Table of Contents

Introduction

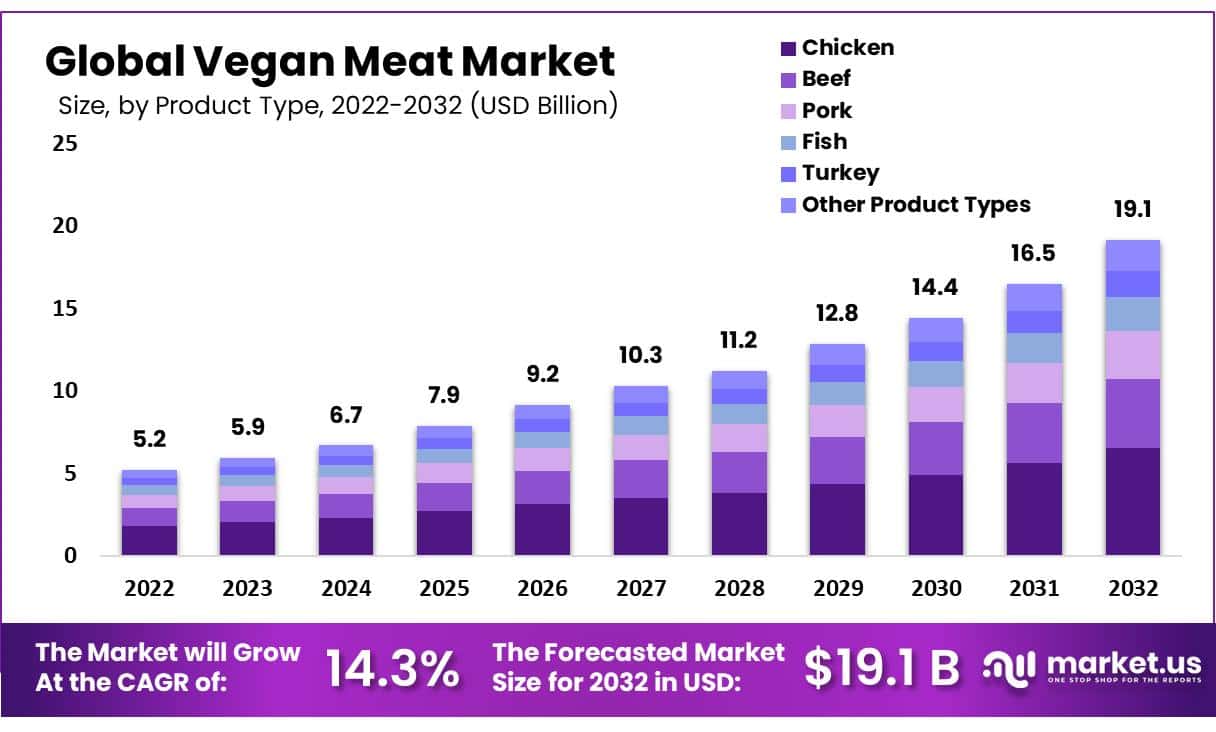

The global vegan meat market is undergoing rapid expansion, anticipated to burgeon from USD 5.2 billion in 2022 to USD 19.1 billion by 2032, reflecting a substantial compound annual growth rate (CAGR) of 14.3% over the forecast period from 2023 to 2033. This robust growth is primarily fueled by shifting consumer preferences towards plant-based diets, driven by health consciousness, environmental concerns, and ethical considerations regarding animal welfare. However, the market faces challenges such as high production costs and competition from traditional meat products, which can impede adoption among price-sensitive consumers.

Recent developments have seen key industry players innovating with ingredients and technologies to enhance flavor and texture, making vegan meat more appealing to a broader audience. Companies are also expanding their geographical presence and production capacities to meet the growing demand. For instance, major players have launched a variety of new products, aiming to replicate the taste and texture of conventional meat, thus broadening the appeal and accessibility of vegan meat options in various culinary applications. These strategic moves indicate a vigorous market that is adapting swiftly to consumer tastes and global sustainability trends.

