Table of Contents

- Introduction

- Editor’s Choice

- History and Evolution of Wireless Charging

- Wireless Charging Market Overview

- Global Wireless Electric Vehicle Charging Market Size

- Power Bank Market Revenue Worldwide

- Wireless Charging Companies Statistics

- Wireless Charging Transmitter/Receiver Shipments Statistics

- Wireless Charging Patents Statistics

- Wireless Charging Wearable Tech Revenue Worldwide

- Statistics By Wireless Charging Price

- Power Banks with the Highest Battery Capacity Worldwide

- Key Determining Factors Among Consumers

- Spending on Research and Development (R&D)

- Initiatives in Wireless Charging Statistics

- Regulations for Wireless Charging

- Recent Developments

- Conclusion

- FAQs

Introduction

Wireless Charging Statistics: Wireless charging is a technology that uses electromagnetic induction to transfer energy between two coils—one in a charging pad and the other in a device—without cables.

The technology offers convenience, reduces wear on charging ports, and provides a safer charging experience.

However, it tends to be slower than wired charging, requires precise alignment between coils, and has limited range and efficiency.

Wireless charging is commonly used in consumer electronics like smartphones and smartwatches. But it is also being explored for electric vehicles and medical devices. Despite its limitations, advancements continue to enhance its capabilities and applications.

Editor’s Choice

- The global wireless charging market revenue reached USD 9.6 billion in 2023.

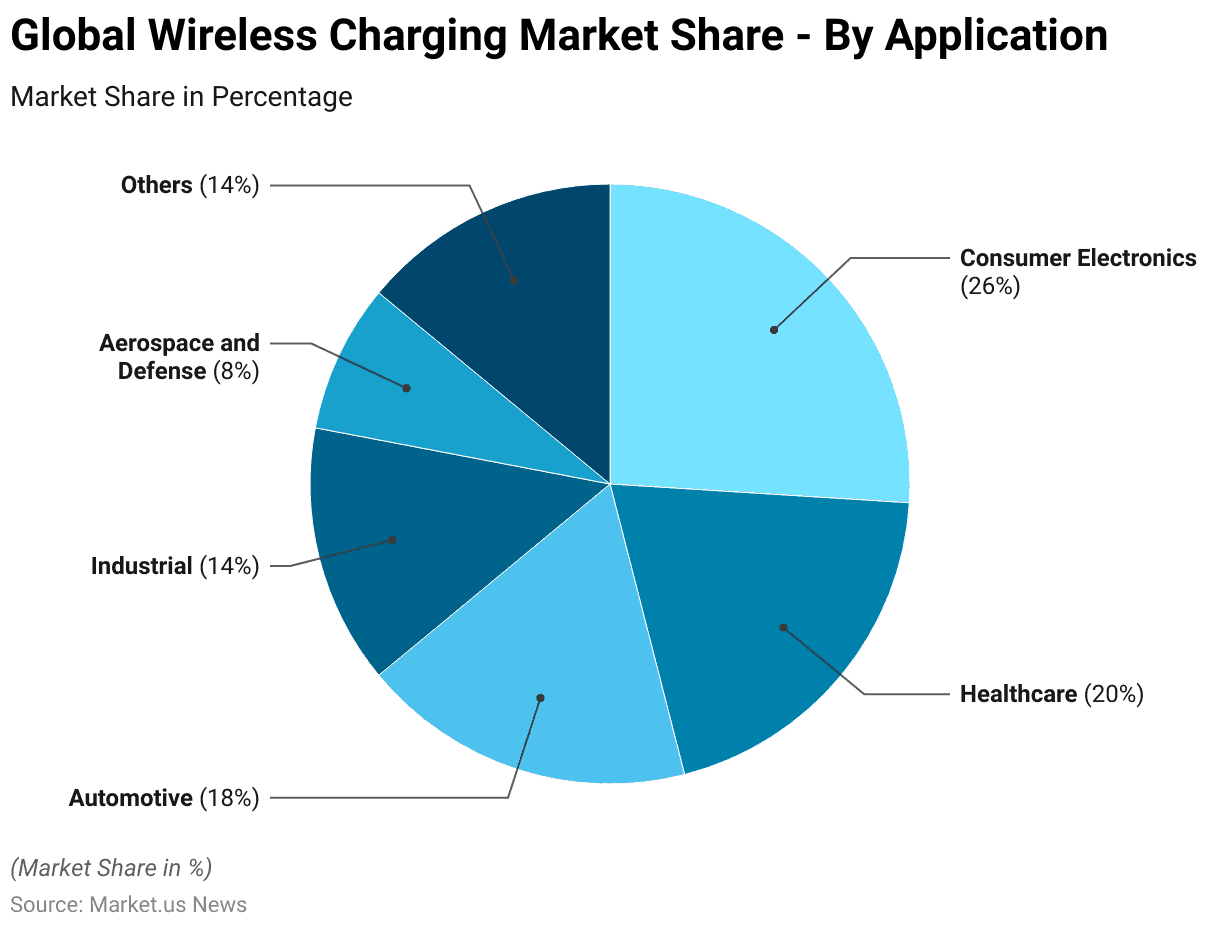

- The global wireless charging market is characterized by diverse application areas. With consumer electronics leading the market with a 26% share.

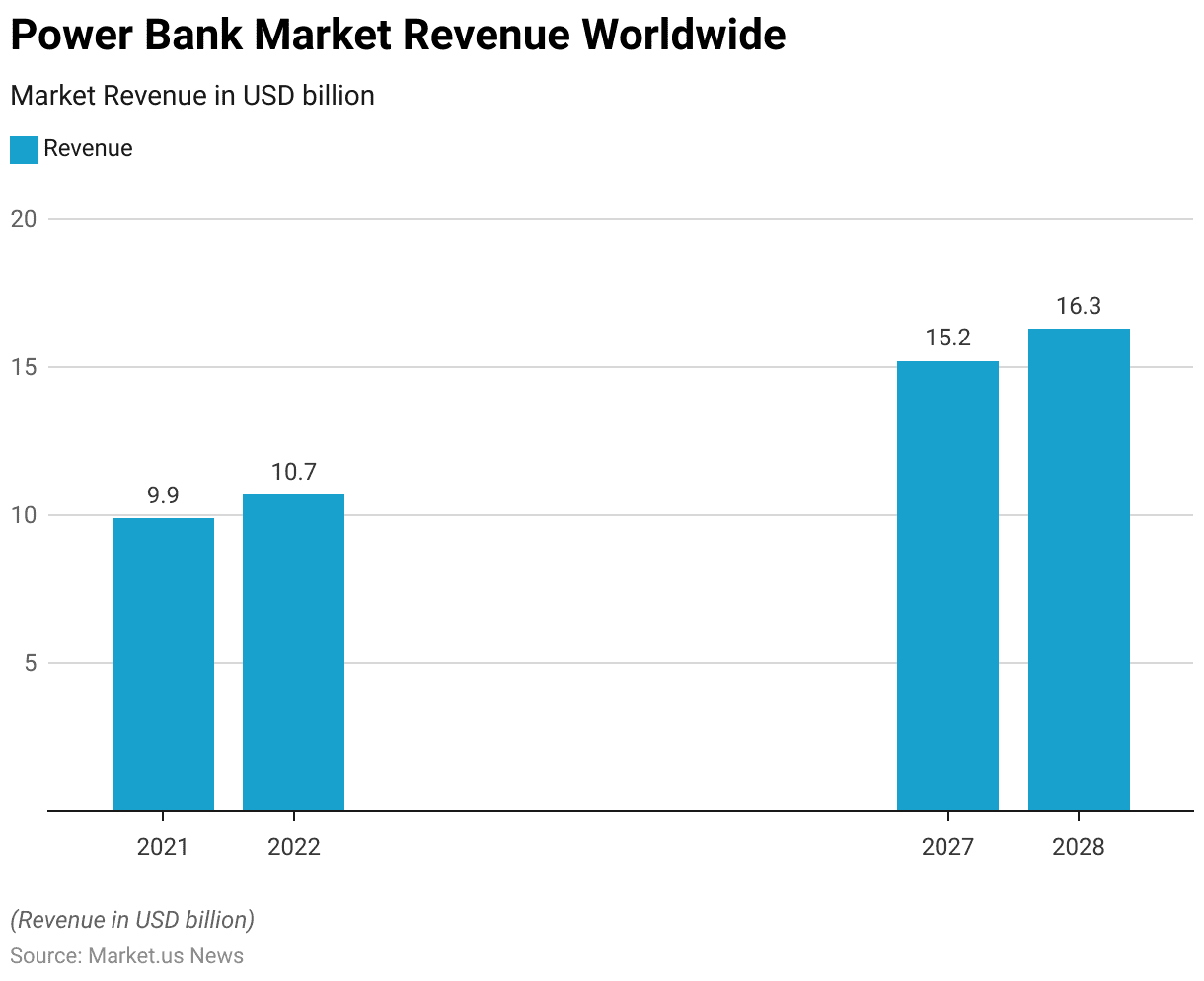

- The global power bank market revenue is projected to reach $16.3 billion by 2028.

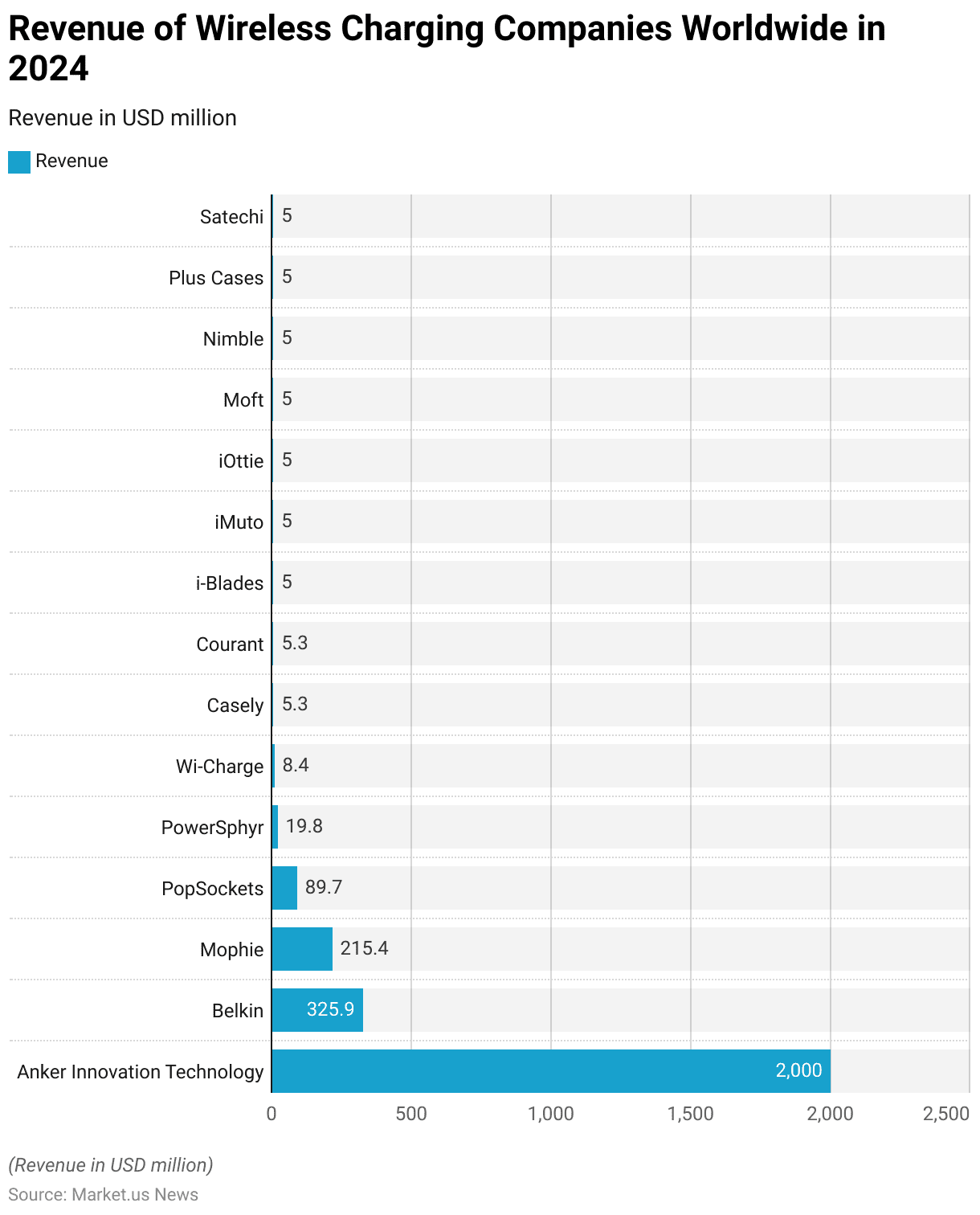

- As of October 2024, Anker Innovation Technology leads the wireless charging market in terms of revenue, generating $2,000 million.

- As of 2020, Koninklijke Philips N.V. (Netherlands) emerged as the leading company in the field of wireless charging Qi standard essential patents (SEPs), holding a total of 981 patents across 201 patent families.

- The U.S. Department of Transportation is setting up a dedicated grant program to fund wireless EV charging infrastructure. Which includes an allocation of $250 million for various projects like roads, parking lots, and bus routes.

- In China, the Provisional Regulations on Radio Management of Wireless Charging (Power Transmission) Equipment set forth specific technical requirements. Such as defined frequency bands and power limits for mobile and portable devices. As well as for electric vehicles, effective from September 2024.

History and Evolution of Wireless Charging

- The history of wireless charging, characterized by innovative progress, has its origins deeply rooted in the late 19th century with Nikola Tesla’s pioneering experiments in wireless power transmission.

