Table of Contents

Introduction

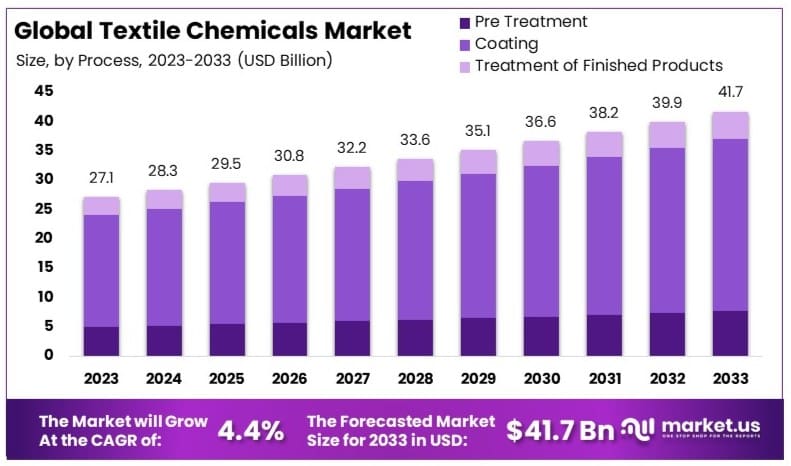

The global textile chemicals market is poised for growth, projected to expand from USD 27.1 billion in 2023 to approximately USD 41.7 billion by 2033, with a compound annual growth rate (CAGR) of 4.4%. This market is critical in the textile production process, contributing to the aesthetics, functionality, and durability of finished textiles.

Growth within this sector is driven by several factors. There’s a rising demand for apparel and home furnishing, bolstered by growing populations and increasing urbanization in emerging markets. Moreover, technological advancements have introduced innovative textile chemicals that enhance the performance and sustainability of textiles. These advancements include the development of eco-friendly and sustainable chemicals, which align with global efforts to mitigate the environmental impact of textile production.

However, the industry faces challenges, notably health concerns associated with certain chemicals used in manufacturing. These concerns have prompted tighter regulations and a push for safer, more sustainable production practices. Additionally, the competitive nature of the market pressures companies to continually innovate while maintaining cost efficiency to sustain profitability.

Recent developments also indicate a shift towards sustainability. For example, collaborations between companies like Archroma and Huntsman Corporation aim to enhance sustainable practices within the industry. Furthermore, the increasing adoption of smart textiles, which require specialized chemicals to improve functionality such as conductivity and durability, presents new opportunities for growth in this sector.

Solvay S.A. is recognized for its innovation in developing eco-friendly and high-performance solutions, which aligns with the global shift towards sustainable manufacturing practices. Solvay’s strategic focus is on enhancing textile functionality while minimizing environmental impact, which is crucial as regulatory pressures increase.

Evonik Industries AG is another major player, investing heavily in research and development to innovate new products that meet the dynamic needs of the textile industry. Evonik’s efforts are geared towards creating solutions that enhance textile properties such as durability and colorfastness while also improving environmental profiles.

Tanatext Chemicals stands out with its specialized chemical solutions that cater to a variety of textile applications. The company’s products are pivotal in enhancing fabric performance, covering needs from dyeing and coloration to finishing processes. Tanatext’s commitment to technology and quality has positioned it well within the market.

Key Takeaways

- Textile Chemicals Market was valued at USD 27.1 billion in 2023 and is expected to reach USD 41.7 billion by 2033, with a CAGR of 4.4%.

- Coating leads in the process segment with 70.3%, critical for enhancing fabric properties.

- Coating & Sizing Chemicals lead in product with 49.4%, essential for textile finishing and quality.

- APAC dominates the market with 54.6%, driven by its extensive textile manufacturing.

Textile Chemicals Statistics

- The environmental impact of the textile industry accounts for around 20% of global wastewater.

- Textile waste accounts for around 10% of all waste generated globally.

- The textile industry contributes to around 3% of total global CO2 emissions.

- The textile industry is responsible for around 20% of industrial water pollution globally.

- The fashion industry is responsible for approximately 10% of global carbon emissions.

- The textile industry contributes 4% to India’s GDP and employs over 45 million people.

- Synthetic fibers account for around 70% of all fibers used in the textile industry.

- Textile and apparel imports to the United States amounted to approximately $86 billion in 2020.

- 20% of all industrial water pollution is caused by fabric dyes and treatments.

- It is estimated that 10,000 different dyes are used industrially.

- 8,000 synthetic chemicals are used to bleach, treat, and brighten our clothes.

