Table of Contents

Introduction

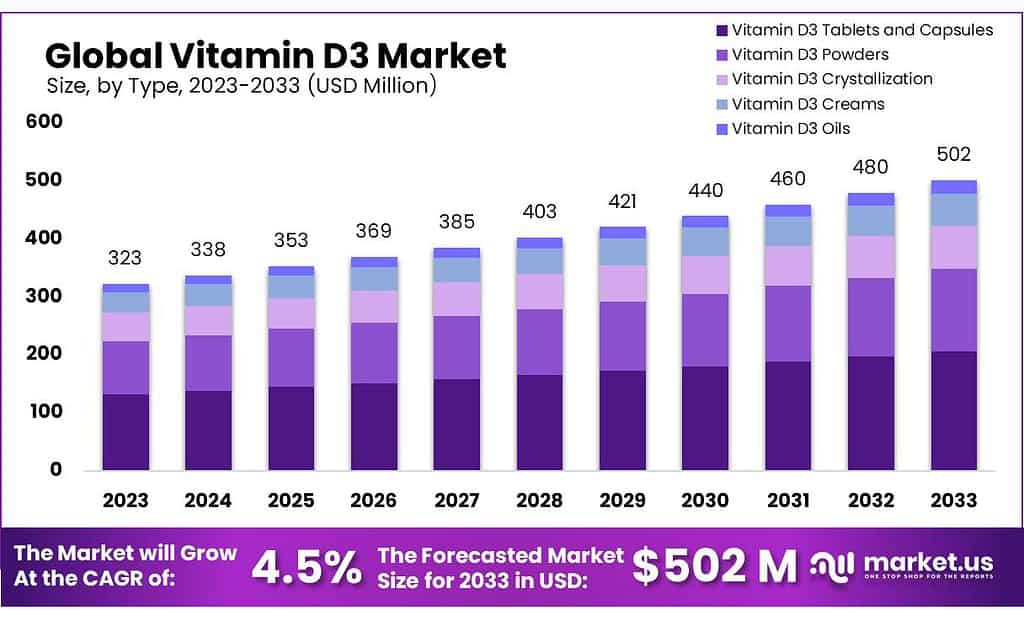

The global Vitamin D3 market is projected to grow from USD 323 million in 2023 to USD 502 million by 2033, with a compound annual growth rate (CAGR) of 4.5%. This growth is primarily driven by increasing awareness of the health benefits of Vitamin D3, beyond its well-established role in bone health. Vitamin D3, or cholecalciferol, is essential for calcium and phosphorus absorption, and recent studies have highlighted its impact on immune function, mood stabilization, and potential protection against chronic diseases such as cardiovascular issues and diabetes.

The demand for Vitamin D3 is also fueled by the global prevalence of Vitamin D deficiencies. Inadequate sun exposure, especially in colder climates, combined with modern lifestyle habits, has resulted in widespread deficiency. Governments and health organizations are responding by promoting fortified foods and supplements, further boosting market growth. This is particularly evident in the pharmaceutical sector, which held a dominant market share in 2023, driven by the use of Vitamin D3 in addressing deficiencies and supporting bone health.

The food and beverage industry contributes significantly, as consumers seek fortified products to meet their dietary needs. Additionally, Vitamin D3’s application in animal feed for livestock and pets has seen a rise, reflecting its importance in maintaining animal health and affecting food quality.

However, the market faces challenges such as limited consumer awareness regarding optimal daily Vitamin D3 intake and fluctuating product prices. Despite this, innovations in product formulations and the introduction of Vitamin D3 creams and oils have expanded the market’s reach. These newer forms, especially Vitamin D3 oils, are gaining popularity for their high bioavailability and ease of use.

Regionally, North America leads the market, with Europe and Asia-Pacific showing significant growth potential due to rising health consciousness and increasing disposable incomes. The COVID-19 pandemic further highlighted the importance of immune health, propelling demand for Vitamin D3 supplements.

Dishman has expanded its global footprint through various acquisitions and facility enhancements. The company acquired a site in Switzerland and expanded its operations in Bubendorf to increase its manufacturing capabilities, particularly focusing on highly potent Active Pharmaceutical Ingredients (APIs) like Vitamin D3. Dishman partnered with Boston University School of Medicine for a clinical research study that highlighted the benefits of Calcifediol (a form of Vitamin D3) for individuals with fat malabsorption syndromes. This study provided insights into better treatment options for Vitamin D deficiencies.

