Table of Contents

Introduction

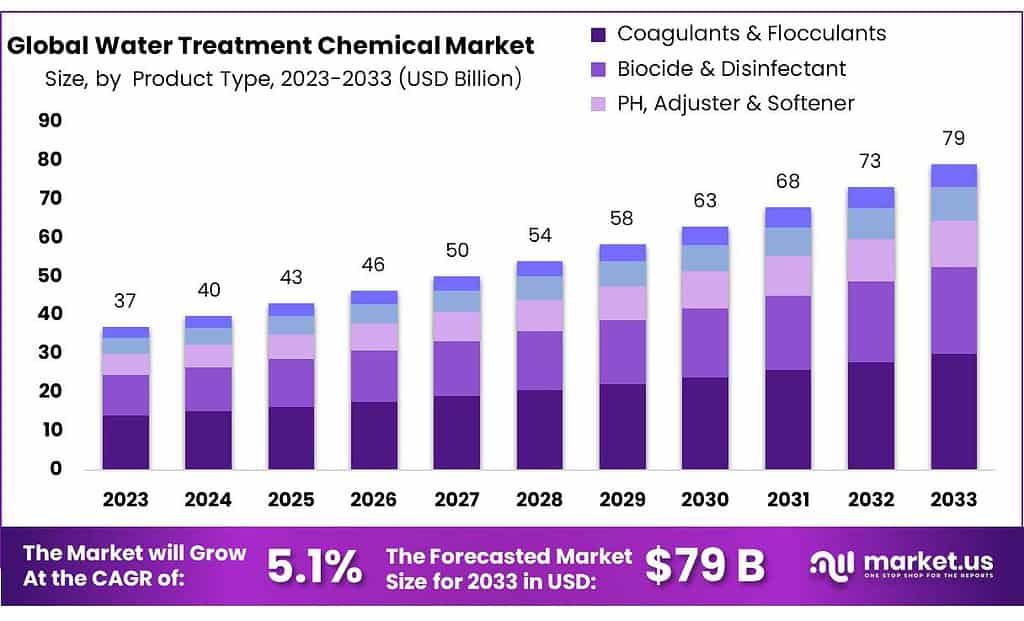

The global Water Treatment Chemicals Market is forecasted to expand from USD 37 billion in 2023 to approximately USD 79 billion by 2033, demonstrating a compound annual growth rate (CAGR) of 5.1%. This growth is primarily driven by increasing demands for clean water across various industrial sectors, coupled with heightened regulatory standards aimed at environmental conservation. These sectors include municipal, power, oil and gas, and chemical manufacturing, which rely heavily on treated water for operational efficiency and regulatory compliance.

However, the market faces significant challenges, including the rising cost of water treatment and the stringent environmental regulations that limit the use of certain chemicals. Innovations in water treatment technologies, such as biocides and disinfectants, are increasingly crucial for maintaining system efficiency and addressing contamination concerns, particularly in food and beverage applications.

Additionally, the adoption of alternative water treatment technologies like UV disinfection and membrane filtration presents a competitive challenge to traditional chemical treatments, pushing the industry towards more sustainable and less chemically reliant solutions.

Recent developments in the market underscore the dynamic nature of this industry. For instance, key acquisitions such as Solenis’ purchase of CedarChem, and Ecolab’s acquisition of Purolite highlight strategic efforts to expand product offerings and geographical reach, indicating a trend towards consolidation to leverage new market opportunities.

SUEZ has been actively expanding its portfolio and market reach. In a recent strategic decision, it enhanced its capabilities in the water treatment sector through acquisitions and collaborations, ensuring a broader service spectrum and deeper market penetration. Similarly, BASF SE continues to innovate in product development, focusing on sustainable solutions that meet the stringent environmental regulations globally.

Ecolab has strengthened its market position through technological advancements and strategic acquisitions, such as the purchase of Purolite. This acquisition has allowed Ecolab to broaden its technology base in water purification, particularly benefiting pharmaceutical and industrial applications.

