Table of Contents

- Introduction

- Editor’s Choice

- Treadmill Market Statistics

- History of Treadmills

- Popular Treadmill Brands Statistics

- Treadmill Specifications Statistics

- Treadmill Sales Statistics and Trends

- Treadmill Costs Statistics

- User Treadmill Preferences Statistics and Trends

- Cardiovascular Fitness Test Protocols for Treadmill Statistics

- Exercise Protocol for Treadmill Statistics

- Technological Advancements in Treadmill Statistics

- Regulations for Treadmills

- Recent Developments

- Conclusion

- FAQs

Introduction

Treadmill Statistics: Treadmills are versatile exercise machines designed for indoor walking, jogging, or running.

They come in two main types: manual, which operates without electricity, and motorized. Which features an electric motor to drive the belt and offer adjustable speeds and inclines. Key components include the belt, deck, frame, control panel, and incline mechanism.

Motor power, belt size, cushioning, incline range, ergometer, and programming features are important factors to consider when choosing a treadmill.

Regular maintenance, such as cleaning, lubrication, and inspection, ensures optimal performance and longevity.

Editor’s Choice

- The first patent for a treadmill as a fitness tracker device was issued in 1913, and 1952. Dr. Robert Bruce and Wayne Quinton developed the first medical treadmill to diagnose heart and lung conditions.

- In 2023, the global treadmill market revenue stood at USD 3,846.2 million.

- By 2033, the market is projected to reach USD 6,507.9 million. With electronic treadmill revenues at USD 3,709.5 million and manual treadmill revenues at USD 2,798.4 million.

- As of April 2022, NordicTrack emerged as the most commonly owned brand of treadmill in the United States. With 31.9% of respondents indicating ownership of this brand.

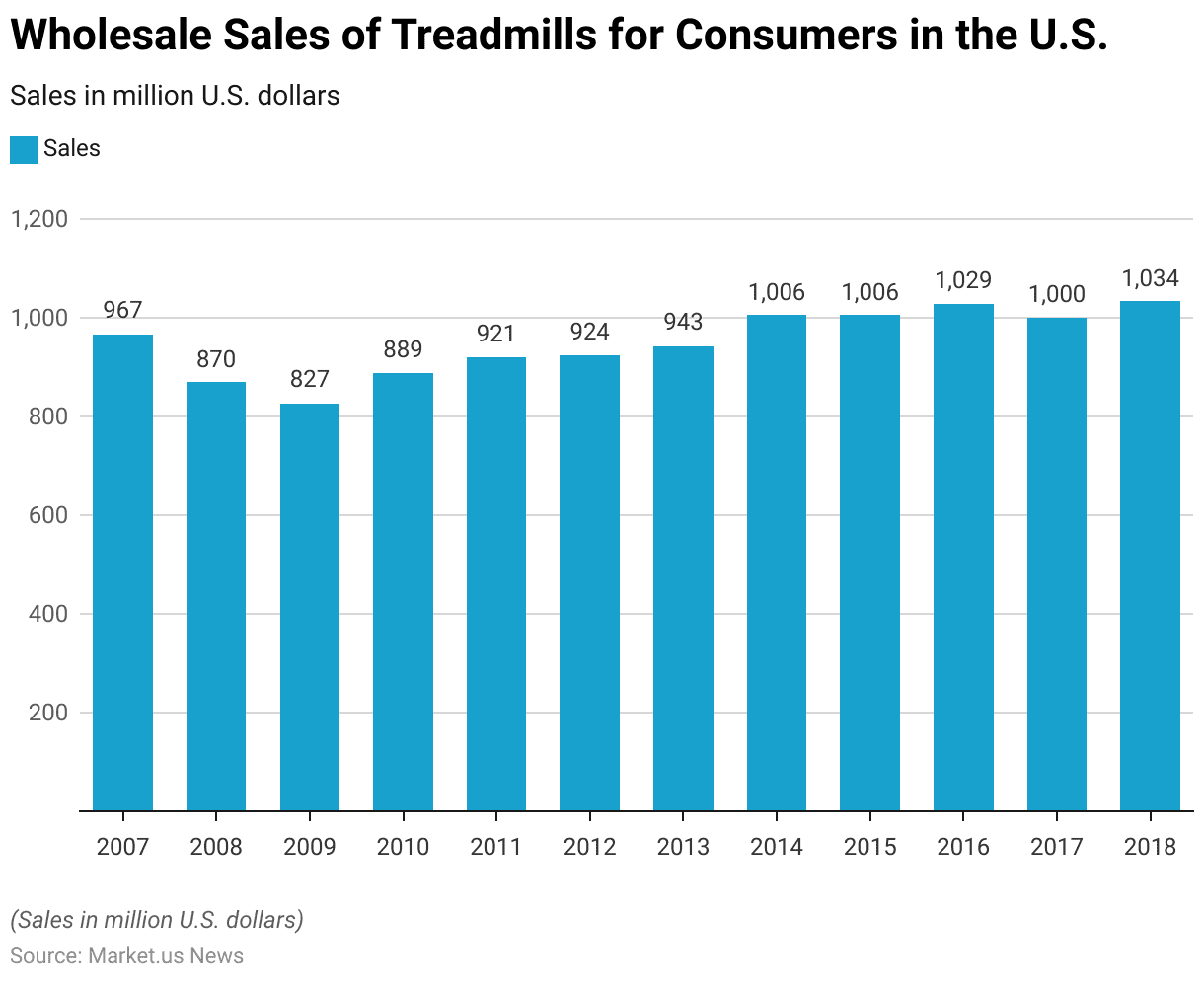

- Wholesale sales of treadmills for consumers in the U.S. peaked at USD 1,034 million in 2018.

- The cost of treadmills in the industry varies significantly, ranging from as low as $100 to over $5,000.

- In the United States, treadmill regulations include compliance with standards set by the Consumer Product Safety Improvement Act (CPSIA). The Federal Communications Commission (FCC) Part 15 for radiofrequency devices, and energy efficiency standards under 10 CFR Part 430.