- Tesla’s inventive work during the 1880s and 1890s laid the groundwork for what would eventually evolve into modern wireless charging technologies.

- Despite the early promise shown by Tesla’s experiments, which included the transmission of electrical power without physical connections. The commercial application of his discoveries remained unrealized for many decades.

- As technology advanced into the 21st century, wireless charging began to gain practical shape and widespread adoption. Spurred by advancements in inductive and magnetic resonance technologies. These methods, which allow for the transfer of energy via electromagnetic fields, became foundational for today’s wireless charging systems.

- The evolution continued with the formalization of standards like the Qi standard by the Wireless Power Consortium. Which further accelerated the adoption and integration of wireless charging into devices such as smartphones, wearables, and even automobiles

- In recent years, the technology has seen rapid advancements. Including fast wireless charging capabilities and the exploration of extended range and over-the-air charging solutions.

- These innovations signify a robust trajectory toward more integrated, efficient, and user-friendly wireless charging solutions. Promising a future where wireless power could become as ubiquitous and straightforward as Wi-Fi.

- As this technology continues to evolve, it is poised to transform how we manage power for a myriad of devices. Making wireless charging a critical component of modern electronic infrastructure.

(Sources: Nonstop Products, The Daily Dot, Wireless)

Wireless Charging Market Overview

Global Wireless Charging Market Size Statistics

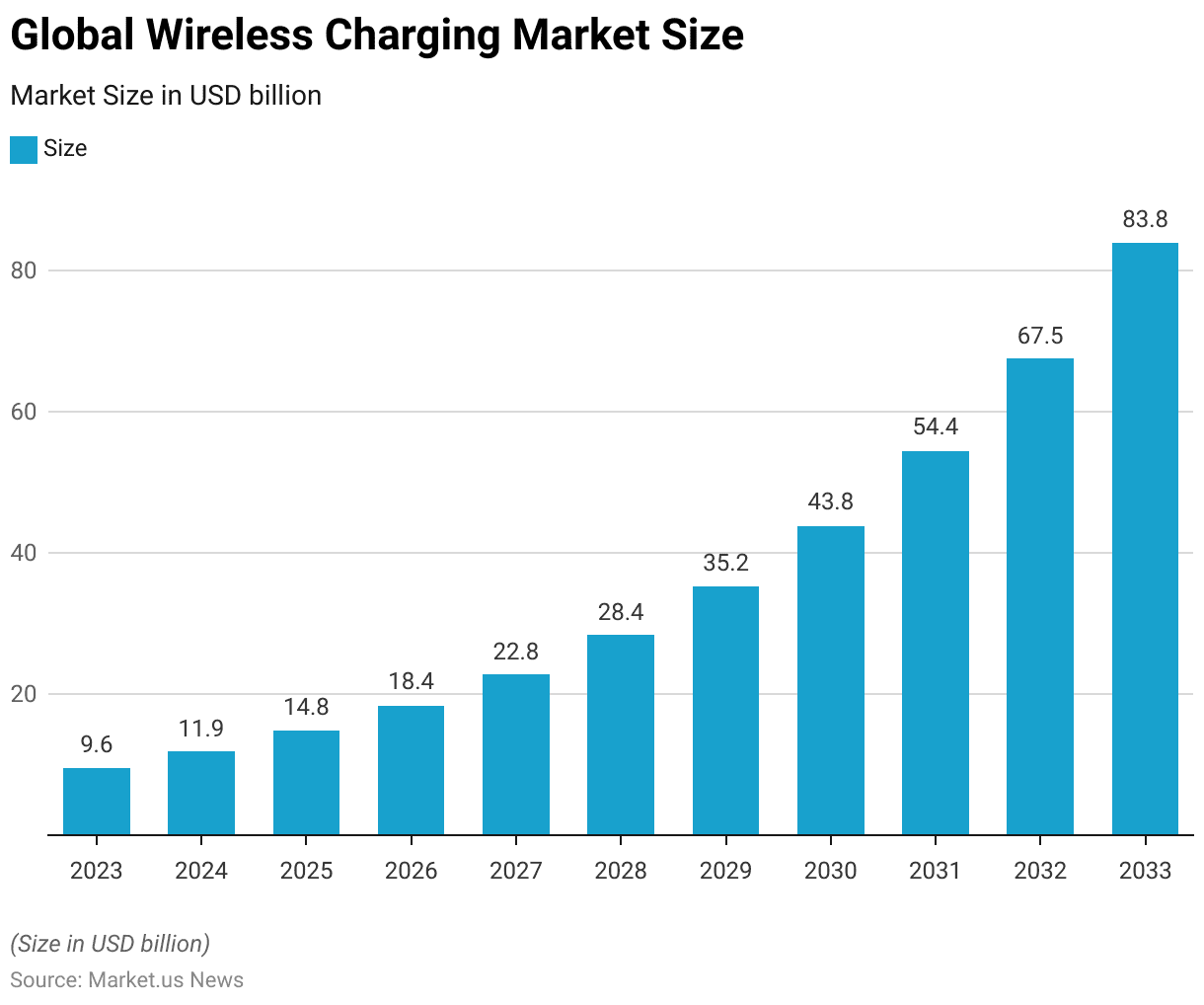

- The global wireless charging market is projected to experience substantial growth over the next decade at a CAGR of 24.2%. Expanding from a market size of USD 9.6 billion in 2023 to an impressive USD 83.8 billion by 2033.

- This trajectory reflects a consistent upward trend, with the market expected to reach USD 11.9 billion in 2024, USD 14.8 billion in 2025, and USD 18.4 billion in 2026.

- By 2027, the market size is anticipated to grow to USD 22.8 billion, followed by USD 28.4 billion in 2028.

- The growth accelerates further in subsequent years, with the market forecasted to hit USD 35.2 billion in 2029 and USD 43.8 billion in 2030.

- By 2031, the market is expected to reach USD 54.4 billion before expanding to USD 67.5 billion in 2032. Ultimately culminating in a significant valuation of USD 83.8 billion by 2033.

- This robust growth can be attributed to the increasing demand for efficient and convenient charging solutions across various consumer and industrial applications.

(Source: market.us)

Wireless Charging Market Share – By Implementation Statistics

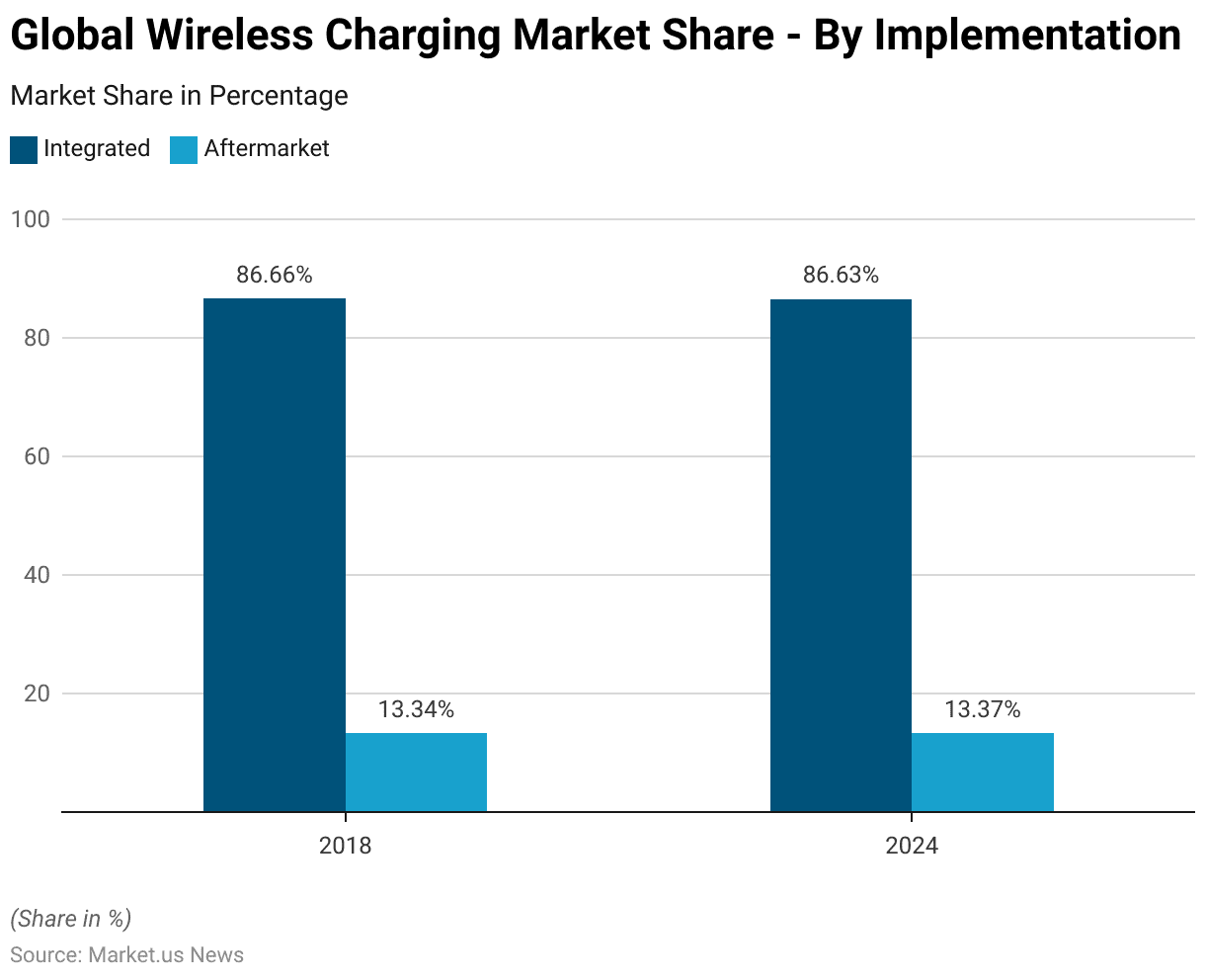

- The global wireless charging market, when segmented by implementation type, has been predominantly led by integrated solutions.

- In 2018, integrated implementations accounted for 86.66% of the market. Reflecting their widespread adoption across industries due to their seamless incorporation into devices and systems.

- This dominance is expected to persist, with integrated solutions maintaining a market share of 86.63% in 2024.

- Conversely, aftermarket solutions held a smaller share of 13.34% in 2018.

- However, this segment is projected to experience a slight increase, capturing 13.37% of the market by 2024. Indicating growing demand for retrofitting wireless charging capabilities in existing products and systems.

(Source: Statista)

Global Wireless Charging Market Size – By Technology Statistics

2023-2027

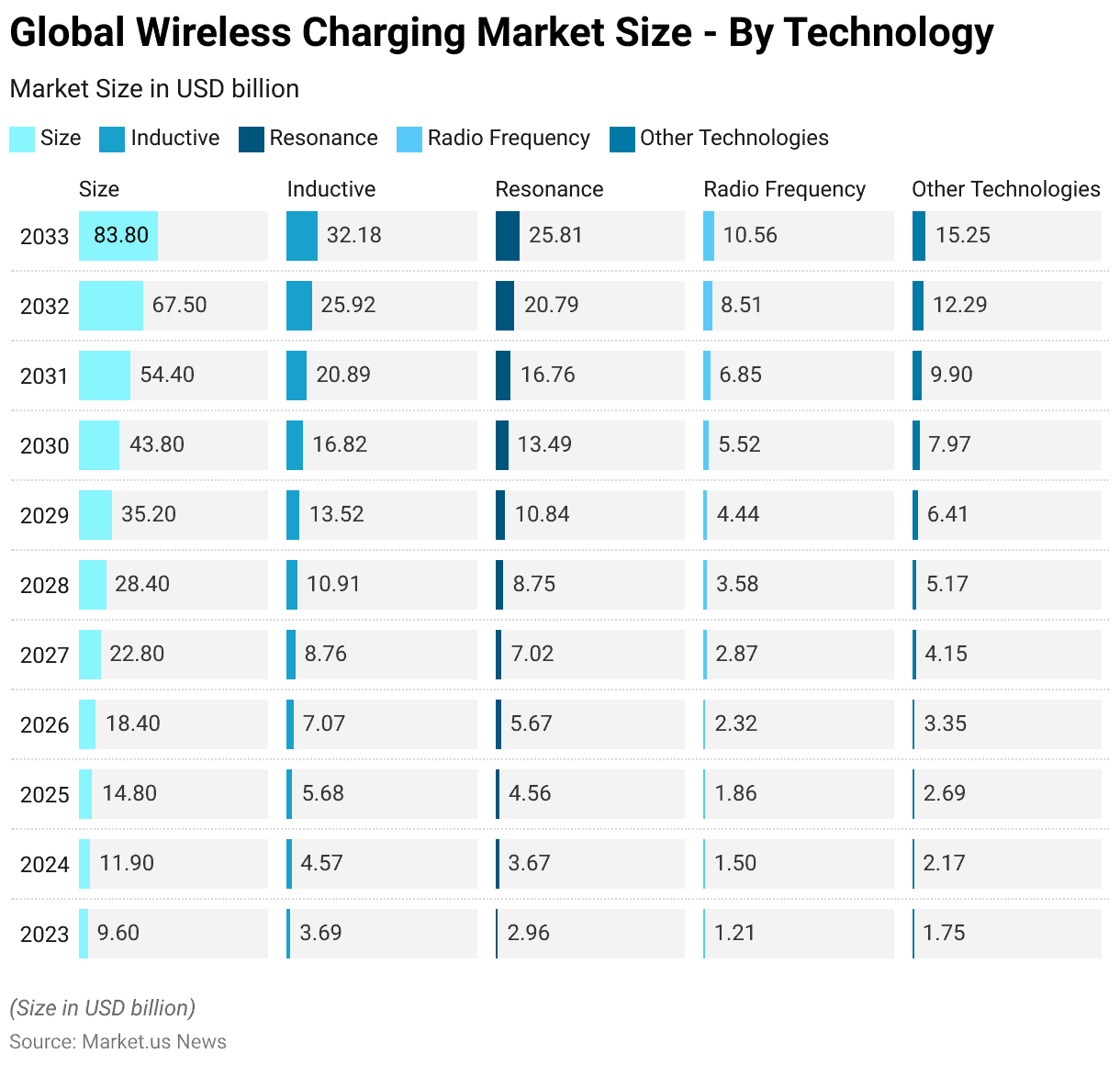

- The global wireless charging market is forecasted to grow significantly from $9.6 billion in 2023 to $83.8 billion by 2033. Driven by advancements across various technologies.

