Table of Contents

Confectionery Market Overview

The confectionery companies encompass diverse sweet products, including chocolates, candies, gums, and mints. Categorized into chocolates, sugar confectionery, gum products, and novelty items.

Key ingredients such as sugars, cocoa, fats, and flavorings are essential in production processes, including mixing, cooking, molding, and packaging.

Current market trends highlight a shift towards health-conscious choices, innovative flavors, sustainability, and the growth of e-commerce.

Reflecting changing consumer preferences and an increasing emphasis on ethical sourcing. This dynamic sector continuously evolves, balancing traditional techniques with modern demands.

Market Drivers

The global confectionery market is propelled by several factors. Including rising consumer demand driven by increasing disposable incomes and population growth, especially in emerging markets.

Due to health trends, there is a notable shift towards low-sugar and organic options. Alongside innovative products featuring unique flavors and premium ingredients.

Seasonal promotions and the expansion of e-commerce enhance product accessibility and boost sales. Effective marketing builds brand loyalty, while sustainability and ethical sourcing increasingly influence consumer preferences.

Additionally, globalization promotes the appreciation of diverse confectionery offerings, shaping the industry and presenting new growth opportunities.

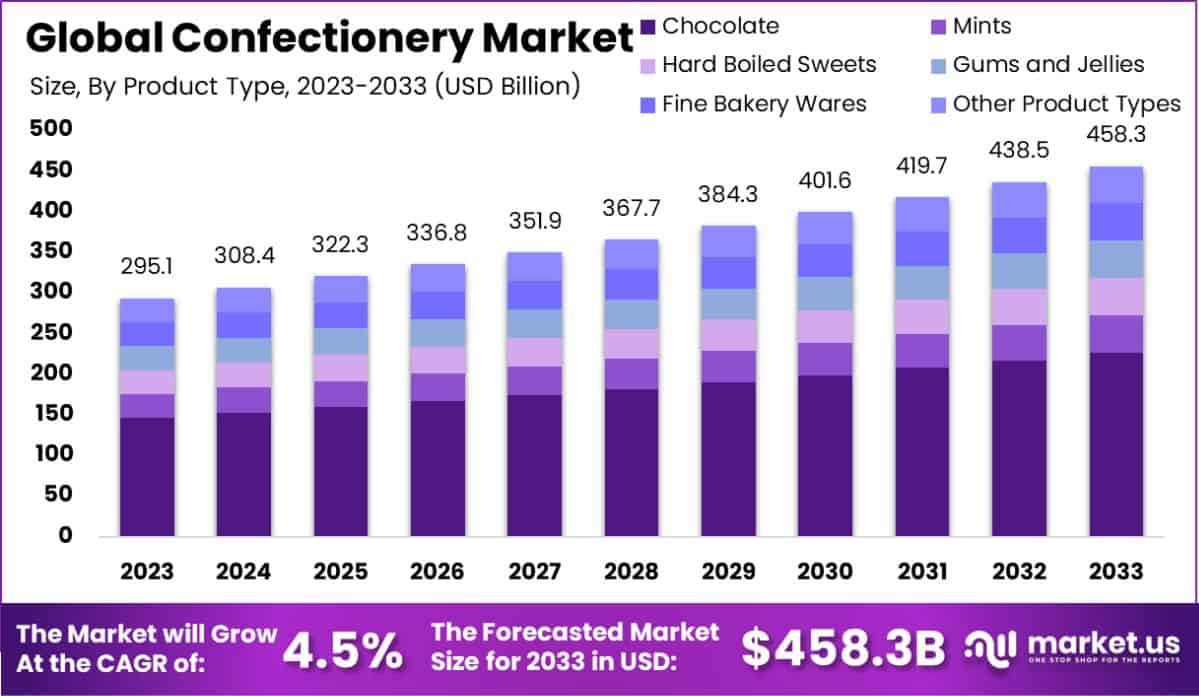

Market Size

The confectionery market is expected to grow from USD 248.7 billion in 2022 to USD 357.7 billion by 2032, with a CAGR of 3.8%.

