Table of Contents

Introduction

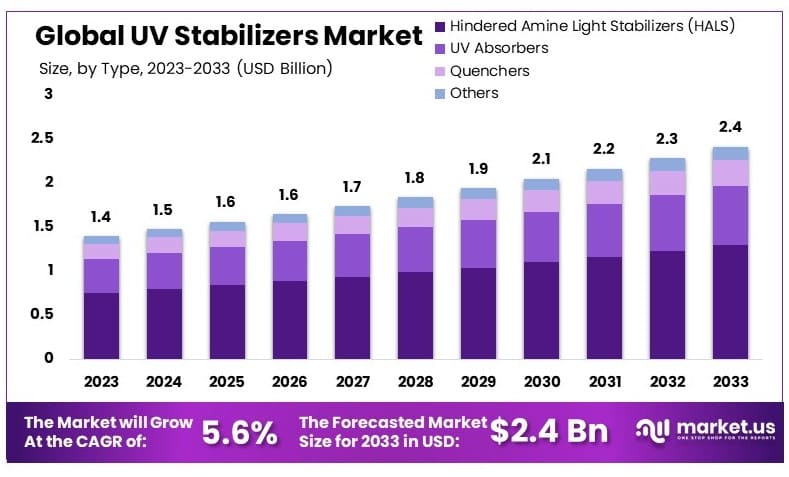

The global UV stabilizers market is projected to expand significantly, growing from USD 1.4 billion in 2023 to an estimated USD 2.4 billion by 2033, with a CAGR of 5.6% over the forecast period from 2024 to 2033. This growth can be attributed to increasing demand in industries such as plastics, coatings, and automotive, where UV stabilizers play a crucial role in prolonging the life and maintaining the quality of products exposed to ultraviolet light.

However, the market faces challenges including stringent environmental regulations regarding the use of certain chemicals in UV stabilizers and the volatility in raw material prices which could impact production costs and market stability. Recent developments in the industry have focused on innovations in green chemistry, aiming to produce eco-friendly UV stabilizers that meet regulatory standards without compromising performance. These advancements are crucial as they address both environmental concerns and market demand, thereby supporting sustained growth in the UV stabilizers market.

Key players like BASF SE and Clariant AG are at the forefront of this evolution, introducing innovative products designed to enhance durability and reduce environmental impact across various applications. These developments reflect the industry’s shift towards sustainable solutions that align with global efforts to mitigate the adverse effects of UV radiation on materials.

BASF SE, a key player in the UV stabilizers market, has recently launched several innovative products and initiatives, strengthening its market position and commitment to sustainability. In 2023, BASF introduced two new light stabilizers: Tinuvin 880 and Tinuvin XT 55. Tinuvin 880 is designed to enhance the long-lasting appearance and performance of automotive interior parts, while Tinuvin XT 55 targets the film, fibers, and tapes industry, offering high performance with minimal environmental impact.

In addition to this, Clariant has also been innovating in the realm of coatings and sealants. They introduced several new products in 2023 that are designed to provide high performance and improved sustainability. For instance, their Hostavin 3400 LIQ is a triazine-based UV absorber recommended for solventborne coatings systems requiring long-lasting outdoor durability. Furthermore, Clariant has developed new light stabilizer solutions such as AddWorks AGC 970 G, which offers enhanced UV and agrochemicals protection, extending the service life of agricultural films used in the mulch segment.

Key Takeaways

- Market Value: The UV Stabilizers Market was valued at USD 1.4 billion in 2023, and is expected to reach USD 2.4 billion by 2033, with a CAGR of 5.6%.

- Type Analysis: Hindered Amine Light Stabilizers (HALS) dominated with 53.6%; critical for protecting materials from UV degradation.

- Application Analysis: Packaging dominated with 48.5%; significant due to the increasing demand for durable packaging solutions.

- Dominant Region: APAC held 38.5% market share; significant due to robust industrial growth and high UV stabilizer consumption.

- High Growth Region: North America projected significant growth; driven by advanced packaging and automotive industries.

- Analyst Viewpoint: The market shows moderate saturation with competition among major players. Future growth is driven by innovations in packaging and construction sectors.

UV Stabilizers Statistics

- Sunlight is electromagnetic radiation spanning a broad wavelength range, with the UV part ranging from 100 to 400 nm.

- The UV spectrum is divided into UV-A, UV-B, and UV-C radiation, with approximately 6% of the total solar radiation falling on the earth being ultraviolet.

- The maximum radiation intensity of the solar spectrum occurs at 500 nm, towards the blue end of the visible range.