Key Takeaways

- The global water treatment chemicals market is projected to grow from USD 37.7 billion in 2023 to USD 62.0 billion by 2033. At a CAGR of of 5.1%.

- Coagulants and flocculants constituted over 38.1% of the market revenue in 2023, primarily used in the oil and gas sectors.

- Recycling and Reuse: Due to water scarcity, major players in North America and Europe have adopted water recycling and reuse, capturing over 39.2% of revenue.

- North America Share: North America held more than 32.2% of the market share in 2023, driven by increased water treatment plants in the oil and gas sectors.

Water Treatment Chemicals Facts And Statistics

- A residual concentration of free chlorine of ≥ 0.5 mg/l is required after at least 30 minutes of contact time at pH < 8.0.

- A chlorine residual should be maintained throughout the distribution system.

- At the point of delivery, the minimum residual concentration of free chlorine should be 0.2 mg/l.

- pH Adjusters Suitable include 93% sulfuric acid, calcium oxide, and magnesium hydroxide.

- Chlorination Procedure Typically, add a capful of chlorine solution to a 25-liter water storage container, shake, and wait for 30 minutes of contact time before drinking.

- It is estimated that during the formulating stage up to 2 % of the finished product will be lost.

- In the UK, recommended levels of water replacement are in the region of 10% of the pool volume per week.

- Carrying 30 kg drums of chemicals can be hazardous, and may result in spilling chemical products or drum bursting if dropped.

Water Treatment Technologies and Chemical Use

- Water Treatment Technologies Slow sand filters are Typically 1–2 meters deep with a hydraulic loading rate of 0.2–0.4 cubic meters per square meter per hour.

- Water Treatment Chemicals Market UV-C light disinfection: Utilizes wavelengths from 200 nm to 280 nm.

- Calcium hypochlorous: Used in chemical water treatments with a 70% by mass concentration.

- Industrial wastewater: Often has pH values beyond 6–9 and may contain high concentrations of dissolved metal salts.

- Biological Oxygen Demand (BOD): Expressed in milligrams of oxygen consumed per liter of sample during 5 days of incubation at 20°C.

- Primary treatment can reduce BOD by 20–30% and total suspended solids by 50–65%.

- Total U.S. domestic manufacturing in 2019: Approximately 22,845 million kilograms.

- U.S. consumption in 2019: Estimated at 25,596 million kilograms.

- Import duty: No general duty, but an additional 25% duty on imports from China.

- Major use: Phosphate fertilizer manufacturing, accounting for 60-75% of domestic consumption.

- Shelf life: Up to 36 months when stored properly.

- Bell Chem is Based in Longwood, FL, with a 50,000+ square-foot warehouse stocking a vast selection of water treatment chemicals.

- The district covers 85,499 hectares: 43.7% level (flat), 8.45% mountainous, and 48.08% valley.

- Water covers almost 70% of the earth’s surface and is essential for drinking, preparing food, bathing, cleaning, irrigation, and various other tasks.

- Global Water Crisis Approximately 3.5 million people die annually due to lack of access to clean drinking water.

Emerging Trends

- Advanced Monitoring Technologies: The integration of Internet of Things (IoT) devices and artificial intelligence (AI) into water quality monitoring systems is a significant trend. These technologies offer real-time data collection and analysis, enabling early detection of contaminants and more precise water treatment. This approach allows for proactive management of water quality, optimizing treatment processes, and ensuring the safety of water supplies.

- Membrane Technology: Innovations in membrane technology are improving the efficiency of water treatment processes. New materials and designs are being developed to reduce fouling, increase flux rates, and lower energy consumption, addressing some of the traditional challenges associated with membrane filtration.

- Eco-friendly Chemicals: There is a growing demand for environmentally friendly water treatment chemicals. This trend is driven by stricter regulatory standards and a general shift towards sustainability. Companies are increasingly focusing on developing biodegradable and less toxic chemicals to minimize environmental impact.

