Table of Contents

Introduction

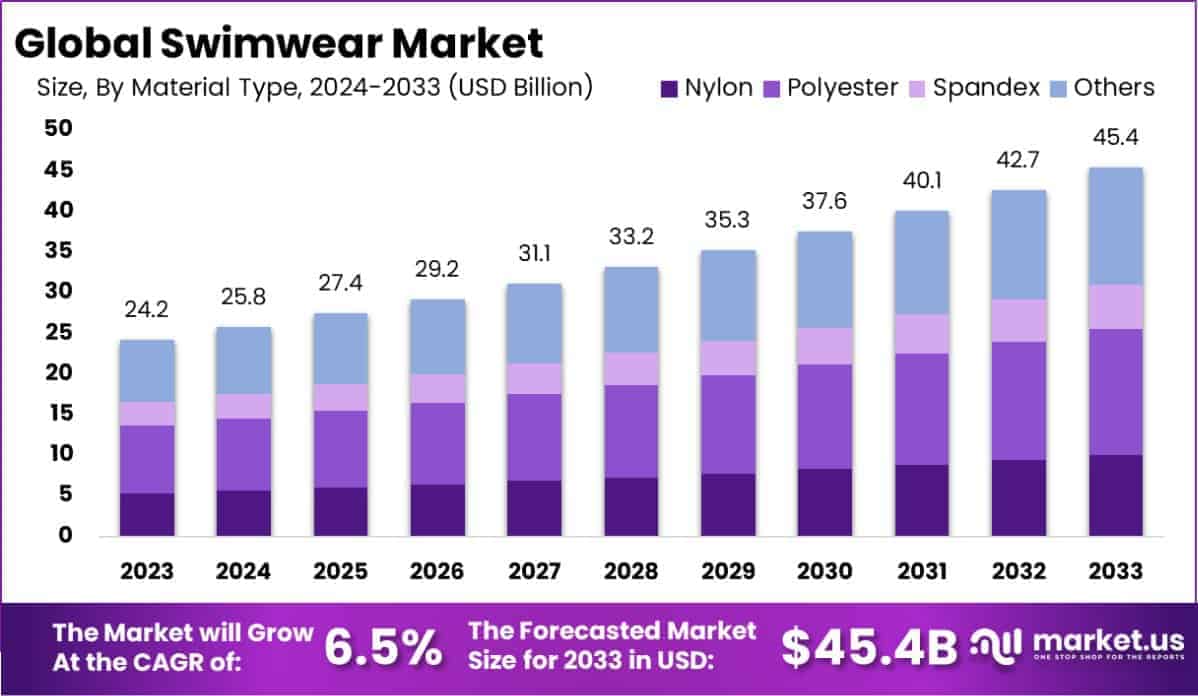

The Global Swimwear Market is projected to grow significantly, reaching an estimated value of USD 45.4 billion by 2033, up from USD 24.2 billion in 2023. This reflects a compound annual growth rate (CAGR) of 6.5% over the forecast period from 2024 to 2033.

Swimwear, also known as bathing suits or swimsuits, refers to garments specifically designed for water-based activities such as swimming, diving, surfing, and recreational beach or poolside wear. These garments are crafted to provide comfort, flexibility, and resistance to water, often using materials such as polyester, spandex, and nylon. Swimwear also plays a significant role in personal expression, offering diverse styles, cuts, and designs that cater to various cultural and fashion preferences.

The swimwear market encompasses the production, distribution, and sale of swimwear across various segments, including casual swimwear, competitive swimwear, and specialty items such as modest swimwear or sun-protective clothing. This market caters to a broad demographic, ranging from children to seniors, and spans both mass-market and luxury segments. It is influenced by trends in fashion, tourism, and health-conscious lifestyles, with products sold through brick-and-mortar stores, online platforms, and specialized outlets.

