Table of Contents

Introduction

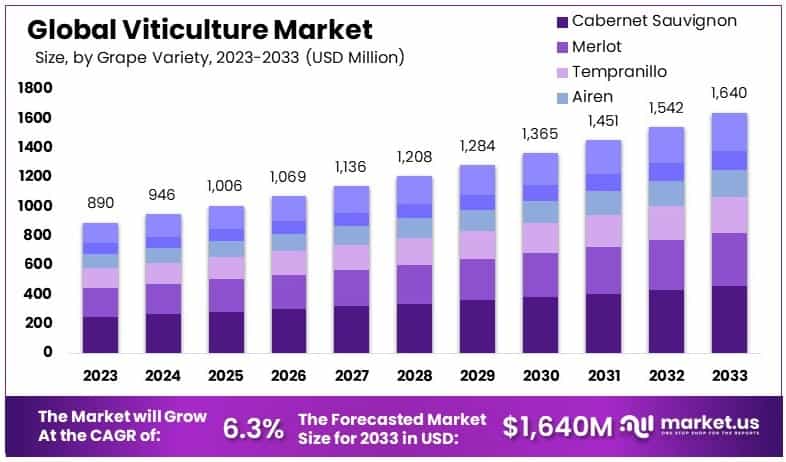

.The Global Viticulture Market is projected to grow from USD 890 million in 2023 to USD 1,640 million by 2033, with a CAGR of 6.3% over the forecast period. This market is primarily driven by the rising demand for premium wines and a growing interest in wine tourism. Consumers are increasingly preferring premium and high-quality wines, evident in regions like Napa Valley and Bordeaux, where the focus on producing superior wines has intensified investments in viticultural practices.

Technological advancements in viticulture, such as precision farming and sustainable agriculture, are significantly enhancing grape yield and quality. The use of drones, remote sensing, and variable rate technology for optimized resource utilization is improving efficiency and reducing environmental impact. These innovations are critical in meeting the rising consumer demands for eco-friendly and organic products.

However, the viticulture market faces challenges from climate change and environmental issues that affect grape yield and quality. Extreme weather, changing precipitation patterns, and new pest outbreaks pose risks that can lead to reduced production and increased costs. Additionally, the competition for land due to urbanization and the high costs associated with securing vineyard space, particularly in established wine regions, restrict market growth.

Recent developments include strategic mergers and acquisitions aimed at enhancing market presence and expanding product portfolios. For instance, the acquisition of DAOU Vineyards by Treasury Wine Estates Ltd in 2023 is part of a strategic move to emphasize a luxury-driven portfolio, which is becoming increasingly significant in the U.S. market. This trend highlights the industry’s shift towards high-end, quality-focused products to cater to a more discerning consumer base.

Food And Beverage Australia Limited, though not explicitly mentioned in recent specific transactions, continues to be a significant entity in the broader market landscape, likely focusing on strategic growth and market penetration based on industry trends.

Madeira Wine Company S.A. remains influential with its traditional and historic brands like Blandy’s Madeira and Cossart Gordon. While specific recent M&A activities weren’t detailed, the company is well-positioned due to its established reputation and extensive experience in wine production.

Overall, the Viticulture Market is set for robust growth, propelled by technological innovations, a shift towards sustainable practices, and the burgeoning sector of wine tourism.

Key Takeaways

- Market Value: The Viticulture Market is expected to reach USD 1,640 Million by 2033, with a CAGR of 6.3% from 2024 to 2033.

- Grape Variety Analysis: Cabernet Sauvignon dominates with 29.3% due to its versatility and robust flavor profile. It is favored for its adaptability and high-quality production.

- Wine Analysis: White wine leads with 26% due to broad appeal and health trends. Its diverse styles and food pairing versatility contribute to its market strength.

- Europe Dominance: Europe leads with 41.2% market share, valued at $366.68 billion, driven by its rich viticulture history and premium wine production.

- North America Presence: North America holds a 22% market share, showing potential for growth as consumer preferences evolve towards premium wines.

Viticulture Statistics

- The Australian winegrape crush is estimated to be 1.73 million tonnes (Table 1) in 2022.

- The white varietal crush declined by 9% for an estimated total of 775,129 tonnes in 2022

- The white crush was approximately 45% of the total crush in 2022 which is lower than the 10-year average of 48% (Wine Australia).

- Turkey has 390.221 ha of vineyards and a total production of 3.670.000 tonnes of fresh grapes.

- The estimated average yield was approximately 12 tonnes per hectare (Table 2), which is slightly lower than the 10-year average of 12.55 tonnes per hectare.

- all the most commonly crushed red varieties suffered a downturn, except Durif, to reach an estimated 959,131 tonnes, a drop of 17% in the intake compared to the previous 12 months

- The produced wine grape varieties are grown in the largest area, of which 72% is white wine and 25% is red wine

- The surface of vineyards is about 63,000 ha, which can be found in 22 wine regions.

- 75% of the vineyards are on hills and mountains, and 25% of them are on the Great Hungarian Plain.

- Genetics has proved this in the case of 76 varieties up to now.

- 95% of the vine is processed for wine, of which 75% is white wine and 25% is rosé and red wine.

Emerging Trends

- Technology Integration: Advanced technologies like Artificial Intelligence (AI) and Blockchain are revolutionizing the viticulture Market. AI aids in optimizing vineyard management, from monitoring plant health to enhancing the fermentation process, while Blockchain improves traceability, allowing consumers to verify the origin and handling of their wine.

- Sustainability Practices: There is a strong movement towards a sustainable and regenerative viticulture Market. Vineyards are increasingly adopting practices that improve soil health, reduce water use, and lower carbon footprints. This shift is driven by both environmental concerns and consumer demand for eco-friendly products.