- Decentralized Treatment Systems: The adoption of compact, modular water treatment systems is on the rise, particularly for use in remote locations or for smaller-scale applications. These systems offer flexibility and can be tailored to specific needs, making water treatment more accessible and customizable.

- Recycling and Reuse Practices: With the increasing scarcity of freshwater resources, there is a heightened focus on wastewater recycling and reuse. This trend is particularly prevalent in industries such as mining and power generation, where water treatment chemicals play a crucial role in ensuring that recycled water meets safety and quality standards.

Use Cases

- Industrial and Municipal Water Treatment: In both sectors, water treatment chemicals are crucial for managing the quality of water used for various applications. For example, polymer flocculants are used extensively to aid in the coagulation and flocculation processes, which are critical for removing contaminants from water. These polymers help form larger aggregates from smaller particles, making it easier to remove them from the water.

- Boiler Water Treatment: Chemicals like oxygen scavengers, alkalinity builders, and anti-scaling agents are vital in maintaining boiler efficiency and longevity. Oxygen scavengers help protect against corrosion by eliminating oxygen from the boiler water, while alkalinity builders are used to maintain a high pH to prevent acid corrosion.

- Cooling Water Treatment: This involves the use of corrosion inhibitors, scale inhibitors, and biocides to maintain the efficiency of cooling towers and systems. These chemicals prevent the buildup of harmful organisms and minerals that can damage the system.

- Food and Beverage Industry: Water treatment in this sector ensures that the water used in production processes is safe and of high quality. Chlorine is commonly used as a disinfectant to eliminate pathogens from water used in food and beverage manufacturing.

- Automotive Industry: The treatment of water used in manufacturing processes within the automotive industry is vital to ensure the quality of products and to prevent damage to manufacturing equipment. Techniques like microfiltration, reverse osmosis, and water softening are employed to treat the water used in various stages of vehicle production.

- Energy and Power Generation: Water treatment chemicals are used extensively in power plants to manage the quality of water used for steam generation and cooling. This ensures the efficient operation of power plants and minimizes the environmental impact of their operations.

- Mining and Minerals Processing: In these industries, water treatment chemicals help manage wastewater that contains various contaminants. The treated water can then be safely discharged or reused within the facility.

Major Challenges

- Increased Regulatory Scrutiny: Regulatory bodies worldwide are tightening the controls on chemical usage, particularly concerning substances deemed hazardous to health and the environment. For instance, South Korea has made substantial updates to its K-REACH regulations, requiring more stringent pre-registration and notification procedures for chemical substances. Such regulations demand comprehensive data on chemical toxicity and environmental impact, increasing the compliance burden for companies.

- Adaptation to Local and Global Standards: Companies must continually adapt to both local and international regulatory frameworks. This adaptation involves significant investment in compliance and risk management strategies to meet diverse standards across different markets. For example, the Chinese government’s introduction of the ‘one enterprise, one product, one code’ policy underscores the need for meticulous management of chemical substances, with heavy penalties for non-compliance.

- Cost of Compliance: Complying with these regulations often requires substantial financial outlays. Businesses must invest in new technologies, systems, and expertise to ensure compliance. For example, in the European Union, the chemical industry faces increased costs due to stringent environmental regulations coupled with high energy prices, affecting profitability and operational efficiency.

- Impact on Global Supply Chains: The chemical industry’s supply chains are highly globalized, making compliance with international regulations critical. This scenario is complicated by varying standards and enforcement practices in different countries. Companies must navigate these complexities to avoid disruptions in their supply chains and potential legal penalties.

- Focus on Sustainability and ESG: Beyond compliance, there is a growing emphasis on environmental, social, and governance (ESG) criteria within the industry. Companies are not only adapting to regulations but are also aligning their operations with broader sustainability goals. This shift requires a transformation in corporate practices and culture, which can be challenging to implement effectively.

Market Growth Opportunities

- Market Expansion Due to Industrial Growth: The industrial boom in Asia-Pacific has significantly increased the need for water treatment to meet both environmental regulations and operational requirements. As industries expand, the demand for various water treatment chemicals, including coagulants, biocides, and corrosion inhibitors, rises, ensuring that industries meet stringent wastewater discharge standards and maintain system efficiency.