Several factors contribute to the growth of the swimwear market. The rising popularity of aquatic fitness and leisure activities has driven demand, supported by an increasing global focus on health and wellness. The growth of international tourism, especially to beach destinations, further fuels market expansion. Additionally, advancements in fabric technology, such as quick-drying and UV-protective materials, enhance product functionality and appeal. Fashion-forward designs and collaborations with influencers also play a pivotal role in capturing consumer interest.

Demand for swimwear is steadily increasing due to multiple socio-economic and cultural drivers. Urbanization and higher disposable incomes have spurred consumer spending on leisurewear, while social media platforms amplify fashion-conscious trends. Seasonality remains a key factor, with demand peaking during summer months and holiday seasons. However, innovations in thermal swimwear and all-season designs are working to mitigate the impact of seasonal fluctuations.

The swimwear market presents several growth opportunities, particularly in emerging markets where rising incomes and expanding middle-class populations are driving lifestyle upgrades. Sustainable and eco-friendly swimwear is an emerging trend, as consumers become more conscious of environmental issues. Additionally, there is a growing demand for inclusive swimwear that caters to diverse body types, cultural preferences, and gender-neutral designs. The expansion of e-commerce platforms also offers a significant channel for growth, providing brands with access to global consumer bases.

Key Takeaways

- The global swimwear market is projected to reach a valuation of USD 45.4 billion by 2033, up from USD 24.2 billion in 2023, with a compound annual growth rate (CAGR) of 6.5% during the forecast period from 2024 to 2033.

- Polyester emerged as the leading material type in the swimwear market in 2023, accounting for a 34.3% share of the segment.

- Women dominated the end-user segment of the market in 2023, representing a significant 65.5% share.

- The Asia Pacific region held a prominent position in the global market, capturing a 37.2% share and contributing USD 9.0 billion in revenue in 2023.

Swimwear Statistics

- The average American woman owns 4 swimsuits.

- A swimsuit typically lasts 2-3 years.

- On average, a person buys 1-2 new swimsuits per year.

- Consumers spend $100-$150 annually on swimwear.

- A swimsuit endures 20-50 wears before losing elasticity.

- Swimwear rental services have experienced 200% growth in two years.

- Nylon dominates swimwear fabrics, making up 40% of the market.

- Polyester accounts for 30% of swimwear fabric usage globally.

- Sales of swimwear made from bamboo fabric have risen by 15%.

- Swimsuits generally contain 18% spandex.

- The average swimsuit price in the U.S. is $60.

- Swimwear has a markup of 70-80%.

- The production cost for a swimsuit ranges from $15-$20.

- Bikinis represent 70% of women’s swimwear sales globally.

- Swimwear with UV protection features has seen a 15% increase in sales.

- Sales of reversible swimwear have grown by 10% in the past year.

- Demand for swimwear with slimming properties has risen by 20%.

- Swimwear with built-in shapewear has experienced a 25% increase in sales.

- Swimwear with adjustable features has seen a 15% sales increase.

- Swimwear featuring SPF protection has witnessed a 20% increase in demand.

- Quick-dry technology in swimwear has led to an 18% demand increase.

- Swimwear with insect-repellent properties has grown by 12%.

- Sustainable swimwear made from recycled materials is growing at a rate of 15% annually.

- Swimwear made from recycled plastic bottles has a 25% increase in demand.

- Sales of swimwear made from recycled fishing nets have risen by 30%.

- Swimwear using algae-based fabrics has seen a 10% demand increase.

- Swimwear made from coffee grounds has grown by 5% in sales.

- Swimwear crafted from recycled ocean plastics has grown by 35% in sales.

- Swimwear from seaweed-based fabrics has seen an 8% sales increase.

- The average swimsuit takes 2-3 years to decompose in a landfill.

- Competitive swimmers swim 6-12 miles daily in preparation for events.

- 14 million adults (31.3% of the population) swam in the past year—7.8 million women and 6.2 million men.

- 4.7 million adults swim at least twice a month (10.5% of the population).

- 2.7 million women (11.7% of females) swim twice a month.

- 27% of children aged 7-16 years (1.88 million) swam last week.