- In 2023, the market was led by the inductive technology segment, valued at $3.69 billion, followed by resonance at $2.96 billion, radio frequency at $1.21 billion, and other technologies at $1.75 billion.

- By 2024, these values are expected to rise to $4.57 billion, $3.67 billion, $1.50 billion, and $2.17 billion, respectively.

- The upward trend continues as inductive technology is projected to grow to $5.68 billion in 2025, $7.07 billion in 2026, and $8.76 billion in 2027, with similar growth patterns observed in other technology segments.

2028-2033

- By 2028, resonance technology is expected to reach $8.75 billion. Radiofrequency and other technologies are anticipated to hit $3.58 billion and $5.17 billion, respectively.

- The market’s rapid expansion is further evident in 2029 when inductive technology is projected to reach $13.52 billion, resonance $10.84 billion, radio frequency $4.44 billion, and other technologies $6.41 billion.

- By 2030, these values are expected to increase to $16.82 billion, $13.49 billion, $5.52 billion, and $7.97 billion, respectively.

- This growth accelerates in the subsequent years. With inductive technology reaching $20.89 billion in 2031, $25.92 billion in 2032, and $32.18 billion by 2033.

- Similarly, resonance technology is forecasted to hit $25.81 billion by 2033. Radiofrequency and other technologies are expected to grow to $10.56 billion and $15.25 billion, respectively.

- This growth trajectory highlights the increasing adoption and technological diversification within the wireless charging industry.

(Source: market.us)

Global Wireless Charging Market Share – By Application Statistics

- The global wireless charging market is characterized by diverse application areas. With consumer electronics leading the market with a 26% share.

- The healthcare sector follows, accounting for 20% of the market. Driven by the increasing adoption of wireless charging in medical devices.

- The automotive segment holds an 18% share. Reflecting the growing integration of wireless charging solutions in electric vehicles and in-car charging systems.

- Industrial applications represent 14% of the market, highlighting the use of wireless charging in manufacturing and logistics environments.

- Aerospace and defense contribute 8% of the market. Where wireless charging technology is increasingly utilized for efficient and safe power transfer in specialized equipment.

- The remaining 14% is attributed to other applications, underscoring the versatility of wireless charging across various sectors.

(Source: market.us)

Global Wireless Electric Vehicle Charging Market Size

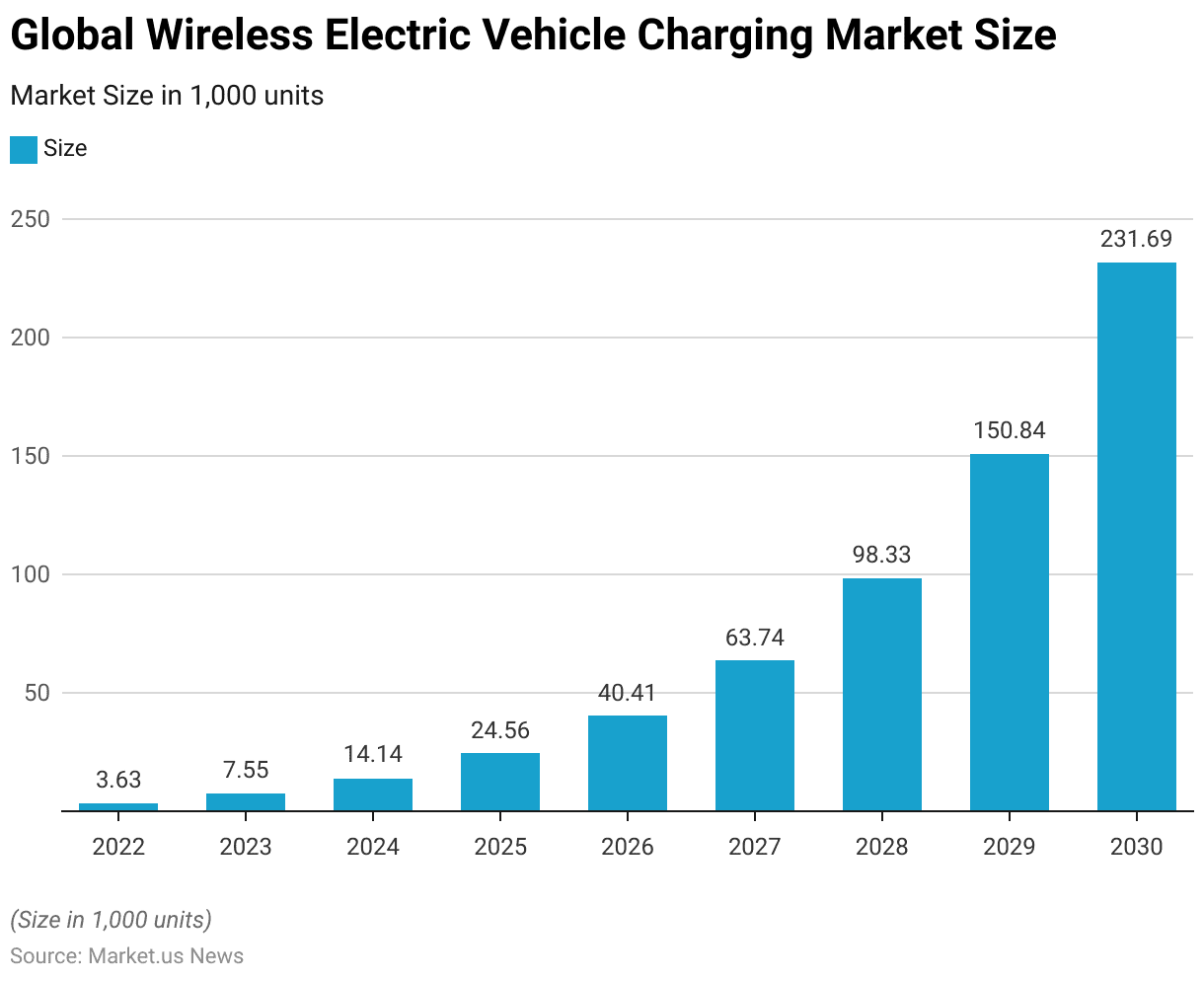

- The global wireless electric vehicle (EV) charging market is poised for significant growth over the coming years.

- In 2022, the market size stood at 3.63 thousand units, reflecting the nascent stage of adoption.

- This figure is expected to more than double by 2023, reaching 7.55 thousand units.

- The upward trend continues, with an estimated market size of 14.14 thousand units in 2024 and 24.56 thousand units by 2025.

- The growth rate is projected to accelerate, with 40.41 thousand units expected in 2026 and 63.74 thousand units in 2027.

- By 2028, the market is forecasted to reach 98.33 thousand units, surpassing the 100-thousand-unit mark.

- This growth trajectory is set to continue, with 150.84 thousand units anticipated in 2029. Culminating in a projected market size of 231.69 thousand units by 2030.

- This robust expansion underscores the increasing adoption of wireless charging technology as a convenient and efficient solution for electric vehicle charging.

(Source: Statista)

Power Bank Market Revenue Worldwide

- The global power bank market has shown steady growth, with revenue increasing from $9.9 billion in 2021 to $10.7 billion in 2022.

- This upward trajectory is expected to continue in the coming years, with projected revenues of $15.2 billion by 2027 and $16.3 billion by 2028.

- The consistent growth highlights the rising demand for portable charging solutions. Driven by the increasing reliance on mobile devices and advancements in battery technology.

(Source: Statista)

Wireless Charging Companies Statistics

Revenue of Wireless Charging Companies Worldwide Statistics

- As of October 2024, Anker Innovation Technology leads the wireless charging market in terms of revenue, generating $2,000 million.

- Following Anker, Belkin ranks second with $325.9 million, while Mophie secures the third position with $215.4 million.

- PopSockets holds a revenue of $89.7 million, positioning it as a notable player in the market.

- PowerSphyr and Wi-Charge, with revenues of $19.8 million and $8.4 million respectively, represent mid-tier companies.

- Several smaller companies, including Casely, Courant, i-Blades, iMuto, iOttie, Moft, Nimble, Plus Cases, and Satechi, each report revenues of $5 to $5.3 million. Highlighting their niche presence in the competitive landscape of the wireless charging industry.

(Source: Statista)

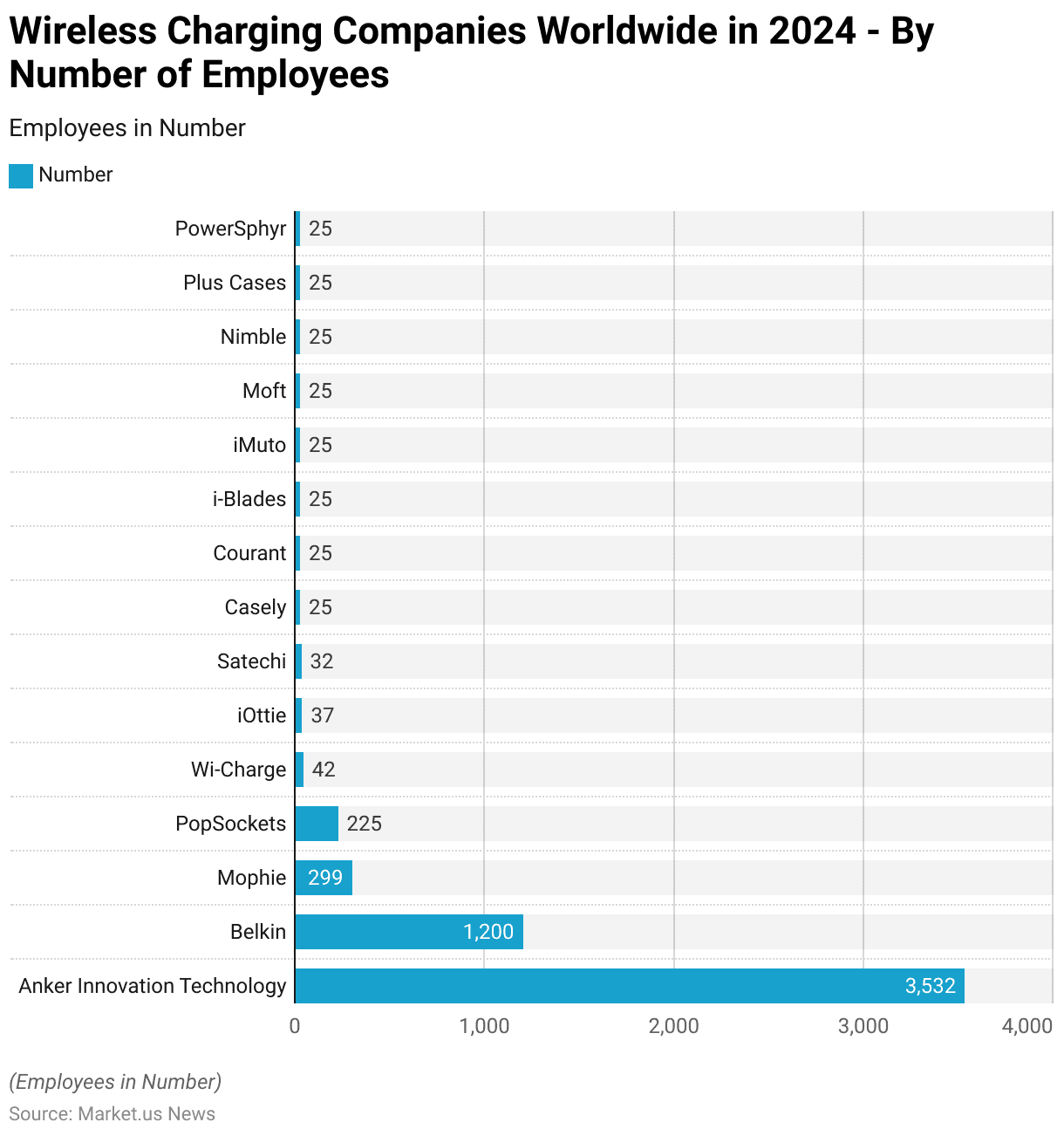

Wireless Charging Companies Worldwide – By Number of Employees Statistics

- As of September 2024, Anker Innovation Technology leads the wireless charging industry in terms of workforce size, employing 3,532 individuals.

- Belkin ranks second with 1,200 employees, followed by Mophie with 299 and PopSockets with 225.

- Wi-Charge has a significantly smaller workforce, employing 42 people, while iOttie and Satechi have 37 and 32 employees, respectively.

- Several companies, including Casely, Courant, i-Blades, iMuto, Moft, Nimble, Plus Cases, and PowerSphyr, operate with lean teams of 25 employees each.

- This distribution highlights the varying scales of operation within the industry, from large enterprises to smaller, specialized firms.