- Government and Regulatory Influence: Governments across the region are enforcing stricter water quality standards to manage the rising water pollution levels due to industrial activities. For instance, initiatives by the Environmental Protection Agency (EPA) and local environmental bodies play a crucial role in shaping the market dynamics. These regulations not only ensure compliance but also drive innovation in water treatment technologies and chemicals.

- Technological Advancements and Infrastructure Development: The market is also benefiting from technological advancements in water treatment processes and chemicals. Innovations such as smart water management systems, which utilize advanced sensors and IoT technologies, are becoming more prevalent. These technologies enhance the efficiency and effectiveness of water treatment operations, thereby increasing the demand for specialized chemicals.

- Urbanization and Rising Public Health Awareness: Urbanization in Asia-Pacific has led to increased stress on existing water infrastructure, necessitating upgraded and more efficient water treatment solutions. Additionally, rising public health awareness about the importance of clean water is influencing the market positively. More consumers and businesses are investing in water treatment solutions to ensure safety against contaminants like pathogens, chemicals, and heavy metals.

- Investments in Residential and Commercial Sectors: The growth in residential and commercial sectors, particularly in emerging economies like China and India, is a catalyst for increased demand for water treatment chemicals. New construction projects often include advanced water treatment facilities to cater to the growing population’s needs.

Recent Developments

In 2023, SUEZ rolled out its Sustainable Development Roadmap 2023-2027, focusing on operational commitments towards climate, nature preservation, and social responsibility. The company demonstrated significant progress in sustainable development, achieving electricity self-sufficiency in Europe and issuing €5.5 billion in green bonds to support environmentally friendly projects.

In 2023, BASF SE continued to strengthen its position in the water treatment chemicals sector with several key developments aimed at enhancing water management and sustainability practices. The company focused on implementing sustainable water management at its production sites, especially those in water-stress areas, which aligns with its commitment to the United Nations’ Sustainable Development Goals. This initiative included the introduction of intelligent cooling water systems and increased water recycling efforts.

In 2023, Ecolab made significant advancements in the water treatment chemicals sector, highlighting its ongoing commitment to sustainability and operational efficiency. The company released its 2023 Growth & Impact Report, which detailed achievements in environmental, social, and governance aspects, aiming to make a positive impact by 2030. Ecolab’s efforts included conserving 226 billion gallons of water and helping to provide safe food to 1.4 billion people, demonstrating the broad reach of their initiatives. They also made substantial progress in reducing greenhouse gas emissions and advancing water stewardship, moving towards achieving a Net Positive Water Impact.

In 2023 Solenis, in a significant transaction valued at approximately $4.6 billion. Diversey is a global leader in hygiene, infection prevention, and cleaning solutions. This merger significantly diversifies Solenis’s business, expanding its global reach and scaling up its operations to better serve a broader range of customer needs across multiple sectors. The acquisition is set to create cross-selling opportunities and enhance the combined entity’s capabilities in water management, hygiene, and cleaning solutions, reflecting a strategic expansion of Solenis’s core business into complementary areas.

Conclusion

As the global emphasis on sustainable water management continues to intensify, the water treatment chemicals market is poised for significant growth. The industry is driven by critical needs across multiple sectors, including industrial processes, municipal water treatment, and stringent environmental regulations.

Technological advancements are pivotal, with innovations like micro-polymerization and polymer blending improving the efficiency and effectiveness of water treatment processes. These technologies not only enhance the performance of water treatment systems but also contribute to a reduction in chemical consumption, aligning with global sustainability goals.

The market’s expansion is further supported by a growing demand in emerging economies, where rapid industrialization and urbanization significantly increase the need for effective water management solutions. This is particularly evident in regions like Asia-Pacific, which is expected to witness robust growth due to the escalating requirements for clean water in industries such as power generation, oil and gas, and mining.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)