Table of Contents

Introduction

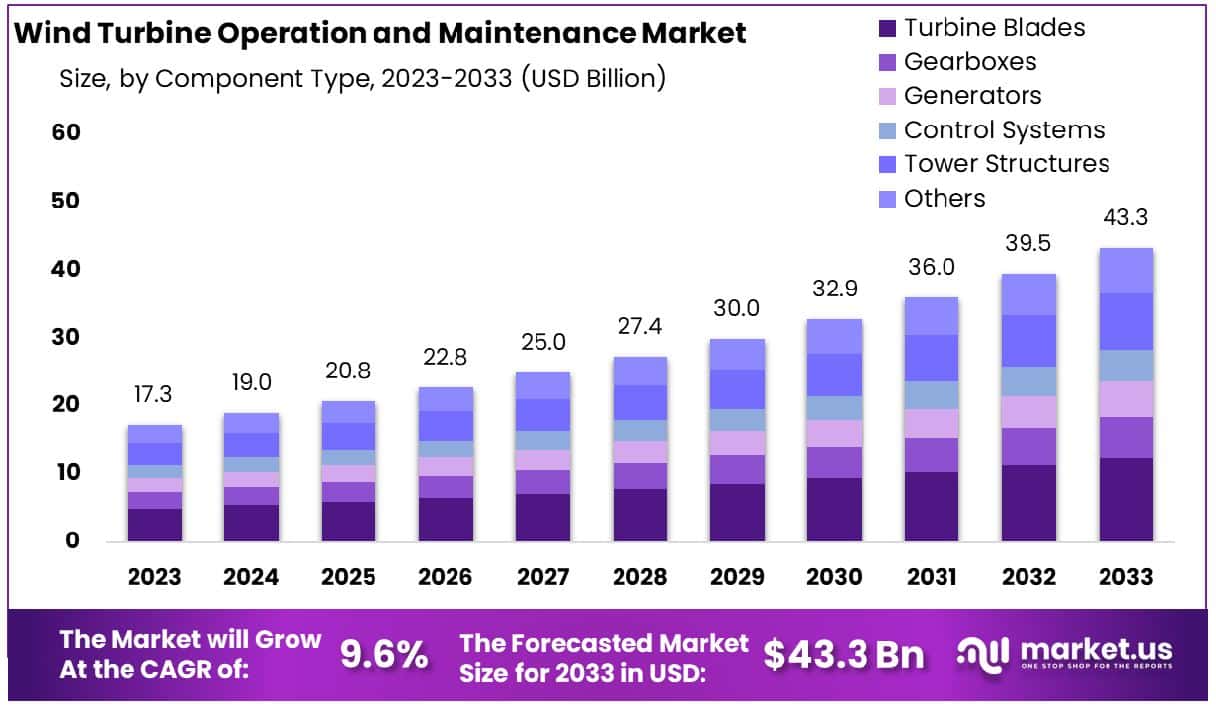

The Global Wind Turbine Operation and Maintenance Market is poised for substantial growth, expected to escalate from USD 17.3 billion in 2023 to around USD 43.3 billion by 2033, with a compound annual growth rate (CAGR) of 9.6% during the forecast period from 2024 to 2033. This market expansion is primarily fueled by increasing installations and technological advancements in wind turbines, alongside a rising focus on sustainable energy solutions.

Key growth drivers include technological innovations such as improved turbine blade designs and predictive maintenance technologies, which enhance operational efficiency and extend the lifespans of wind turbines. These advancements reduce the frequency of maintenance, although they also demand specialized skills due to the increased complexity of the systems.

However, the market faces challenges such as high initial investment costs for wind turbine installation and ongoing maintenance expenses, which can be substantial. These costs often act as barriers to entry and may slow down the rate of new installations, especially in regions lacking significant government support for renewable energy.

Vestas Wind Systems A/S continues to strengthen its market presence globally. In recent years, Vestas has achieved a substantial volume of commissioned projects across the Americas, Europe, and the Asia-Pacific regions. Notably, Vestas secured significant orders in Argentina and Sweden, including the supply and installation of turbines for the Mataco III and Vivoratá projects, and the Marhult wind project, respectively. These projects also include long-term service agreements, underscoring Vestas’ commitment to comprehensive after-sales service.

Siemens Gamesa Renewable Energy has made significant strides in the offshore wind sector. The company recently secured a large order to supply 95 of its largest offshore wind turbines for the UK East Anglia 3 wind power project. This project is significant as it marks the first deployment of Siemens Gamesa’s SG 14-236 DD turbines in UK waters, highlighting its commitment to leading in both technology and capacity in the offshore wind sector.