(Source: Statista)

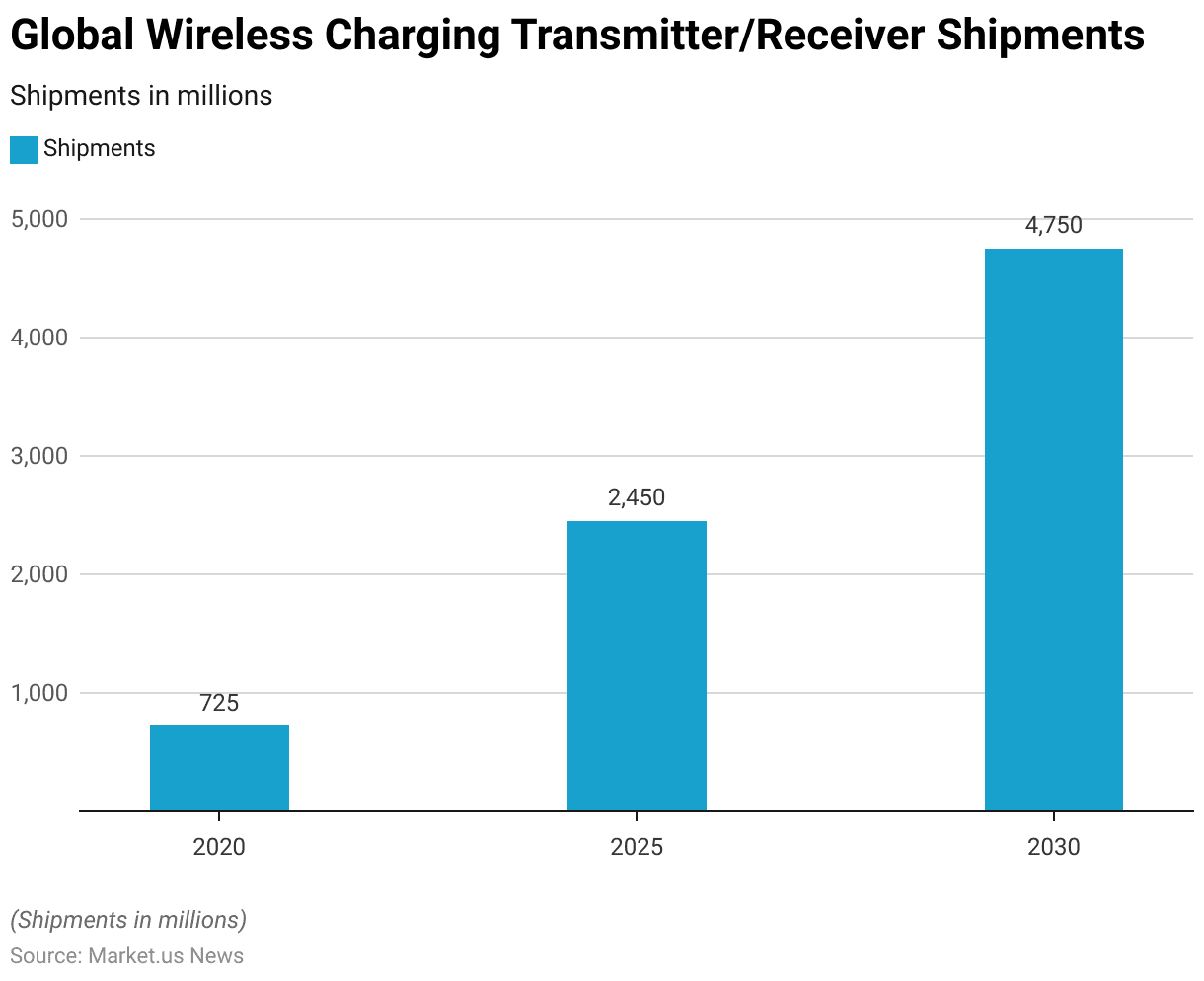

Wireless Charging Transmitter/Receiver Shipments Statistics

Global Wireless Charging Transmitter/Receiver Shipments Statistics

- Global shipments of wireless charging transmitters and receivers are expected to experience significant growth between 2020 and 2030.

- In 2020, unit shipments were recorded at 725 million.

- This figure is projected to rise sharply to 2,450 million units by 2025. Reflecting increased adoption across various devices and industries.

- By 2030, unit shipments are anticipated to reach 4,750 million. Highlighting the growing demand for wireless charging solutions driven by advancements in technology and the proliferation of wireless-enabled devices.

(Source: Statista)

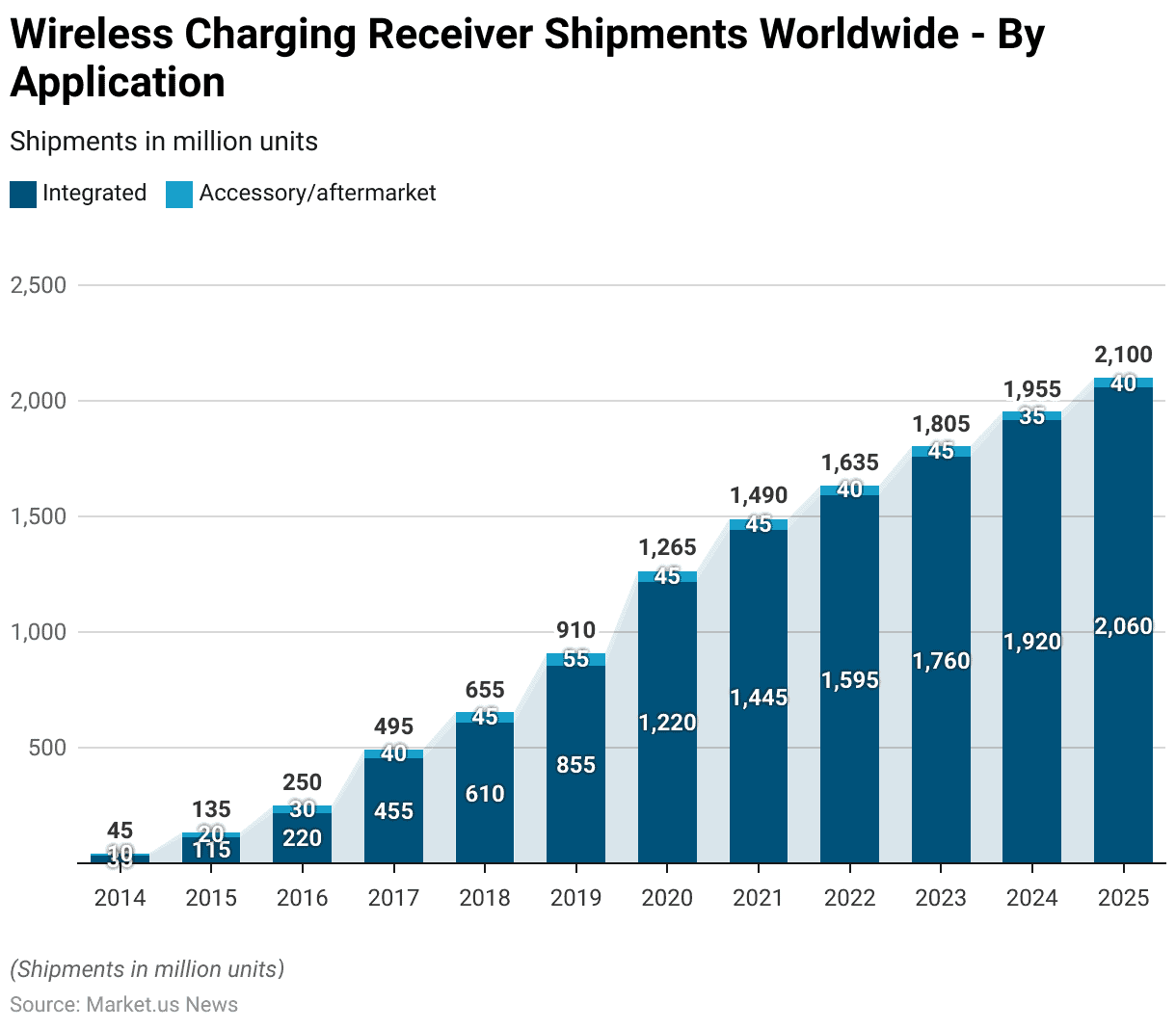

Wireless Charging Receiver Shipments Worldwide – By Application Statistics

- Global wireless charging receiver shipments have witnessed substantial growth across both integrated and accessory/aftermarket applications from 2014 to 2025.

- In 2014, integrated receiver shipments stood at 35 million units, with accessory shipments at 10 million units.

- By 2015, these figures had increased to 115 million and 20 million units, respectively.

- The upward trend continued, with integrated receivers reaching 220 million units and accessory receivers 30 million units in 2016.

- Between 2017 and 2019, integrated shipments surged from 455 million to 855 million units. While accessory shipments grew from 40 million to 55 million units.

- By 2020, integrated receivers had surpassed the billion mark, reaching 1,220 million units. Although accessory shipments slightly declined to 45 million units.

- This trend remained consistent in 2021 and 2022, with integrated receivers growing to 1,595 million units and accessory shipments fluctuating around 40–45 million units.

- Looking forward, integrated receivers are projected to continue their dominance. Reaching 2,060 million units by 2025, while accessory shipments are expected to stabilize around 40 million units.

- This data highlights the increasing integration of wireless charging technology directly into devices, reducing the need for aftermarket solutions.

(Source: Statista)

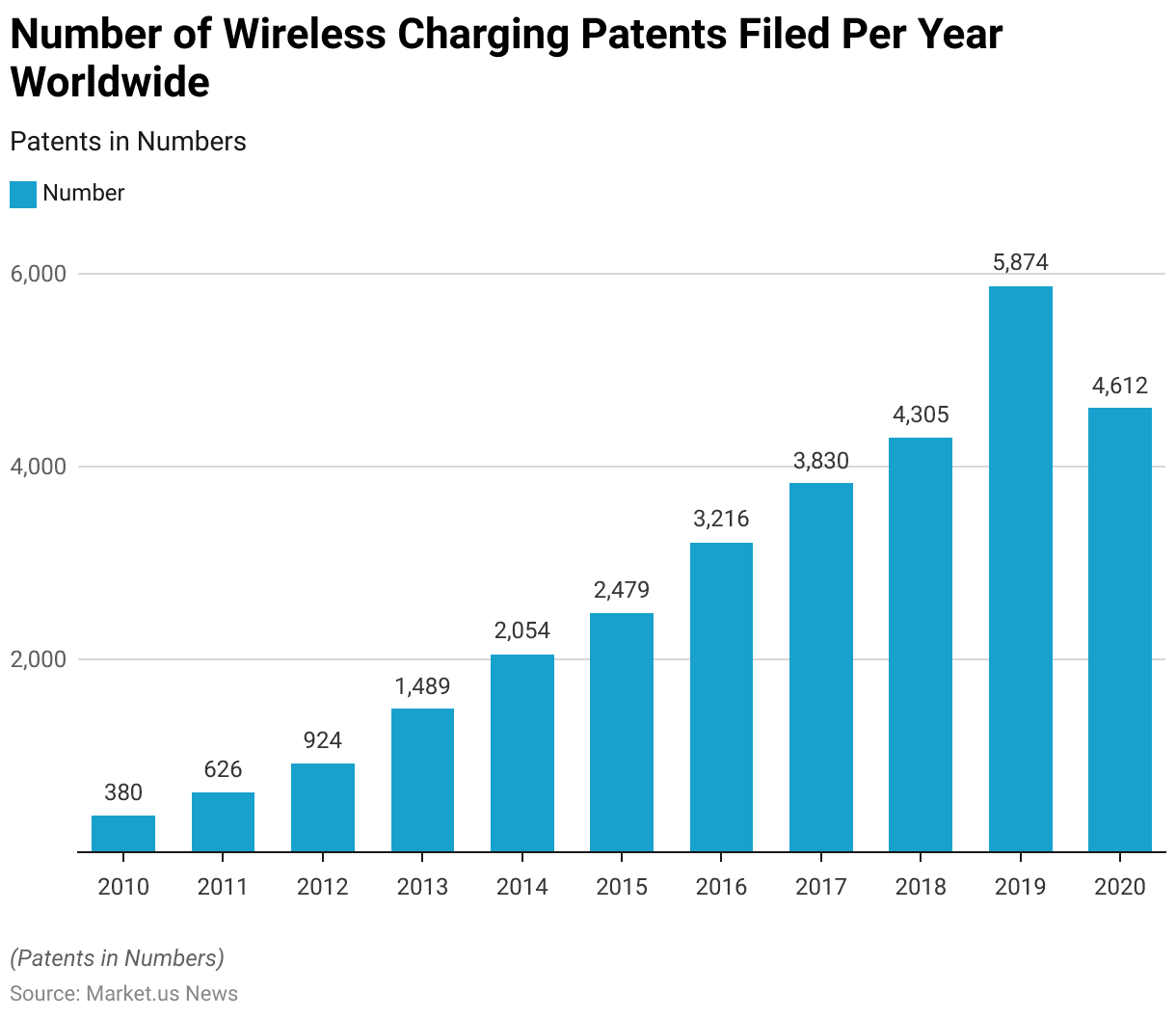

Wireless Charging Patents Statistics

Number of Wireless Charging Patents Filed Per Year Worldwide Statistics

- The number of wireless charging patents filed worldwide has shown a significant upward trend from 2010 to 2020, reflecting growing innovation and technological advancements in the field.

- In 2010, 380 patents were filed, which increased to 626 in 2011 and 924 in 2012.

- The pace of filings accelerated further, with 1,489 patents in 2013 and over 2,000 filings in 2014, reaching 2,054.

- By 2015, the number of patents filed had risen to 2,479, followed by a notable surge to 3,216 in 2016 and 3,830 in 2017.

- This upward trajectory continued with 4,305 patents filed in 2018, peaking at 5,874 in 2019.

- However, 2020 saw a slight decline to 4,612 patents, possibly reflecting market maturity or external factors.

- Overall, the steady increase in patent filings over the decade underscores the industry’s focus on innovation and the development of advanced wireless charging technologies.