Treadmill Market Statistics

Global Treadmill Market Size Statistics

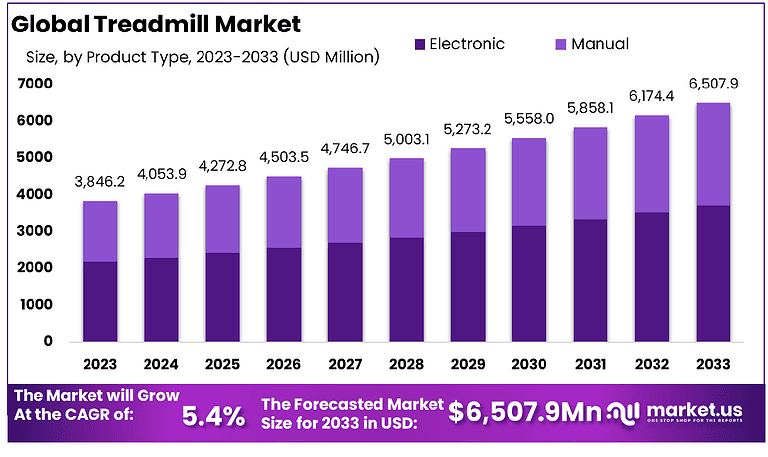

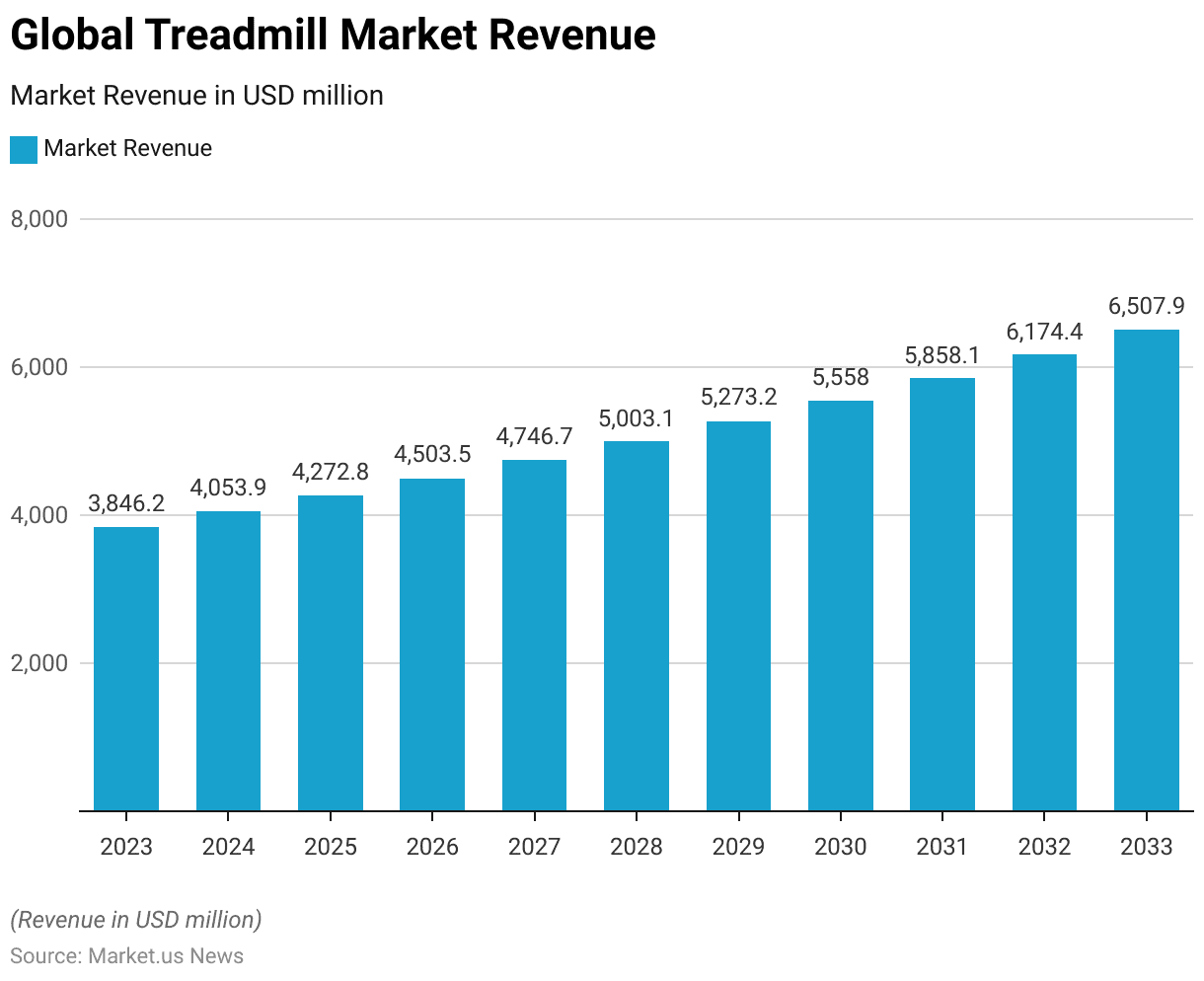

- The global treadmill market is projected to exhibit consistent growth from 2023 to 2033 at a CAGR of 5.4%.

- In 2023, the market revenue stood at USD 3,846.2 million.

- This figure is expected to rise to USD 4,053.9 million in 2024, reflecting a steady increase.

- By 2025, the market revenue is anticipated to reach USD 4,272.8 million, followed by USD 4,503.5 million in 2026.

- The upward trajectory continues, with the market revenue forecasted to hit USD 4,746.7 million in 2027 and USD 5,003.1 million in 2028.

- In subsequent years, the market is set to grow further. With revenues projected at USD 5,273.2 million in 2029, USD 5,558.0 million in 2030, and USD 5,858.1 million in 2031.

- The trend persists into the early 2030s, with the market expected to generate USD 6,174.4 million in 2032 and USD 6,507.9 million by 2033.

- This sustained growth highlights the increasing demand and market expansion for treadmills globally over the forecast period.