List of Major Companies

These are the top ten companies operating in the Confectionery Market:

Smuckers

Company Overview

| Establishment Year | 1897 |

| Headquarter | Orrville, Ohio, U.S. |

| Key Management | Mark Smucker (CEO) |

| Revenue (US$ Bn) | $ 8.5 Billion (2022) |

| Headcount | ~ 5,800 (2022) |

| Website | http://jmsmucker.com/ |

About Smuckers

The J.M. Smucker Company has enhanced its position in the confectionery companies and sweet baked goods market through strategic acquisitions and product innovations.

Notably, its acquisition of Hostess Brands in late 2023 added popular items like Twinkies and Donettes to its existing portfolio, including Voortman cookies.

This move aims to strengthen Smucker’s presence in the U.S. snacking market. Recent product launches under the Hostess brand include a mystery flavor Twinkie and seasonal HoneyBun Donettes.

Additionally, Smucker introduced the Jif Peanut Butter & Chocolate Spread, marking a significant flavor expansion.

These initiatives are expected to bolster Smucker’s market share in the U.S. confectionery sector while effectively managing supply chain and pricing challenges.

Geographical Presence

The J.M. Smucker Company operates extensively across multiple regions, with its largest market in the United States.

Where it offers a diverse portfolio of well-known brands such as Folgers, Jif, and Meow Mix. In Canada, Smucker adapts its products to local preferences, while in Latin America.

It targets growth in coffee and snacks by localizing offerings. The company’s presence in Europe is strengthened through strategic acquisitions, and it sees potential in the Asia-Pacific region as demand for Western food products rises.

With a robust logistics network and a focus on e-commerce, J.M. Smucker is well-positioned to enhance its market share and drive growth internationally.

Recent Developments

- In September 2024, J. M. Smucker introduced a new Uncrustables flavor, peanut butter, and raspberry, its first new PB&J.

- In July 2024, J.M. Smucker announced its plans to sell Voortman Bakery.

Kraft-Heinz

Company Overview

| Establishment Year | 2015 |

| Headquarter | Chicago, Illinois, and Pittsburgh, Pennsylvania, U.S. |

| Key Management | Miguel Patricio (Chairman) |

| Revenue (US$ Bn) | $ 26.6 B (2023) |

| Headcount | ~ 36,000 (2023) |

| Website | https://kraftheinzcompany.com/ |

About Kraft Heinz

The Kraft Heinz Company has made significant progress in the confectionery companies/sector through product innovations and acquisitions.

Notable initiatives include the introduction of the “Heinz Remix” machine, enabling consumers to customize sauces.

Which aligns with the trend toward flavor personalization. This effort is part of the company’s strategy to achieve up to $2 billion in sales growth by 2027.

Additionally, Kraft Heinz is enhancing its healthy and sustainable product offerings. Including investments in plant-based alternatives through its joint venture with NotCo, which uses AI to develop plant-based cheeses.

The company is also revitalizing iconic brands to cater to modern demands for health and convenience, featuring lower-sugar and single-portion products.

Geographical Presence

The Kraft Heinz Company is a significant player in the global food and beverage sector, with operations across North America, Latin America, Europe, Asia-Pacific, the Middle East, and Africa.

In the U.S. and Canada, it leads the market with well-known brands like Heinz and Kraft. In Latin America, particularly Brazil and Mexico, it adapts products to local tastes.

The company focuses on innovation in key European markets such as the UK and Germany and targets growth in the Asia-Pacific region, especially China.

In the Middle East and Africa, efforts are concentrated on increasing brand awareness and distribution. Kraft Heinz prioritizes product innovation, sustainability, and e-commerce, strategically aligning with regional preferences to foster future growth.

Recent Developments

- In September 2024, Kraft Heinz introduced Heinz Pickle-flavored Ketchup.