(Source: Statista)

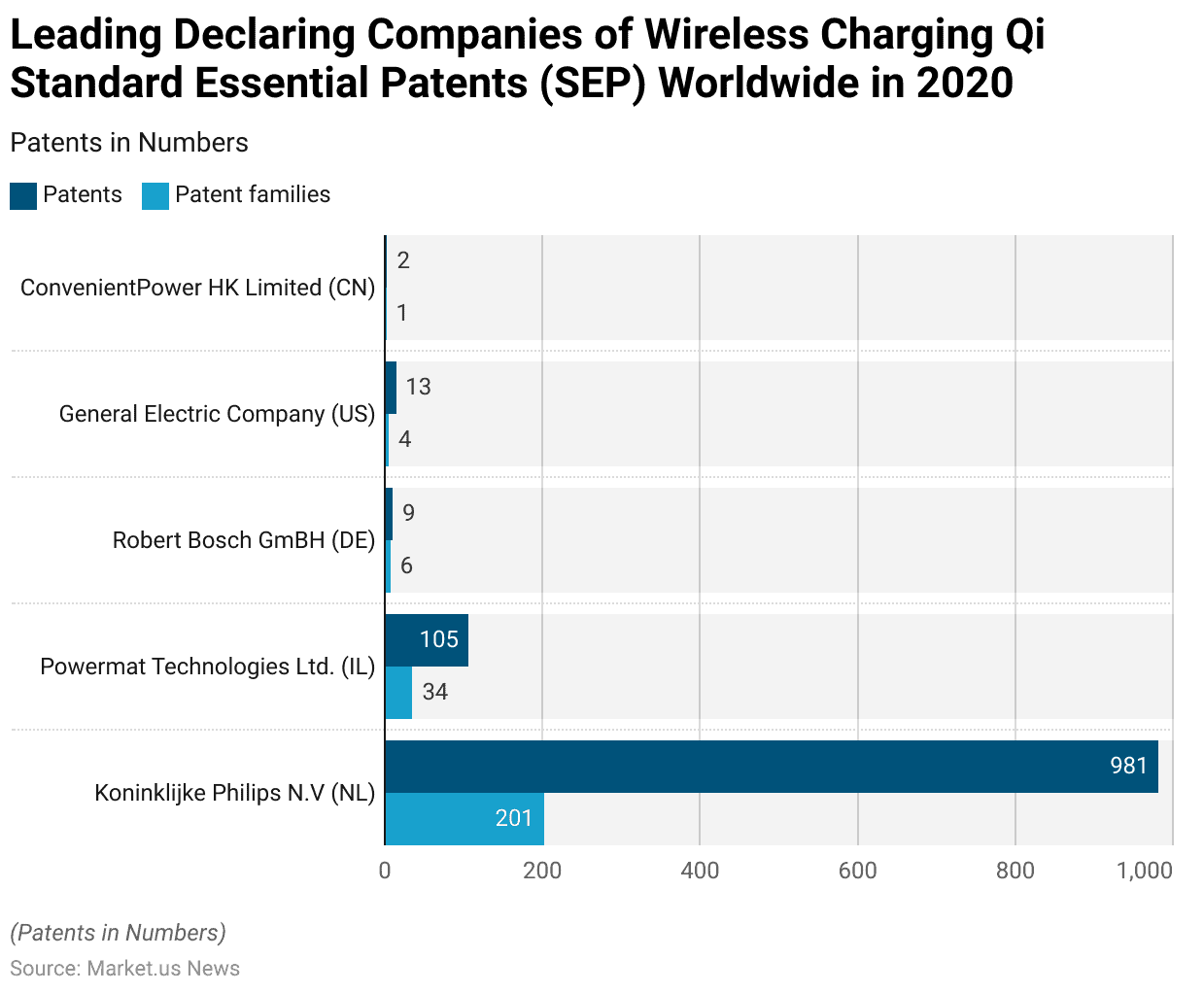

Leading Declaring Companies of Wireless Charging Qi Standard Essential Patents (SEP) Worldwide Statistics

- As of 2020, Koninklijke Philips N.V. (Netherlands) emerged as the leading company in the field of wireless charging Qi standard essential patents (SEPs), holding a total of 981 patents across 201 patent families.

- Powermat Technologies Ltd. (Israel) ranked second, with 105 patents spanning 34 patent families.

- Robert Bosch GmbH (Germany) held nine patents across six families, while General Electric Company (United States) had 13 patents within four families.

- ConvenientPower HK Limited (China) rounded out the list with two patents in a single patent family.

- This data highlights the competitive landscape and the varying degrees of patent portfolio strength among key players in the wireless charging technology domain.

(Source: Statista)

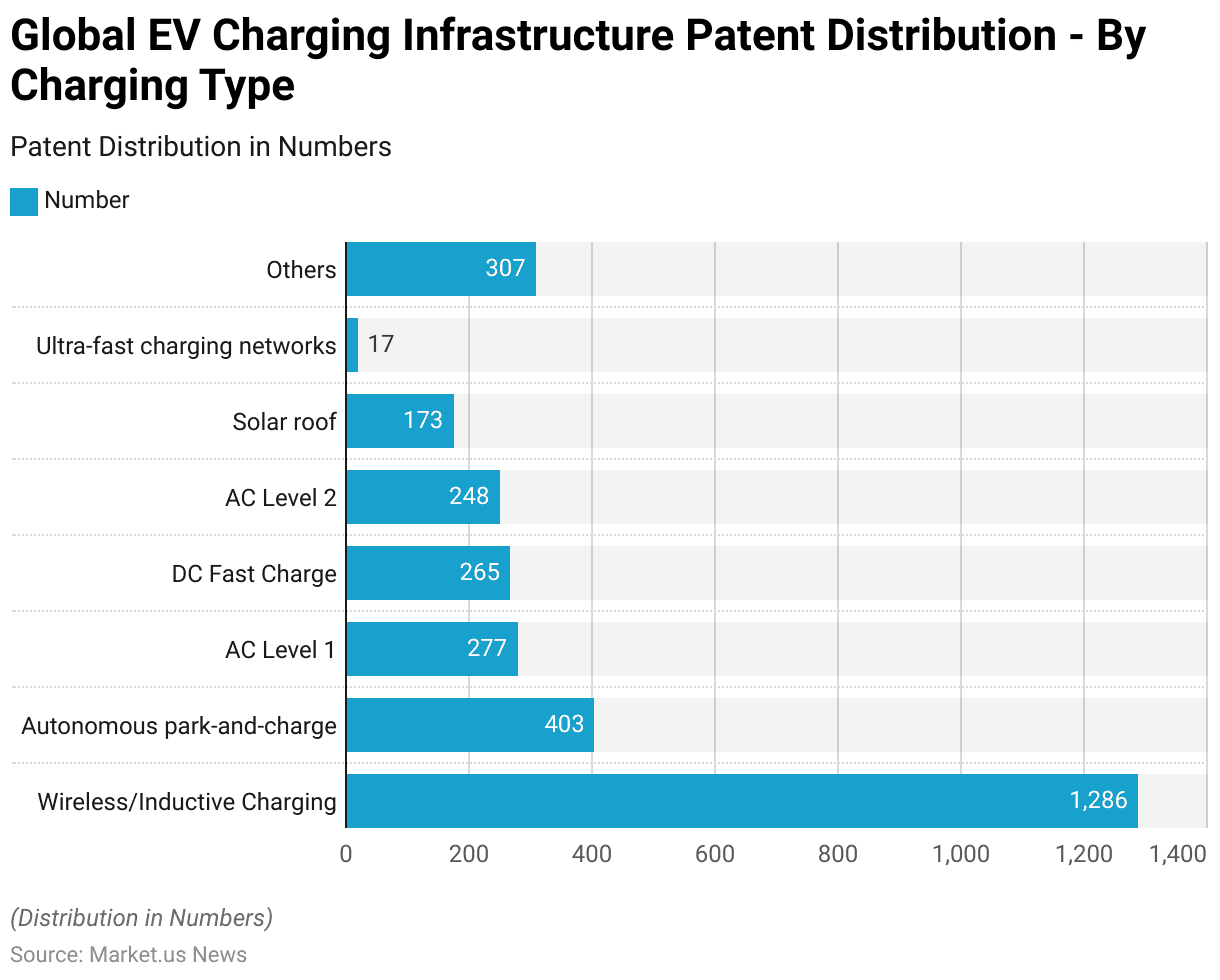

Global EV Charging Infrastructure Patent Distribution – By Charging Type

- As of January 2019, the global patent distribution for electric vehicle (EV) charging infrastructure highlights a strong focus on wireless and inductive charging technologies, which led the market with 1,286 patents.

- Autonomous park-and-charge systems hold the second position, with 403 patents reflecting advancements in automated charging solutions.

- AC Level 1 and DC Fast Charge technologies account for 277 and 265 patents, respectively, underscoring their importance in the EV charging ecosystem.

- AC Level 2 technology follows closely, with 248 patents.

- Solar roof charging systems have also gained traction, with 173 patents filed.

- Ultra-fast charging networks, although relatively nascent, hold 17 patents, indicating a growing interest in high-speed charging solutions.

- Additionally, 307 patents are attributed to other miscellaneous charging technologies, showcasing the diversity of innovation in this sector.

(Source: Statista)

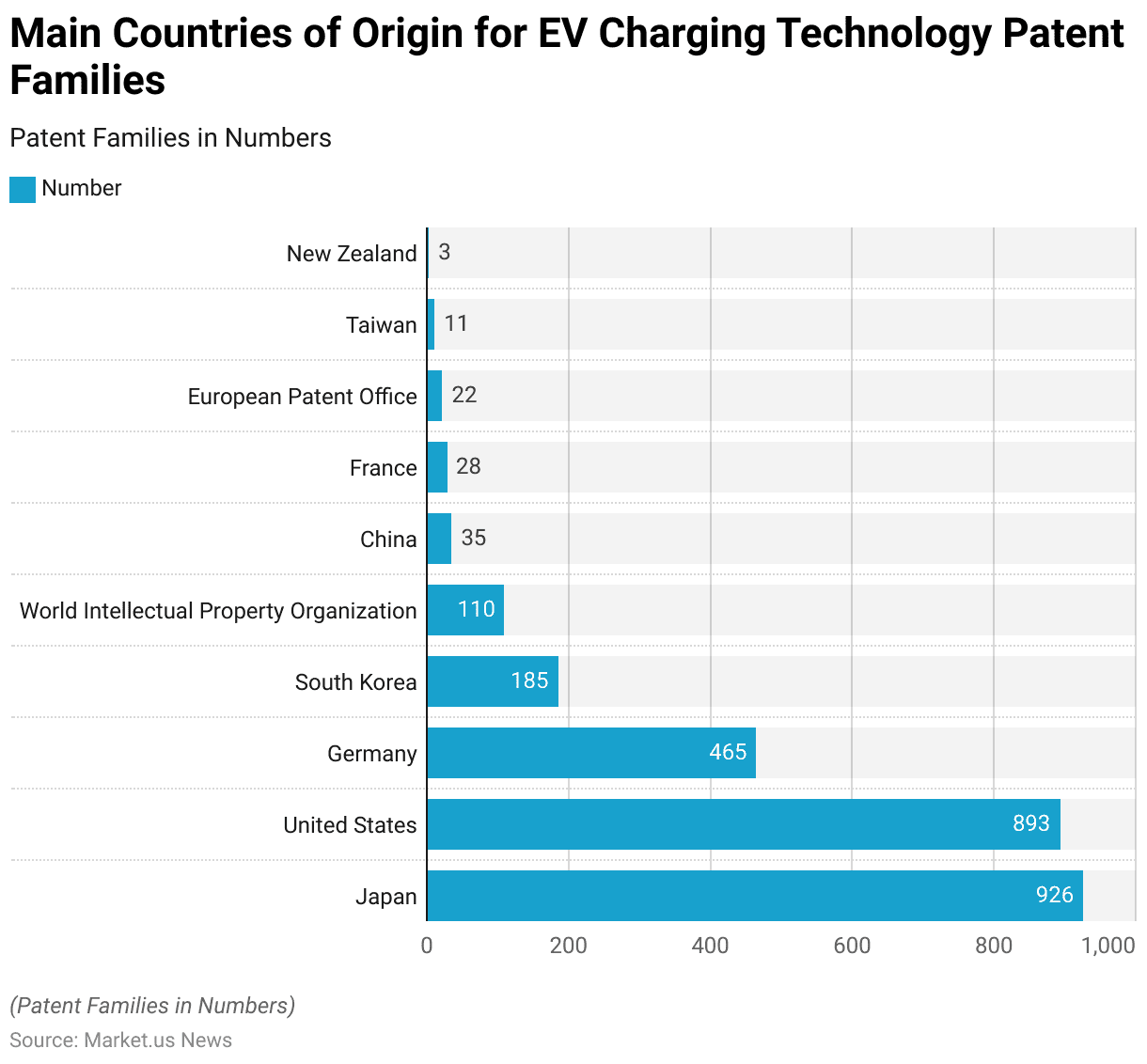

Main Countries of Origin for EV Charging Technology Patent Families

- As of January 2019, Japan and the United States led the world in electric vehicle (EV) charging technology patents, with 926 and 893 patent families, respectively.

- Germany followed with 465 patent families, highlighting its strong presence in the EV market.

- South Korea held 185 patent families, while the World Intellectual Property Organization accounted for 110.

- China contributed 35 patent families, slightly ahead of France with 28.

- The European Patent Office reported 22 patent families, Taiwan had 11, and New Zealand recorded three patent families.

- This distribution underscores the global effort in advancing EV charging technologies, with key contributions from both developed and emerging markets.