(Source: market.us)

Global Treadmill Market Size – By Product Type Statistics

2023-2028

- The global treadmill market, segmented by product type, is forecasted to experience robust growth from 2023 to 2028.

- In 2023, the total market revenue was USD 3,846.2 million. With electronic treadmills contributing USD 2,192.3 million and manual treadmills generating USD 1,653.9 million.

- The market is expected to grow to USD 4,053.9 million in 2024, with electronic and manual treadmills accounting for USD 2,310.7 million and USD 1,743.2 million, respectively.

- By 2025, revenues are projected to reach USD 4,272.8 million. Comprising USD 2,435.5 million from electronic treadmills and USD 1,837.3 million from manual treadmills.

- This upward trend continues, with the total market revenue anticipated to be USD 4,503.5 million in 2026, USD 4,746.7 million in 2027, and USD 5,003.1 million in 2028.

- For these years, electronic treadmill revenues are forecasted at USD 2,567.0 million, USD 2,705.6 million, and USD 2,851.8 million. In contrast, manual treadmill revenues are expected to be USD 1,936.5 million, USD 2,041.1 million, and USD 2,151.3 million, respectively.

2029-2033

- The growth persists through 2029, with total market revenue reaching USD 5,273.2 million. Driven by USD 3,005.7 million from electronic treadmills and USD 2,267.5 million from manual treadmills.

- By 2030, the market is projected to be USD 5,558.0 million. With electronic and manual treadmill revenues of USD 3,168.1 million and USD 2,389.9 million, respectively.

- The forecast for 2031 shows total revenues of USD 5,858.1 million. With electronic and manual treadmills contributing USD 3,339.1 million and USD 2,519.0 million, respectively.

- In 2032, the market is expected to generate USD 6,174.4 million in total revenue. With USD 3,519.4 million from electronic and USD 2,655.0 million from manual treadmills.

- Finally, by 2033, the market is projected to reach USD 6,507.9 million. With electronic treadmill revenues at USD 3,709.5 million and manual treadmill revenues at USD 2,798.4 million.

- This data indicates a strong and sustained demand for both electronic and manual treadmills over the forecast period.

(Source: market.us)

History of Treadmills

- The history of treadmills dates back to ancient times and has evolved significantly through various applications.

- Initially used in Roman times around the first century CE as treadwheel cranes for lifting heavy objects. Treadmills found their next prominent use in the early 19th century as punitive devices in prisons.

- English inventor Sir William Cubitt introduced the treadmill in 1817 to reform idle prisoners through hard labor. Which involved the monotonous, strenuous activity of grinding grain or pumping water.

- By the late 19th century, the penal use of treadmills was largely abandoned due to its excessive cruelty.

- The first patent for a treadmill as a fitness device was issued in 1913, and in 1952, Dr. Robert Bruce and Wayne Quinton developed the first medical treadmill to diagnose heart and lung conditions.

- The commercial treadmill for exercise gained popularity in the 1960s and 70s. It was fueled by Dr. Kenneth Cooper’s promotion of aerobic exercise.

- Modern advancements have integrated technology such as touchscreens and connectivity features. Making treadmills a staple in both home and gym environments worldwide.

(Sources: BarBend, Life Fitness, Inside Bodybuilding, Treadmill. run)