- In August 2024, Kraft Heinz launched two new flavors of macaroni and cheese.

Mondelez

Company Overview

| Establishment Year | 1902 |

| Headquarter | Chicago, Illinois, U.S. |

| Key Management | Dirk Van de Put (CEO) |

| Revenue (US$ Bn) | $ 36.02 Billion (2023) |

| Headcount | ~ 91,000 (2023) |

| Website | http://www.mondelezinternational.com/ |

About Mondelez

Mondelez International has experienced significant growth in the confectionery companies/sector, driven by strong demand for core brands like Cadbury, Oreo, and Toblerone, resulting in a 14.7% revenue increase to $36.1 billion in 2023.

The company has pursued geographic and portfolio expansion through key acquisitions, including Clif Bar, Chipita, and Ricolino, enhancing its market presence.

Notably, emerging markets have made substantial revenue contributions, aided by strategic price adjustments.

Despite challenges from cocoa inflation and political tensions in the Middle East, disciplined pricing and cost controls helped boost gross profit by 18.8% to $13.3 billion.

Looking ahead to 2024, Mondelez forecasts revenue growth of 5–7%, emphasizing brand reinvestment and market diversification.

Geographical Presence

Mondelez International, Inc. is a leading multinational in the confectionery companies and snack industry, with a robust geographical presence across several key regions.

North America enjoys strong sales from brands like Oreos and Trident. Europe remains a significant market, particularly in the UK and Germany, where brands like Cadbury thrive.

The Asia Pacific region, including China and India, is a rapidly growing area driven by rising incomes and urbanization.

In Latin America, Brazil and Mexico represent substantial growth potential, while the Middle East and Africa focus on local tastes, particularly in South Africa and the GCC.

Mondelez’s strategic approach to local adaptation positions it favorably for continued growth in the global snack market.

Recent Development

- In October 2023, Mondelez International announced its plans to sell its stake in JDE Peet to JAB Holding Co. for US$2.34 billion.

- In October 2023, SnackFutures Ventures acquired a minority stake in doughnut maker Urban Legend.

Nestle

Company Overview

| Establishment Year | 1866 |

| Headquarter | Vevey, Switzerland |

| Key Management | Laurent Freixe (CEO) |

| Revenue (US$ Bn) | $ 103.5 Billion (2023) |

| Headcount | ~ 270,000 (2023) |

| Website | https://www.conagrabrands.com/ |

About Nestlé

Nestlé S.A. is enhancing its presence in the global confectionery companies/market, particularly in Brazil, through strategic acquisitions and sustainability initiatives.

Recently, the company acquired Grupo CRM, a premium chocolate retailer with over 1,000 stores under the Kopenhagen and Brasil Cacau brands, allowing it to enter Brazil’s high-end chocolate sector.

This acquisition is supported by regulatory approval for the purchase of Garoto, a renowned Brazilian chocolate brand, concluding a lengthy approval process.

Nestlé is also investing 2.7 billion reais ($550.8 million) over three years to modernize its chocolate and biscuit factories in Caçapava and Marília.

Aligned with its Nestlé Cocoa Plan, the company emphasizes sustainable cocoa sourcing, addressing consumer demand for eco-friendly products while aiming to capture a significant share of the premium confectionery market.

Geographical Presence

Nestlé S.A., a Swiss multinational food and beverage company, operates in 189 countries with a diverse portfolio of over 2,000 brands.

Its geographical presence spans North America (notably the U.S., Canada, and Mexico), Europe (including Switzerland, Germany, and France), Asia (with significant operations in China and India), Latin America (notably Brazil and Argentina), Africa and the Middle East (focusing on nutrition and wellness), and Oceania (Australia and New Zealand).

Nestlé adapts its products to local tastes, offering a wide range of items such as coffee, dairy, infant nutrition, and pet care.