- The ultraviolet index (UV index) was developed by Canadian scientists in 1992 to measure the strength of sunburn-producing ultraviolet radiation at a given location and time.

- Mean noontime UV index values in summer range from 1 in the Arctic to about 12 over the subtropical latitudes.

- The UV index can be as high as 26 over higher elevations in the tropics.

- Erythemal irradiance (UVE), which mimics human skin’s response to UV radiation, typically comprises about 17% UVA and 83% UVB for a clear sky around solar noon.

- UV exposure is believed to cause between 50% and 90% of all skin cancer cases, depending on the region.

- 85% of UV radiation is absorbed by lignin in the wood, making it the primary target for UV degradation.

- A mixture of organic UV absorbers and hindered amine light stabilizers (HALSs), specifically T-479/T-292, T-5248, and T-5333, also showed high effectiveness in minimizing lignin degradation.

- Carbon black is effective as a UV screener when used in concentrations of only 1-2%.

- UV absorbers such as benzophenones and benzotriazoles are used to prevent UV absorption by chromophores. Benzotriazoles offer intense UV absorption at 390-280 nm, while benzophenones provide moderate absorption in the 390-230 nm range.

- UV stabilizers like HALS (Hindered Amine Light Stabilizers) are 2 to 4 times more efficient than UV absorbers in providing UV stabilization.

- The EC Commission regulates the maximum allowable concentration of UV stabilizers in food contact materials, such as 0.5% in PP and PE, 0.3% in PVC, and 0.6% in PS.

- The incorporation of 0.3-0.45% of a light stabilizer system significantly enhances the tensile strength performance of silyl-terminated polyether sealants, as demonstrated by tests showing no loss of strength after 2500 hours in a weatherometer.

- In hot-melt adhesives, the use of 0.5-1% antioxidant/UV absorber or hindered amine light stabilizers (HALS) is typical to achieve low color and good age stability.

- For SIS-based hot-melt adhesives, the addition of 1% benzotriazole UVAs or HALS significantly reduces discoloration after 360 hours of exposure in a weatherometer.

- SEBS-based hot-melts show that HALS and UVAs at 1% concentration provide effective protection against discoloration and loss of tack properties.

- The service life of UV-resistant agricultural products can be estimated based on local KLY (kilo langley) values, with 1 KLY equaling 41.84 MJ/m².

- In Spain, with a local KLY value of 120, the same netting will last for more than 5 years, retaining 50% of its mechanical properties after four years.

- Shade nets with UV stability of 500 KLY, 700 KLY, and 1400 KLY have guaranteed UV protection for 3, 5, and 10 years, respectively.

Emerging Trends

- Increased Adoption in Packaging: UV stabilizers are increasingly being used in the packaging sector to prevent degradation of materials caused by sunlight. This trend is driven by the growing demand for durable consumer packaging that can withstand various environmental conditions without compromising the quality of the contents.

- Development of Advanced Agricultural Films: There is a significant shift towards using UV stabilizers in agricultural films. These films help in extending the life of greenhouse covers and mulch films, enhancing the growth environment for crops. This application is crucial in regions with high solar intensity, where UV damage can severely impact agricultural productivity.

- Expansion in Automotive Applications: Automotive manufacturers are incorporating UV stabilizers in vehicle parts to prevent fading and brittleness caused by sun exposure. This trend is particularly prominent in automotive interiors and components that require enhanced resistance to sunlight to maintain appearance and functionality over time.

- Innovation in Wood Coatings: UV stabilizers are being integrated into wood coatings to protect against discoloration and degradation. This application is critical in both residential and commercial settings, where the aesthetic and structural integrity of wood products needs to be maintained against UV exposure.

- Growth in the Construction Sector: The construction industry is increasingly utilizing UV stabilizers in building materials such as PVC piping and window frames to ensure longevity and reduce maintenance costs. This trend reflects a broader move towards more durable, weather-resistant construction materials.

- Enhancements in Cosmetic Formulations: There is a growing trend of incorporating UV stabilizers in cosmetic products to protect them from losing efficacy or changing in texture when exposed to sunlight. This application is crucial for products like sunscreens and lip balms, where UV protection is a key functional attribute.

- Focus on Sustainable and Bio-based Solutions: With rising environmental concerns, there is a significant push towards developing sustainable and bio-based UV stabilizers. These products aim to provide effective UV protection while being eco-friendly, responding to both regulatory pressures and consumer preferences for greener alternatives.

