Table of Contents

Introduction

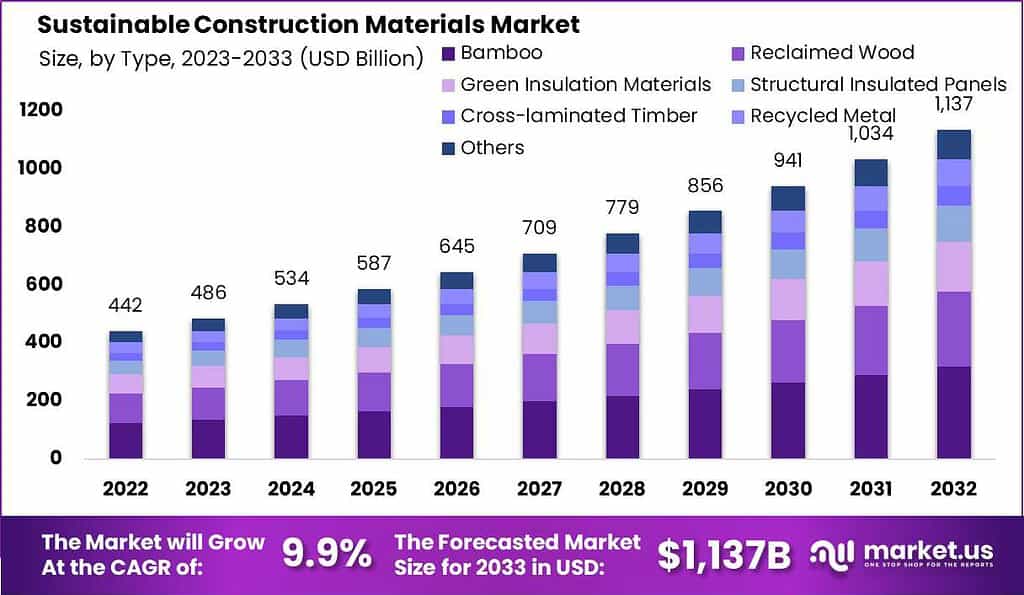

The Sustainable Construction Materials Market is poised for significant growth, projected to expand from USD 442.19 billion in 2023 to approximately USD 1137.0 billion by 2033, at a compound annual growth rate (CAGR) of 9.9%.

This surge is largely driven by heightened awareness of environmental impacts and increasing demand for green building practices. The market’s expansion is bolstered by technological advancements and a shift towards eco-friendly materials, which promise not only reduced environmental footprints but also cost efficiencies over time.

However, the sector faces several challenges, including high initial costs and a complex regulatory landscape that can vary significantly by region. For instance, Europe is seeing robust growth due to supportive government initiatives like the EU Energy Performance of Buildings Directive, which encourages the use of sustainable materials.

Recent developments in the market include strategic acquisitions and the introduction of innovative products. For example, Binderholz GmbH expanded its capabilities by acquiring BSW Timber Ltd, becoming Europe’s largest sawmill and solid wood processor. Additionally, Lafarge Egypt introduced Ecolabel cement, aligning with green building requirements by significantly reducing carbon emissions. These developments reflect a broader industry trend towards consolidating capabilities and enhancing product offerings to meet evolving environmental standards and consumer expectations.

Alumasc Group Plc has demonstrated a strong focus on sustainability and growth through recent acquisitions and product innovations. In December 2023, Alumasc acquired ARP Group, enhancing its product range and market reach. This acquisition aligns with its strategy to strengthen its sustainable product offerings and capitalize on market demand for environmentally friendly solutions. Alumasc has also been actively involved in developing sustainable roofing solutions, such as the integration of green and blue roofing techniques, which emphasize rainwater buffering and energy savings, further establishing its commitment to sustainability.

Amvic Inc., although specific recent activities were not detailed in the latest data, the company is known for its innovative approach in the sustainable building sector. Amvic produces insulated concrete forms that offer significant energy savings, an essential feature in sustainable construction. Their products are designed to provide high thermal resistance and structural integrity, which aligns with the growing demand for energy-efficient building solutions.

Key Takeaways

- The global Sustainable Construction Materials Market size is expected to be worth around USD 1137.0 Bn by 2033, from USD 442.19 Bn in 2023, growing at a CAGR of 9.9% during the forecast period from 2023 to 2033.