- Azo dyes, which account for 60-70% of all dyes in the industry – are known carcinogens.

- Mills can use up to 200 tons of water per ton of dyed fabric; which in turn, only produces about 1400 pieces of clothing.

- During the dyeing process, it is estimated that the loss of colorants that end up in the environment ranges from 10-50%, depending on the color and chemicals used.

- The textile industry is one of the largest industries in the world; producing an average of 60 billion kilograms of fabric annually.

Emerging Trends

- Sustainable Chemicals: There is a growing emphasis on eco-friendly textile chemicals, such as bio-based dyes and finishing agents. Companies are increasingly investing in sustainable practices to reduce their environmental footprint, responding to consumer demand for greener products.

- Smart Textiles: The integration of technology into textiles is gaining momentum. Chemical manufacturers are developing materials that incorporate functionalities like moisture-wicking, UV protection, and antimicrobial properties, catering to markets such as sportswear and medical textiles.

- Digitalization: The adoption of digital technologies is revolutionizing the textile chemicals industry. Innovations like 3D printing and digital dyeing are enhancing efficiency and reducing waste, while also allowing for greater customization of textile products.

- Regulatory Compliance: Stricter regulations regarding chemical safety and environmental impact are pushing manufacturers to reformulate products. Compliance with international standards is becoming essential, influencing product development and marketing strategies.

- Recycling Initiatives: The focus on circular economy principles is prompting advancements in recycling processes for textile chemicals. Companies are exploring ways to reuse chemicals and fibers, minimizing waste and resource consumption.

Use Cases

- Apparel Manufacturing: Textile chemicals are essential in producing clothing. Dyes and pigments enhance the color and aesthetics of fabrics while finishing agents improve qualities like softness and wrinkle resistance. For instance, eco-friendly dyes are gaining popularity, with the global market for natural dyes projected to reach approximately USD 3 billion by 2026.

- Home Textiles: Chemicals used in home textiles, such as upholstery and curtains, provide features like stain resistance and flame retardancy. For example, stain-repellent treatments can reduce cleaning frequency, extending the life of textiles and enhancing consumer satisfaction.

- Technical Textiles: This sector includes applications in automotive and medical textiles, where specialized chemicals improve performance. For instance, antimicrobial agents in medical textiles help prevent infections, a critical feature in hospital settings. The global technical textiles market is expected to grow from USD 160 billion in 2020 to over USD 220 billion by 2026, indicating a robust demand for innovative textile chemicals.

- Sustainable Practices: The push for sustainability has led to the development of bio-based and recycled textile chemicals. For example, companies are creating biodegradable polymers for textile applications, aiming to reduce the environmental impact of synthetic fibers. The global biodegradable textile market is anticipated to reach USD 2.5 billion by 2025.

- Smart Textiles: Innovations in smart textiles incorporate conductive fibers and sensors, leading to applications in wearable technology. Chemical treatments enable these functionalities, such as moisture management and temperature regulation. The market for smart textiles is projected to grow from USD 1.8 billion in 2020 to USD 5.4 billion by 2025, underscoring the potential of chemical advancements in this area

Major Challenges

- Environmental Regulations: Increasingly stringent regulations regarding chemical use and waste disposal are a major concern for textile manufacturers. Compliance with regulations such as REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) in Europe can be costly and time-consuming. Non-compliance can lead to heavy fines and damage to reputation, with the global cost of non-compliance estimated to reach USD 100 billion annually across various industries.

- Health Concerns: The use of hazardous chemicals in textile production poses health risks to workers and consumers. For example, certain dyes and finishing agents have been linked to skin allergies and respiratory issues. The demand for safer alternatives is increasing, driving the need for investment in research and development to create non-toxic chemicals.

- Sustainability Pressures: There is a growing demand for sustainable products, which forces companies to rethink their manufacturing processes. The transition to eco-friendly chemicals often requires significant investment in new technologies. The global sustainable textile market is projected to grow from USD 105 billion in 2020 to USD 150 billion by 2025, highlighting the shift but also the pressure on companies to adapt.

- Cost of Raw Materials: Fluctuations in the prices of raw materials can severely impact profit margins in the textile chemicals sector. For instance, the prices of key inputs like petrochemicals can be volatile, affecting overall production costs. Companies must find ways to manage these costs while maintaining competitive pricing.

- Competition and Innovation: The textile chemicals market is highly competitive, with numerous players vying for market share. Companies are required to continuously innovate and improve their product offerings to stay relevant. This ongoing need for innovation can strain resources, especially for smaller manufacturers.