Popular Treadmill Brands Statistics

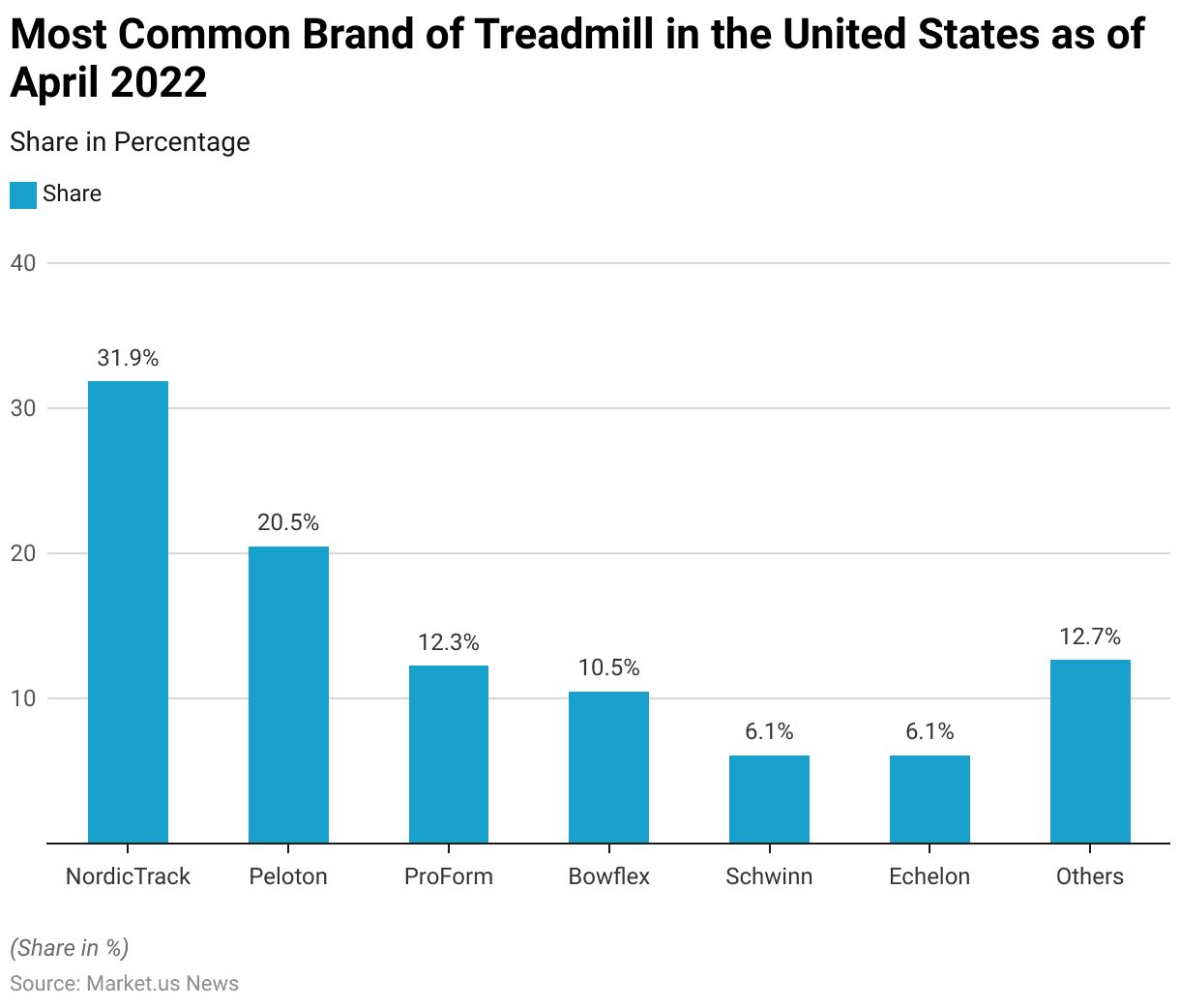

- As of April 2022, NordicTrack emerged as the most commonly owned brand of treadmill in the United States, with 31.9% of respondents indicating ownership of this brand.

- Peloton followed as the second most popular brand, with a 20.5% share of respondents.

- ProForm treadmills were owned by 12.3% of respondents, while Bowflex accounted for 10.5%.

- Both Schwinn and Echelon treadmills were owned by 6.1% of respondents.

- The remaining 12.7% of respondents owned treadmills from various other brands. Highlighting a diverse market presence beyond the leading manufacturers.

(Source: Statista)

Treadmill Specifications Statistics

General Specifications

- When evaluating treadmill specifications, several key factors must be considered. To ensure a comprehensive understanding of the machine’s capabilities and suitability for various fitness needs.

- The weight of the treadmill, which typically ranges between 150 to 345 pounds, influences its stability and portability.

- Rollers, often 2.5 to 3 inches in diameter, affect the smoothness and longevity of the belt.

- Speed capabilities can vary, with many treadmills offering a range from 0.1 to 12 miles per hour.

- Motor capacity, crucial for sustained performance, often ranges from 3.0 to 4.0 horsepower (HP).

- Dimensions, such as those of the Sole F89 (83″ L x 38″ W x 68″ H), dictate the space required for operation and storage.

- Power requirements usually involve standard home electrical systems, like 110 VAC, 50/60Hz, and 15A.

- Incline range is another critical feature, with advanced models offering from -6% decline to a 40% incline. As seen in the NordicTrack X11i, allowing for varied workout intensities.

- Additional features may include integrated safety mechanisms, heart rate monitoring, and multimedia capabilities such as touchscreen displays and Bluetooth connectivity.

- These specifications collectively determine the treadmill’s effectiveness, user experience, and suitability for different fitness goals.

(Sources: Peleton Support, Treadmill Reviews, Landice)

NordicTrack Commercial 1750

- The NordicTrack Commercial 1750 offers various features that cater to different user needs.

- The Commercial 1750 features a 14-inch HD touchscreen, includes a 30-day free trial family membership to iFit (regularly $39 per month or $396 per year), and has a belt length of 61 inches and a width of 22 inches.

- It supports speeds up to 12 mph, inclines up to 12% with a –3% decline, and can accommodate users up to 400 pounds.

- It measures 80 by 38 by 65 inches, has a step-up height of 9.6 inches, is foldable, and has a 3.5 continuous horsepower motor, with a warranty of 10 years on the frame, two years on parts, and one year on labor.

(Source: NordicTrack)

Bowflex Treadmill 10

- The Bowflex Treadmill 10 is equipped with a 10-inch HD touchscreen, includes a two-month Jrny membership (regularly $20 per month or $149 per year), and offers a belt length of 62 inches and a width of 22 inches.

- It also supports speeds up to 12 mph but with a higher incline capacity of 15% and a –5% decline.

- It supports a maximum user weight of 400 pounds and measures 85 by 39.6 by 65.3 inches, with a step-up height of 9.5 inches.

- It is also foldable, and while BowFlex has not disclosed the motor’s horsepower. It offers an extensive warranty of 15 years on the frame and motor, five years on parts, one year on electronics, and two years on labor.

(Source: BowFlex)

NordicTrack EXP 7i

- The NordicTrack EXP 7i has a 7-inch HD touchscreen and includes the same iFit membership offer as the Commercial 1750.

- It features a shorter belt length of 55 inches and a width of 20 inches, with a maximum speed of 10 mph and an incline capacity of 12% without a decline.

- This model supports a maximum user weight of 300 pounds. It has dimensions of 70.8 by 34.9 by 59.7 inches, and a step-up height of 7.9 inches.

- It is also foldable, comes with a 2.6 continuous horsepower motor, and carries the same warranty as the Commercial 1750.

(Source: NordicTrack)

Treadmill Sales Statistics and Trends

- Wholesale sales of treadmills for consumers in the U.S. have shown notable fluctuations over the period from 2007 to 2018.

- In 2007, wholesale sales reached USD 967 million.

- However, this figure declined over the next two years. Dropping to USD 870 million in 2008 and further to USD 827 million in 2009.

- The market began to recover in 2010, with sales rising to USD 889 million. Followed by a steady increase to USD 921 million in 2011 and USD 924 million in 2012.

- The upward trend continued, with sales reaching USD 943 million in 2013.

- A significant increase was observed in 2014, when sales hit USD 1,006 million, maintaining this level through 2015.

- In 2016, sales grew slightly to USD 1,029 million but then slightly decreased to USD 1,000 million in 2017.

- The market saw another rise in 2018, with wholesale sales peaking at USD 1,034 million, indicating a strong and growing demand for treadmills in the U.S. market over this period.

(Source: Statista)

Treadmill Costs Statistics

- The cost of treadmills in the industry varies significantly, ranging from as low as $100 to over $5,000.

- Treadmills priced around $100 are typically from disreputable brands, featuring only basic functionalities and potentially compromising on safety, particularly if purchased second-hand; therefore, such low-cost treadmills are not recommended.