- Reclaimed Wood dominated Sustainable Construction Materials with a 23.3% share.

- Structural dominated the Sustainable Construction Materials Market with a 37.3% share.

- Residential dominated the Sustainable Construction Materials Market with a 34.5% share.

- Asia-Pacific led the global Aluminum Castings Market in 2023, capturing 41% market share, valued at USD 182.6 Bn.

Sustainable Construction Materials Statistics

- The environmental dimension consisted of eleven indicators, social dimension had eight indicators, and economic dimension had six indicators, making a total of 25 indicators.

- In determining the key indicators for each dimension, a hypothesized mean of 4.000 and above was set as a critical cutoff point. It means that any indicator that recorded a mean of 4.000 or above was considered a key indicator, which the study identified as measuring sustainable construction materials.

- The first ranked indicator for the environmental dimension is “human toxicity” with a mean value of 4.267. The following two indicators are “climate change” and “solid waste,” both with a mean value of 4.000.

- The result indicates that four indicators were rated by the respondents as the key indicators within the theoretical mean of 4.000.

- The construction industry is a big consumer of raw materials, accounting for over 30% of the extraction of natural materials. It’s also responsible for 40% of carbon emissions and over 30% of energy consumption.

- The World Health Organization (WHO) states that up to 24% of global deaths are linked to unhealthy environments.

- Sustainable construction reduces waste, which is a big problem in the construction industry, given it has a rework rate of 30%.

- The industry is responsible for at least 40% of the world’s carbon dioxide emissions.

You can monitor everything on the go to identify gaps and streamline parallel operations to ensure zero waste and reduce build time by up to 20%. - Moreover, sustainability is increasingly influencing tenant choice, with a Nielsen global online study indicating that 81% of respondents feel strongly that companies should help improve the environment.

Emerging Trends

- 3D Printing: This technology is revolutionizing construction by allowing for the efficient use of materials and reducing waste. It enables the printing of complex building components directly onsite, speeding up construction processes and reducing carbon emissions associated with transport.

- Green and Biophilic Architecture: These design philosophies integrate natural elements within architectural plans, improving energy efficiency and occupant well-being. Buildings designed with these principles use less energy and enhance the quality of the living or working environment.

- Living Materials: Innovations include the use of biological compounds like mycelium, which are being harnessed to develop self-repairing concrete and other living materials that grow and regenerate themselves. This could drastically reduce the maintenance costs and environmental impact of buildings.

- Circular and Zero Waste Construction: Emphasizing the reuse and recycling of materials, circular construction minimizes waste and maximizes resource efficiency. Zero waste construction focuses on designing buildings from the outset to minimize waste during construction and throughout their lifecycle.

- Renewable Energy Integration: More buildings are incorporating renewable energy sources like solar and wind directly into their design, contributing to the net-zero energy goals. This trend is supported by advancements in energy-efficient materials and green building certifications like LEED.

- Advanced Materials: New materials such as advanced composites and those derived from waste products (like agricultural waste) are becoming more prevalent. These materials are not only environmentally friendly but also perform as well or better than traditional construction materials.

Use Cases

- Recycled Materials in Building Construction: Recycled construction materials, such as steel and glass, are used in building projects to reduce costs and environmental impact. For example, the use of recycled steel in a corporate office building in London led to a 20% reduction in construction costs and obtained a LEED Gold certification, which enhanced its rental and resale value.

- High-Performance Concrete: This material integrates advanced admixtures to achieve superior strength and durability, reducing the overall resource consumption and enhancing the longevity of structures. It is particularly valuable in infrastructural projects where longevity and resilience are critical.

- Green Composites: These materials, made from natural fibers and bio-based resins, offer sustainable alternatives to traditional construction materials. They are used in various construction applications where reduced carbon footprint is a priority, aligning with eco-friendly construction practices.

- Sustainable Timber: Timber is a renewable resource that stores carbon, making it a key material in sustainable construction. Its use is crucial in projects aiming for carbon neutrality and in achieving sustainability certifications like LEED.

- LEED Certification Projects: The use of LEED-certified materials such as bamboo, insulated concrete forms, and non-VOC paints in construction projects helps achieve LEED certification, which can significantly improve a building’s marketability and energy efficiency.

- Living Materials: Innovative materials such as self-mending concrete, which uses bacteria to heal cracks in the concrete, are being explored for their potential to reduce maintenance costs and increase the durability of structures.

