Table of Contents

Introduction

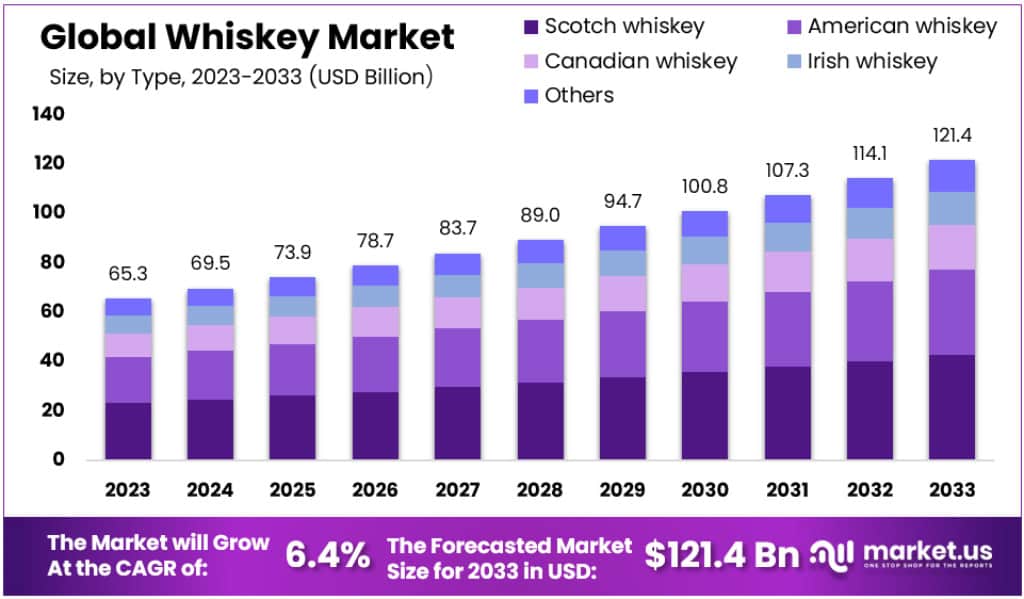

The global whiskey market is poised for substantial growth, with the market size expected to expand from USD 65.3 billion in 2023 to USD 121.4 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.4% during this period. This growth is driven by several key factors, including a surge in demand for premium and luxury whiskey products, particularly in developing regions with increasing purchasing power and a shift in consumer preferences towards high-end spirits.

One of the major growth factors is the rising popularity of alcoholic beverages globally, supported by changing consumer preferences, rapid urbanization, and an increasing middle-class population. This has led to a notable rise in alcohol consumption, particularly in whiskey, which is seeing innovation and premiumization within its sector. Companies are actively expanding their product ranges and engaging in marketing strategies to cater to this growing demand.

However, the market also faces challenges such as the emergence of non-alcoholic beverage alternatives, which are gaining traction due to growing consumer health consciousness. This trend could potentially restrain the growth of the whiskey market as preferences shift towards healthier beverage choices.

Recent developments within the industry include strategic expansions and innovations by key players such as Brown-Forman and Diageo, who are looking to enhance their market presence and adapt to changing consumer tastes by introducing new product lines and entering new markets.

Diageo Plc has been active with product launches and strategic partnerships. In January 2024, they announced a partnership with Black Cap to enhance their digital marketing strategies for Indri Single Malt Whiskey. This move aims to boost Indri’s visibility and consumer engagement through sophisticated digital and social media campaigns. Pernod Ricard SA has also been innovative, launching “The Chuan Whiskey” in August 2021. This brand is deeply embedded in Chinese culture, reflecting Pernod Ricard’s strategy to tap into culturally rich and diverse markets to cater to local tastes and preferences.

Key Takeaways

- The Global Whiskey Market is expected to reach approximately USD 121.4 billion by 2033, compared to USD 65.3 billion in 2023.

- This growth is projected at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2033.

- Scotch whiskey dominated the market in 2023, with a 35.2% share.

- Wheat whiskey held a dominant market position in 2023, with a 48.6% share.

- On-trade distribution channels held a dominant market position in 2023, with a 55.2% share, followed by Off-Trade channels, particularly supermarkets and hypermarkets.