Beyond Meat, Inc. has been at the forefront of expanding its product range and market presence. Recently, the company launched a new version of its plant-based burger, which claims to offer improved taste and nutritional profile, including lower saturated fats and no cholesterol. Beyond Meat has also entered into strategic partnerships with global fast-food chains to include their products in menus, significantly boosting their market reach and consumer accessibility.

Impossible Foods Inc. is another innovator, known for its Impossible Burger, which closely mimics the taste and texture of beef. The company recently secured funding of over $200 million to accelerate its research and development efforts. Impossible Foods’ strategy focuses on enhancing its product formulations and expanding its portfolio to include a variety of new vegan meat options, targeting not only vegetarians and vegans but also meat eaters looking for sustainable alternatives.

Lightlife Foods has responded to the competitive market by revamping its branding and product formulations. The company has committed to using simpler ingredients and has launched a campaign promoting transparency in production processes, which appeals to consumers increasingly concerned about food origins and manufacturing ethics. Lightlife has expanded its distribution channels, making its products available in more stores across North America, thereby increasing its market penetration.

Tofurky continues to innovate within the niche of turkey-like vegan products and has recently expanded its range to include plant-based ham and sausages. The company focuses on celebrating traditional flavors in a vegan format, catering to consumers who seek plant-based alternatives without compromising on taste during festive and family occasions. Tofurky’s products are known for their high protein content and are made from ingredients like wheat gluten and tofu, catering to health-conscious consumers.

Vegan Meat Statistics

- Though as a collective world, only 1% identify as a vegan, veganism is still on the rise. The numbers differ greatly by region.

- 9% of the Asia Pacific region reported following a vegan diet, 6% within the Middle East and Africa, and 4% of Latin Americans.

- 2% of North America reported themselves as vegan, as did 2% of Europe. The math’s confusing, we know.

- In 2022, of the countries surveyed, the US was the least aware of animal cruelty in the industry, at 46%, whilst Switzerland was the most aware, at 84% according to studies.

- Not all is doom and gloom, though. A survey recently run in 2023 concluded about 3% of US citizens follow a vegan diet, with 5% being vegetarians.

- In a 2020 survey, 4.6% of Canadians were reported to be vegan.

- 70% of 18-34 year old Canadian females view vegan eating as positive

- 60% of 35-54 year old Canadian females view vegan eating as positive

- 53% of 55+ year-old Canadian females view vegan eating as positive

- 78% of 18-34 year old Canadian males view vegan eating as positive

- 67% of 35-54 year old Canadian males view vegan eating as positive

- 68% of 55+ year-old Canadian males view vegan eating as positive

- survey results also reported that 58% of respondents were worried about the increased prevalence of plant-based food due to processing.

- As of 2023, there are an estimated 6.62 million vegans in the European Union, forecasted to rise to 8.25 million by 2033.

- 95% of respondents reported it being because of animal welfare, 83.9% because of the environment, and 55.9% because of health reasons.

- 20.8% answered as neutral, and 10.6% claimed to have not that much or no support at all for the idea.

- Low-meat diets, those that include 50 grams of meat or less, yield roughly half as much heat-trapping gas, half as much water pollution, and use half as much land as meat-rich diets.

- Meat consumption has increased in India and around 50% of the population consumes meat once a week.

Emerging Trends

- Enhanced Flavor and Texture: One of the most significant trends is the continuous improvement in the flavor and texture of vegan meat products. Companies are investing heavily in food technology to create products that closely mimic the taste, texture, and juiciness of traditional meats. This includes using ingredients like heme, which is derived from plants and mimics the flavor of blood in meat, making plant-based options more appealing to traditional meat-eaters.

- Diversification of Base Ingredients: Initially, most vegan meats were primarily made from soy or wheat. However, there is now a trend towards diversifying base ingredients to include peas, lentils, and other legumes, which offer nutritional benefits and cater to consumers with soy and gluten allergies or sensitivities. This shift is also a response to the growing demand for whole-food-based and non-GMO products.