(Source: Statista)

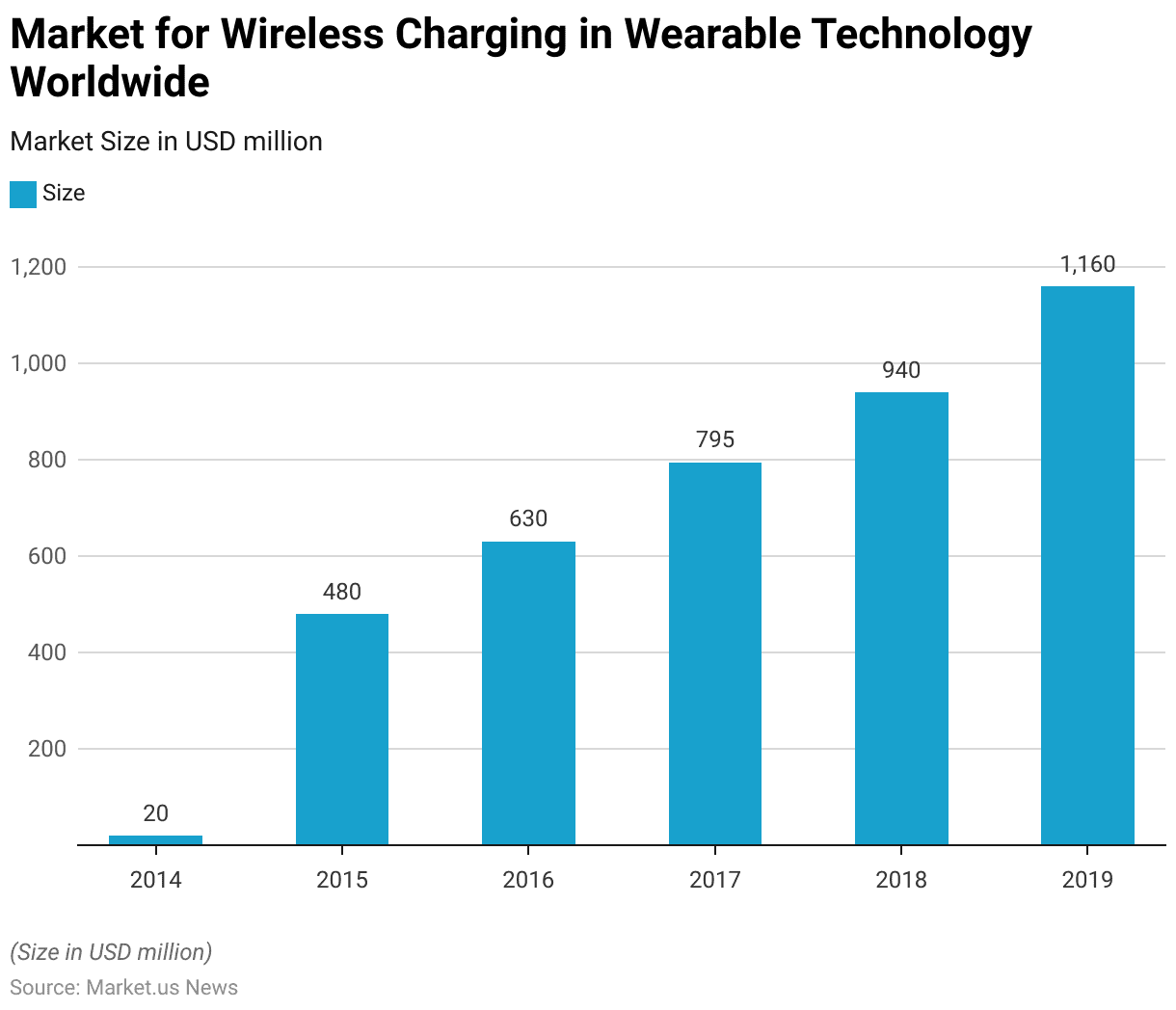

Wireless Charging Wearable Tech Revenue Worldwide

- The global market for wireless charging in wearable technology experienced exponential growth between 2014 and 2019.

- In 2014, the market size was valued at a modest $20 million.

- However, by 2015, the market had surged to $480 million, driven by increased adoption of wearable devices and advancements in wireless charging technology.

- This growth trajectory continued, with the market reaching $630 million in 2016 and $795 million in 2017.

- By 2018, the market had grown to $940 million, and in 2019, it surpassed the $1 billion mark, reaching $1,160 million.

- This rapid expansion highlights the rising demand for convenient and efficient charging solutions in the wearable technology sector.

(Source: Statista)

Statistics By Wireless Charging Price

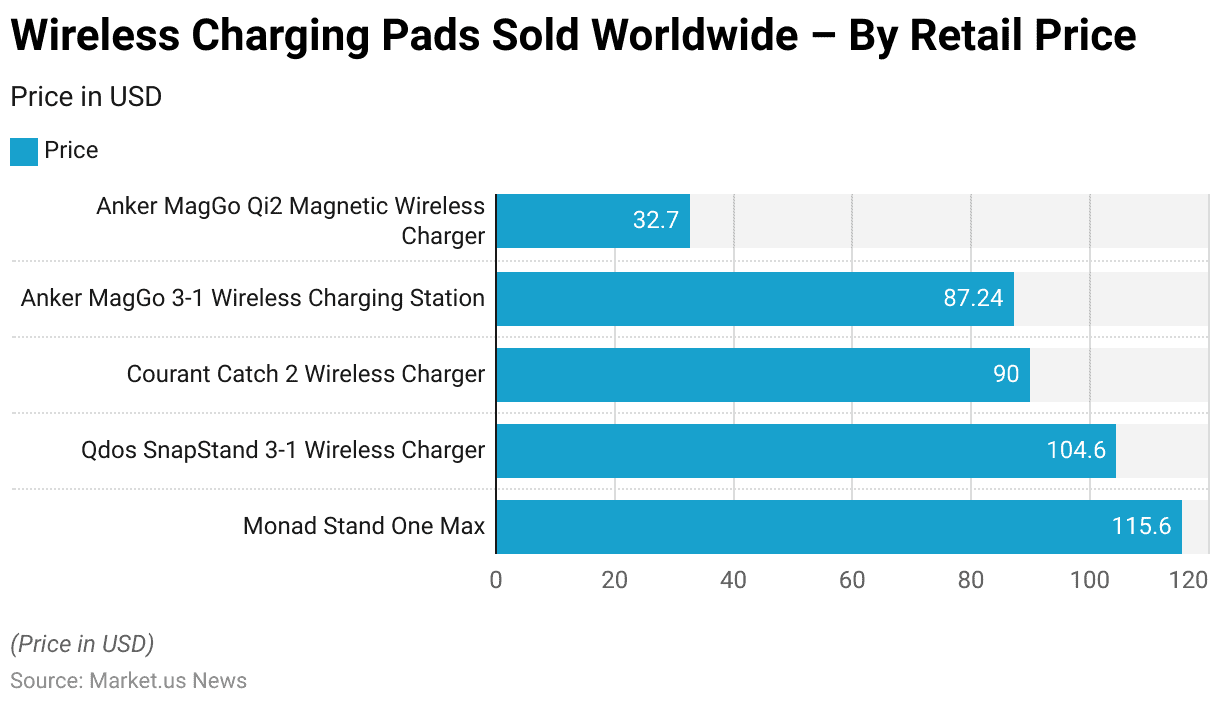

Wireless Charging Pads Sold Worldwide – By Retail Price Statistics

- In 2024, the retail prices of wireless charging pads worldwide vary significantly, reflecting differences in features and functionalities.

- The Monad Stand One Max leads the market with a price of $115.6, followed by the Qdos SnapStand 3-in-1 Wireless Charger at $104.6.

- The Courant Catch 2 Wireless Charger is priced at $90, offering a premium option for consumers.

- The Anker MagGo 3-in-1 Wireless Charging Station provides a slightly more affordable solution at $87.24.

- For budget-conscious users, the Anker MagGo Qi2 Magnetic Wireless Charger is available at $32.7, highlighting the broad price spectrum within the wireless charging pad market.

(Source: Statista)

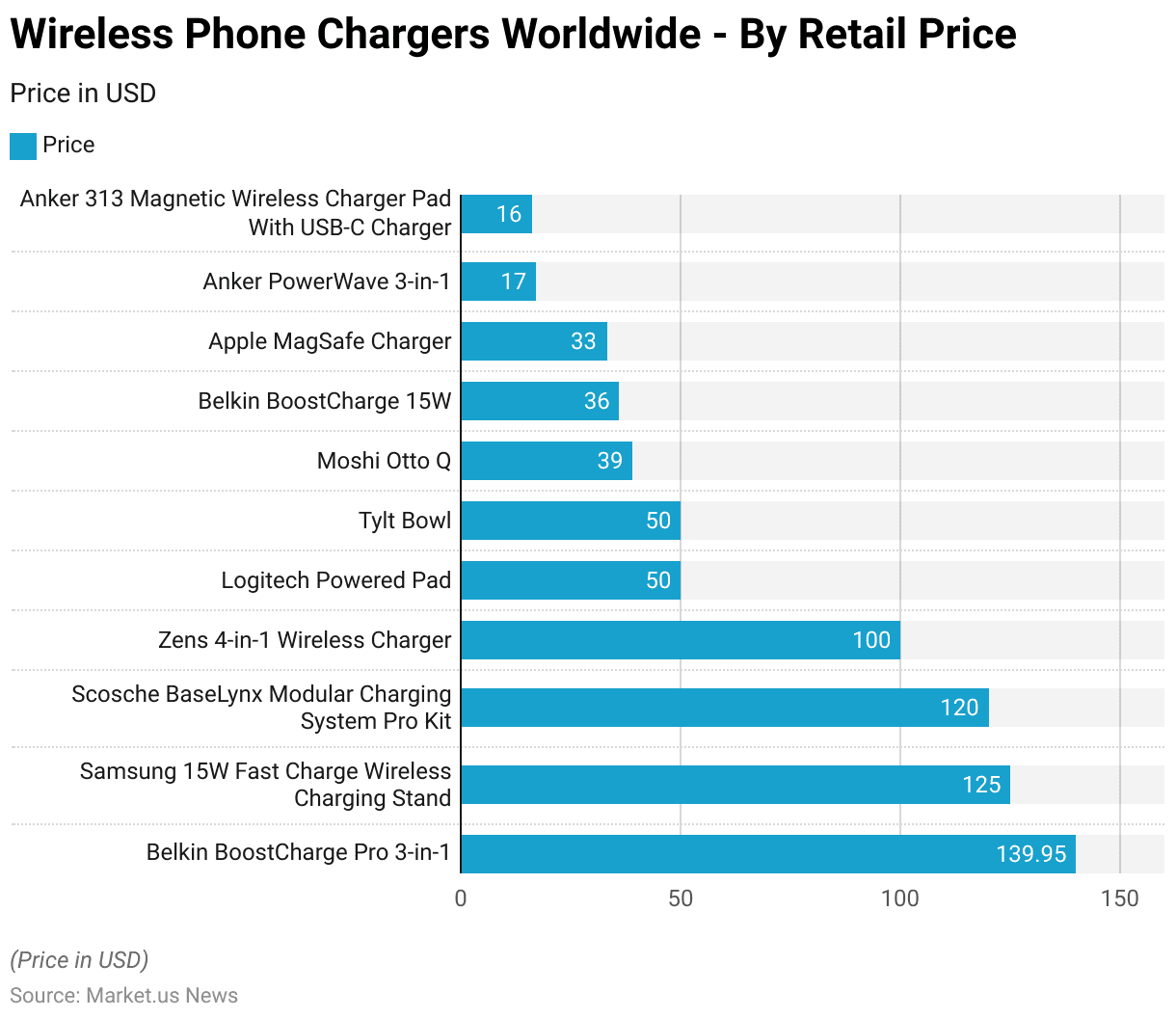

Wireless Phone Chargers Worldwide – By Retail Price

- In 2023, the retail prices of wireless phone chargers worldwide showcase a wide range, catering to different consumer needs and budgets.

- The Belkin BoostCharge Pro 3-in-1 is the most expensive, priced at $139.95, followed by the Samsung 15W Fast Charge Wireless Charging Stand at $125.

- The Scosche BaseLynx Modular Charging System Pro Kit offers a modular charging solution for $120, while the Zens 4-in-1 Wireless Charger is available for $100.

- Mid-range options include the Logitech Powered Pad and Tylt Bowl, both priced at $50, and the Moshi Otto Q at $39.

- Belkin’s BoostCharge 15W is slightly more affordable at $36, while Apple’s MagSafe Charger is priced at $33.

- For budget-conscious consumers, the Anker PowerWave 3-in-1 and Anker 313 Magnetic Wireless Charger Pad with USB-C Charger are available at $17 and $16, respectively, highlighting a diverse market catering to various price points.

