production efficiency and meet the growing global demand for stainless steel.

ThyssenKrupp Stainless GmbH, a subsidiary of the German industrial giant ThyssenKrupp AG, is a key player in the stainless steel market. The company produces a comprehensive range of stainless steel products, including flat products and special alloys, which are used in industries such as automotive, aerospace, and construction. ThyssenKrupp Stainless is renowned for its commitment to quality and innovation, focusing on developing advanced materials that meet the evolving needs of modern industry while also prioritizing sustainability and efficiency in its production processes.

Conclusion

In conclusion, the stainless steel industry is poised for sustained growth, driven by increasing demand across diverse automotive, construction, and energy sectors. The industry’s focus on innovation, sustainability, and technological advancements is critical in meeting the evolving needs of global markets. As industries shift towards more sustainable practices, the demand for high-quality, durable, and environmentally friendly materials like stainless steel will continue to rise. Companies that invest in advanced manufacturing technologies, expand their recycling capabilities, and adapt to emerging market trends will be well-positioned to lead in this dynamic and essential industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)