Introduction

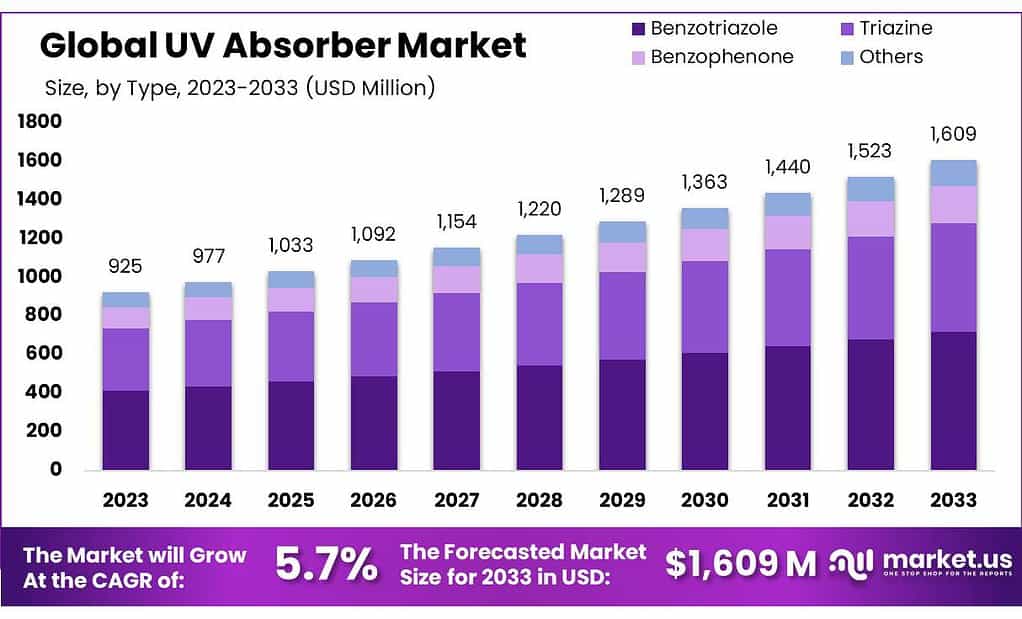

The global UV absorber Market is expected to grow significantly, reaching USD 1609 million by 2033, up from USD 925 million in 2023, at a CAGR of 5.7% during the forecast period from 2023 to 2033. UV absorbers are crucial additives used in various industries to protect materials from the harmful effects of ultraviolet radiation, thus enhancing the durability and performance of products.

Key growth factors include the increasing demand for UV protection in plastics and packaging, the rise of UV absorbers in automotive applications, and the growing popularity of UV-protective cosmetics. The construction and agriculture sectors also contribute to market growth by incorporating UV absorbers to extend the life of materials exposed to sunlight. Technological advancements in UV absorber formulations, such as nano-sized UV absorbers, further drive market expansion by offering improved performance and stability.

Amfine Chemical Corporation is a key player in the UV absorber sector, offering a variety of high-performance products designed to protect plastics and fibers from UV radiation. Notable products include the LA-46 triazine UV absorber, known for its strong UV absorbance at short wavelengths and superior photostability, and the LA-36 benzotriazole UV absorber, which provides long-wavelength UV protection and is FDA-cleared for use in polyolefins. These products are widely used in applications such as polycarbonates, PET fibers, and various engineering plastics.

Adeka Corporation is another significant entity in the UV absorber market, providing advanced UV protection solutions. The company’s UV absorbers, such as the Adeka Stab LA series, are known for their excellent light stabilization properties, which enhance the durability of plastics exposed to UV light. These absorbers are utilized in various applications, including automotive parts, packaging materials, and construction products, ensuring long-term performance and protection against UV degradation.

Key takeaways

- UV Absorber Market is poised to reach USD 1,609 million by 2033, with a 5.7% CAGR from USD 925 million in 2023.

- Benzotriazole dominates the UV absorber market with over 44.6% share in 2023, valued at USD 413.05 million.

- Adhesives hold the largest market share in 2023, capturing over 35.8%, valued at USD 330.85 million.

- The construction sector leads end-use applications in 2023, with over 35.9% market share, valued at USD 331.98 million.

- Indirect sales dominate distribution channels with over 71.3% market share in 2023, valued at USD 658.88 million.

- Asia Pacific emerges as the dominant force in the UV absorber market, securing 37.6% market share in 2023, valued at USD 435.4 million.

Statistics

- Heat-resistant of at least 300°C as a UVA simple substance, with excellent heat resistance even in resins.