Market Growth Opportunities

- Sustainability Initiatives: With increasing consumer awareness regarding environmental issues, there is a significant opportunity for companies to develop eco-friendly textile chemicals. The market for sustainable textiles is expected to grow from USD 105 billion in 2020 to USD 150 billion by 2025, indicating strong consumer demand for greener alternatives.

- Technological Advancements: Innovations in smart textiles, which incorporate functionalities like moisture-wicking and temperature regulation, are on the rise. The smart textiles market is projected to expand from USD 1.8 billion in 2020 to USD 5.4 billion by 2025. Companies can capitalize on this growth by investing in research and development to create advanced chemical solutions.

- Emerging Markets: The growth of the textile industry in regions such as Asia-Pacific, particularly in countries like India and Bangladesh, offers substantial expansion opportunities. The Asia-Pacific textile chemicals market is expected to witness significant growth due to rising disposable incomes and increasing demand for clothing.

- Healthcare Textiles: The demand for antimicrobial and biocompatible textiles in the healthcare sector is increasing, especially in the wake of the COVID-19 pandemic. The global market for healthcare textiles is anticipated to reach USD 30 billion by 2026, presenting a lucrative opportunity for manufacturers of specialized textile chemicals.

- Circular Economy Practices: The shift towards a circular economy, which emphasizes recycling and reuse, offers companies the chance to develop recyclable textile chemicals. This approach not only addresses sustainability concerns but also meets regulatory requirements, potentially increasing market appeal.

Key Players Analysis

Solvay S.A. is a key player in the textile chemicals sector, focusing on sustainable solutions that enhance textile performance while minimizing environmental impact. The company offers a wide range of products, including specialty dyes, finishing agents, and performance chemicals designed to meet the needs of modern textiles. Solvay’s commitment to innovation is evident in its development of eco-friendly products that comply with global regulations, positioning the company as a leader in sustainable practices within the industry.

Evonik Industries AG is a prominent provider of textile chemicals, specializing in high-performance materials that improve fabric functionality and durability. The company’s product portfolio includes additives and surfactants that enhance dyeing processes and textile treatments. Evonik is dedicated to sustainability, investing in research to create safer and more efficient chemical solutions. This focus not only addresses regulatory demands but also meets the increasing consumer preference for environmentally friendly textile products, reinforcing Evonik’s competitive edge in the market.

Tanatext Chemicals is a notable player in the textile chemicals sector, focusing on innovative solutions that enhance the performance of various fabrics. The company specializes in producing specialty chemicals for dyeing, finishing, and functional applications, catering to the needs of both apparel and industrial textiles. Tanatext is committed to sustainability, developing eco-friendly products that comply with international environmental standards. This dedication to quality and innovation positions Tanatext as a trusted partner in the global textile industry.

Rudolf GmbH operates as a leading supplier of textile chemicals, offering a wide range of products designed to improve textile performance. The company’s offerings include pre-treatment, dyeing, and finishing chemicals that enhance properties such as stain resistance, water repellency, and fire retardancy. Rudolf GmbH emphasizes sustainability by developing environmentally friendly solutions that meet stringent regulatory requirements. Their commitment to innovation and quality helps ensure that their products remain competitive in a rapidly evolving textile market, supporting diverse applications from fashion to technical textiles.

NICCA Chemical Co. Ltd. is a prominent player in the textile chemicals sector, specializing in a diverse range of products that enhance fabric performance and aesthetics. The company offers innovative solutions, including dyes, finishing agents, and specialty chemicals that cater to various applications, from fashion textiles to technical fabrics. NICCA emphasizes sustainability, developing eco-friendly products that meet global environmental standards. Their commitment to research and development enables them to stay ahead in a competitive market, positioning NICCA as a reliable partner for textile manufacturers worldwide.

Kemin Industries Inc. is a key contributor to the textile chemicals market, focusing on providing specialty chemicals that improve the quality and performance of textiles. Their product portfolio includes softeners, anti-static agents, and finishing chemicals designed for a variety of applications, from apparel to industrial textiles. Kemin prioritizes sustainability and innovation, investing in research to develop environmentally friendly solutions that align with industry trends. This focus allows Kemin to support textile manufacturers in enhancing product functionality while addressing environmental concerns effectively.