Use Cases

- Packaging Materials: UV stabilizers are used in plastic packaging to prevent the breakdown of polymers that can occur due to UV radiation. This extends the shelf life of packaged goods, particularly in food and pharmaceuticals, by maintaining the integrity and safety of the packaging.

- Agricultural Films: In agriculture, UV stabilizers are incorporated into films used for greenhouses and tunnels. These stabilizers extend the life of the films, ensuring they remain strong and transparent, thus optimizing the light available to plants and protecting them from harmful external conditions.

- Automotive Parts: UV stabilizers are essential in automotive applications, where they are used in components such as dashboards, exterior panels, and trim parts to prevent fading, cracking, and brittleness caused by sun exposure, thereby enhancing vehicle longevity and aesthetic value.

- Building and Construction: In construction, UV stabilizers are added to materials like PVC pipes and vinyl siding to resist weathering and maintain mechanical properties over time. This application is critical for ensuring that buildings and infrastructure can withstand long-term exposure to sunlight without degradation.

- Coatings and Paints: UV stabilizers are incorporated into coatings and paints to prevent color fading and material degradation on surfaces exposed to sunlight. This application is widely used in both indoor and outdoor settings, ranging from automotive finishes to architectural coatings.

- Cosmetics and Personal Care: In cosmetic formulations, UV stabilizers help to preserve the stability and effectiveness of products like sunscreens and moisturizers. They ensure that these products provide sustained UV protection and maintain their intended benefits throughout their usage.

- Consumer Goods: UV stabilizers are used in a variety of consumer goods, including outdoor furniture, sporting goods, and toys, to protect against UV-induced wear and tear. This application helps in maintaining the functional and aesthetic properties of goods used outdoors.

Key Players Analysis

BASF SE is a leading provider in the UV stabilizers sector, offering products under its TINUVIN® brand. These stabilizers, including both ultraviolet light absorbers (UVA) and hindered amine light stabilizers (HALS), are designed to protect coatings and plastics from UV-induced degradation. Recently, BASF launched TINUVIN 5070, a blend of UVA and HALS, which offers high thermal stability and broad compatibility, particularly for automotive coatings. In 2023, BASF reported annual revenue of $74.57 billion, reflecting its strong market presence and ongoing innovations.

Clariant AG, another key player in the UV stabilizers market, offers a range of products under its AddWorks® brand. These stabilizers enhance the durability and color retention of plastics and coatings. In 2023, Clariant expanded its portfolio with the launch of AddWorks AGC 970, a new generation stabilizer for agricultural films, which helps in extending the lifespan and performance of these films. Clariant’s financial performance has been robust, with a reported annual revenue of approximately $5.3 billion in 2023.

Solvay S.A. has introduced the CYASORB CYXTRA V9900, an advanced UV stabilizer for thermoplastic polyolefins and reinforced plastics, designed to meet stringent automotive weathering specifications and reduce costs. This development highlights Solvay’s focus on innovative solutions for durable plastic materials in demanding applications.

Songwon Industrial Co., Ltd. showcased its new high-performance coating stabilizers at the ACS 2024, including the SONGSORB CS 400 series UV absorbers. These products enhance durability and sustainability in various applications, such as automotive and architectural coatings. Songwon also reported its Q1 2024 financial results, indicating robust performance and ongoing commitment to the coatings industry.

Adeka Corporation has expanded its portfolio in UV stabilizers with the recent development of advanced hindered amine light stabilizers (HALS) and benzotriazole UV absorbers. These new products, such as ADK STAB LA-458XP, are designed to enhance the durability and weatherability of plastics used in outdoor applications, including construction materials and agricultural films. In its latest financials, Adeka reported strong performance in the polymer additives segment, contributing to a positive outlook for 2024.

Evonik Industries AG has been actively enhancing its UV stabilizers segment with new innovations like the Ancamine® 2880, a fast-curing and UV-resistant curing agent for coatings. Evonik’s first quarter of 2024 exceeded expectations, supported by strategic investments and expansions, including a new plant for AEROSIL® silicas. The company anticipates an increase in adjusted EBITDA to €1.7-2.0 billion for the year, driven by cost savings and growth in key segments like Nutrition & Care.

Altana AG has been actively enhancing its presence in the UV stabilizers sector through strategic acquisitions and investments. In 2023, the company acquired the Silberline Group, expanding its ECKART division’s capabilities in effect pigments used in various applications like automotive coatings and plastics. Despite a challenging economic environment, Altana’s sales reached €2.74 billion, with a notable focus on expanding research and development efforts and digitalization. These strategic moves are expected to bolster the company’s growth and market position in the coming years.