- Expansion into New Product Forms: Companies are expanding beyond the typical burgers and sausages to offer a wider variety of vegan meat options, such as vegan steaks, seafood, and even ready-to-eat meals. This diversification caters to a broader range of culinary tastes and meal-preparation preferences, helping vegan meat enter more market segments.

- Increased Retail Presence and Accessibility: Vegan meat products are becoming more accessible, with increased presence not only in health food stores but also in mainstream supermarkets and online platforms. This expansion into conventional retail spaces is making vegan meat products more accessible to a wider audience, encouraging trial and adoption.

- Collaborations and Partnerships: There is a growing trend of collaborations between vegan meat companies and traditional food companies and restaurants. These partnerships help vegan meat brands leverage existing distribution networks and customer bases, while traditional companies can diversify their offerings to include plant-based options.

- Focus on Sustainability: Sustainability is becoming a major selling point. Many companies are highlighting the environmental benefits of vegan meats, such as lower water usage, reduced land use, and decreased greenhouse gas emissions compared to conventional meat production. This not only appeals to environmentally conscious consumers but also aligns with global sustainability goals.

Use Cases

- Automotive Industry: Flat steel is extensively used in vehicle manufacturing, accounting for approximately 40% of the total steel used in cars. Advanced High-Strength Steel (AHSS) is particularly popular, as it provides safety and fuel efficiency. The global demand for flat steel in this sector is projected to grow by around 6% annually, driven by the rise of electric vehicles, which require lightweight materials for better performance.

- Construction: In the construction industry, flat steel serves as a fundamental component for structural applications, including beams, columns, and roofing. The construction sector consumes about 30% of flat steel produced globally. With infrastructure investments expected to reach USD 4 trillion by 2025, the demand for flat steel is anticipated to increase significantly, particularly in developing economies.

- Appliances and Consumer Goods: Flat steel is used in the manufacturing of household appliances like refrigerators, washing machines, and ovens. This segment is estimated to represent about 15% of the flat steel market. As the global appliance market is projected to grow to USD 750 billion by 2025, the demand for flat steel in this category is expected to rise accordingly.

- Energy Sector: The renewable energy sector increasingly utilizes flat steel for constructing wind turbines and solar panel frames. The global renewable energy market is projected to reach USD 2 trillion by 2025, creating significant opportunities for flat steel manufacturers. For instance, each wind turbine requires around 100 tons of flat steel, highlighting its critical role in this industry.

- Packaging: Flat steel is also used in the production of metal packaging, including cans and containers. The global metal packaging market is anticipated to grow at a CAGR of 4.3%, increasing the demand for flat steel products used in this sector. With the rising focus on sustainable packaging solutions, the use of flat steel in this area is likely to expand.

Major Challenges

- High Production Costs: Producing vegan meat often involves complex processing and sophisticated technology, which can drive up production costs. These increased costs are typically passed on to the consumer, making vegan meat products more expensive than conventional meat. This price difference can be a significant barrier for widespread consumer adoption, especially in cost-sensitive markets.

- Consumer Taste Preferences: While advancements have been made in the flavor and texture of vegan meat, matching the exact taste and mouthfeel of traditional meat remains a challenge. Consumer acceptance is crucial, and any disparity in taste can deter traditional meat-eaters from switching to plant-based alternatives. Surveys indicate that approximately 38% of consumers are hesitant to try vegan meat due to concerns about taste and texture.

- Nutritional Profile: There is ongoing scrutiny regarding the nutritional value of vegan meats. Some products are criticized for high sodium content or the use of artificial additives to achieve the desired taste and texture. Ensuring that vegan meat products meet health standards without compromising on taste is a challenge that manufacturers continue to face.

- Regulatory Hurdles: The vegan meat sector is subject to stringent food regulations, which can vary significantly from one region to another. Navigating these regulations, especially regarding labeling and ingredient disclosures, can be complex and costly. For example, in some regions, the term “meat” cannot legally be used to describe plant-based products, which affects branding and marketing strategies.