- In contrast, high-quality models, such as the NordicTrack X32i, can be priced around $5,000, offering advanced features and robust build quality.

- Treadmill costs can be broadly categorized into three segments: Budget treadmills, priced between $100 and $1,000;

- Medium-range treadmills cost between $1,000 and $2,000, and high-quality treadmills cost more than $2,000.

- This categorization helps consumers understand the range of options available based on their budget and desired features.

(Source: AKFIT)

User Treadmill Preferences Statistics and Trends

Treadmill Preference Compared to Other Heavy Cardio Machines Statistics

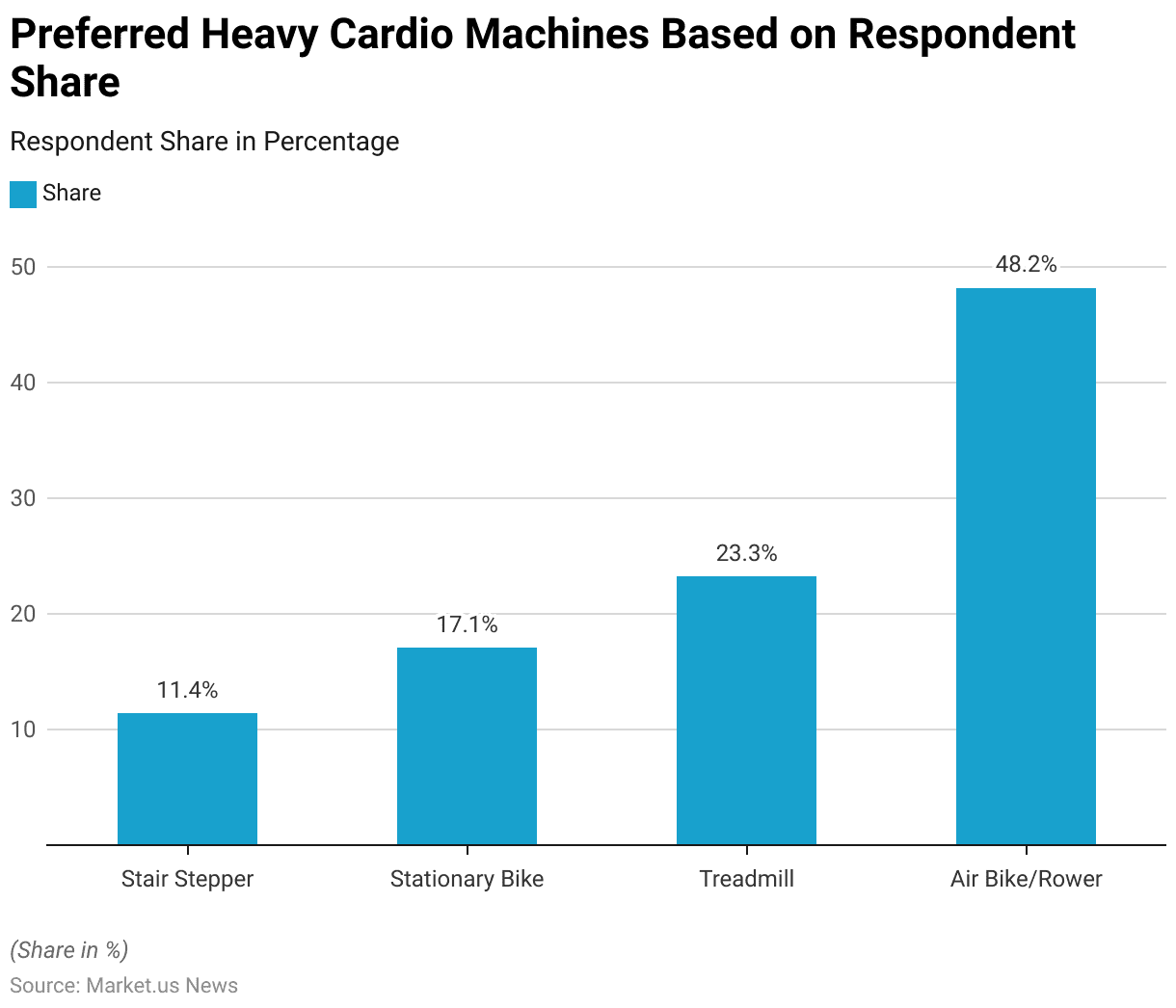

- In a comparison of preferences for heavy cardio machines, treadmills were favored by 23.3% of respondents.

- This places treadmills as the second most popular choice among heavy cardio equipment.

- The air bike/rower emerged as the top preference, with 48.2% of respondents selecting it.

- Stationary bikes were the third most preferred, garnering 17.1% of the responses.

- Lastly, stair steppers were chosen by 11.4% of respondents, making them the least favored among the listed options.

- This data indicates a strong preference for air bikes/rowers over other heavy cardio machines, with treadmills also maintaining significant popularity.

(Source: Garage Gym Equipment)

