Table of Contents

Introduction

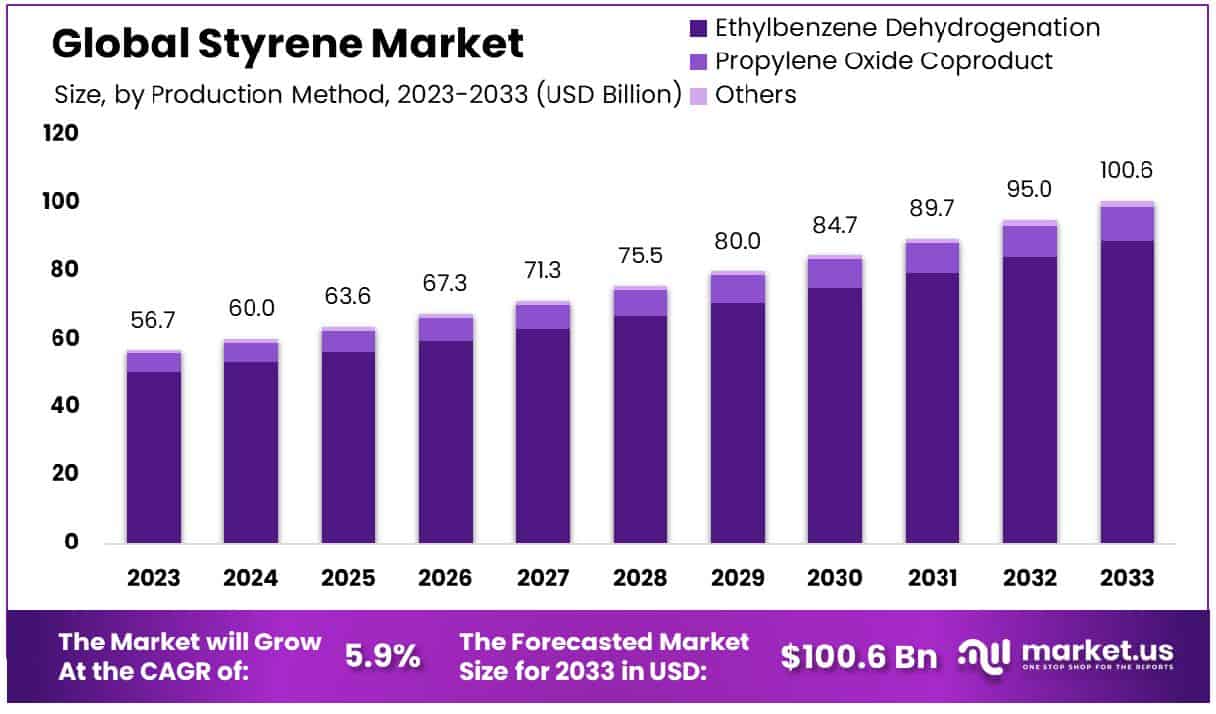

The global styrene market, valued at USD 56.7 billion in 2023, is projected to expand significantly, reaching an estimated USD 100.6 billion by 2033. This growth, at a compound annual growth rate (CAGR) of 5.9% from 2024 to 2033, is primarily fueled by increasing demands in industries such as automotive, construction, and consumer goods for styrene-based products like polystyrene and ABS (Acrylonitrile Butadiene Styrene).

The expansion is also driven by technological advancements in styrene production processes and rising applications in emerging markets. However, the market faces challenges including stringent environmental regulations regarding volatile organic compound (VOC) emissions and global supply chain disruptions affecting raw material availability. Recent developments have seen major players investing in sustainable production techniques and recycling initiatives to mitigate environmental impact and align with regulatory standards, indicating a proactive approach to overcoming these challenges.

Chevron Phillips Chemical Company has taken a significant step forward by announcing a partnership with a technology firm to improve the efficiency of its styrene production process. This collaboration is expected to enhance yield by 20% and reduce energy consumption, marking a critical advancement in operational capabilities.

Covestro AG has launched a new range of eco-friendly styrene products, which has been well-received in markets prioritizing sustainability. This launch aligns with global trends towards environmentally sustainable materials and is projected to capture a new customer base, potentially increasing its market share by 15% in the next five years.

Hanwha Group has recently expanded its reach by acquiring a smaller competitor, aiming to enhance its production capacity of styrene products. This acquisition is part of Hanwha’s strategic initiative to strengthen its position in the Asian markets and is projected to boost its production volume by 30%.