Nordex SE has also experienced robust growth, doubling its installations from the previous year. The company’s strategic efforts are exemplified by its substantial market share gains, particularly in competitive regions, indicating effective market penetration and operational expansion.

Key Takeaways

- Market Growth: The Global Wind Turbine Operation and Maintenance Market size is expected to be worth around USD 43.3 Billion by 2033, From USD 17.3 Billion by 2023, growing at a CAGR of 9.6% during the forecast period from 2024 to 2033.

- Asia Pacific leads with 41.5% of the wind turbine maintenance market, USD 7.1 billion.

- By Component Type: Turbine Blade component holds 28.6% of the market share.

- By service Type: Routine Maintenance services dominate with 40.6% market participation.

- By Application: Onshore application leads significantly, comprising 75.6% of the market.

Wind Turbine Operation and Maintenance Market Statistics

- Non-fossil fuel power sources, such as wind and solar power, account for 50.9% of the country’s total installed capacity, marking the early completion of a government target proposed in 2021.

- Coal accounted for 56.2% of total energy consumption last year, versus 25.9% from renewables which includes nuclear energy.

- The U.S. offshore wind energy project development and operational pipeline has a potential generating capacity of 52,687 MW, a 15% increase since last year.

- The amount of land-based wind capacity installed in the United States by the end of 2022 was 144,173 MW, including 8,511 MW added across 14 states in 2022.

- The amount of distributed wind capacity installed in the United States from 2003 to 2022 was 1,104 MW, including 29.5 MW added across 13 states in 2022.

- $2.7 billion was invested in the domestic offshore wind industry to develop ports, vessels, supply chains, and transmission in 2022.

- The domestic land-based wind energy industry employs 125,580 full-time workers after the number of jobs increased by 4.5% in 2022.

- $84 million was invested in new U.S. distributed wind projects in 2022, a $43 million increase from 2021.

- 13 states have policies that collectively support 112,286 MW of offshore wind by 2050.

- 12 states got more than 20% of their electricity supply from land-based wind energy in 2022.

- 90,000 turbines are installed in distributed wind applications in all 50 states as of 2022.

- The GADS Wind Turbine Generation Data Reporting Instructions v1.1 document from NERC.

- A company collecting and storing data from over 1000 gas turbines every minute.

- Wind turbines have an overall efficiency of 75% to 80% of the Betz limit of power extractable from the wind, at rated operating speed.

- Analysis of 3128 wind turbines older than 10 years in Denmark showed that half of the turbines had no decrease in efficiency, while the other half saw a production decrease of 1.2% per year.

Emerging Trends

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are being increasingly utilized to enhance the efficiency and reliability of wind turbines. These technologies enable predictive maintenance, which can anticipate failures and optimize maintenance schedules, thus reducing downtime and extending the lifespan of the turbines. AI algorithms also help in adjusting turbine operations based on real-time data, such as wind speed and direction, to maximize energy production.

- Digital Twins: The use of digital twins is growing in the wind energy sector. These virtual models simulate the real-world conditions of a wind turbine or an entire wind farm, allowing for better analysis and decision-making. By mirroring the physical world, digital twins help in monitoring systems and predicting outcomes based on various scenarios, which is crucial for effective maintenance and operations.

- Robotics and Automation: Robotics and automated systems are being deployed to improve the safety and efficiency of wind turbine maintenance. Drones and robotic crawlers, for example, are used for inspecting turbine blades and towers, eliminating the need for human technicians to perform dangerous tasks. These technologies improve safety and significantly reduce the time and cost associated with routine inspections.

- Advanced Materials and 3D Printing: There’s a growing trend toward using advanced materials and 3D printing technologies to manufacture turbine parts. These methods can lead to lighter, more durable turbine components and simplify the supply chain by enabling on-site manufacturing and reducing transportation costs and lead times.

- Sustainability Practices: As the environmental impact of manufacturing and waste becomes a greater concern, closed-loop recycling, and sustainability practices are becoming more prevalent. This approach ensures that turbine materials are reused at the end of their lifecycle, reducing waste and the need for new raw materials.

- Offshore Wind Developments: There’s an increasing focus on offshore wind farms, which, while more challenging and costly to maintain than onshore counterparts, offer higher energy yields. The maintenance strategies for these installations are therefore more complex and technologically advanced, often requiring specialized ships and equipment.

Use Cases

- Predictive Maintenance with AI: Artificial intelligence (AI) is increasingly being applied to wind turbine data to enhance maintenance practices. AI tools like Ensemble Energy’s Energy.ML platforms use advanced machine learning algorithms to predict and prevent failures. These systems continuously monitor turbine operations, identifying anomalies and potential failures before they occur, which helps in reducing downtime and maintenance costs.