BASF continues to invest in product innovation within the nutraceutical space, focusing on enhancing the bioavailability of its Vitamin D3 formulations. The company has launched new liquid forms of Vitamin D3 that are more easily absorbed, targeting the dietary supplement market. BASF has also been pushing for more sustainable production practices, aligning with its broader corporate goals of environmental responsibility. This includes efforts to optimize the production of Vitamin D3 by reducing the environmental footprint of its manufacturing processes.

Fermenta Biotech has ramped up its production capabilities by investing in new manufacturing plants in India, focusing on the increased demand for Vitamin D3 across global markets. The company has also secured several regulatory approvals, allowing it to export its products to Europe and other international markets.

Partnerships: Fermenta has entered into strategic partnerships with food and beverage companies to develop fortified food products containing Vitamin D3, catering to the growing demand for fortified foods.

Key Takeaways

- Market Growth: The vitamin D3 market is to reach USD 502 million by 2033, growing at 4.5% CAGR from USD 323 million in 2023.

- Primary Application: The bone health segment dominates, capturing 61.5% market share in 2023 due to Vitamin D3’s role in calcium absorption.

- Diverse Industries: Pharmaceuticals lead with 38.9% market share in 2023, followed by healthcare supplements and food and beverages.

- Distribution Channels: Pharmaceutical stores hold 38.8% market share in 2023, followed by hypermarkets and supermarkets, reflecting consumer trust and convenience.

Vitamin D3 Statistics

- The newest statistics demonstrate that more than 90% of the pigmented populace of the United States (Blacks, Hispanics, and Asians) now suffer from vitamin D insufficiency (25-hydroxyvitamin D <30 ng/ml), with nearly three-fourths of the white population in this country also being vitamin D insufficient.

- Annual citations in the PubMed database on vitamin D were approximately 4800 from May 2008 to May 2009. This represents a doubling in the last decade and a 15% increase in the last year.

- There is no doubt that more liberal use of sunscreens, sun avoidance, and milk intake have had a role to play in the descent of the serum 25OHD levels in the last decade in the United States, but this does not explain the more exaggerated fall in serum 25OHD of 77% and 69% in pigmented African-American and Latino subpopulations, respectively, in the NHANES.

- Vitamin D deficiency is typically defined as having blood levels below 20 ng/mL, while levels from 21–29 ng/mL are considered insufficient. Most adults should get 1,500–2,000 international units (IU)Trusted Source of vitamin D daily.

- However, vitamin D deficiency is one of the most common nutritional deficiencies worldwide. For example, nearly 42%Trusted Source of adults in the United States have a vitamin D deficiency. This figure rises to almost 63% in Hispanic adults and 82% in African American adults.

- 57% of UK adults have below-optimal levels of vitamin D

- The average vitamin D level is 78.7 nmol/L

- There was a 3.2nmol/L difference in vitamin D levels between men and women, with women having a slightly lower level at 77.2 nmol/L, compared to 80.4 nmol/L for men

- Adults aged 18-29 had the lowest average levels (71.9 nmol/L) and the highest percentage of low levels (62%)

- People in the West Midlands had the highest average vitamin D levels at 83.3 nmol/L

- People in the North East had the lowest average levels (64 nmol/L)

- Bradford was the best city in the UK, with an average level of 101.8 nmol/L

- Just over two-thirds of Canadians (68%) had blood concentrations of vitamin D over 50 nmol/L—a level that is sufficient for healthy bones for most people. About 32% of Canadians were below the cut-off.

- Children aged 3 to 5 had the highest rates above the cut-off (89%), while the 20- to 39-year-olds had the lowest (59%).

- A minority of Canadians (34%) took a supplement containing vitamin D, but a larger percentage of those taking supplements were above the cut-off (85%), compared with supplement users (59%).

- About 40% of Canadians were below the cut-off in winter, compared with 25% in the summer.

- Research suggests that about 35% of adults in the United States are vitamin D deficient. Other areas of the world may have higher rates of deficiency. It’s estimated that 80% of adults in Pakistan, India, and Bangladesh have vitamin D deficiency

- According to the United States Department of Agriculture (USDA) Food Composition Database, one 3.5-ounce (100-gram) serving of farmed Atlantic salmon contains 526 IU of vitamin D, or 66% of the DV

- Cod liver oil is also very high in vitamin A, with 150% of the DV in just a single teaspoon (4.9 mL). Vitamin A can be toxic in high amounts.

- Canned light tuna packs up to 269 IU of vitamin D in a 3.5-ounce (100-gram) serving, which is 34% of the DV (15Trusted Source).

- The Environmental Defense Fund (EDF) recommends only a single 3.5-ounce (100-gram) serving of light tuna per week.