- North America is dominating the Whiskey Market with a 36.1% share, with USD 9.1 Billion in 2023.

Whiskey Statistics

- If we consider the total amount of money that households spend on alcoholic beverages, just over half is spent on beer and 21% on spirits

- Northern Cape households, on the other hand, don’t seem to have the taste for a little Scotch, devoting only 8% of their alcoholic spending to spirits.

- The average price of a 750ml bottle of whiskey in February 2017 was recorded as R1733.

- Number of single cask whiskies we released in 2022: 16, plus our first 2 private casks

- Revenue, out-of-home (e.g., revenue generated in restaurants and bars) amounts to US$0.5bn in 2024.

- Revenue, combined amounts to US$18.2bn in 2024.

- The revenue, at home is expected to grow annually by 6.42% (CAGR 2024-2028).

- In global comparison, most revenue, at home is generated in India (US$17,700m in 2024).

- About total population figures, the average revenue per capita, at home of US$12.28 is generated in 2024.

- In the Whisky market, volume, at home is expected to amount to 3.3bn L by 2024.

- Volume, out-of-home is expected to amount to 57.7 mL in 2024.

- Volume, combined is expected to amount to 3.4bn L in 2024.

- The Whisky market is expected to show a volume growth, at home of 2.7% in 2025.

- The average volume per person, at home in the Whisky market is expected to amount to 2.30L in 2024.

- Revenue, at home (e.g., revenue generated in supermarkets and convenience stores) in the Whisky market amounts to US$17.7bn in 2024.

- Currently, 243,206 whiskies are cataloged, with over 2,000 whiskies added every month.

- More than 2.1 million secondary market price observations with over 25,000 added each month.

- Retail prices from more than 2,974 retailers worldwide.

Emerging Trends

Emerging trends in the whiskey market reveal significant shifts in consumer preferences and product innovation. One notable trend is the growing interest in alternative Mexican spirits, like sotol, which is gaining popularity due to its unique flavors and cultural heritage. This movement is supported by influential figures like Lenny Kravitz, who has recently partnered with Casa Lumbre to launch a sotol brand, highlighting the potential for lesser-known spirits to make a mark on the global stage.

Additionally, the whiskey industry is exploring new flavor avenues to adapt to environmental concerns and diversify its offerings. For instance, with peat becoming a less sustainable option, whiskey makers are turning to ancient methods like kilning barley with botanicals or using different wood smokes to introduce new flavors. This not only preserves the traditional essence of whiskey but also caters to the modern palate seeking distinct tastes.

Moreover, there’s a noticeable trend towards premiumization, where consumers are increasingly drawn to high-end, quality products. This is particularly evident in regions like North America, where an affinity for luxury and quality drives a strong preference for premium whiskey brands. The trend is not just limited to traditional markets but is also pronounced in Asia Pacific, where economic growth has fueled spending on luxury spirits.

These trends highlight a dynamic period in the whiskey market, with brands innovating and expanding their portfolios to meet the sophisticated tastes of a global audience while embracing sustainable and diverse production methods.

Use Cases

- Culinary Delights: Whiskey can be a game-changer in the kitchen. It is often used in desserts, like the no-bake Kentucky bourbon balls, which mix bourbon with nuts and chocolate for a rich treat. Additionally, whiskey can transform simple dishes into gourmet experiences; for instance, adding it to the glaze for carrots or using it in barbecue sauces can introduce a complex flavor profile that enhances the dish.

- Beverage Enhancements: Beyond its role in classic cocktails, whiskey can be included in innovative drink recipes. It’s used in unique creations like boozy pickles and complex whiskey-infused sauces that can serve as both a flavor enhancer and a key ingredient in crafting sophisticated cocktails.

- Tourism and Culture: Distilleries often double as tourist attractions, offering tours and tastings that educate visitors on the whiskey-making process and its cultural significance. For example, the old Jameson Distillery in Dublin has been transformed into a museum and visitor center, which plays a significant role in promoting whiskey tourism.

Key Players Analysis

Asahi Group Holdings Ltd. does not appear to have direct involvement in the whiskey sector. Their core business focuses primarily on beverages such as beer and soft drinks, as well as on health and food products. Asahi’s involvement in the alcoholic beverage sector primarily revolves around beer and related products, rather than whiskey.