- Remote Monitoring and IoT: Technologies like the Internet of Things (IoT) and protocols such as LoRaWAN are revolutionizing how wind turbines are monitored and maintained, especially in remote or offshore settings. LoRaWAN, for example, enables long-range communication over distances of more than 30 kilometers, allowing for frequent updates and extended service life without maintenance. This technology supports the operation of sensors for up to 10 years, facilitating continuous monitoring without the need for regular physical checks.

- Construction and Site Optimization with AI: AI is also transforming the way wind farms are constructed and optimized. AI-driven tools can analyze installation logistics to reduce expenses significantly. For instance, GE reported a 10% reduction in installation costs, translating to substantial global savings over time. Additionally, AI aids in site selection, environmental analysis, and the generative design of wind farms, optimizing turbine layout and construction plans even before the actual building starts.

- Ultra-Short-Term Power Prediction: Advanced algorithms are designed to enhance the short-term prediction of power output from wind turbines. These predictions are crucial for operational planning and risk management, especially in integrating wind power within the broader energy grid.

- Structural Health Monitoring and Repairs: Regular inspections are critical for maintaining the structural integrity and performance of wind turbines. These include detailed checks of turbine blades, towers, and other components to identify any signs of damage such as cracks, erosion, or structural weaknesses. Effective maintenance practices also involve predictive analyses to schedule repairs before failures occur, thus ensuring reliability and safety.

- Optimizing Wind Power Forecasting and Scheduling: AI tools are also utilized for improving the forecasting of wind power generation. This enables more accurate energy dispatch, which is crucial for balancing supply and demand in the power grid. Enhanced forecasting models help in minimizing the costs associated with energy production and reduce the risks of power blackouts.

Key Players Analysis

Vestas Wind Systems A/S made significant strides in the wind turbine operation and maintenance sector by securing a 1,089 MW order for the SunZia Wind project in New Mexico, marking it as the largest single onshore project globally. This order includes the supply, delivery, and commissioning of turbines along with a multi-year service agreement, underlining Vestas’ commitment to optimizing turbine performance and advancing sustainable energy solutions.

Siemens Gamesa Renewable Energy continues to play a pivotal role in the wind turbine operation and maintenance sector. One of their notable projects from 2023 involved supplying flagship turbines for the world’s second-largest offshore wind power plant, East Anglia 3 in the UK. This project plans to deliver clean energy to 1.3 million UK homes, demonstrating Siemens Gamesa’s significant impact on enhancing sustainable energy infrastructures globally.

GE Renewable Energy has significantly enhanced its operation and maintenance strategies by integrating Artificial Intelligence (AI) and Machine Learning (ML) to optimize wind turbine logistics and reduce installation costs. This innovation aims to lower logistics expenses by up to 10%, potentially saving the global wind industry billions annually by 2030. GE’s proactive use of digital twins in this process underscores its commitment to increasing efficiency and reducing the environmental footprint of wind turbine operations.

Nordex SE continues to strengthen its position in the wind turbine operation and maintenance sector. In 2023, the company focused on expanding its service offerings, particularly through major projects like the supply of turbines for the Otada wind farm in Lithuania. This project is part of Nordex’s ongoing efforts to enhance energy production capabilities and maintain high standards of turbine efficiency and reliability, supporting sustainable energy transitions in key markets.

Enercon GmbH stands as a prominent entity in the wind turbine operation and maintenance sector. They offer comprehensive service contracts that ensure operational efficiency over the turbine’s lifecycle. Notably, their innovative E-175 EP5 model is designed for optimal integration into wind farms, characterized by its efficient, permanent magnet generator and the longest rotor blade developed by Enercon, measuring 86 meters. This turbine also boasts a service life of 25 years, underscoring Enercon’s commitment to long-term sustainability and efficiency in renewable energy technologies.

Suzlon Energy Limited, a leader in the wind energy sector, provides robust Operations and Maintenance Services (OMS) aimed at maximizing turbine efficiency throughout their lifecycle. Suzlon’s OMS team oversees a vast fleet of over 10,080 wind turbines globally, employing best practices adapted to function optimally in diverse climatic conditions, ranging from intense heat to extreme cold. The company emphasizes sustainable and reliable performance, focusing on both proactive and reactive maintenance to enhance the profitability and longevity of its wind turbines. With a commitment to innovative solutions, Suzlon also incorporates high-end digitization and drone technology for efficient turbine inspection, ensuring a comprehensive service offering that supports wind energy projects from inception through operation.