Major Challenges

- High Costs: Sustainable construction materials and green building practices can be 1-25% more expensive than traditional methods, primarily due to the intricacies of design, modeling, and the costs associated with green certifications. The materials themselves can be 3-4% more expensive, leading to hesitation among potential adopters concerned about the initial investment.

- Supply Chain and Scaling Issues: Scaling the production of innovative sustainable materials to meet market demand presents a major challenge. This is often due to high upfront costs and the need for large quantities of materials, which can require significant changes to existing supply chains or the creation of new ones.

- Regulatory and Standardization Barriers: The construction industry faces a complex regulatory landscape that can slow the adoption of sustainable practices. Standards and certifications, while beneficial for ensuring safety and efficacy, often involve lengthy and costly processes that can deter stakeholders from adopting new materials.

- Market and Stakeholder Resistance: There is often a lack of awareness and understanding about the benefits of sustainable construction, leading to resistance from clients, contractors, and other stakeholders. This resistance is compounded by fears of higher initial costs and uncertainty regarding the long-term benefits and performance of sustainable materials.

- Technological Adaptation: Integrating new technologies such as Building Information Modelling (BIM) and advanced sustainable materials into traditional construction processes requires a shift in industry mindset and operations. The construction sector needs to overcome its inherent risk aversion to embrace these innovative solutions fully.

Market Growth Opportunities

- Regional Growth Dynamics: North America currently leads the market, attributed to a strong demand across various applications such as roofing and insulation, driven by regulatory support and consumer demand for sustainable buildings. Asia Pacific is expected to witness the highest growth rate, spurred by rapid urbanization and extensive infrastructure developments, particularly in emerging economies like China and India. The region benefits from strong governmental initiatives promoting sustainable construction.

- Innovations Driving Growth: Advances in material science, such as the development of green concrete and energy-efficient building systems, are transforming the industry. These innovations not only meet environmental standards but also offer enhanced performance, which is critical for market acceptance and growth.

- Government and Institutional Support: Increased regulatory support, particularly in Europe with directives like the EU Energy Performance of Buildings Directive, has catalyzed the adoption of green building practices and materials. Governments are also offering incentives for green building projects, which further stimulates market growth.

- Increasing Consumer Awareness: There is a growing awareness among consumers about the environmental impacts of construction, which is driving demand for sustainable building materials. This consumer shift is influencing both residential and commercial construction sectors to adopt greener practices.

Key Players Analysis

Alumasc Group Plc has shown strong performance in the sustainable construction materials sector, focusing on eco-friendly roofing solutions and water management products. In 2023, the company continued to innovate with products like green and blue roofs, which contribute to environmental sustainability by enhancing biodiversity and managing stormwater. Alumasc’s commitment to sustainability is evident in its strategic initiatives to integrate environmental benefits into its offerings, positioning it well for future market opportunities despite the competitive landscape.

Amvic Inc. specializes in providing innovative building solutions that focus on energy efficiency and environmental sustainability. Their product line includes insulated concrete forms (ICFs), which are known for their superior thermal insulation, contributing to significant energy savings and structural integrity in buildings. Amvic’s commitment to sustainable building practices is reinforced by their continual innovation and dedication to enhancing the energy efficiency of construction projects, although specific recent developments or financial data from 2023 or 2024 were not detailed in the latest sources

In 2023 and 2024, AECOM has made significant strides in its Sustainable Legacies strategy, focusing on achieving net-zero carbon emissions and embedding sustainable development across its projects. AECOM has implemented the ScopeX™ initiative, aiming to reduce carbon impact by at least 50% on major projects. This effort aligns with their broader goals of operational net-zero achieved by 2022 and science-based net-zero targets set for 2040. Their efforts include significant collaborations, like partnering with One Click LCA to enhance decarbonization across building and infrastructure projects globally.

Bauder Ltd. specializes in providing roofing systems with a focus on sustainability and durability. Although specific data from 2023 or 2024 was not directly mentioned in the latest resources, Bauder is known for its commitment to green building solutions, often incorporating advanced, eco-friendly materials and technologies into its roofing products to meet stringent environmental standards. Their approach typically involves innovations in green and blue roofing solutions, which are designed to reduce building energy use and manage stormwater effectively.