Diageo Plc, on the other hand, is a major player in the global whiskey market. The company boasts an extensive portfolio of whiskey brands including Johnnie Walker, Crown Royal, and Buchanan’s among others. Diageo is actively expanding its presence in the whiskey market through strategic investments and innovations. Notably, Diageo has invested $75 million to build its first malt whiskey distillery in China, which is expected to enhance its production capabilities and tap into the growing Asian market. This move is part of Diageo’s broader strategy to cater to evolving consumer preferences and to capitalize on the significant market potential in China.

Kirin Holdings Company, Limited has been expanding its presence in the whiskey sector, particularly through its ownership of the renowned Four Roses Distillery in Kentucky, USA. Kirin’s focus on premium whiskey is evident in its commitment to maintaining the unique character and high quality of Four Roses’ products, which include single barrel and small batch bourbons. This strategic involvement in the whiskey market aligns with Kirin’s broader business goals to diversify and strengthen its global beverage portfolio, enhancing its standing in the international spirits market.

Pernod Ricard SA is a powerhouse in the whiskey industry, holding a significant portfolio of prestigious whiskey brands such as Jameson, Chivas Regal, and The Glenlivet. The company has been actively expanding its whiskey offerings, most notably through acquisitions such as The Whisky Exchange, which bolsters its distribution capabilities and market reach. Pernod Ricard’s strategic investments and focus on premiumization reflect its commitment to capturing a larger share of the global whiskey market, driven by a strong emphasis on quality and heritage in its brand development.

Constellation Brands Inc. has strategically positioned itself in the whiskey market through its acquisition of High West Distillery, a craft distillery known for its premium and innovative whiskeys. This move reflects Constellation’s commitment to expanding its portfolio in the high-end spirits segment. High West Distillery continues to operate with a strong emphasis on craftsmanship and innovation, producing a variety of distinctive blends and single malt whiskeys that cater to a growing audience of whiskey enthusiasts looking for unique tasting experiences.

Bacardi Ltd, traditionally known for its rum, has been making significant strides in the whiskey sector as well. Most notably, Bacardi expanded its whiskey portfolio through the acquisition of Angel’s Envy, marking its entry into the bourbon and American whiskey market. This acquisition aligns with Bacardi’s strategy to diversify its offerings and strengthen its presence in North America. Bacardi’s involvement in whiskey exemplifies its adaptation to market trends and consumer preferences, leveraging its extensive experience in spirits to nurture and grow its whiskey brands.

Brown–Forman Corporation is a major player in the whiskey sector, particularly renowned for owning Jack Daniel’s, one of the best-selling whiskey brands globally. The company continues to expand its influence in the whiskey market, evidenced by its significant investment in the expansion of its facilities and product lines. Brown–Forman’s commitment to innovation and quality has also led to the introduction of various new flavors and limited editions under its whiskey brands, ensuring it remains a key competitor in the global spirits industry.

Beam Suntory Inc. is another heavyweight in the whiskey industry, owning a broad portfolio of iconic brands, including Jim Beam, Maker’s Mark, and Yamazaki. Beam Suntory is committed to leadership in premium spirits and has been actively expanding its global presence through strategic investments and marketing initiatives. The company’s focus on craftsmanship, innovation, and premiumization has helped it capture significant market share and cater to a growing base of discerning consumers looking for high-quality and unique whiskey experiences.

Sazerac Company, Inc. has made significant strides in the whiskey sector, underscored by a series of strategic expansions and acquisitions. Notably, Sazerac has invested $600 million to enhance its operations in Kentucky, which includes constructing new barrel storage warehouses and expanding its barrel cooperage capabilities. This investment is part of Sazerac’s broader effort to bolster its production capacity and support the growth of Kentucky’s signature bourbon industry. Additionally, the company has a rich portfolio of whiskey brands including well-known names like Buffalo Trace and Pappy Van Winkle, showcasing its substantial presence in the whiskey market.

Radico Khaitan Ltd. is another prominent player in the whiskey sector, known for its flagship brand, Rampur Indian Single Malt Whisky. Radico Khaitan has leveraged its extensive experience in distilling to develop and market high-quality whiskey products tailored to both domestic and international markets. The company’s focus on expanding its premium whiskey offerings is aimed at capturing a significant share of the growing global demand for refined spirits.