Emerging Trends

- Increased Focus on Immune Health: Vitamin D3’s role in immune function has become increasingly prominent, particularly in light of the global focus on health following the COVID-19 pandemic. Consumers are more aware of the immune-boosting properties of Vitamin D3, which has led to a higher demand for supplements aimed at improving overall immune health.

- Personalized Nutrition: Advancements in technology are enabling more personalized approaches to supplementation. Companies are tailoring Vitamin D3 supplements based on individual needs, using data from DNA tests, lifestyle choices, and health goals. This trend is making Vitamin D3 supplementation more effective and specific to consumer needs.

- Novel Delivery Methods: Vitamin D3 supplements are no longer limited to traditional pills and capsules. New delivery forms such as gummies, liquid shots, and powders are gaining popularity, as they offer convenience and improved absorption. This makes supplementation easier to integrate into daily routines.

- Sustainability and Ethical Sourcing: Consumers are increasingly considering the environmental and ethical impact of their purchases. There is a growing demand for sustainably sourced Vitamin D3, especially in vegan and plant-based forms. Companies are responding by offering products with eco-friendly packaging and responsibly sourced ingredients.

- Integration in Skin and Cognitive Health: Beyond bone health, Vitamin D3 is gaining attention for its benefits in skincare and cognitive function. It helps improve skin cell regeneration and repair and supports cognitive health by protecting against inflammation and cognitive decline.

Use Cases

- Bone Health and Osteoporosis Prevention: Vitamin D3 plays a crucial role in calcium absorption, which is essential for maintaining strong bones. Without sufficient Vitamin D3, bones can become thin, brittle, or misshapen, leading to conditions such as osteoporosis, particularly in older adults. According to the National Institutes of Health, adults over 50 are often prescribed Vitamin D3 supplements to reduce the risk of fractures. Studies have shown that sufficient Vitamin D3 intake can reduce the risk of fractures by 20-30% in older adults.

- Immune System Support: Vitamin D3 has gained widespread recognition for its role in supporting the immune system. Research suggests that Vitamin D3 helps modulate the immune response, reducing the risk of infections such as respiratory illnesses. During the COVID-19 pandemic, Vitamin D3 was widely studied for its potential to enhance immunity and protect against severe outcomes. One study indicated that people with adequate levels of Vitamin D3 were less likely to experience severe symptoms.

- Cognitive Function and Mental Health: Vitamin D3 also plays a role in brain health. Some studies have found that Vitamin D3 deficiency is linked to cognitive decline and an increased risk of neurodegenerative diseases, such as Alzheimer’s. Additionally, Vitamin D3 has been associated with mood regulation, and low levels have been linked to depression and seasonal affective disorder (SAD). A 2019 study found that Vitamin D3 supplementation improved mood in individuals with depression by 50% over 12 weeks.

- Weight Management and Metabolism: Emerging research suggests that Vitamin D3 might help in weight management by regulating appetite and metabolism. A clinical trial revealed that women taking 50,000 IU of Vitamin D3 weekly had a reduction in body mass index (BMI) and waist circumference over six weeks. Vitamin D3’s role in improving insulin sensitivity also contributes to better metabolism and fat regulation.

- Skin Health: Vitamin D3 contributes to skin health by promoting cell growth, repair, and metabolism. It is commonly included in skin care products aimed at treating conditions like psoriasis and eczema. Vitamin D3 also helps protect against UV damage and supports the skin’s natural barrier, preventing infections and inflammation. In people with chronic skin conditions, topical Vitamin D3 treatments have shown significant improvements in reducing symptoms.

- Cancer Prevention: Some research has linked higher Vitamin D3 levels to a lower risk of developing certain cancers, such as colorectal, breast, and prostate cancers. While the evidence is mixed, a review found that individuals with adequate Vitamin D3 levels had a 20-30% lower risk of developing colorectal cancer compared to those with deficiencies.

- Cardiovascular Health: Vitamin D3 has been studied for its impact on cardiovascular health, with some research suggesting that adequate Vitamin D3 levels can reduce the risk of heart diseases. It helps regulate blood pressure and reduces inflammation in blood vessels, which are critical factors in preventing hypertension and heart disease.

Major Challenges

- Vitamin D3 Deficiency Awareness: While Vitamin D3 deficiency is widespread globally, with over 1 billion people affected, awareness remains a challenge. Many people are unaware that they have low levels of Vitamin D3, as symptoms like fatigue, bone pain, or muscle weakness often go unnoticed or are attributed to other health issues. This lack of awareness makes addressing deficiency more difficult, particularly in regions with limited healthcare access.