INEOS Styrolution has focused on innovation by investing USD 25 million in a new research and development facility dedicated to next-generation styrene applications. This investment underscores their commitment to leading the market in innovative styrene solutions, targeting a 10% increase in sales from new products by 2025.

LG Chem has secured funding amounting to USD 40 million to develop a new production line for styrene derivatives in high demand in the electronics and automotive industries. This expansion is expected to increase their output by 25%, catering to the burgeoning demand in these sectors.

Key Takeaways

- Market Growth: The Styrene Market is projected to grow from USD 56.7 billion in 2023 to USD 100.6 billion by 2033, at a CAGR of 5.9%.

- Asia-Pacific dominates the styrene market with 65.9% share, valued at USD 37.3 billion.

- By Production Method: Ethylbenzene dehydrogenation accounts for 88.4% of styrene production methods globally.

- By Product Type: Polystyrene represents 38.6% of the product types in the styrene market.

- By End-Use: Packaging, as an end-use sector, comprises 37.8% of the styrene market.

Production and Characteristics of Styrene

- Styrene acrylonitrile resin (SAN) is a copolymer plastic consisting of styrene and acrylonitrile. It is widely used in place of polystyrene owing to its greater thermal resistance. The chains of between 70 and 80% by weight styrene and 20 to 30% acrylonitrile.

- Pure styrene is a clear, colorless, flammable liquid that boils at 145 °C (293 °F) and freezes at −30.6 °C (−23.1 °F).

- Almost all styrene is now produced by the dehydrogenation of ethylbenzene, a compound obtained by reacting ethylene and benzene—both of which in turn are derived from petroleum. More than 15 million metric tons of the liquid are made each year.

- The “On-purpose” method represents approximately 70 % of the styrene monomer produced globally. Furthermore, styrene is a co-product when producing propylene oxide.

Approximately 25 million tonnes of styrene were produced in 2010, increasing to around 35 million tonnes by 2018.

Applications and Market Dynamics of Styrene

- Approximately 50% of styrene production is for polymerization when manufacturing polystyrene. The second main use of styrene (15%) is the synthetic rubber found notably in tires. Other markets are synthetic latex (12%) and ABS (11%), a plastic widely used in electronics. Styrene is therefore everywhere in our lives.

- In 2012, more than 5.4 million tonnes of SBR were processed worldwide. About 50% of car tires are made from various types of SBR. The styrene/butadiene ratio influences the properties of the polymer.

- The Plastics Product Manufacturing sector (NAICS 3261) accounted for 51% (15.2 million pounds) of all styrene releases reported to EPA’s TRI Program for 2016. Since 2006, the sector’s styrene releases have decreased by 40%.

- The price of Styrene (Southeast Asia) declined slightly throughout April 2019, reaching 1,060 USD per metric ton. The price is 2% lower than the average price in the previous month and 24% lower than the average price one year before.

- From the data of the export of styrene from January to September 2022, the export of styrene in the second quarter was the most concentrated, with the highest monthly export in May, reaching 155,400 tons, and the first three quarters without exception had different quantities of export in each month.

Safety and Environmental Aspects of Styrene

- These monitors use photoionization sensors for concentration measurements. Styrene – CAS: 100-42-5- is a flammable, toxic, and carcinogenic volatile organic compound used in many industries (petrochemicals, electronics, laboratories, metallurgy, perfumes). It is a very dangerous substance for humans, it is harmful by inhalation and it can cause eye and skin irritation. C8H8 is flammable between 0.9% and 6.8% volume and styrene vapors may form explosive mixtures.

- Despite its detectable smell, only a styrene gas detector can accurately measure the concentration levels of this gas. Although it can explode at 0.9 % volume, explosivity monitoring (in LEL) is pointless with this highly toxic gas. It is recommended to use a ppm styrene detection device or complete system.

- Recycled styrene monomer from the pilot plant meets American Society for Testing and Materials (ASTM) standards for styrene monomer and is greater than 99.8 wt% purity.

- Contribution investigates the addition of poly(styrene-stat-chloromethylstyrene (ClMS))s as dewetting inhibitors of polystyrene (PS) thin films with thicknesses ranging from 12 to 38 nm. The ClMS ratios in the copolymers are 5, 25, and 45 mol%.