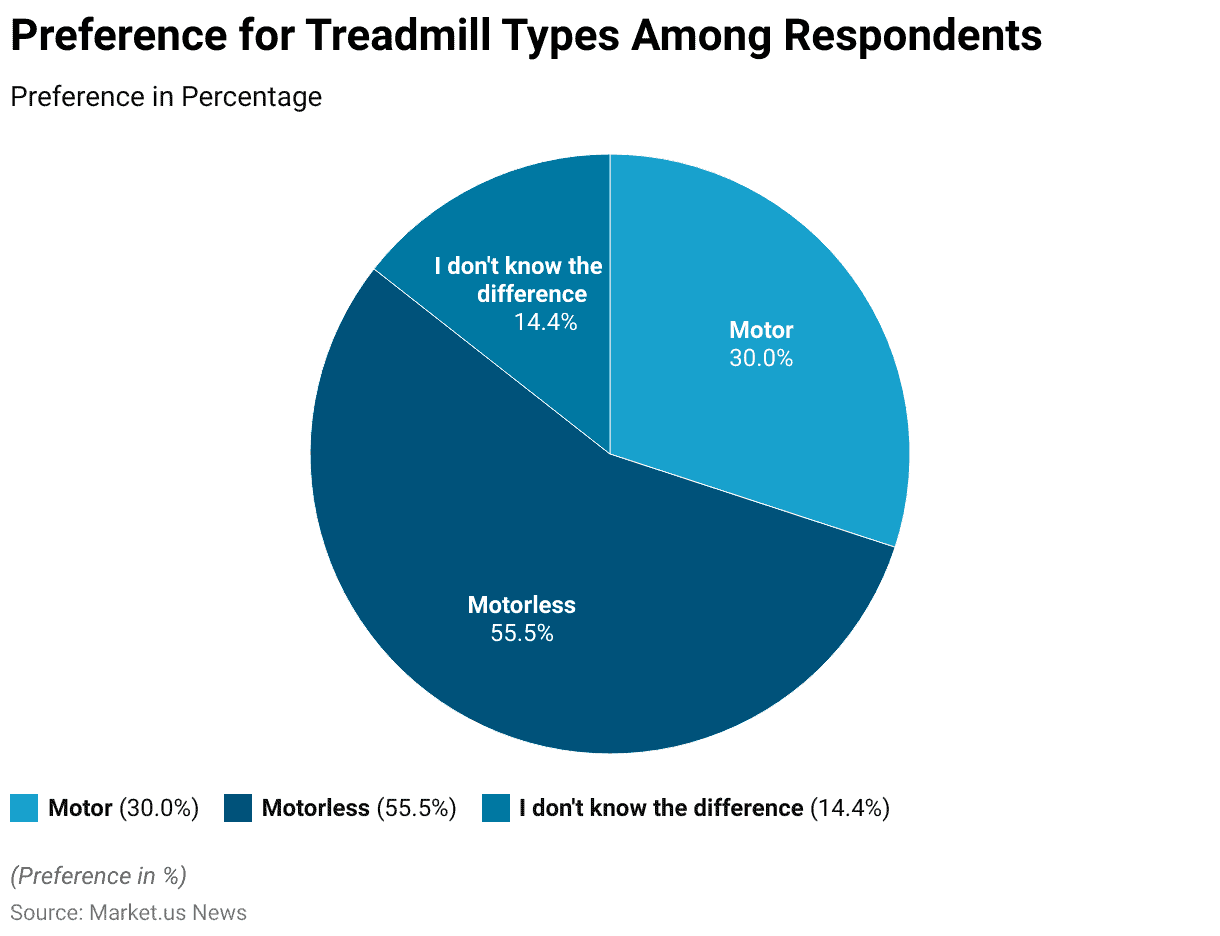

Type of Treadmill Preferred Statistics

- When asked about their preferred type of treadmill, a majority of respondents, 55.5%, indicated a preference for motorless treadmills.

- In contrast, 30% of respondents expressed an interest in motorized treadmills.

- Additionally, 14.4% of respondents were unsure about the difference between motorized and motorless treadmills.

- This data suggests a notable inclination towards motorless treadmills among consumers, while a significant portion remains undecided or uninformed about the distinctions between the two types.

(Source: Garage Gym Equipment)