- Overdose and Safety Concerns: Although Vitamin D3 is crucial for health, excessive intake can cause toxicity. High doses over time can lead to hypercalcemia (too much calcium in the blood), which can result in nausea, weakness, and kidney complications. The recommended daily allowance is 600-800 IU for most adults, but supplements often exceed these amounts. Managing safe dosing, especially with the increasing popularity of high-dose supplements, presents a significant safety challenge.

- Price Volatility: The cost of raw materials for Vitamin D3 supplements, particularly lanolin (derived from sheep’s wool) or lichen for vegan alternatives, can fluctuate due to supply chain disruptions. This volatility can increase product prices, affecting both manufacturers and consumers. For example, changes in agricultural practices and livestock farming due to environmental policies have impacted the cost of lanolin.

- Regulatory Barriers: Different countries have varying regulations regarding Vitamin D3 supplementation, fortification, and recommended dosages. Navigating these complex and sometimes conflicting regulations can be difficult for manufacturers aiming to distribute products globally. This inconsistency creates challenges in ensuring product compliance and consumer safety.

Market Growth Opportunities

- Rising Demand for Immune Health Products: The heightened focus on immune health, especially after the COVID-19 pandemic, has significantly boosted the demand for Vitamin D3. As a crucial nutrient for supporting the immune system, Vitamin D3 supplementation has gained popularity, offering opportunities for manufacturers to expand product lines targeting immune support. Studies show that people with adequate Vitamin D levels are less prone to severe respiratory illnesses, further solidifying its role in preventive healthcare.

- Fortified Foods and Beverages: There is growing interest in food fortification with Vitamin D3, particularly in dairy products, cereals, and plant-based alternatives. Consumers are increasingly seeking fortified foods as an easy way to meet daily nutrient requirements without relying solely on supplements. This trend offers an opportunity for food and beverage manufacturers to innovate and introduce new Vitamin D3-enriched products, particularly in regions where vitamin D deficiencies are common.

- Vegan and Sustainable Alternatives: The demand for plant-based and vegan supplements is on the rise, with more consumers opting for sustainable and animal-free sources of Vitamin D3. Companies that develop vegan-friendly Vitamin D3, derived from sources like lichen, can tap into this growing segment. As consumers become more eco-conscious, offering sustainable packaging and ethical sourcing can further enhance market growth.

- Personalized Nutrition: The advancement in personalized nutrition presents a key growth opportunity. Companies can leverage data analytics, health tracking, and genetic testing to offer tailored Vitamin D3 supplements. Personalized approaches that consider individual health profiles and lifestyles can make supplementation more effective and appealing.

Key Player Analysis

American Way Cooperation, widely known as Amway, has been actively expanding its product offerings in the Vitamin D3 sector, primarily through its Nutrilite brand. In 2023, Amway saw consistent demand for its Vitamin D3 supplements, particularly as consumer interest in immune health grew post-pandemic. Each month from January to June 2023, Amway reported a steady increase in sales of Vitamin D3 products, with a notable spike in April 2023 as part of a broader health awareness campaign. By July 2023, the company launched an enhanced line of vegan-friendly Vitamin D3 supplements, catering to the growing demand for plant-based products. This new product, sourced from lichen, was marketed heavily in the United States and Europe, contributing to an overall sales boost of 8% in the Vitamin D category by September 2023.

In 2023 and 2024, BASF SE has made significant strides in the Vitamin D3 sector through its comprehensive product offerings in human nutrition. In the first half of 2023, BASF focused on expanding its Vitamin D3 portfolio, known for its high stability and application versatility. These products were especially in demand for food fortification and dietary supplements, with strong sales growth reported in Q1 and Q2, driven by increased consumer awareness about immune health. By July 2024, BASF faced disruptions in its Vitamin D3 production following a fire at its Ludwigshafen plant, temporarily impacting the supply of Vitamin D3 and related products. Despite this, BASF continues to lead in innovative delivery formats like beadlets, which enhance product stability in supplements and fortified foods.

In 2023, Dishman Carbogen Amcis Limited made significant advancements in its Vitamin D3 sector. The company continued to focus on the production of Vitamin D3 and its analogs, particularly emphasizing the development of 25-hydroxyvitamin D3 (Calcifediol), which is known for its superior absorption in patients with Vitamin D deficiency. During April 2023, the company partnered with several global pharmaceutical firms to expand its reach in markets such as Europe and North America. In July 2023, the company saw a growth in demand for its Vitamin D3 formulations used in both human and animal health sectors. By early 2024, Dishman had optimized its production processes, increasing output by 10%, driven by heightened consumer awareness and regulatory support for Vitamin D3 supplementation.