- Supply Chain Limitations: The supply chain for raw materials needed to produce vegan meat, such as peas, soy, and other plant proteins, is not as well-established as the supply chain for animal meat. This can lead to inconsistencies in supply and quality, affecting production schedules and product availability.

- Market Saturation and Competition: As more companies enter the vegan meat market, the risk of saturation increases. This competition can put pressure on existing companies to continuously innovate and differentiate their products to maintain market share. The competitive landscape also makes it challenging for newer and smaller players to gain a foothold.

Market Growth Opportunities

- Innovative Product Development: There’s a continuous demand for innovations in taste, texture, and variety in vegan meat products. Companies that can closely mimic the sensory attributes of traditional meats or offer unique flavors have the opportunity to capture a larger market share. For example, improving the texture of vegan seafood or developing types of vegan meat that can be used in diverse culinary traditions can attract a wider audience.

- Expansion into New Geographies: While much of the growth in the vegan meat sector has been concentrated in North America and Europe, there’s significant potential in expanding to Asia, Latin America, and Africa. These regions are experiencing rising health awareness, increasing concerns about animal welfare, and shifting dietary patterns. Tailoring products to meet local taste preferences and dietary needs can facilitate market penetration and growth in these areas.

- Partnerships with Food Service Providers: Collaborating with restaurants, cafeterias, and fast-food chains to include vegan meat options on menus can dramatically increase visibility and consumer trial. For instance, a partnership between a vegan meat producer and a global fast-food chain could expose millions of consumers to plant-based alternatives, fostering market growth.

- Targeting Health-Conscious Consumers: Leveraging the health benefits of plant-based diets can attract health-conscious consumers. Vegan meats that are not only alternatives to animal protein but also offer added health benefits, such as being fortified with vitamins and minerals, can appeal to this demographic. Marketing these health benefits effectively can open up new consumer segments.

- Increasing Retail Channels: Expanding the availability of vegan meat products in mainstream grocery stores, convenience stores, and online platforms can enhance consumer accessibility. As the retail presence grows, so does consumer familiarity and acceptance, driving up sales.

- Technological Advancements in Production: Investing in technology to streamline production and reduce costs can help companies offer vegan meat products at more competitive prices. Technologies that improve shelf life, enhance safety, and increase production efficiency can also help companies scale up and meet growing demand.

Key Players Analysis

Beyond Meat, Inc. is a prominent leader in the vegan meat sector, known for its innovative plant-based products designed to emulate the taste, texture, and nutritional benefits of animal meat. Beyond Meat has significantly expanded its product lineup and distribution, collaborating with major fast-food chains and supermarkets globally. This expansion strategy, coupled with continuous R&D to enhance product quality, positions Beyond Meat as a pioneer in making plant-based meat accessible and appealing to a broad consumer base.

Impossible Foods Inc. specializes in developing plant-based meat substitutes that closely mimic the flavor and texture of real meat. Their flagship product, the Impossible Burger, has gained widespread acclaim for its use of heme, an ingredient that replicates the taste of meat, derived from soy plants. Impossible Foods’ strategy focuses on environmental sustainability and targets not only vegetarians but also meat-eaters looking to reduce their meat consumption. Their products are available in a variety of restaurants and grocery stores, enhancing their visibility and market presence.

Lightlife Foods is a key player in the vegan meat sector, offering a diverse range of plant-based protein products including tempeh, sausages, and burgers. Committed to sustainability and health, Lightlife emphasizes clean, simple ingredients and has recently reformulated its products to enhance taste and nutritional profiles. Their strategic marketing and extensive distribution network enable them to reach a wide audience, reinforcing their position as a trusted brand in the rapidly growing plant-based food market.

Tofurky is well-known for its variety of plant-based alternatives to traditional meat products, particularly focusing on holiday-centric items like vegan turkey. They have expanded their offerings to include a range of other vegan meats such as sausages and deli slices. Tofurky emphasizes sustainability and ethical eating, using non-GMO ingredients and eco-friendly practices. Their continued innovation and dedication to quality have helped them maintain a strong presence in the vegan market, appealing to both longstanding vegetarians and newer plant-based eaters.