- China completely dominates global styrene demand. China’s share of global demand grew from 10% to 36% in 2021. In second place in 2021 was Northeast Asia ex-China (Japan, South Korea, and Taiwan) at 20% because of its large styrene derivatives capacities.

Emerging Trends

- Increased Use of Recycled Styrene: There is a growing trend towards recycling styrene to minimize environmental impact. Companies are investing in advanced recycling technologies that allow for the reuse of styrene in various applications, reducing waste and promoting sustainability. This approach not only supports environmental goals but also helps companies comply with stricter regulations on waste management and emissions.

- Development of Bio-based Styrene: Another significant trend is the development of bio-based styrene, which is derived from renewable resources rather than traditional fossil fuels. This shift is driven by the global push for sustainable materials and is expected to reduce the carbon footprint associated with styrene production. Bio-based styrene is gaining traction, particularly in industries looking to improve their sustainability credentials.

- Application in 3D Printing: Styrene is increasingly being used in the 3D printing industry due to its excellent properties such as ease of use and smooth finishing capabilities. As 3D printing technology advances, the demand for styrene as a key component in filaments is expected to grow, opening new markets and applications for this versatile material.

- Enhanced Product Features: Companies are continuously innovating to improve the properties of styrene-based products to meet specific industry needs. This includes developing styrene products that are more durable, lightweight, and offer better heat resistance. These enhanced features are making styrene more attractive for use in high-performance applications across various sectors including automotive, aerospace, and electronics.

- Regulatory Impact: The increasing scrutiny of chemical materials by regulatory bodies worldwide is prompting the styrene industry to innovate in the direction of safer and more environmentally friendly products. Compliance with these regulations is not only a legal requirement but also a critical factor in maintaining market presence and consumer trust.

Use Cases

- Packaging Solutions: Styrene is extensively used in the production of polystyrene, a material prevalent in the packaging industry. Polystyrene is favored for its lightweight, insulating properties, and cost-effectiveness, making it an ideal choice for protective packaging and food containers. Approximately 40% of global styrene production is allocated to manufacturing packaging materials, underscoring its significant role in this sector.

- Construction Materials: In the construction industry, styrene-based products such as Expanded Polystyrene (EPS) and Acrylonitrile Butadiene Styrene (ABS) are utilized for insulation panels, plumbing fixtures, and even flooring. EPS is particularly valued for its thermal insulation properties, contributing to energy efficiency in buildings. Styrene’s usage in construction materials accounts for about 20% of its total market demand.

- Automotive Components: Styrene derivatives are critical in manufacturing various automotive components, including instrument panels, knobs, energy-absorbing panels for doors, and housing parts for electrical systems. The automotive sector uses styrene for its durability and lightweight nature, which can enhance fuel efficiency. Roughly 15% of styrene produced globally is used in the automotive industry.

- Consumer Goods: A wide range of everyday consumer goods—such as toys, appliances, and electronics—contain styrene-based plastics. These plastics are chosen for their aesthetic finish, strength, and flexibility. The adaptability of styrene plastics means they can be found in products ranging from kitchen appliances to personal gadgets, making up approximately 10% of the styrene market.

- Medical Applications: In the medical field, styrene is utilized in the production of disposable syringes, IV tubing, and diagnostic components. It is preferred for its clarity, sterility, and resistance to chemical degradation, which are essential properties for medical supplies. This application represents around 5% of the global usage of styrene.

Major Challenges

- Environmental Regulations: Stringent environmental regulations pose a major challenge to the styrene industry. Governments worldwide are imposing strict limits on emissions and waste management practices. For instance, in the European Union, REACH regulations mandate rigorous testing and registration of chemicals, impacting styrene due to its classification as a potential human carcinogen. This has led companies to invest heavily in compliance, which can increase production costs by up to 15-20%.

- Volatility of Raw Material Prices: The cost of benzene, a primary raw material for styrene, frequently fluctuates due to global oil price dynamics and supply chain uncertainties. This volatility makes it difficult for manufacturers to predict costs and set prices, potentially reducing profit margins. In recent years, shifts in benzene prices have led to a price variability in styrene of approximately 10-12% annually, impacting budgeting and financial planning for businesses.

- Health and Safety Concerns: Health concerns associated with styrene exposure, including potential links to neurological and respiratory issues, have led to increased scrutiny by health organizations and the public. This scrutiny can influence public perception and lead to decreased demand or increased regulatory pressure, requiring companies to invest in safer production technologies and protective measures for workers, which can increase operational costs by 5-10%.