JINTEX Ltd. is an influential player in the textile chemicals sector, specializing in a broad range of high-quality products for textile processing. The company focuses on manufacturing dyes, finishing agents, and auxiliaries that enhance fabric properties such as color vibrancy and durability. JINTEX is committed to sustainability, developing eco-friendly solutions that comply with international environmental standards. Their dedication to innovation and quality positions JINTEX as a trusted partner for textile manufacturers looking to improve the performance and sustainability of their products.

Sarex Chemicals is a notable supplier in the textile chemicals market, offering a comprehensive range of specialty chemicals for textile processing. Their product lineup includes dyes, chemicals for pre-treatment, and finishing agents designed to enhance fabric quality and performance. Sarex places a strong emphasis on sustainability, actively developing environmentally friendly alternatives to traditional chemicals. By investing in research and development, Sarex aims to meet the evolving needs of the textile industry, positioning itself as a reliable partner for manufacturers seeking innovative and sustainable solutions.

Archroma is a leading company in the textile chemicals sector, known for its innovative solutions that enhance the quality and sustainability of fabrics. The company offers a wide range of products, including dyes, finishing agents, and performance chemicals designed to meet the needs of various textile applications. Archroma prioritizes environmental responsibility by developing eco-friendly products that minimize environmental impact. Their commitment to research and development ensures that they remain at the forefront of industry trends, making Archroma a trusted partner for textile manufacturers worldwide.

Huntsman Corporation is a significant player in the textile chemicals market, providing a diverse array of products that improve textile performance. Their offerings include specialty dyes, textile auxiliaries, and finishing agents that enhance fabric properties such as colorfastness and durability. Huntsman focuses on sustainability, creating innovative chemical solutions that comply with global environmental standards. By investing in advanced technologies and sustainable practices, Huntsman helps textile manufacturers meet consumer demands while maintaining a competitive edge in the rapidly evolving market.

DIC Corporation is a prominent player in the textile chemicals sector, known for its comprehensive range of high-quality dyes and specialty chemicals. The company focuses on developing innovative solutions that enhance the performance and aesthetics of textiles. DIC emphasizes sustainability by creating environmentally friendly products that align with global regulations and market trends. Their commitment to research and development allows DIC to address the evolving needs of the textile industry, making it a reliable partner for manufacturers seeking quality and sustainable chemical solutions.

Kiri Industries Ltd. operates as a key supplier in the textile chemicals market, specializing in producing a wide variety of dyes and textile auxiliaries. The company focuses on delivering high-performance products that improve color vibrancy and fabric durability. Kiri Industries is committed to sustainability, investing in eco-friendly technologies that reduce environmental impact. With a strong emphasis on quality and innovation, Kiri Industries aims to meet the diverse needs of textile manufacturers, positioning itself as a trusted partner in the global textile chemicals sector.

Covestro AG is a significant player in the textile chemicals sector, focusing on developing innovative materials that enhance fabric performance and sustainability. The company specializes in producing high-performance polyurethane solutions that are used in coatings, adhesives, and other textile applications. Covestro emphasizes eco-friendly practices, striving to reduce the environmental impact of its products throughout their lifecycle. Their commitment to research and development ensures they stay at the forefront of industry advancements, making Covestro a reliable partner for textile manufacturers seeking innovative and sustainable solutions.

Omnova Solutions Inc. is an established supplier in the textile chemicals market, known for its diverse range of specialty chemicals and coatings. The company provides products that enhance textile properties, including durability, stain resistance, and color retention. Omnova places a strong emphasis on sustainability by developing eco-friendly solutions that comply with environmental regulations. Their focus on innovation and quality positions them as a trusted partner for textile manufacturers looking to improve the performance and appeal of their products in a competitive market.

Lubrizol Corporation is a key player in the textile chemicals industry, offering a variety of specialty chemicals that improve fabric performance and functionality. Their product portfolio includes softeners, anti-static agents, and water repellents, which are designed to enhance the quality and durability of textiles. Lubrizol is committed to sustainability, investing in research to create environmentally friendly alternatives that meet evolving industry standards. By focusing on innovation and quality, Lubrizol helps textile manufacturers achieve superior product performance while addressing consumer demands for sustainability.

Conclusion

In conclusion, the textile chemicals market is positioned for substantial growth, driven by increasing demand for innovative and sustainable solutions. With a projected market size reaching approximately USD 41.7 billion by 2033, companies are focusing on eco-friendly products and advanced technologies to meet regulatory requirements and consumer preferences. The rise of smart textiles and sustainable practices further underscores the need for continuous innovation in this sector. As manufacturers adapt to these trends, the textile chemicals industry is likely to play a crucial role in shaping the future of textile production and sustainability.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)