- Sharp maximum absorption in UVA wave range (320 – 400 nm).

- General coatings or substrates needing protection up to 420 nm.

- Tinuvin 123 (for acid-catalyzed systems) or Tinuvin 292 (for 2K PUR). HALS/UV absorber combinations are synergistic and impart superior coating protection against gloss reduction, cracking, blistering, delamination, and color change.

- For optimum spectral coverage, it can be combined with a triazine-based UV absorber such as Tinuvin 400 (in liquid paints) and Tinuvin 405 (in powder coatings).

- Carbon black can be used in concentrations of only 1-2% in UV screening.

- Benzophenones are UV absorbers that provide moderate absorption in the 390-230 nm range and come in high-temperature versions suitable for high-temperature processing, though they may cause objectionable color.

- Benzotriazoles offer intense UV absorption between 390-280 nm and are known for their good initial color and color stability.

- Oxanilides absorb UV light from 320-280 nm, have very low color and volatility, and are suitable for high-temperature processing.

- Acrylic esters, absorbing strongly from 320-290 nm, are usually less effective than other absorbers but maintain good initial color and stability upon aging.

- Spectra range from 0.3 μm to 1.5 μm including some gaseous H2O and CO2 bands, as well as part of the SO2 absorption band and the core of the UV absorption.

- The UV absorption is found to be centered at 0.34 ± 0.03 μm with a full width at half maximum of 0.14 ± 0.01 μm.

- VIRS uses two different detectors for visible (VIS, 0.3–1.05 μm) and near-infrared wavelengths (0.85–1.45 μm), although there is a gap in the calibrated data that leaves no overlap between channels.

Emerging Trends

Increased Use in Personal Care Products: There’s a growing demand for UV absorbers in personal care products, such as sunscreens and moisturizers. This trend is driven by rising consumer awareness of the harmful effects of UV radiation on the skin and the importance of UV protection in daily skincare routines.

Growth in the Plastics Industry: UV absorbers are increasingly used in the plastics industry to prevent the degradation of materials like polyvinyl chloride and polycarbonate when exposed to UV radiation. This application helps in enhancing the durability and longevity of plastic products used in packaging, automotive parts, and agricultural films.

Innovation and Product Development: Companies are focusing on developing new and advanced UV absorber products to meet the specific needs of various applications. For example, Clariant’s AddWorks AGC 970, introduced in 2022, is designed to improve the durability of polyethylene agricultural films against UV exposure.

Geographical Expansion: The Asia-Pacific region, particularly countries like China, Japan, and India, is emerging as a significant market for UV absorbers. The region’s rapid industrialization and growing end-use industries, such as automotive and construction, are driving the demand for UV absorbers.

Environmental Concerns and Regulations: As environmental awareness increases, there’s a growing emphasis on the development and use of UV absorbers that are environmentally friendly and comply with stringent regulatory standards. This trend is influencing the market dynamics and pushing companies to innovate in this direction.

Use Cases

Plastic Packaging: UV absorbers are essential in extending the life of plastic packaging materials by preventing degradation from UV exposure. For instance, adding UV absorbers can increase the durability of polyethylene and polypropylene packaging materials, which are widely used in food and consumer goods packaging.

Automotive Coatings: In the automotive industry, UV absorbers are incorporated into clearcoat formulations to protect vehicle exteriors from UV-induced damage. This ensures longer-lasting paint finishes and reduces the frequency of maintenance and repainting. Studies show that effective UV absorbers can significantly prolong the durability of automotive coatings, helping maintain a vehicle’s aesthetic appeal and structural integrity.

Outdoor Furniture and Fabrics: UV absorbers are added to outdoor furniture and fabrics to prevent color fading and material degradation. This application is critical for products exposed to sunlight for extended periods, such as patio furniture, awnings, and outdoor sports equipment.

Construction Materials: UV absorbers are used in construction materials like PVC roofing sheets and sidings. These absorbers help materials withstand harsh weather conditions and prolonged sun exposure, increasing the longevity and performance of construction elements.

Agricultural Films: In agriculture, UV absorbers are integrated into greenhouse films and mulch films to protect crops from harmful UV rays. These films help create a controlled environment for plants, enhancing growth and yield by minimizing UV damage and regulating temperature.

Key players

Amfine Chemical Corporation is a key player in the UV absorber sector, offering a variety of high-performance products designed to protect plastics and fibers from UV radiation. Notable products include the LA-46 triazine UV absorber, known for its strong UV absorbance at short wavelengths and superior photostability, and the LA-36 benzotriazole UV absorber, which provides long-wavelength UV protection and is FDA-cleared for use in polyolefins. These products are widely used in applications such as polycarbonates, PET fibers, and various engineering plastics.