- Competition from Alternatives: The development of alternative materials that are less harmful to the environment or offer better performance characteristics poses a competitive threat to styrene. Materials such as bio-based polymers are gaining popularity due to their lower environmental impact. The shift towards these alternatives could potentially reduce the market share of traditional styrene products, necessitating innovation and adaptation strategies.

- Global Supply Chain Disruptions: The styrene market is highly dependent on a global supply chain, which can be disrupted by geopolitical tensions, trade disputes, or pandemics. Such disruptions can lead to shortages of raw materials or finished products, impacting production and delivery schedules. For example, supply chain disruptions during recent global events have led to delays and increased costs for up to 30% of styrene producers, significantly affecting their market operations.

Market Growth Opportunities

- Expansion into Emerging Markets: There is a significant opportunity for growth in emerging markets, particularly in Asia-Pacific regions such as China and India, where industrial and economic expansion is driving demand for consumer goods, automotive components, and construction materials. The market in these regions is projected to grow at a CAGR of around 7%, higher than the global average, due to increasing urbanization and industrial activities.

- Innovation in Styrene Applications: Innovation in product development offers substantial growth prospects. For example, the development of lightweight and high-strength styrene materials for automotive and aerospace applications can meet the industry’s demand for fuel-efficient and performance-oriented materials. Such innovations have the potential to increase market share in these sectors by 10-15% over the next decade.

- Advancements in Recycling Technologies: As environmental concerns continue to rise, investing in recycling technologies for styrene products provides an opportunity not only to reduce environmental impact but also to tap into the circular economy. The market for recycled styrene products is expected to grow by 20% annually, driven by both regulatory pressures and consumer preferences for sustainable products.

- Strategic Alliances and Mergers: Forming strategic alliances or mergers with other companies can help styrene producers expand their product offerings, enter new markets, and achieve economies of scale. Such collaborations can lead to a 5-10% increase in market penetration rates, particularly in tightly regulated markets where local partnerships can facilitate easier market entry and compliance with local laws.

- Bio-based Styrene Production: The development of bio-based styrene aligns with the global shift towards sustainable materials. This sector presents an emerging market that could represent up to 10% of the overall styrene market by 2030. Investing in the research and production of bio-based styrene not only addresses environmental concerns but also caters to the growing consumer demand for “green” products.

Key Players Analysis

Chevron Phillips Chemical Company is a significant player in the styrene sector, primarily producing styrene monomer, a fundamental component of various plastics. Their operations include modern production methods and a focus on sustainability through recycling initiatives. The company’s global presence is bolstered by facilities like the St. James Plant, which has recently undergone modernization to increase production efficiency and output.

Covestro AG is a prominent player in the global chemicals market, focusing on innovative and sustainable polymer solutions. In the styrene sector, it is involved as part of its broader range of precursor chemicals, which also includes polyurethane foams and polycarbonate production. The company’s strategy integrates sustainability, aiming to transition towards a circular economy and reduce environmental impact, thereby aligning its operations with global sustainability targets.

Hanwha Group, a major South Korean conglomerate, has taken strategic steps to bolster its position in the styrene market by increasing production at its Daesan facility. This facility is crucial for the production of styrene monomer, a key component in manufacturing plastics like polystyrene and acrylonitrile-butadiene-styrene. With a production capacity adjustment, Hanwha aims to meet the growing market demand for these essential materials, aligning with its broader commitment to operational efficiency and market responsiveness.

INEOS Styrolution, a global leader in the styrenics market, is at the forefront of sustainable practices in the industry. The company has introduced a new line of eco-friendly styrenics, including mechanically recycled polystyrene and bio-attributed styrene products, which significantly reduce greenhouse gas emissions by up to 74% compared to traditional styrene production. These advancements underscore INEOS Styrolution’s commitment to sustainability, leveraging innovative technologies to offer products with reduced environmental impact while maintaining the functional integrity and regulatory compliance required for a wide range of applications.

LyondellBasell Industries actively produces styrene, utilized across a broad spectrum of applications from automotive parts to food packaging, at their manufacturing facilities in Texas, the Netherlands, and China. The company emphasizes innovation in its styrene production processes to enhance efficiency and sustainability. LyondellBasell is also advancing a circular economy approach, notably through the creation of polymers from recycled plastic waste, aligning with their commitment to reducing environmental impact while continuing to meet the global demand for styrene products.