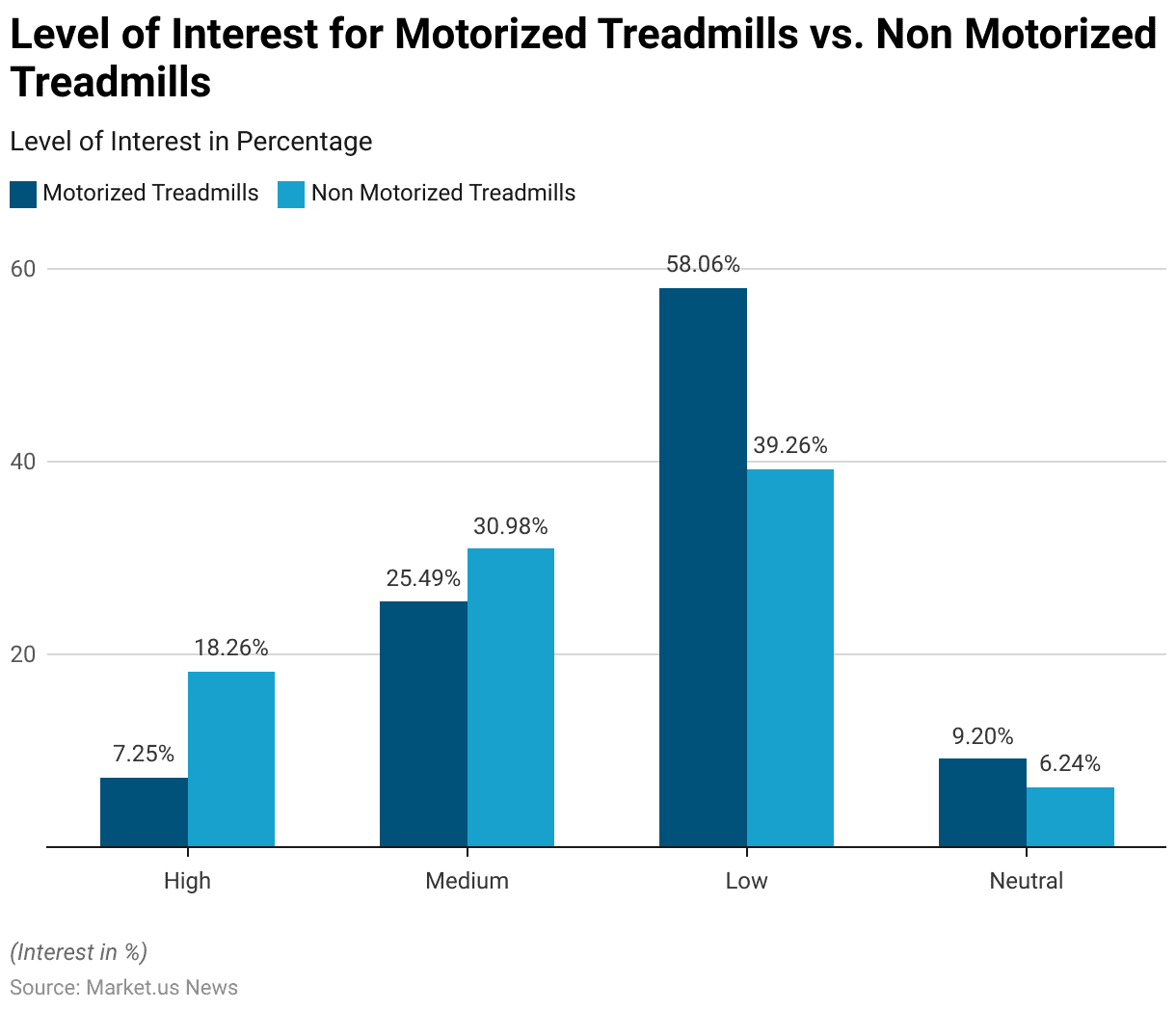

Level of Interest for Motorized Treadmill vs. Non-Motorized Treadmill Statistics

- Interest levels for motorized treadmills and non-motorized treadmills exhibit notable differences.

- For motorized treadmills, only 7.25% of respondents reported a high level of interest, 25.49% indicated a medium level of interest, 58.06% expressed a low level of interest, and 9.20% remained neutral.

- In contrast, non-motorized treadmills garnered a higher level of interest, with 18.26% of respondents showing high interest, 30.98% medium interest, 39.26% low interest, and 6.24% neutral.

- This data indicates a stronger overall preference and interest in non-motorized treadmills compared to their motorized counterparts.

(Source: Garage Gym Equipment)

Cardiovascular Fitness Test Protocols for Treadmill Statistics

- Cardiovascular fitness test protocols for treadmills involve several stages, each designed to measure predicted VO2 max at varying speeds and grades.

- In Stage 1 (Warm-up), participants start at a moderate pace, with speeds and grades adjusted according to age groups.

- For example, individuals aged 25-29 start at 2.2 mph with a 2% grade, predicting 45% of their VO2 max at 11.5 ml/kg/min.

- As they progress to Stage 2, the intensity increases, with the same age group moving to 2.7 mph at a 3% grade, predicting 55% of their VO2 max at 14.6 ml/kg/min.

- Stage 3 further intensifies, with speeds and grades increasing to predict 75% of VO2 max. For example, the same group now runs at 2.7 mph with a 7.5% grade, predicting 20.6 ml/kg/min.

- During the Recovery stage, all age groups reduce the intensity to 2 mph at a 0% grade, predicting a lower VO2 max percentage (e.g., 33% or 8.9 ml/kg/min for the 25-29 age group).

- This protocol ensures a comprehensive assessment of cardiovascular fitness across different age groups, adjusting speed and grade to predict VO2 max percentages at each stage accurately.

(Source: CDC National Youth Fitness Survey (NYFS)- Treadmill Examination Manual 2012)

Exercise Protocol for Treadmill Statistics

According to Stage

- The exercise protocol for treadmill cardiovascular fitness testing involves a series of stages to assess predicted VO2 max across different age groups.

- The protocol begins with a warm-up phase tailored to the individual’s age and fitness level.

- For instance, participants in the first protocol (<20 years) warm up at 1.7 mph with no incline, predicting 45% of their VO2 max at 8.1 ml/kg/min.

- As they progress to Stage 1, the speed increases to 2.1 mph with a 0.5% grade, predicting 55% of their VO2 max at 9.6 ml/kg/min.

- In Stage 2, the intensity further increases to 2.1 mph with a 4.5% grade, predicting 76% of their VO2 max at 13.6 ml/kg/min.

- The recovery phase involves a reduction in speed to 2.0 mph with no incline, predicting 49% of VO2 max at 8.9 ml/kg/min.

(Source: CDC National Youth Fitness Survey (NYFS)- Treadmill Examination Manual 2012)

For Adults

- Similarly, the protocol adjusts for other age groups. For instance, individuals aged 25-29 begin with a warm-up at 2.2 mph and a 2% grade, predicting 45% of VO2 max at 11.5 ml/kg/min.

- In Stage 1, they move to 2.7 mph with a 3% grade, predicting 55% of VO2 max at 14.6 ml/kg/min, and in Stage 2, the speed increases to 2.7 mph with a 7.5% grade, predicting 75% of VO2 max at 20.6 ml/kg/min.

- The recovery stage for this group involves 2.0 mph with no incline, predicting 33% VO2 max at 8.9 ml/kg/min.

(Source: CDC National Youth Fitness Survey (NYFS)- Treadmill Examination Manual 2012)

Older Age Group

- For older age groups, such as those over 50 years, the warm-up phase starts at 3.6 mph with a 5% grade, predicting 45% of VO2 max at 21.8 ml/kg/min.

- Stage 1 involves a speed of 3.7 mph with an 8.5% grade, predicting 55% of VO2 max at 28.7 ml/kg/min.

- In Stage 2, the speed and incline increase to 3.7 mph and 14.5%, predicting 75% of VO2 max at 39.5 ml/kg/min. The recovery phase maintains a speed of 2.0 mph with no incline, predicting 17% VO2 max at 8.9 ml/kg/min.

- This structured approach ensures a comprehensive assessment of cardiovascular fitness, with each stage carefully calibrated to measure VO2 max across different age groups and fitness levels.

(Source: CDC National Youth Fitness Survey (NYFS)- Treadmill Examination Manual 2012)

Technological Advancements in Treadmill Statistics

- Technological advancements in treadmills have significantly transformed the fitness industry, making workouts more engaging and effective.

- Modern treadmills now feature interactive touchscreens, Bluetooth connectivity, and built-in speakers to enhance user experience.

- Innovations such as virtual running trails, gamification with leaderboards and reward points, and compatibility with fitness apps like Zwift provide immersive and entertaining workout sessions.

- Non-motorized treadmills like the AssaultRunner Pro offer a unique curved design to reduce joint stress, while foldable models like the WalkingPad A1 Pro cater to space-conscious users with their compact, quiet operation.