Adeka Corporation is another significant entity in the UV absorber market, providing advanced UV protection solutions. The company’s UV absorbers, such as the Adeka Stab LA series, are known for their excellent light stabilization properties, which enhance the durability of plastics exposed to UV light. These absorbers are utilized in various applications, including automotive parts, packaging materials, and construction products, ensuring long-term performance and protection against UV degradation.

BASF SE, a global leader in chemical production, is heavily involved in the UV absorber market, offering products that protect materials from UV radiation. Their UV absorbers, including the Tinuvin range, are widely used in plastics, coatings, and personal care products to prevent degradation and extend the life of these materials. BASF’s advanced research and development capabilities ensure continuous innovation and high-performance solutions in the UV absorber sector.

Anhui Best Progress Imp & Exp Co., Ltd. is an established trading company based in Hefei, China, specializing in exporting various organic chemicals, including UV absorbers like UV-P, UV-326, and UV-329. These UV absorbers are essential in protecting materials from ultraviolet radiation, enhancing the durability and lifespan of products exposed to sunlight. The company has built a significant market presence, exporting to regions such as Japan, Taiwan, Korea, Southeast Asia, and Europe.

Everlight Chemical Industrial Co. is a key player in the UV absorber market, focusing on the development of advanced UV stabilizers for various applications. Their products are known for enhancing the UV resistance of polymers, coatings, and other materials, thereby preventing degradation and extending the lifespan of these products. Everlight’s UV absorbers are integral to industries that require reliable protection against the harmful effects of UV radiation, ensuring performance and durability in diverse environmental conditions.

Clariant AG plays a significant role in the UV absorber sector by offering a variety of products designed to enhance UV protection in plastics and coatings. Their Hostavin® range, including Hostavin® 3315 DISP and Hostavin® VSU powder, provides high-performance UV stabilization for waterborne coatings, plastics, and other industrial applications. These products ensure durability, resistance to discoloration, and compatibility with other materials, making them essential for maintaining the longevity and appearance of polymers exposed to UV radiation.

Hangzhou Disheng Import & Export Co., Ltd. is a key player in the UV absorber market, specializing in the production and distribution of benzotriazole, benzophenone, and triazine UV absorbers. These products are widely used in plastics, rubber, coatings, textiles, and adhesives to prevent light-induced aging. With a strong foundation from Hangzhou Shinyang Fine Chemical Co., Ltd., Disheng ensures high-quality standards and extensive market reach, exporting to regions like Europe, the United States, Japan, and Korea.

Greenchemicals SpA specializes in producing UV absorbers that protect materials from the harmful effects of ultraviolet radiation. Their range of UV absorbers is used in various applications, including plastics, coatings, and personal care products. The company focuses on developing environmentally friendly and sustainable chemical solutions, ensuring high performance and compliance with safety standards. Greenchemicals SpA’s innovative approach and dedication to quality have made them a significant player in the UV absorber market.

Hunan Chemical BV is an established player in the UV absorber sector, offering a broad range of UV absorbers, including products like UV Absorber 1130, 234, and 531. These absorbers are crucial for protecting materials from the damaging effects of ultraviolet radiation, making them essential for various industries, including plastics and coatings.

Huntsman Corporation, a global chemical company, is actively engaged in the UV absorber market. They offer innovative UV absorber products that enhance the durability and performance of materials exposed to sunlight. Huntsman’s advanced solutions are designed to meet stringent regulatory standards and cater to diverse applications, including automotive, construction, and packaging industries.

Conclusion

In conclusion, the UV absorber market is poised for robust growth in the coming years, driven by increasing awareness of the detrimental effects of ultraviolet radiation on both health and materials. The rising demand for UV protection in various sectors, including automotive, textiles, and cosmetics, is significantly shaping market dynamics. Technological advancements are leading to the development of more efficient and versatile UV absorbers, expanding their applications and enhancing their effectiveness. Additionally, the growing emphasis on sustainability and regulatory pressures are encouraging innovations in eco-friendly UV absorbers.

As industries continue to seek solutions to mitigate UV-related damage, the market for UV absorbers is expected to expand, offering substantial opportunities for growth and innovation. Companies that invest in research and development, and adapt to evolving consumer and regulatory demands, will be well-positioned to capitalize on this expanding market. The outlook remains positive as the importance of UV protection continues to gain prominence across various applications and regions.