LG Chem, a leading petrochemical company from South Korea, has shifted its focus to the styrene sector. After closing its styrene monomer (SM) plant in Daesan due to market oversaturation and price declines influenced by increased production from Chinese competitors, LG Chem plans to expand its styrene monomer output by 70,000 tons per year at its Yeosu site to meet shifting market demands. This adjustment is part of a broader strategic reorientation towards high-value-added products.

Reliance Industries Ltd has expanded its focus on sustainability within its petrochemical operations, particularly in the production of high-value chemicals from its integrated Oil to Chemicals (O2C) business. Their approach emphasizes enhancing refinery efficiency and reducing environmental footprint by transitioning towards cleaner fuels and energy sources.

Repsol, on the other hand, has expanded its presence in the styrene market through international collaborations, including a significant agreement to construct three chemical plants in Jiangsu, China. These plants, with a substantial production capacity, will produce styrene monomers and other polymers, reinforcing Repsol’s strategic expansion into high-demand chemical products.

BASF SE is actively engaged in the styrene sector, with a significant production unit in Ludwigshafen, Germany. This unit, having a capacity of 550,000 metric tons per year, is scheduled to restart at the end of October following a planned maintenance period. This restart is crucial for BASF as it navigates the economic pressures of production costs and the market demand for styrene.

Royal Dutch Shell plc, now known simply as Shell plc, is reevaluating its chemicals business, including its involvement in the styrene sector, due to lagging performance. This strategic review is part of Shell’s broader efforts to address challenges within its diverse portfolio, focusing on enhancing efficiency and profitability across its operations.

Ashland Inc. has focused on managing production and inventory to align with fluctuating customer demand within its performance materials sector, which includes products like styrene. These strategic adjustments, which are part of broader portfolio optimization efforts, aim to enhance operational efficiency and financial performance amidst ongoing market uncertainties.

Nova Chemicals Corporation is actively involved in the styrene sector, notably through strategic joint ventures to bolster its position in the European market. For instance, it has partnered with INEOS to expand its joint venture in styrenics, incorporating North American assets into this collaboration, which aims to enhance production efficiencies and market reach. However, Nova Chemicals faced operational challenges at its Bayport, Texas styrene plant due to a shortage of ethylene, leading to a temporary shutdown of the facility. Despite this, the company remains committed to meeting its market obligations through other production capabilities.

SABIC Co is a key player in the global chemicals market, with a strong presence in the styrene sector. The company operates with a focus on diversified chemical manufacturing and maintains a robust position in the production of styrene products, leveraging its extensive global operational footprint and advanced research capabilities to meet broad market demands effectively.

Ineos Group AG, through its subsidiary INEOS Styrolution, is a global leader in the styrene sector, focusing on the production of styrene monomer, polystyrene, and ABS Standards. The company is pioneering sustainable solutions, such as bio-attributed styrenics, which significantly lower greenhouse gas emissions by up to 74% compared to traditional methods. These efforts are part of a broader strategy to enhance the environmental sustainability of their products, including innovations like mechanically recycled and bio-based styrenics suitable for various applications including packaging and healthcare.

Alpek S.A.B. de C.V. has enhanced its presence in the styrenics market by acquiring NOVA Chemicals’ expandable styrenics business. This strategic acquisition includes facilities in Pennsylvania and Ohio, USA, significantly boosting Alpek’s production capabilities in expandable polystyrene (EPS) and specialty polymers like ARCEL, which aligns with their long-term growth strategy and focus on sustainable product portfolios.

Shell plc has refocused its chemical business strategy to address performance issues within its diverse portfolio, including its activities in the styrenics sector. This strategic evaluation is part of Shell’s broader initiative to optimize efficiency and profitability across its operations, reflecting a pivot towards more sustainable and economically viable practices.

Conclusion

The styrene market is positioned for significant growth and transformation, driven by its critical role in numerous industrial applications and the ongoing development of innovative and sustainable solutions. Despite facing challenges such as stringent environmental regulations and volatility in raw material costs, the market is expected to thrive, fueled by opportunities in emerging markets, advancements in recycling technologies, and the increasing demand for bio-based and high-performance styrene derivatives.

By strategically navigating these opportunities and challenges, industry players can enhance their competitive advantage and contribute to the sustainable evolution of the styrene market, ensuring robust growth and profitability in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)