The company emphasizes sustainability and responsible sourcing across its supply chain, positioning itself for continued growth in the competitive food and beverage market.

Recent Development

- In October 2024, Nestlé announced its plans to introduce a range of frozen meals on Asian and Mexican cuisines.

- In September 2023, Nestlé expanded in South America by acquiring a majority stake in Brazilian premium chocolate company Grupo CRM, which has over 1,000 Kopenhagen and Brasil Cacau boutiques.

Hershey

Company Overview

| Establishment Year | 1894 |

| Headquarter | Hershey, Pennsylvania, U.S. |

| Key Management | Michele Buck (CEO) |

| Revenue (US$ Bn) | $11.2 B (2023) |

| Headcount | ~ 18,650 (2023) |

| Website | https://www.thehersheycompany.com/en_us/home.html |

About Hershey

The Hershey Company, a major player in the confectionery companies/industry, is driving growth through innovation and acquisitions, with a strong focus on better-for-you (BFY) products.

Recent efforts include expanding its zero-sugar offerings and testing reduced-sugar options for popular brands like Reese’s and Hershey’s.

The 2021 acquisition of Lily’s enhanced its BFY portfolio, supported by ongoing R&D collaborations, such as with ASR Group, to explore sugar alternatives.

In 2024, Hershey announced the opening of its first new U.S. chocolate plant in over 30 years, aimed at boosting production for flagship brands and creating 125 new jobs.

This expansion underscores Hershey’s commitment to both product innovation and community investment.

Geographical Presence

The Hershey Company, based in Hershey, Pennsylvania, is a prominent global chocolate manufacturer with a significant presence across North America, Latin America, Europe, and Asia.

It leads the U.S. market, supported by various manufacturing facilities and a broad product range. In Canada and Mexico, Hershey tailors its offerings through localized production.

In Latin America, the company is expanding its market share, particularly in Brazil and Argentina, through strategic investments.

In Europe, growth has been notable in the UK via acquisitions, while the Asia-Pacific region, especially China and India, offers considerable growth potential.

Hershey focuses on e-commerce, sustainability, and product innovation to maintain its competitive edge and meet diverse consumer needs globally.

Recent Developments

- In October 2024, Hershey signed a five-year agreement with nine cocoa cooperatives in Côte d’Ivoire to enhance farmer relationships and strengthen the supply chain.

- In September 2024, Hershey signed a partnership with Nutrabolt to launch C4 variants with candy flavors.

Mars

Company Overview

| Establishment Year | 1911 |

| Headquarter | McLean, Virginia, U.S. |

| Key Management | Poul Weihrauch (CEO) |

| Revenue (US$ Bn) | $ 50.0 Billion (2024) |

| Headcount | ~ 150,000 (2024) |

| Website | https://www.mars.com/ |

About Mars

Mars, Incorporated is actively expanding its confectionery companies portfolio and sustainability initiatives.

Recently, the company acquired UK-based Hotel Chocolat for around £534 million, boosting its luxury chocolate segment and potential for global growth.

Mars is also investing $1 billion to cut greenhouse gas emissions by 50% by 2030, demonstrating its commitment to environmental stewardship.

Additionally, a $237 million investment in a new Nature’s Bakery production facility in Utah will increase plant-based snack output.

Furthermore, the $36 billion acquisition of Kellanova, which includes popular brands like Pringles and Pop-Tarts, enhances Mars’ offerings while focusing on premium and healthier snacking options.

Geographical Presence

Mars, Incorporated, a leading American multinational corporation, operates in over 80 countries with a diverse portfolio in confectionery, pet care, and food.

Significant markets include the United States and Canada in North America, the United Kingdom, Germany, and France in Europe, and a growing presence in Asia, particularly China and India.

In Latin America, Brazil and Mexico are key markets, while the company is gradually expanding its footprint in Africa and Australia.

Mars’s strategic focus on emerging markets, local product adaptation, and sustainability initiatives underpins its global growth, solidifying its position as a leader in the consumer goods sector.