Tilaknagar Industries Ltd. has made notable strides in the whiskey sector by focusing on producing a variety of Indian-made foreign liquor (IMFL), including their flagship Mansion House Whisky. The company’s strategy revolves around enhancing their presence in the domestic market by improving distribution networks and launching new products that cater to the evolving tastes of Indian consumers. Their efforts to expand and refine their whiskey offerings aim to capitalize on the growing demand for quality spirits in India.

John Distilleries Private Limited has established a strong foothold in the whiskey market, particularly with its acclaimed Paul John Single Malts. Located in Bangalore, India, John Distilleries has gained international recognition for producing high-quality single malt whiskeys that embody the rich flavors and traditions of Indian whiskey-making. Their commitment to excellence and innovation in distillation and aging processes has allowed them to capture a significant share of both domestic and international whiskey markets.

Alexandrion Group has been expanding its influence in the whiskey sector, particularly with its operations in Romania, and plans to establish a distillery in the United States. The group produces a range of spirits, including whiskey, which caters to both local and international markets. Their commitment to craftsmanship and quality, coupled with strategic marketing and distribution efforts, positions Alexandrion as a growing force in the global spirits industry, particularly in whiskey production.

Highwood Distillers is renowned for producing a variety of high-quality Canadian whiskies, such as their notable brands Highwood Canadian Rye Whisky and Century Reserve. Located in Alberta, Canada, Highwood takes pride in using local ingredients, including Canadian rye and wheat, which are key to their distinct whiskey profiles. The distillery’s dedication to traditional craft methods and local sourcing contributes significantly to its reputation in the whiskey market, appealing to both domestic and international whiskey enthusiasts.

Boone County Distilling Company LLC has made significant strides in the whiskey sector by focusing on small-batch and single-barrel whiskey production. Located in Kentucky, Boone County Distilling embraces its rich local heritage by producing whiskeys that reflect the history and spirit of the Boone County area. Their products are known for their quality and craft, appealing to enthusiasts who appreciate traditional methods and story-driven brands. This approach has helped Boone County Distilling carve out a niche in the crowded whiskey market, emphasizing artisanal techniques and a deep connection to local history.

Willett Distilling, also known as Kentucky Bourbon Distillers, is a family-owned and operated distillery with a rich tradition in whiskey production. Established in 1936, Willett is renowned for its high-quality bourbon and rye whiskies. The distillery has a strong reputation for producing a diverse range of spirits that cater to both connoisseurs and casual drinkers alike. Their dedication to craft and quality has positioned Willett as a key player in the whiskey industry, particularly in the production of premium small-batch and single-barrel whiskeys.

Michter’s Distillery stands out in the whiskey sector for its exceptional quality and rich history. Based in Louisville, Kentucky, Michter’s has achieved notable acclaim, recently being named the World’s Most Admired Whiskey. The distillery is renowned for its small batch and single barrel whiskeys, which include aged bourbons and ryes that have garnered a loyal following among whiskey enthusiasts. Michter’s commitment to small-batch production techniques ensures a focus on quality and craftsmanship, distinguishing its products in a competitive market.

Barrel House Distilling Co. is an integral part of the craft distillery movement, known for its small-scale, high-quality whiskey production. Located in Lexington, Kentucky, Barrel House prides itself on its hands-on approach to whiskey making, utilizing traditional methods and local ingredients. Their dedication to crafting unique spirits is evident in their diverse product line, which includes both classic and innovative whiskey styles, appealing to a broad spectrum of whiskey lovers looking for distinctive flavors and authentic distilling artistry.

Conclusion

In conclusion, the whiskey market is experiencing dynamic growth, fueled by an increasing appreciation for premium spirits and the expanding interest in unique, culturally rich whiskey offerings across the globe. The trend towards premiumization, innovative flavor explorations, and sustainable production practices are significantly shaping consumer preferences and market strategies. Additionally, the sector is benefiting from rising global demand, particularly in emerging markets where economic growth is enabling more consumers to indulge in luxury spirits. As the industry continues to evolve, the focus on quality, heritage, and sustainability is likely to remain key drivers, ensuring the continued popularity and growth of the whiskey market well into the future.