- 138,000 children cannot swim the statutory 25 meters when leaving primary school.

Emerging Trends

- Sustainable and Eco-Friendly Materials: Consumers are increasingly favoring swimwear made from recycled and environmentally friendly materials. Brands are responding by incorporating fabrics like recycled polyester and nylon, aligning with the global push towards sustainability. This shift not only appeals to eco-conscious buyers but also enhances brand reputation in a competitive market.

- Inclusive Sizing and Body Positivity: There’s a growing demand for swimwear that caters to diverse body types and sizes. Companies are expanding their size ranges and designing styles that promote body confidence, reflecting a broader societal movement towards inclusivity and acceptance. This approach helps brands connect with a wider audience and fosters customer loyalty.

- Technological Innovations in Fabric: Advancements in fabric technology are leading to swimwear that offers UV protection, chlorine resistance, and quick-drying capabilities. These functional enhancements meet consumer demands for durability and comfort, setting new standards in swimwear performance.

- Rise of Athleisure and Multi-Functional Designs: The blending of athletic wear with leisure fashion has led to swimwear that doubles as casual wear. Designs now often feature elements suitable for both swimming and everyday activities, providing versatility that appeals to modern consumers seeking value and practicality.

- Influence of Social Media and Celebrity Endorsements: Platforms like Instagram and TikTok play a pivotal role in shaping swimwear trends. Celebrity endorsements and influencer partnerships amplify brand visibility and drive consumer interest, making social media a critical component of marketing strategies in the swimwear sector.

Top Use Cases

- Recreational Swimming: Swimwear is primarily used for leisure swimming in pools, lakes, and beaches. This segment continues to dominate as families and individuals prioritize relaxation and wellness. The demand for comfortable and stylish swimwear for vacations and weekend getaways drives this use case.

- Water Sports and Adventure Activities: Swimwear is a key requirement for water-based sports like surfing, diving, and jet skiing. This segment sees strong demand from adventure enthusiasts and professionals, leading to ongoing innovation in designs that offer durability and enhanced mobility.

- Fitness and Aquatic Training: A growing number of people use swimwear for health-focused activities, such as lap swimming, water aerobics, and rehabilitation exercises. These use cases favor performance-enhancing swimwear that provides support and resistance to chlorine damage.

- Beachwear and Resort Fashion: Beyond functional purposes, swimwear is a staple for sunbathing and resort wear. It often doubles as casual or lounge attire, catering to consumers looking for stylish, multifunctional options suitable for beach vacations and poolside events.

- Youth and Competitive Sports: Swimwear plays a crucial role in competitive swimming and youth sports, including school competitions and community events. Its use in this context prioritizes speed, aerodynamics, and comfort, driving specialized product lines.

Major Challenges

- Seasonal Demand Fluctuations: Swimwear sales are highly seasonal, with peak demand during warmer months. This seasonality can lead to inventory management challenges and cash flow issues for manufacturers and retailers. For instance, in regions with short summers, the limited selling window can result in unsold stock, affecting profitability.

- Price Sensitivity Among Consumers: Many consumers are price-sensitive, especially during economic downturns. This sensitivity can pressure swimwear brands to lower prices, potentially impacting profit margins. Balancing affordability with quality remains a persistent challenge in the market.

- Rapidly Changing Fashion Trends: The swimwear market is influenced by fast-evolving fashion trends, requiring brands to continually innovate and update their product lines. Keeping pace with these changes demands significant investment in design and marketing, which can strain resources, particularly for smaller companies.

- Environmental Concerns and Sustainability: The production of swimwear often involves synthetic materials that contribute to environmental pollution. Consumers are increasingly demanding eco-friendly products, pushing brands to adopt sustainable practices. Transitioning to sustainable materials and processes can be costly and complex, posing a challenge for the industry.

- Intense Market Competition: The swimwear industry is highly competitive, with numerous brands vying for market share. This competition can lead to market saturation, making it difficult for new entrants to establish themselves and for existing brands to maintain their positions without continuous innovation and effective marketing strategies.