Recent Developments

- In August 2024, Mars, Inc. acquired Kellanova, maker of Pringles and Pop-Tarts, a move expected to significantly impact the consumer packaged goods (CPG) industry, especially the snacking segment.

- In January 2024, Mars, Inc. invested $237 million to build a baking facility for its newly acquired brand, Nature’s Bakery, in Salt Lake City, Utah.

General-Mills

Company Overview

| Establishment Year | 1856 |

| Headquarter | Golden Valley, Minnesota, U.S. |

| Key Management | Jeffrey Harmening (CEO) |

| Revenue (US$ Bn) | $ 20.1 Billion (2023) |

| Headcount | ~ 34,000 (2023) |

| Website | http://www.generalmills.com/ |

About General Mills

General Mills, Inc. has concentrated on strategic growth and innovation in its confectionery and snacking segments as part of its Accelerate Strategy.

The company has prioritized product innovation to increase market share, particularly in snacking, where it responds to consumer demand for convenient and healthier options featuring bold flavors and better ingredients.

Additionally, General Mills is enhancing its digital infrastructure to improve e-commerce and supply chain efficiency.

It is also committed to sustainability, with a focus on regenerative agriculture across over 500,000 acres, aligning with consumer preferences for eco-friendly products.

These initiatives have enabled General Mills to achieve steady growth, even in a challenging market, while aiming to deliver sustainable returns to shareholders.

Geographical Presence

General Mills, Inc. is a prominent global food company with a diverse geographical footprint. In North America, particularly the U.S. and Canada, it features well-known brands like Cheerios and Yoplait, emphasizing innovation and health.

In Latin America, the company tailors its offerings to local tastes, while in Europe, it focuses on sustainability with brands such as Nature Valley and Häagen-Dazs.

The Asia-Pacific region, including China and Australia, is targeted for growth through e-commerce, and its operations in Africa and the Middle East prioritize partnerships to boost brand visibility. This multifaceted approach allows General Mills to meet global consumer demands effectively.

Recent Developments

- In September 2024, General Mills agreed to sell its North American yogurt business to Groupe Lactalis and Sodiaal for US$2.1 billion.

- In September 2024, General Mills signed a partnership with Ahold Delhaize USA (ADUSA) to reduce Scope 3 emissions.

Ferrero

Company Overview

| Establishment Year | 1946 |

| Headquarter | Alba, Piedmont, Italy |

| Key Management | Lapo Civiletti (CEO) |

| Revenue (US$ Bn) | $ 17.9 Billion (2023) |

| Headcount | ~ 47,212 (2023) |

| Website | http://www.ferrero.com/ |

About Ferrero

Ferrero International S.p.A. has enhanced its global footprint in the confectionery companies/market through strategic acquisitions and product innovation, achieving a 21% increase in turnover to €17 billion for the 2022-2023 fiscal year.

The acquisition of Wells Enterprises in early 2023 added popular ice cream brands like Blue Bunny and Halo Top to its North American portfolio while purchasing Italy’s Fresystem Group strengthened its frozen bakery offerings.

Recent product launches, such as Nutella Muffins and Nutella Biscuits in new markets, have further bolstered the brand.

Ferrero is committed to sustainability, reaching 90% traceability in its hazelnut supply chain and implementing eco-friendly cocoa sourcing practices, supported by €811 million in investments across global facilities.

Geographical Presence

Ferrero International S.p.A., based in Alba, Italy, is a prominent global confectionery company with a significant presence in Europe, particularly in Germany, France, and the UK. In North America, it has expanded in the U.S. and Canada through strategic acquisitions.

The company has tailored its products for local tastes in Asia-Pacific markets like China and India, and it maintains strong operations in Brazil and Mexico in Latin America, as well as a foothold in the UAE and South Africa in the Middle East and Africa.