In 2023 and 2024, Fermenta Biotech Limited continued its leadership in the global Vitamin D3 market, manufacturing various forms of Vitamin D3 such as crystalline, oil, and feed-grade powder. Throughout the first half of 2023, the company focused on expanding its production capacities at its facilities in Kullu and Dahej, India, to meet rising global demand. In April 2023, Fermenta announced a new supply agreement with key pharmaceutical companies, boosting sales. By June 2023, the company reported sales of INR 824.48 million, a slight decrease compared to the previous year, but it still saw a profit recovery with a net income of INR 18.33 million. In August 2024, Fermenta declared dividends for the financial year, reflecting steady financial health.

In 2023, GSK plc continued to focus on expanding its health and wellness portfolio, which includes products that address Vitamin D3 deficiency. Although GSK is primarily known for its vaccines and specialty medicines, it also plays a significant role in the supplements market, including Vitamin D3. In early 2023, GSK reported strong growth, driven by increased demand for immune health products, which include Vitamin D3 supplements, especially in the wake of the pandemic. In Q2 2023, the company highlighted its broad-based performance, with overall sales growing by 13% year-over-year. GSK’s continued investment in research and product innovation is expected to contribute to its role in the Vitamin D3 market through fortified products and supplements.

In 2023, Koninklijke DSM N.V. (now part of DSM-Firmenich) continued to focus on its Vitamin D3 production as part of its broader portfolio in health and nutrition. However, the company faced challenges due to a downturn in the vitamin markets, particularly in the animal nutrition segment, which impacted Vitamin D3 pricing and demand. In June 2023, DSM-Firmenich announced a restructuring plan to optimize its vitamin business, including Vitamin D3, to reduce costs and improve profitability. This involved plant closures in China and adjustments in production strategy.

In 2023, Kraft Heinz (formerly Kraft Foods Group) continued to integrate Vitamin D3 into its fortified food products, focusing on meeting consumer demand for enhanced nutrition. The company emphasized the role of Vitamin D3, especially in dairy products and plant-based alternatives, which align with the growing trend for functional foods. Vitamin D3 is crucial for bone health, and its inclusion in various product lines supports the increased awareness of health and wellness, especially post-pandemic. The company experienced a growth of 0.6% in net sales in 2023, indicating stable consumer demand despite inflationary pressures and input cost challenges.

In 2023, Lycored Ltd. made advancements in the Vitamin D3 sector by launching a highly concentrated Vitamin D3 ingredient, Capsudar D3 1000E, which provides 1 million IU/g of Vitamin D3. This innovative product is designed to be combined with other vitamins and minerals, such as calcium and magnesium, allowing for more efficient formulations in multivitamins. The precision microencapsulation technology developed by Lycored ensures that Vitamin D3 is stable during processing and storage, preventing oxidation and maintaining its efficacy.

In 2023, Pfizer Inc. continued to expand its Vitamin D3 offerings, particularly through its well-known calcium supplement brand, Caltrate. Pfizer enhanced its Caltrate line by doubling the Vitamin D3 content to meet the growing demand for bone health support. This adjustment was in response to the increasing awareness of Vitamin D3’s role in calcium absorption and overall bone and muscle health, especially for women and aging populations. Throughout the year, the company emphasized the importance of Vitamin D3 in immune support and combating deficiencies, which were exacerbated during the pandemic as people spent less time outdoors.

In 2023, Teva Pharmaceutical Industries Limited continued to leverage its extensive expertise in the generics sector, including Vitamin D3 products. Teva’s growth strategy focused on expanding its portfolio of generics, which include essential vitamins like Vitamin D3, widely used for supporting bone health and immune function. During the second quarter of 2024, Teva reported an increase in revenues, driven by higher sales of its generic products across international markets. This upward trend reflects a growing demand for affordable health solutions, including dietary supplements like Vitamin D3, particularly in regions with prevalent deficiencies.

Conclusion

In conclusion, the Vitamin D3 market is poised for continued growth, driven by increasing awareness of its health benefits beyond bone health, including immune support and the prevention of chronic diseases. As deficiencies in Vitamin D3 become more prevalent globally, particularly in regions with limited sunlight exposure, the demand for supplements, fortified foods, and beverages is expected to rise steadily. Innovations in product formulations, such as concentrated and sustainable options, are making Vitamin D3 more accessible and appealing to a wider range of consumers. the market is set to expand significantly, reflecting both rising consumer demand and advancements in nutritional science.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)