Top Opportunities

- Expansion into Emerging Markets: Developing regions, particularly in Asia and Latin America, are experiencing rising disposable incomes and urbanization. This economic growth leads to increased participation in leisure activities, boosting demand for swimwear. Companies can capitalize on this by tailoring products to local tastes and establishing distribution networks in these areas.

- Development of Multi-Functional Swimwear: Consumers are seeking versatile swimwear suitable for various activities, including swimming, beach sports, and casual wear. Designing products that seamlessly transition between these uses can attract a broader customer base, meeting the demand for both functionality and style.

- Integration of Technological Innovations: Advancements in fabric technology, such as UV protection, quick-drying materials, and enhanced durability, offer opportunities to differentiate products. Incorporating these features can meet consumer demands for performance and comfort, setting brands apart in a competitive market.

- Promotion of Body Positivity and Inclusive Sizing: There’s a growing consumer demand for swimwear that caters to diverse body types and promotes body confidence. Offering a wide range of sizes and inclusive designs can tap into this market segment, fostering brand loyalty and expanding the customer base.

- Leveraging Digital Marketing and E-Commerce: The increasing prevalence of online shopping provides a platform to reach a global audience. Utilizing digital marketing strategies, including social media campaigns and influencer partnerships, can enhance brand visibility and drive online sales, especially among younger demographics.

Key Player Analysis

- Adidas AG: A global leader in sportswear, Adidas offers a comprehensive range of swimwear products. The company’s swimwear line emphasizes performance and style, catering to both professional athletes and casual swimmers. Adidas’ extensive distribution network and strong brand recognition have solidified its position in the swimwear market.

- Nike Inc.: Renowned for innovation in athletic apparel, Nike provides swimwear that combines functionality with modern design. The brand’s focus on high-quality materials and advanced technology appeals to a broad consumer base, from competitive swimmers to recreational users. Nike’s global presence and marketing strategies contribute significantly to its market share.

- Pentland Group PLC: As the parent company of Speedo, Pentland Group holds a significant share in the swimwear industry. Speedo is synonymous with competitive swimming gear, offering products that blend performance with innovation. Pentland’s strategic acquisitions and brand portfolio diversification have strengthened its market position.

- Arena SpA (Berkshire Hathaway): Specializing in swimwear for competitive swimming, Arena is recognized for its technical expertise and high-performance products. The brand’s commitment to research and development has led to the creation of advanced swimwear technologies, catering to professional athletes worldwide.

- LVMH Moët Hennessy Louis Vuitton: Through its luxury brand portfolio, LVMH offers high-end swimwear that combines fashion with premium quality. Targeting affluent consumers, the company’s swimwear lines are characterized by exclusive designs and superior materials, reinforcing its status in the luxury segment of the market.

Recent Developments

- In 2024, Consortium Brand Partners (CBP) acquired Outdoor Voices (OV), the athleisure brand founded in 2013 by Tyler Haney. This follows CBP’s acquisition of a majority stake in Draper James in 2023, expanding its portfolio of lifestyle brands.

- In 2024, Water Babies, the swim school founded in 2002 by Paul Thompson, was acquired by Elmsley Capital and Westerly Group. The company, headquartered in Devon, teaches over 80,000 babies annually through franchises in several countries, including the US and China.

- In 2024, HUE, the NYC-based women’s clothing brand, launched its first swimwear collection. Combining style and functionality, the collection debuted in March to meet the evolving needs of modern women.

Conclusion

The global swimwear market is poised for significant growth, driven by increasing participation in aquatic activities, evolving fashion trends, and rising health consciousness among consumers. Advancements in fabric technology, such as quick-drying and UV-protective materials, are enhancing product appeal and functionality. The shift towards sustainable and inclusive designs reflects a broader societal emphasis on environmental responsibility and body positivity. The expansion of e-commerce platforms is further broadening market reach, offering brands access to a diverse and global consumer base. Collectively, these factors are expected to sustain the market’s upward trajectory in the coming years.