Ferrero’s growth is fueled by its focus on localization, sustainable sourcing, and acquisitions, enabling it to meet diverse consumer preferences worldwide.

Recent Development

- In February 2023, Ferrero International acquired Fresystem SPA, a frozen pastry producer.

- In December 2022, Ferrero International agreed to acquire Wells Enterprises Inc.

Barry-Callebaut

Company Overview

| Establishment Year | 1996 |

| Headquarter | Zürich, Switzerland |

| Key Management | Peter Feld (CEO) |

| Revenue (US$ Bn) | $ 8.9 Billion (2022) |

| Headcount | ~ 13,754 (2023) |

| Website | http://www.barry-callebaut.com/ |

About Barry Callebaut

Barry Callebaut AG, a leader in the confectionery companies/industry, has recently taken strategic steps to solidify its market position and address challenges in the cocoa sector.

The company secured €700 million in Euro bond financing in 2024 to navigate the volatility in cocoa prices and support long-term corporate goals.

It launched the “Second Generation” chocolate, a premium, low-sugar line with high sustainability standards, appealing to consumers’ demand for both indulgence and ethical sourcing.

Barry Callebaut has also implemented the “BC Next Level” program, enhancing operational efficiency and positioning for sustainable growth despite industry headwinds, including a rising cost of raw materials and global supply chain constraints.

Geographical Presence

Barry Callebaut AG is a prominent global producer of chocolate and cocoa products with a significant presence in various regions.

It operates major facilities in Belgium and Switzerland, solidifying its status in Europe, and has production sites in the U.S. and Canada, emphasizing premium chocolate.

In Latin America, especially Brazil and Mexico, demand is rising due to a growing middle class. The company also targets the Asia-Pacific market, notably China and India, where consumer interest in chocolate is increasing.

In Africa, Barry Callebaut focuses on sustainable cocoa sourcing in countries like Ivory Coast and Ghana. These strategic initiatives position the company for ongoing growth in both established and emerging markets.

Recent Developments

- In July 2024, Barry Callebaut Group formed a strategic partnership with Microsoft to streamline integration across the entire value chain, from cocoa farmers to customers.

- In January 2024, Barry Callebaut launched Ruby Chocolate, a new type of chocolate characterized by its naturally reddish hue.

British-Foods

Company Overview

| Establishment Year | 1935 |

| Headquarter | London, England, UK |

| Key Management | George G. Weston (CEO) |

| Revenue (US$ Bn) | $ 24.3 Billion (2023) |

| Headcount | ~ 133,000 (2024) |

| Website | https://abf.co.uk/ |

About British Foods

In the confectionery companies/sector, Associated British Foods plc (ABF) has focused on strategic growth through targeted acquisitions and product expansions via its Ingredients division, ABF Ingredients (ABFI).

A key acquisition was the Fytexia Group, a life sciences company specializing in polyphenols and bioactive nutrients, which bolstered ABFI’s capabilities in nutraceuticals and dietary supplements.

Additionally, ABF has invested in innovation and capacity expansion, including a new enzyme powder packing facility in Hamburg and a yeast production plant in India to meet increasing demand.

These initiatives align with ABF’s strategy to enhance its portfolio with health-focused and functional ingredients while ensuring resilience in global markets.

Geographical Presence

Associated British Foods plc (ABF) operates worldwide in various sectors, including grocery, sugar, agriculture, and retail.

In the UK and Ireland, it features prominent grocery brands like Ovaltine and Twinings alongside its retail chain Primark.

ABF’s operations in Europe include grocery and sugar businesses in Germany and Poland, as well as Illovo Sugar in Southern Africa.

In North America, it offers grocery products under the Pioneer brand and taps into the growing Asian market with Twinings.

The agricultural division further strengthens its presence in Africa and Australia, contributing to ABF’s global resilience.

Recent Developments

- In September 2024, ABF acquired the Australian bakery business, The Artisanal Group.

- In August 2023, ABF acquired National Milk Records for GBP48 million.