Gardein is a prominent brand in the vegan meat sector, offering a wide array of plant-based products including burgers, chicken substitutes, and fishless fillets. Gardein has gained recognition for its versatile and flavorful options that cater to both vegetarians and meat-eaters looking to reduce animal protein in their diets. Their products, which boast a blend of soy, wheat, pea proteins, and ancient grains, are designed to provide a satisfying alternative to meat without compromising on taste or texture.

MorningStar Farms is a veteran in the plant-based food industry, historically known for its vegetarian offerings and now increasingly focusing on vegan products. As a subsidiary of Kellogg Company, MorningStar Farms leverages extensive distribution networks to offer a variety of vegan meats, including burgers, sausages, and chicken substitutes. Their commitment to producing high-quality, accessible plant-based foods has made them a favorite among consumers aiming to incorporate more plant-based proteins into their diets, thereby supporting the shift towards sustainable eating habits.

Quorn Foods specializes in meat-free alternatives primarily made from Mycoprotein, a fungus-based protein that is unique in the plant-based market. Quorn’s products range from nuggets to mince, appealing particularly to those seeking to reduce meat consumption without sacrificing texture and protein content. The company focuses on health and sustainability, positioning its products as not only vegetarian and vegan-friendly but also lower in fat and high in fiber, aligning with global trends towards healthier dietary choices.

Rollin’ Greens is an innovative company in the vegan meat sector, known for transforming traditional comfort foods into plant-based alternatives. Their offerings include millet-based tots and plant-based wings, which stand out due to their unique use of ingredients and commitment to gluten-free, organic foods. Rollin’ Greens focuses on creating nutritious, convenient products that cater to health-conscious consumers without compromising on flavor, meeting the growing demand for wholesome, ready-to-cook vegan options.

Amy’s Kitchen is well-established in the vegan meat sector, recognized for its wide range of organic and non-GMO comfort foods, including plant-based versions of popular dishes like burgers, meatballs, and sausages. Amy’s stands out for its commitment to high-quality ingredients and environmentally friendly practices, catering to both health-conscious individuals and those with dietary restrictions. Their focus on family recipes and handmade processes appeals to consumers looking for wholesome, homestyle vegan options.

No Evil Foods makes a strong impact in the vegan meat market with its artisanal, small-batch meat alternatives, which include plant-based chicken, pork, and sausages. Emphasizing sustainability and ethical practices, No Evil Foods uses organic, non-GMO ingredients packaged in environmentally friendly materials. Their products are geared towards consumers who seek not just vegan options but also environmentally conscious choices that contribute to lessening their carbon footprint, aligning with a broader movement towards sustainable living.

Before the Butcher is a notable player in the vegan meat sector, recognized for its diverse range of plant-based meat alternatives including burgers, grounds, and chunks designed to mimic beef, chicken, and pork. The company focuses on providing flavors and textures that appeal to both meat-eaters and vegetarians, facilitating a smoother transition to plant-based eating. Before the Butcher prides itself on affordability and accessibility, aiming to make vegan options more available to a broader audience. Their commitment to non-GMO, gluten-free, and soy-free products caters to various dietary preferences and needs, broadening their consumer base.

Conclusion

The vegan meat market is poised for significant growth, projected to expand from USD 5.2 billion in 2022 to USD 19.1 billion by 2032, at a CAGR of 14.3%. This growth is driven by increasing consumer awareness of health, environmental sustainability, and animal welfare issues. While challenges such as high production costs and meeting consumer taste preferences remain, the opportunities for innovation and market expansion are abundant.

Companies that continue to innovate in product development, expand into new geographic markets, and enhance distribution channels are likely to see sustained growth. Additionally, strategic partnerships and technological advancements in production can help overcome existing barriers and solidify the position of vegan meat as a mainstream food choice. Overall, the future of the vegan meat market looks promising, with significant opportunities for businesses to thrive and contribute to a more sustainable global food system.