Cytec Solvay Group, part of the Solvay Group, has been actively involved in the UV stabilizers market, offering products under the CYASORB CYNERGY SOLUTIONS® brand. Recently, Solvay introduced two new UV stabilizers: CYASORB CYNERGY SOLUTIONS® B878T for the building and construction sector and CYASORB CYNERGY SOLUTIONS® M535 for injection and blow molding applications. These products aim to provide long-term UV and thermal protection, ensuring durability and performance in various plastic applications. In 2023, Solvay reported robust financial performance with a focus on sustainable solutions across multiple sectors.

Mayzo, Inc., a prominent player in the UV stabilizers market, specializes in providing innovative solutions for plastic and coating industries. The company offers a range of UV absorbers and hindered amine light stabilizers (HALS) designed to enhance the longevity and durability of materials exposed to UV radiation. Recently, Mayzo expanded its product portfolio to include advanced stabilizers that meet the stringent demands of automotive and construction applications. In 2023, Mayzo reported increased revenue, driven by the growing demand for its high-performance additives and strategic market expansions.

Lycus Ltd. is a key player in the UV stabilizers market, offering a range of products under the MAXGARD® line. Recently, Lycus introduced MAXGARD® 2700, a 100% active powder UV stabilizer designed for applications in flexible PVC, industrial coatings, and liquid color formulations. This product is intended as a replacement for TINUVIN® 328, providing enhanced UV protection and extending the lifespan of materials exposed to sunlight. Lycus continues to expand its product offerings and market presence, contributing to robust financial performance in 2023.

Akcros Chemicals Ltd., a notable supplier of specialty chemicals for polymers, paints, and coatings, was acquired by Valtris Specialty Chemicals in a strategic move to enhance its market position. Akcros offers a range of UV stabilizers and other additives that improve the durability and performance of materials exposed to UV radiation. The acquisition has expanded Valtris’s footprint in Europe and North America, supporting Akcros’s continued innovation and growth in the UV stabilizers market.

Everlight Chemical Industrial Corporation has been advancing in the UV stabilizers sector with its Eversorb® product line. Recent innovations include the Eversorb SH Series, which enhances the durability and heat resistance of self-healing coatings, and the Eversorb AQ Series, designed to improve the weatherability of waterborne coatings. The company reported a revenue of TWD 7.82 billion in 2023, driven by its diverse portfolio and commitment to sustainable solutions in polymers, coatings, and cosmetics.

Addivant, a global leader in specialty additives, focuses on providing high-performance UV stabilizers for various industries. The company’s recent developments include the launch of advanced UV stabilizers tailored for automotive and construction applications. These products are designed to extend the lifespan of materials exposed to UV radiation, ensuring better performance and durability. Addivant continues to expand its market presence through strategic innovations and partnerships, contributing to its strong financial performance in recent years.

Valtris Specialty Chemicals, headquartered in Independence, Ohio, is a global leader in the production of specialty chemical additives, including UV stabilizers. The company offers the UV-Chek® product line, which includes benzophenone and hydroxybenzoate type UV stabilizers designed to protect polymers like polyolefin and vinyl from UV radiation. In 2022, Valtris was acquired by SK Capital Partners, which aims to further expand the company’s capabilities and market presence. Valtris operates nine manufacturing facilities globally, with a workforce of approximately 700 employees.

Chemtura Corporation, now part of Lanxess, was a significant player in the UV stabilizers market before its acquisition in 2017. The company developed a range of UV stabilizers that catered to various industries, including plastics and coatings, enhancing the durability and longevity of materials exposed to UV radiation. Chemtura’s expertise in specialty chemicals has been integrated into Lanxess’s broader portfolio, continuing to support innovations in UV stabilization and other advanced material solutions.

Conclusion

The UV stabilizers market is expected to see steady growth in the coming years. This growth can be attributed to the increasing demand for high-performance materials in industries such as automotive, packaging, and construction. UV stabilizers help extend the lifespan of products by protecting them from harmful UV radiation, which makes them highly valuable.

Key drivers of this market include the rising awareness about the benefits of UV stabilizers and the growing focus on sustainability. Manufacturers are investing in research and development to create more efficient and eco-friendly stabilizers. Additionally, the expansion of industries in emerging economies is creating new opportunities for market players.

However, challenges such as high costs and stringent regulatory requirements may impact market growth. Despite these challenges, the overall outlook for the UV stabilizers market remains positive. Continued innovation and increasing applications across various sectors are likely to drive the market forward, ensuring its continued relevance and expansion.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)