- These advancements are driving the growth of the treadmill market, with increasing health awareness and demand for home fitness solutions fueling continued innovation and market expansion.

(Source: Breaking Muscle)

Regulations for Treadmills

- Regulations for treadmills vary by country and encompass several aspects, such as safety standards, electrical requirements, and restrictions on hazardous substances.

- In the United States, treadmill regulations include compliance with standards set by the Consumer Product Safety Improvement Act (CPSIA), the Federal Communications Commission (FCC) Part 15 for radiofrequency devices, and energy efficiency standards under 10 CFR Part 430.

- Additionally, treadmills must meet the American Society for Testing and Materials (ASTM) standards, particularly ASTM F2115-18 for motorized treadmills.

- In the European Union, regulations such as the Restriction of Hazardous Substances (RoHS) Directive and the Radio Equipment Directive (RED) apply, along with the requirement for CE marking to indicate conformity with EU standards.

- Australia follows its own set of standards, including compliance with the Trade Practices (Consumer Product Safety Standard) Regulations 2009, which stipulate safety and labeling requirements for treadmills.

- These regulations ensure that treadmills are safe for consumer use, energy-efficient, and free from harmful substances.

(Source: Compliance Gate, Government of Australia, Life Fitness)

Recent Developments

Acquisitions and Mergers:

- Peloton acquires Precor: In early 2023, Peloton completed its $420 million acquisition of Precor, a leading commercial fitness equipment manufacturer. This acquisition aims to enhance Peloton’s product portfolio, manufacturing capabilities, and market presence in the commercial fitness sector.

- ICON Health & Fitness acquires iFit: ICON Health & Fitness, known for its NordicTrack brand, acquired iFit, a company specializing in interactive fitness content, for $200 million in late 2023. This merger is expected to strengthen ICON’s position in the connected gym or fitness market by integrating iFit’s content with its treadmill offerings.

New Product Launches:

- NordicTrack Commercial 2450: In mid-2023, NordicTrack launched the Commercial 2450 treadmill, featuring a 22-inch interactive HD touchscreen, advanced cushioning technology, and iFit integration for personalized workouts and real-time coaching.

- Peloton Tread+: Peloton introduced the Tread+ in early 2024, an upgraded version of its popular treadmill, offering enhanced safety features, a larger touchscreen, and access to a wide range of live and on-demand fitness classes.

Funding:

- Tonal raises $250 million: In 2023, Tonal, a company specializing in digital weight training and fitness solutions, raised $250 million to expand its product line and enhance its treadmill offerings, focusing on integrating strength training and cardio workouts.

- Echelon Fitness secures $65 million: Echelon Fitness, known for its connected fitness equipment, secured $65 million in early 2024 to develop new treadmill models and improve its live and on-demand fitness content library.

Technological Advancements:

- AI and Machine Learning in Treadmills: Advances in AI and machine learning are being integrated into treadmills to provide personalized workout recommendations, real-time performance feedback, and adaptive training programs, enhancing user experience and outcomes.

- Connected Fitness Integration: Treadmills are increasingly featuring connectivity options such as Bluetooth, Wi-Fi, and app integration, allowing users to sync their workouts with fitness apps, track progress, and participate in virtual fitness classes.

Market Dynamics:

- Growth in Treadmill Market: The global treadmill market is projected to grow at a CAGR of 5.8% from 2023 to 2028, driven by increasing health awareness, rising demand for home fitness equipment, and the popularity of connected fitness solutions.

- Increased Adoption in Home Fitness: The home fitness segment is seeing significant growth due to the convenience and flexibility it offers, with treadmills being one of the most popular equipment choices for home gyms.

Regulatory and Strategic Developments:

- Safety Standards for Treadmills: New safety standards for treadmills were introduced in early 2024 by the Consumer Product Safety Commission (CPSC) in the US, focusing on preventing injuries and ensuring that treadmills meet stringent safety requirements.

- EU Fitness Equipment Regulations: The European Union updated its regulations for fitness equipment in 2023, emphasizing product safety, durability, and environmental impact, encouraging manufacturers to develop more sustainable and safe treadmills.

Research and Development:

- Advanced Cushioning Systems: R&D efforts are focusing on developing advanced cushioning systems for treadmills to reduce impact on joints and provide a more comfortable running experience, particularly for older adults and people with joint issues.

- Interactive Training Features: Researchers are exploring the potential of interactive training features, such as virtual reality integration and gamification, to make treadmill workouts more engaging and motivating for users.

Conclusion

Treadmill Statistics – In conclusion, treadmills are essential for cardiovascular fitness, with a growing global market projected to rise from USD 3,846.2 million in 2023 to USD 6,507.9 million by 2033.

They cater to various budgets, from $100 to over $5,000, with high-end models like the NordicTrack X32i exemplifying advanced features.

NordicTrack leads in popularity at 31.9%, and treadmills are the second most preferred cardio machine at 23.3%. Non-motorized treadmills are more favored than motorized ones.

Comprehensive fitness testing protocols highlight their versatility, underscoring their critical role in the fitness industry.

FAQs

Treadmills offer numerous benefits, including improved cardiovascular health, weight management, enhanced stamina, and the convenience of indoor exercise regardless of weather conditions. They also allow for controlled workouts with adjustable speed and incline settings.

Motorized treadmills have a motor that drives the belt, offering features like adjustable speed and incline. Non-motorized treadmills, powered by the user’s movement, typically offer greater engagement of lower body muscles and can be safer due to the absence of a moving belt when not in use.

Yes, treadmills come in various types, including manual, motorized, folding, commercial-grade, and hybrid models. Each type caters to different user needs, from basic walking to high-intensity running and fitness training.

Regular maintenance is essential for optimal performance and longevity. Basic maintenance includes lubricating the belt and checking the alignment. Tightening loose bolts, and cleaning the machine regularly to prevent dust build-up.

The lifespan of a treadmill varies based on usage, maintenance, and build quality. On average, a well-maintained treadmill can last between 7 to 12 years.