(Source: Statista)

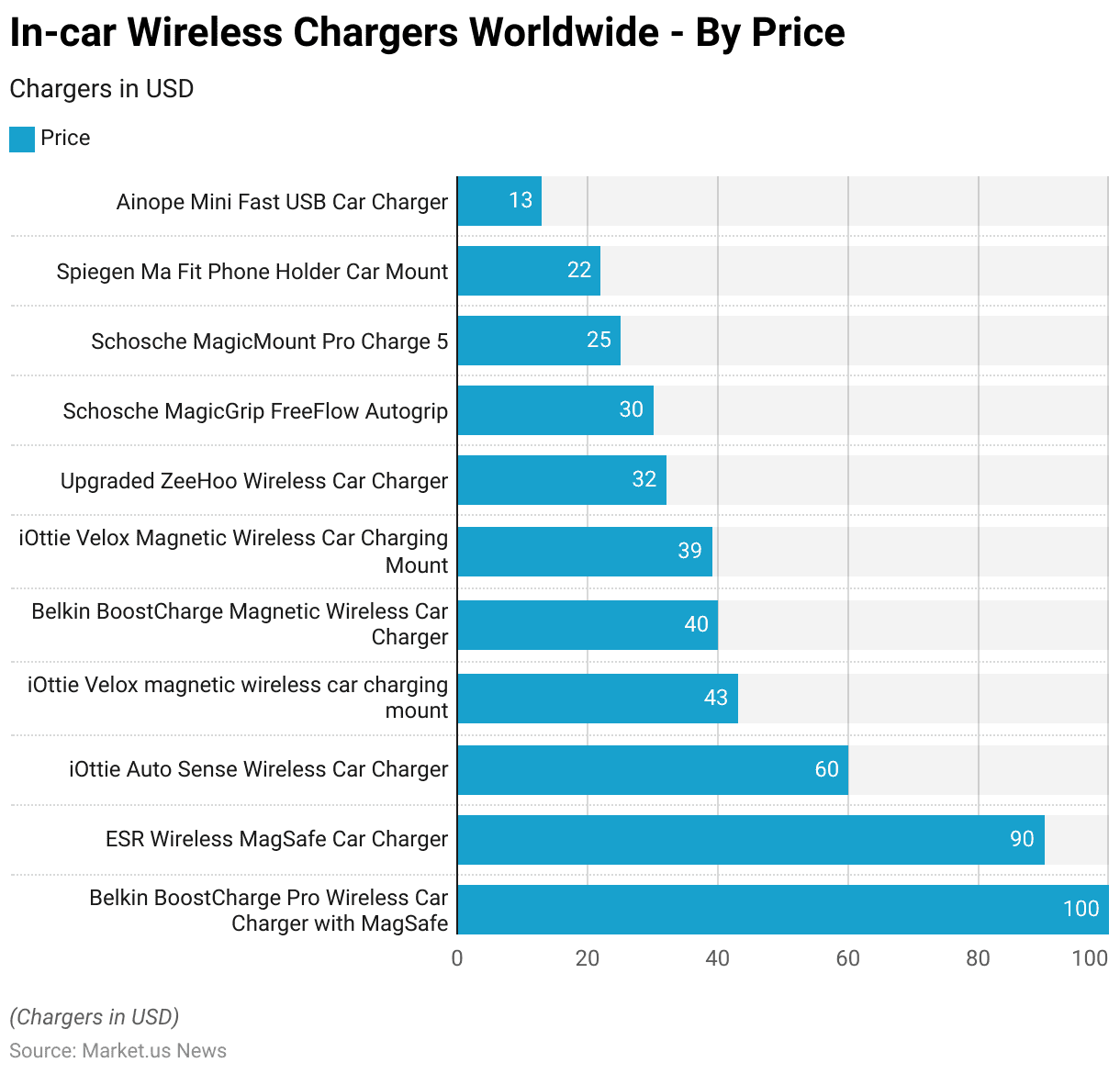

In-car Wireless Chargers Worldwide – By Price

- As of September 2024, the global market for in-car wireless chargers features a diverse range of products catering to different price points and functionalities.

- The premium segment is led by the Belkin BoostCharge Pro Wireless Car Charger with MagSafe, priced at $100, followed by the ESR Wireless MagSafe Car Charger at $90.

- Mid-range options include the iOttie Auto Sense Wireless Car Charger at $60 and the iOttie Velox Magnetic Wireless Car Charging Mount at $43.

- Belkin offers a more affordable BoostCharge Magnetic Wireless Car Charger at $40, while another iOttie Velox model is available for $39.

- For consumers seeking budget-friendly options, the Upgraded ZeeHoo Wireless Car Charger is priced at $32, and Schosche offers the MagicGrip FreeFlow Autogrip and MagicMount Pro Charge 5 for $30 and $25, respectively.

- The Spiegen Ma Fit Phone Holder Car Mount is available for $22, while the Ainope Mini Fast USB Car Charger is the most economical choice at $13.

- This range illustrates the growing accessibility and variety in the in-car wireless charging market.

(Source: Statista)

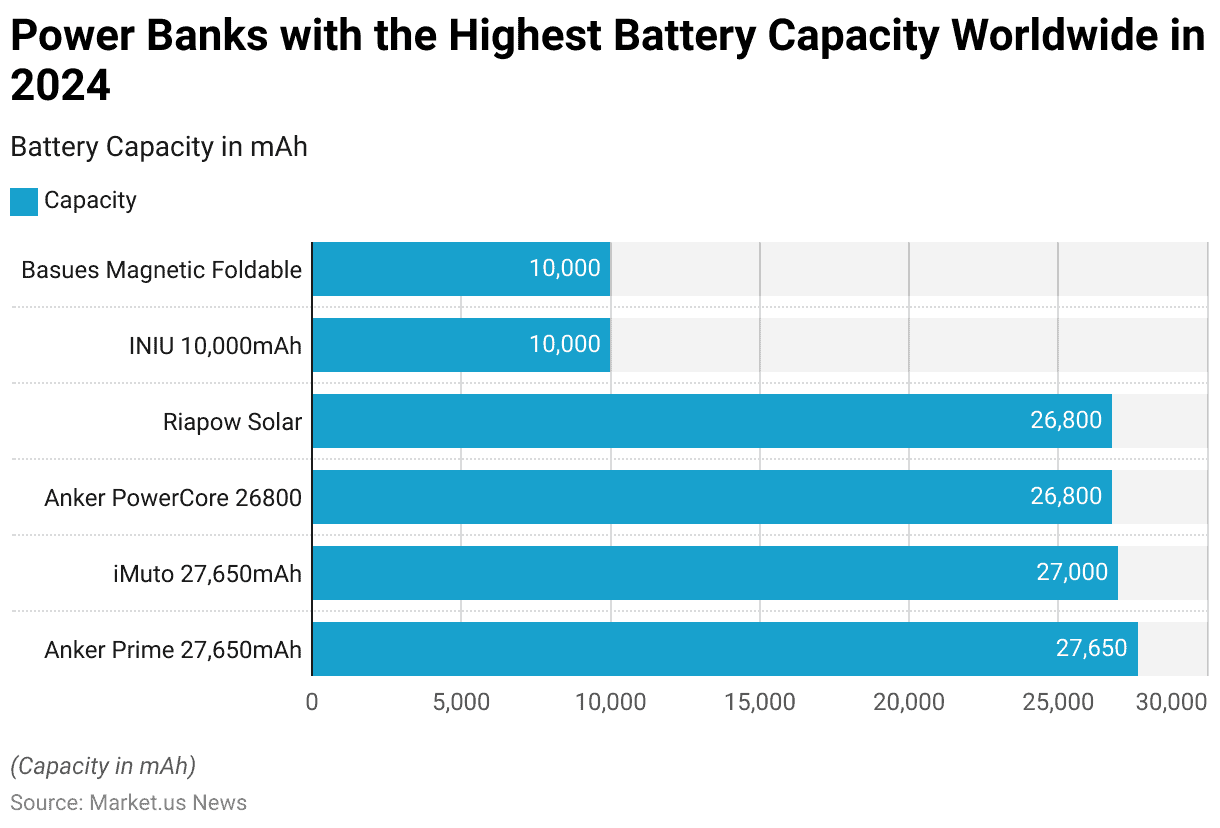

Power Banks with the Highest Battery Capacity Worldwide

- In 2024, the global market for power banks will be dominated by models with high battery capacities, catering to users with demanding power needs.

- Leading the market is the Anker Prime, with a capacity of 27,650mAh, closely followed by the iMuto 27,000mAh power bank. Both offer substantial energy reserves for extended device usage.

- The Anker PowerCore and Riapow Solar power banks also rank highly, each providing a capacity of 26,800mAh, making them ideal for multiple device charges or prolonged off-grid use.

- For users seeking more compact options, the INIU 10,000mAh and Baseus Magnetic Foldable power banks offer a balance between portability and functionality, catering to moderate daily charging needs.

- This range of products highlights the diversity in the power bank market, with options tailored for both heavy and standard usage scenarios.

(Source: Statista)

Key Determining Factors Among Consumers

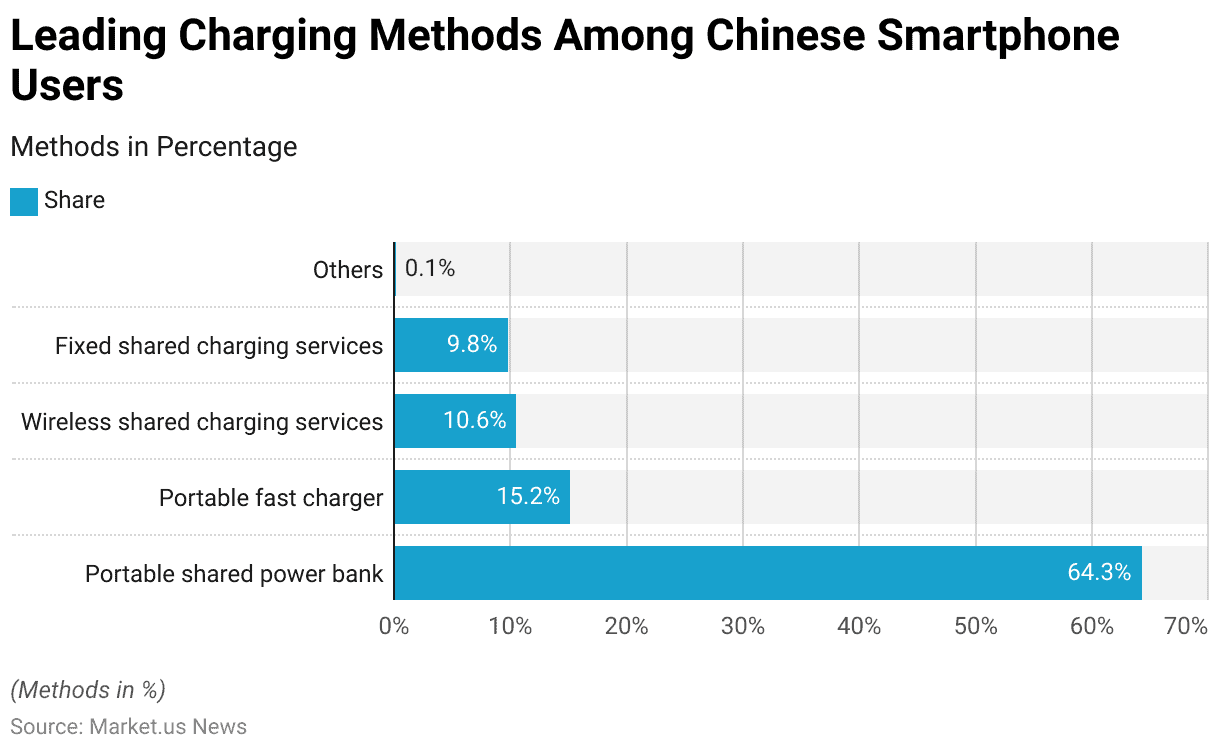

Leading Charging Methods Among Smartphone Users

- In 2022, portable shared power banks emerged as the most popular charging method among Chinese smartphone users, with 64.3% of respondents utilizing this service.

- Portable fast chargers were the second most preferred option, used by 15.2% of respondents.

- Wireless shared charging services accounted for 10.6% of user preferences, while fixed shared charging services were chosen by 9.8%.

- Other charging methods constituted a negligible 0.1%, highlighting the dominance of portable and shared solutions in meeting the changing needs of smartphone users in China.

(Source: Statista)

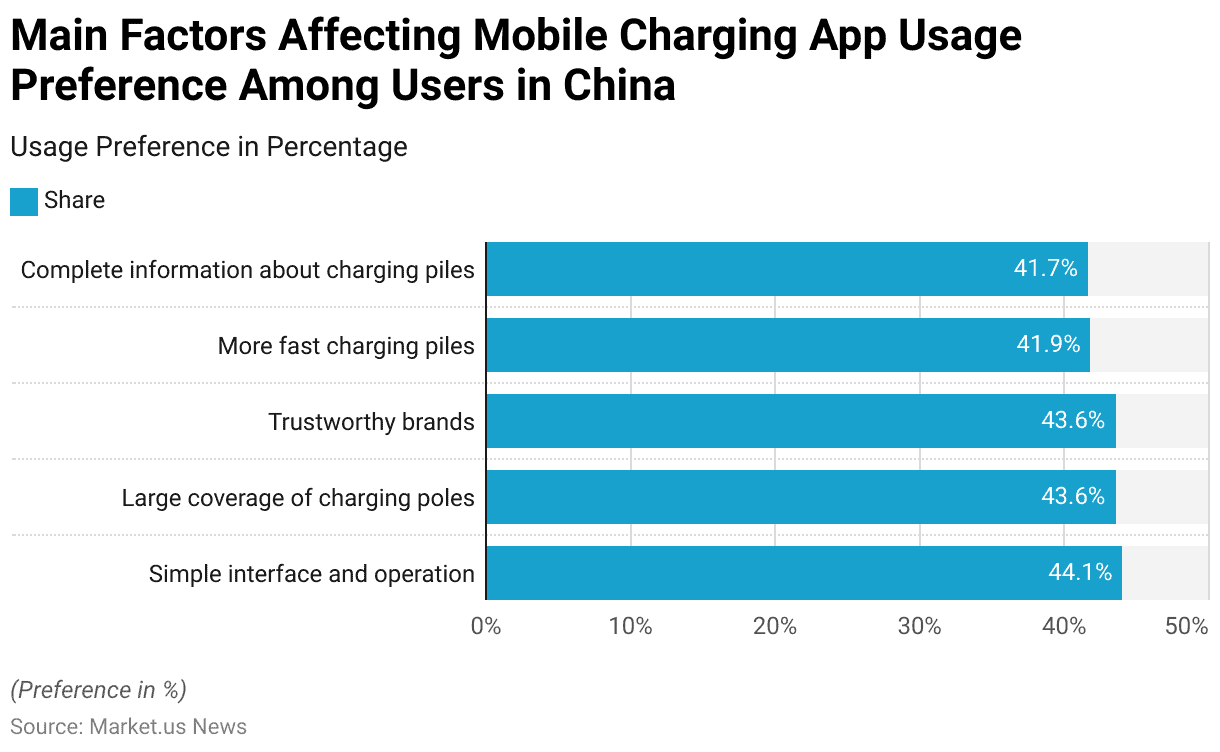

Main Factors Affecting Mobile Charging App Usage Preference Among Users

- As of May 2020, various factors influenced the usage of mobile apps for public electric vehicle charging stations in China.