- Consumer-Driven Changes: The market is seeing a rise in demand for premium wines and a notable pivot towards white wines due to global warming. Additionally, there’s a growing segment for low and no-alcohol wines, aligning with a broader trend of health-conscious consumption.

- Urban and Vertical Viticulture: The concept of growing vines in urban settings using vertical agriculture is gaining traction. This approach not only addresses space limitations but also fits well with the urban lifestyle, offering fresh perspectives on local production and consumption.

- Packaging Innovations: In response to environmental concerns, the industry is moving towards sustainable packaging options. This includes lighter bottles, the use of recycled materials, and alternatives like cans, which are becoming popular for their convenience and reduced shipping impact.

- Diversification through Co-Fermentation: There’s a growing interest in co-fermentation techniques that mix different types of fruits and even non-traditional ingredients. This trend is driven by innovative winemakers looking to cater to diverse palates and stand out in a competitive market.

Use Cases

- Precision Viticulture: This approach uses data analytics to enhance vineyard management, focusing on improving yield quality while reducing labor, energy, and input costs. Technologies like eVineyard integrate data from microclimate, soil, and plant sensors to provide detailed insights that help manage daily operations efficiently and enhance decision-making.

- Automation and AI Integration: Vineyards are increasingly utilizing AI to automate complex processes and make data-driven decisions. For instance, AI systems like VIGOR and FILCS at Palmaz Vineyards monitor vine growth and fermentation processes, respectively. These systems help adjust conditions in the vineyard in real time and track wine aging, improving both the efficiency and quality of wine production.

- Water Management Models: Precision irrigation models use detailed weather data and evapotranspiration rates to determine the optimal amount of water for each vineyard block. This approach not only conserves water but also ensures that grapes grow under ideal conditions, which is crucial for maintaining the desired quality of yield.

- Pest and Disease Management: Advanced analytics and modeling tools provide vineyard managers with precise information on disease risks based on microclimate data. These tools can forecast the potential development of vine diseases like downy mildew or botrytis, enabling timely and targeted interventions.

- Geographic Analysis and Planning: By analyzing activities across the vineyards, managers can optimize the use of machinery and personnel, reducing unnecessary movements and focusing efforts where they are most needed. This not only saves time but also reduces operational costs.

Key Players Analysis

Food And Beverage Australia Limited (FABAL) is a prominent figure in the Australian viticulture sector, managing over 1,600 hectares of vineyards across various premium wine regions including the Barossa, Clare Valley, and Margaret River. The company specializes in vineyard management and winemaking, catering to both its own estates and those of strategic partners. FABAL’s expertise ensures high-quality grape production with secure purchase agreements, linking the grapes to leading wine companies in Australia.

Madeira Wine Company S.A. is renowned for its significant role in the Madeira wine industry, boasting heritage brands like Blandy’s Madeira and Cossart Gordon. The company operates from Madeira, Portugal, where it manages vineyards and produces a variety of Madeira wines. These wines are celebrated for their unique qualities, derived from the distinctive volcanic soil and subtropical climate of the region. The Madeira Wine Company continues to uphold a long tradition of quality winemaking, blending heritage with modern techniques to meet contemporary tastes and standards.

Viticultura Ltd operates extensively in the viticulture sector, providing a range of vineyard management services in Central Otago, New Zealand. The company specializes in managing various aspects of vineyard operations, including planting, canopy management, and crop regulation, ensuring high-quality wine production. Viticultura is known for its comprehensive service package that covers everything from site appraisal to the final stages of wine production, helping vineyard owners optimize their operations and produce premium fruit.

HORTUS LIMITED excels in providing comprehensive vineyard management and labor services, specifically within New Zealand’s viticulture sector. Established to supply labor and machinery with expert management, Hortus has grown into a leading service provider in both horticulture and viticulture. The company’s strong focus on delivering high-quality and reliable services has earned it a robust partnership base, enhancing vineyard operations for many growers. Hortus is particularly recognized for its dedication to sustainable practices and excellent worker accommodations, setting high standards in the industry.

MONTEFILI operates in the heart of Tuscany’s Chianti Classico region, focusing on crafting wines that reflect the unique terroir of this area. The vineyard embraces traditional methods, such as hand-picking grapes and using native yeasts for fermentation, to produce wines that are expressive of their origin. Montefili’s commitment to low-intervention winemaking techniques ensures the purity and distinctiveness of their varietals, making them a notable player in the Italian viticulture scene.

Treasury Wine Estates (TWE) is a major player in the global viticulture sector, headquartered in Australia and celebrated for its innovative approaches in sustainable wine production. The company operates on a global scale, managing a rich portfolio of wine brands across various regions, with significant advancements in environmental sustainability. TWE has been recognized for its strategic growth through acquisitions and commitments to sustainable viticulture, including nearly universal site certification for sustainable practices and a notable focus on regionally-relevant sustainably sourced fruit. This strategic direction not only emphasizes TWE’s leadership in premium wine production but also highlights its dedication to environmental stewardship and excellence in the viticulture industry.

Conclusion

The viticulture industry stands at a dynamic crossroads, where tradition meets innovation. Emerging trends such as precision viticulture, sustainability practices, and technological integrations like AI and blockchain are reshaping the landscape. These advancements are not only enhancing efficiency and production quality but are also addressing environmental concerns and changing consumer preferences. As viticulture evolves, it faces challenges including climate change, resource management, and market fluctuations, yet it also sees opportunities in adapting to these changes through innovative practices and technologies. With a growing focus on sustainable and data-driven agriculture, the viticulture industry is poised to continue its growth, ensuring that it can meet future demands while maintaining the integrity and quality that have defined wine production for centuries. As the sector navigates these opportunities and challenges, its success will increasingly depend on how well it integrates these new technologies and adapts to evolving market conditions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)