In 2023, Balfour Beatty has been actively advancing its sustainability strategy, notably achieving a 2% reduction in its total carbon emissions and improving carbon intensity by 7% compared to 2022. These strides are part of their broader goal to achieve net-zero carbon emissions by 2040. The company has also implemented innovative technologies such as EcoNet to manage power consumption more efficiently on construction sites, which has been particularly effective in reducing carbon emissions.

Binderholz GmbH, a leader in the sustainable construction materials sector, has been focusing on expanding its capabilities through strategic acquisitions. In 2023, Binderholz acquired BSW Timber, making it Europe’s largest sawmill operation. This expansion not only increases its production capacity but also strengthens its position in the market by broadening its sustainable product offerings and enhancing its ability to meet the rising demand for eco-friendly building materials.

Clark Group has consistently emphasized sustainability in its construction projects, showcasing a commitment to reducing embodied carbon and enhancing building performance. Throughout 2023, Clark has been a leader in green construction, highlighted by their deployment of over 360 LEED-accredited professionals and the completion of over 500 sustainably certified projects. This commitment places them as a top-ranked green builder in the nation, continually integrating sustainable practices from project inception to completion.

CEMEX, a global leader in the building materials industry, is heavily focused on sustainable construction practices. CEMEX’s efforts are rooted in their “Future in Action” strategy aimed at achieving carbon neutrality. This includes reducing their carbon footprint through the development of low-carbon and carbon-neutral products and solutions across their operations. Their commitment is further evidenced by initiatives to increase the use of renewable energy and improve energy efficiency across their plants.

Florbo International SA is actively involved in the sustainable construction materials sector, focusing on integrating green building practices and materials to reduce environmental impact. Florbo International SA, along with other industry leaders, is contributing to the expansion of environmentally friendly building solutions, which are increasingly favored due to rising regulatory and consumer demand for sustainability in construction.

Gilbane Building Company is also making significant strides in the sustainable construction sector, leveraging its expertise to foster the adoption of green building certifications and integrating renewable energy sources into its projects. The company’s commitment to sustainable construction is underscored by its active role in promoting environmentally responsible practices and reducing the carbon footprint of the built environment. Gilbane is recognized for its strategic approach to embedding sustainability into its construction processes, significantly contributing to the industry’s shift towards more sustainable development practices.

Gensler: In 2023 and 2024, Gensler has been at the forefront of sustainable design, significantly expanding its Gensler Product Sustainability (GPS) standards to include a broad range of building products and furniture. This initiative aims to drastically reduce the environmental impact across the construction industry by setting sustainability performance criteria for interior design materials used across their global projects. Gensler’s commitment is evident in their focus on reducing carbon footprints and enhancing the sustainability profiles of their designs, promoting a more responsible approach throughout the industry

Hensel Phelps: Hensel Phelps is recognized for its commitment to sustainability, utilizing innovative construction practices and materials to reduce environmental impact. While specific 2023 or 2024 initiatives were not detailed, the company is known for integrating sustainable solutions into their projects, focusing on energy efficiency, and using materials that minimize ecological footprints. Their approach includes rigorous compliance with environmental standards and certifications, underscoring a deep commitment to building sustainably and responsibly

Johnson Controls: In 2023 and 2024, Johnson Controls has shown significant advancement in sustainable construction through its Smart Buildings initiative, leveraging technology to reduce carbon emissions. The company’s 2024 sustainability report highlights their progress in decarbonizing the built environment, reporting a 43.8% reduction in Scope 1 and 2 emissions since 2017. Additionally, their OpenBlue digital platform has quadrupled the emissions avoided by customers since 2020, showcasing their commitment to innovative, climate-focused solutions in the sustainable construction sector

LafargeHolcim: Now known as Holcim Group, the company has continued its leadership in sustainable construction materials into 2023 and 2024 by focusing on eco-friendly products like ECOPlanet, which delivers at least 30% lower carbon footprint. Holcim’s initiatives also extend into recycling, with significant investments in processes that repurpose materials like demolished concrete and used asphalt. Their commitment is further demonstrated through their active involvement in global green building councils and partnerships aimed at promoting circular economy practices within the construction industry.