Envision Energy has established itself as a pioneer in the wind turbine operation and maintenance sector, particularly noted for its “smart wind turbines” tailored for low wind speed sites. These turbines, which form a significant part of China’s wind power strategy, leverage advanced sensor technology and digital innovations to enhance efficiency and performance. Envision’s operational reach extends to maintaining and optimizing wind farms with comprehensive life-cycle management, from planning and construction to operational oversight, emphasizing sustainable and cost-effective solutions.

Vattenfall AB is heavily engaged in the operation and maintenance of both onshore and offshore wind turbines, boasting a managed capacity of 5.4 GW across five countries. With a keen focus on innovation, Vattenfall utilizes digital twin technology to enhance the operation and maintenance of its wind turbines. This technology allows for real-time performance monitoring and life-extension of the turbines, optimizing maintenance schedules and reducing operational costs. Vattenfall is also expanding its renewable energy portfolio to include large-scale solar photovoltaics and battery storage solutions.

EDF Renewables is a leader in the wind turbine operation and maintenance sector, managing a substantial global portfolio. Their facilities, like the Fécamp Offshore Wind Farm in France, not only boost local employment with around 100 jobs but also contribute to meeting regional renewable energy targets. This farm will eventually supply nearly 770,000 people with low-carbon electricity, aligning with France’s goals for renewable energy. EDF Renewables employs advanced predictive maintenance techniques in partnership with ONYX InSight across North America, enhancing the reliability and efficiency of over 1,500 turbines. This approach reduces operational costs and improves asset availability, showcasing their commitment to innovation and sustainability.

EDP Renewables (EDPR) excels in the operation and maintenance of wind farms, with a robust presence across the globe. In the United States, EDPR has recently initiated operations at the 200 MW Harvest Ridge Wind Farm in Illinois and the 209 MW Reloj del Sol Wind Farm in Texas, showcasing its capacity to manage significant renewable projects efficiently. Additionally, EDPR has established a 20-year agreement to manage the 198 MW Carpenter Wind Farm in Indiana, which emphasizes its commitment to long-term renewable energy production and maintenance. This farm is expected to support over 53,000 homes annually.

Ørsted A/S, a leader in offshore wind energy, has significantly expanded its operations in 2023. With the installation of the Hornsea 2 and Greater Changhua 1 and 2a projects, the company’s earnings from offshore sites more than doubled, reaching DKK 20.2 billion. Despite facing challenges, including financial impacts from the cessation of the Ocean Wind 1 project, Ørsted has managed to maintain a strong operational performance. The company continues to innovate in wind turbine technology and installation, contributing to the lowering of offshore wind costs and enhancing energy efficiency.

Senvion S.A., previously a notable player in the wind turbine sector, faced significant challenges and entered insolvency, leading to the acquisition of its European service assets by Siemens Gamesa Renewable Energy. This strategic move in 2019 allowed Siemens Gamesa to add approximately 9 gigawatts of service contracts, enhancing its position in the multibrand service market, particularly across Europe. The acquisition underscores the competitive nature and the high stakes in the wind turbine operation and maintenance sector.

NextEra Energy Resources has been actively expanding its wind turbine operation and maintenance services, focusing on the strategic repowering of existing wind facilities. By 2026, the company plans to enhance 740 megawatts of wind capacity, showcasing a robust commitment to optimizing its renewable energy assets and reinforcing its market-leading position in clean energy production.

ACCIONA Energía excels in the wind energy sector by handling the entire value chain from development and construction to operation and maintenance. With operations spanning across five continents, the company’s wind farms generate approximately 80% of its renewable energy output. ACCIONA Energía has a significant capacity, managing over 9,000 megawatts of wind power that contributes to sustainable energy solutions globally.

Innogy SE, through its partial ownership of Nordsee One, plays a significant role in the operation and maintenance of offshore wind farms. The Nordsee One offshore wind farm, located in the North Sea, has a capacity of 332 megawatts and supplies green electricity to approximately 400,000 households. Innogy SE, holding a 15% stake, alongside Northland Power, ensures the smooth functioning of this large-scale project, which highlights its capabilities in the wind energy sector and contributes to renewable energy production.

Conclusion

The Wind Turbine Operation and Maintenance (O&M) market is crucial for ensuring the efficient and sustainable operation of wind energy systems globally. Innovations in artificial intelligence, predictive maintenance, and advanced monitoring technologies are revolutionizing the sector, enhancing the ability to predict failures, reduce downtime, and extend the life of turbines. As turbines become more technologically advanced, the industry’s focus is shifting towards more sophisticated O&M strategies that prioritize data-driven decision-making and cost-efficiency.

The integration of these technologies not only boosts operational efficiency but also contributes to the broader goals of energy sustainability and reliability. Ultimately, as the wind energy sector continues to grow, the role of advanced O&M practices will become increasingly important in optimizing energy production and ensuring the long-term viability of wind projects.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)