Saint-Gobain has continued to assert its leadership in the sustainable construction materials sector through significant contributions to global sustainability and innovation. In 2023 and 2024, the company focused on promoting circular economy practices and advancing the decarbonization of construction materials. Their initiatives include launching RenuCore™ by CertainTeed, which innovatively recycles asphalt shingle waste, demonstrating Saint-Gobain’s commitment to reducing landfill waste and enhancing the recycling content in building materials. Saint-Gobain’s efforts are supported by a broad strategy aimed at achieving carbon neutrality by 2050, with the company also deeply involved in various educational and community-based initiatives to promote sustainable construction practices globally.

Skanska has positioned itself as a key player in the sustainable construction sector by implementing rigorous environmental strategies across its projects. Although specific data from 2023 or 2024 was not detailed, Skanska is known for its strong commitment to green building practices, including the use of renewable energy sources and sustainable materials in their construction projects. The company’s focus on enhancing the energy efficiency of buildings and reducing carbon emissions aligns with its long-term sustainability goals, reinforcing its reputation as a leader in developing eco-friendly and innovative construction solutions.

Siemens AG: In 2023, Siemens AG demonstrated significant progress in sustainable construction materials by focusing on its ambitious sustainability targets. The company managed to halve its CO2 emissions since 2019 and is helping customers avoid around 190 million tons of CO2 emissions through its technologies. Siemens integrates sustainability deeply into its operations and product design, aligning with its DEGREE framework which emphasizes decarbonization, resource efficiency, and ethical business practices. This approach underpins their broader goal to achieve carbon neutrality in their operations by 2030.

Sika AG: Sika AG, while specific year-wise data for 2023 or 2024 was not detailed in the latest sources, is known for its commitment to sustainable development within the construction materials sector. The company is focused on enhancing the durability and energy efficiency of construction projects globally. Sika promotes the use of innovative materials that improve the environmental footprint of building projects and continues to develop solutions that contribute to sustainable construction practices. Their efforts are particularly noted in the production of high-quality concrete and admixtures that reduce energy and resource consumption in construction.

The Whiting-Turner Contracting Company has made notable strides in the sustainable construction sector, particularly highlighted by their management of several green projects across the United States. In 2023 and 2024, they undertook key projects like the Port of Cleveland’s General Cargo Terminal modernization, which includes significant upgrades for decarbonization and enhanced stormwater management. This project not only aims to extend the terminal’s operational capabilities but also integrates environmental sustainability at its core, reflecting Whiting-Turner’s commitment to reducing environmental impact through innovative construction practices.

The Turner Corp., while specific 2023 or 2024 data was not detailed, is known for its long-standing commitment to sustainable construction. The company has been involved in numerous projects that incorporate green building practices and materials, aiming to meet LEED certification standards and reduce overall environmental footprints. Turner Corp.’s focus on sustainability is integral to their project planning and execution, ensuring that they meet the increasing demands for environmentally responsible building practices.

Veolia Environnement S.A.: In 2023 and 2024, Veolia Environnement S.A. has significantly advanced its commitment to sustainable construction through its GreenUp strategic program. This initiative emphasizes the rapid deployment of solutions that not only decarbonize and depollute but also regenerate resources, aligning with a broader ecological transformation. Veolia’s focus on using non-recyclable waste, wastewater, and other residues for energy highlights their innovative approach to creating sustainable and efficient materials and energy solutions. The company’s drive towards ecological transformation is expected to generate substantial market opportunities, estimated at around €2.5 trillion, underscoring the potential impact and profitability of sustainable practices in construction and beyond.

WSP Global Inc.: Although specific 2023 or 2024 updates for WSP Global Inc. were not detailed in the latest sources, WSP Global is renowned for its emphasis on sustainable construction and engineering solutions. The company typically integrates cutting-edge technologies and green building practices to enhance infrastructure sustainability. Their strategic focus often involves leveraging global expertise to deliver projects that meet rigorous environmental standards and contribute to the sustainable development of communities and cities. WSP Global’s ongoing projects likely continue to reflect this commitment, positioning them as a leader in sustainable practices within the construction sector.

Conclusion

This trend is supported by innovations in material technology, stringent environmental regulations, and increasing consumer awareness about the benefits of sustainable living. As the industry continues to evolve, stakeholders from manufacturers to end-users are urged to capitalize on the integration of sustainable practices to not only enhance building performance but also contribute to a more sustainable global economy. The future of construction lies in the balance of innovation, regulation, and market readiness to embrace green solutions as the new standard.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)