- Among respondents, 44.1% valued a simple interface and ease of operation, making it the most critical determinant.

- Large coverage of charging poles and trustworthy brands were equally important, with 43.6% of respondents citing these as key factors.

- Additionally, 41.9% emphasized the availability of more fast-charging piles, while 41.7% highlighted the importance of complete information about charging piles.

- These findings underscore the need for user-friendly, comprehensive, and reliable charging app solutions to enhance the charging experience for EV users.

(Source: Statista)

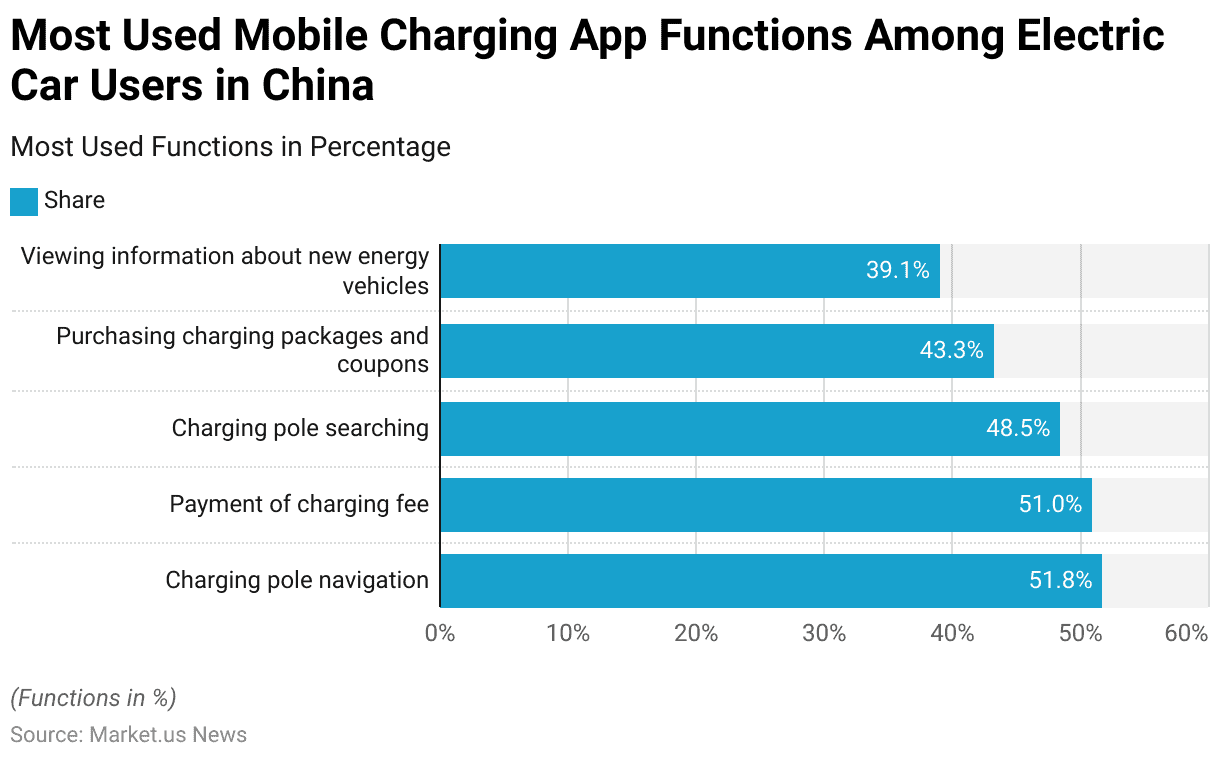

Most Used Mobile Charging App Functions Among Electric Car Users

- As of May 2020, several functions within mobile charging apps were widely used by respondents who charged their electric vehicles at public stations in China.

- The most popular feature was charging pole navigation. Utilized by 51.8% of respondents.

- Close behind, 51% of users relied on apps to pay charging fees.

- Charging pole searching was another commonly used function, with 48.5% of respondents highlighting its importance.

- Additionally, 43.3% of users took advantage of purchasing charging packages and coupons through these apps.

- Viewing information about new energy vehicles was also a notable feature utilized by 39.1% of respondents.

- These insights underscore the multifunctionality of mobile charging apps and their role in enhancing the user experience for EV drivers.

(Source: Statista)

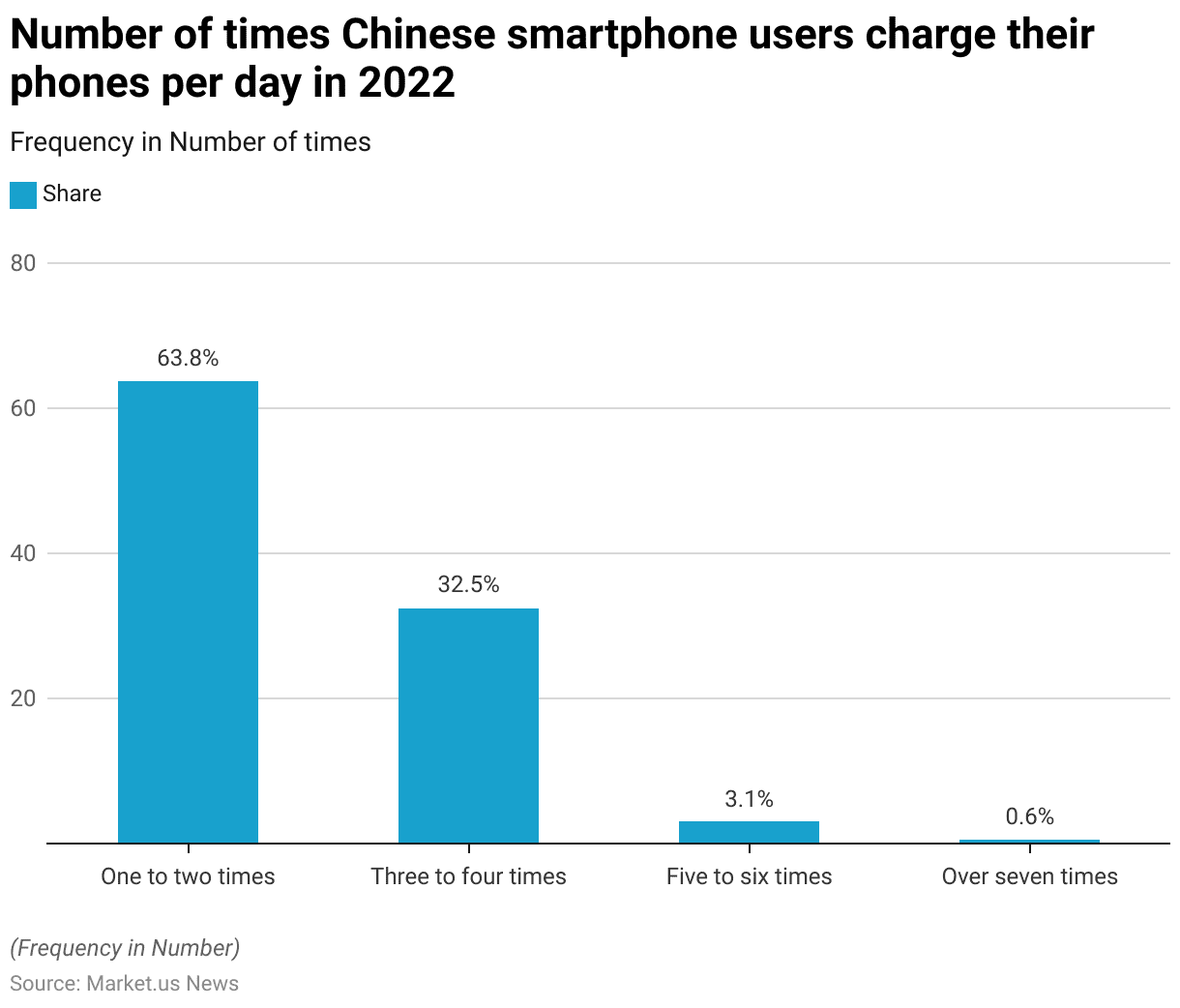

Frequency of Charging Among Smartphone Users

- In 2022, the majority of Chinese smartphone users charged their devices one to two times per day, with 63.8% of respondents reporting this frequency.

- Another significant portion, 32.5%, charged their phones three to four times daily.

- A smaller group, 3.1%, reported charging their devices five to six times a day, while only 0.6% of users charged their phones more than seven times daily.

- This data reflects varying levels of smartphone usage and battery dependency among users.

(Source: Statista)

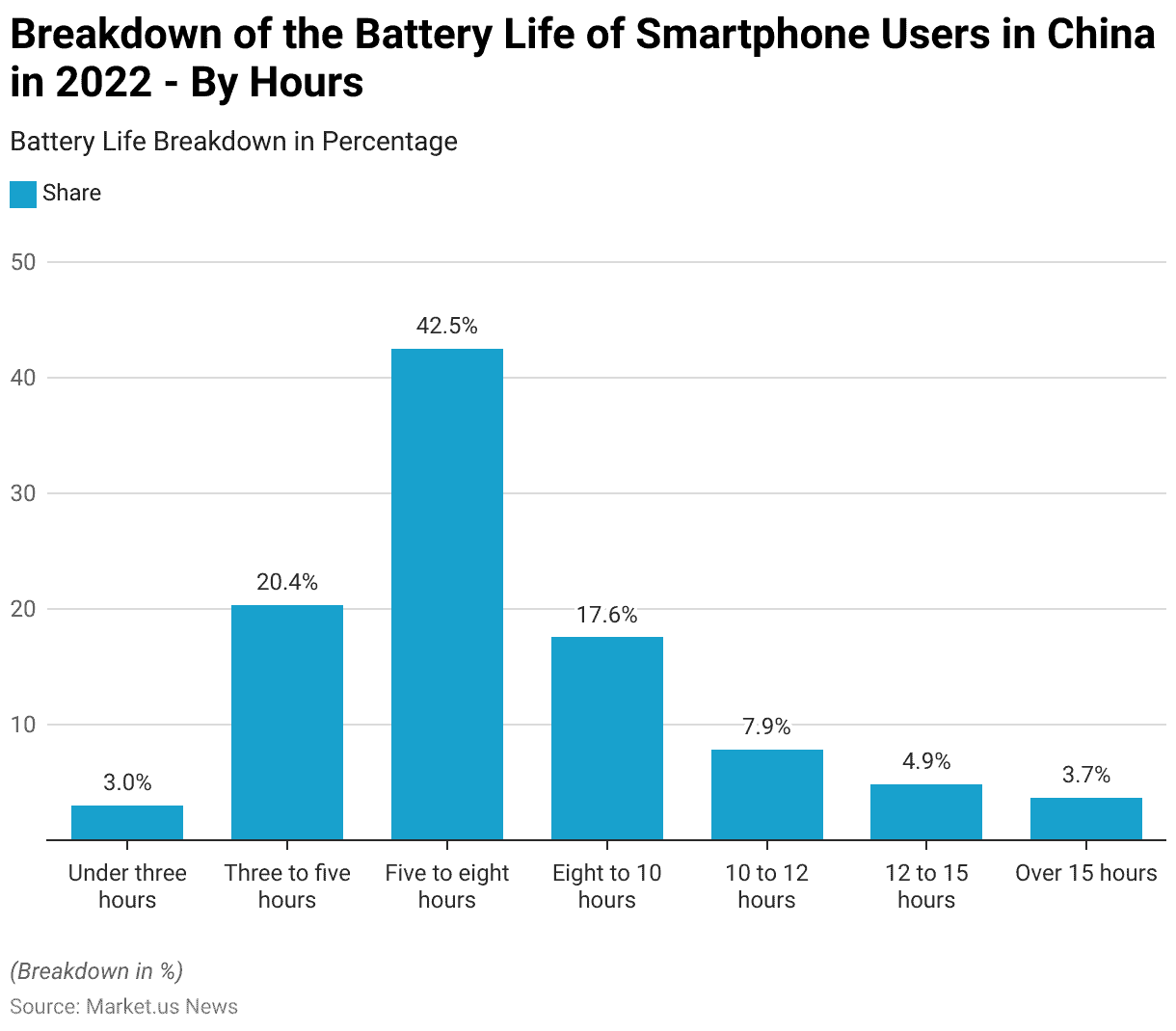

Breakdown of the Battery Life of Smartphone Users – By Hours

- In 2022, the battery life of smartphones used by Chinese consumers varied widely.

- The majority of respondents, 42.5%, reported a battery life of five to eight hours.

- Another significant portion, 20.4%, experienced battery life between three to five hours. While 17.6% indicated a longer duration of eight to 10 hours.

- Additionally, 7.9% of users reported their smartphone battery lasting between 10 to 12 hours, and 4.9% experienced a battery life of 12 to 15 hours.

- A smaller group, 3.7%, enjoyed a battery life exceeding 15 hours. While 3% had less than three hours of usage per charge.

- This data highlights diverse smartphone usage patterns and battery performance among users.

(Source: Statista)

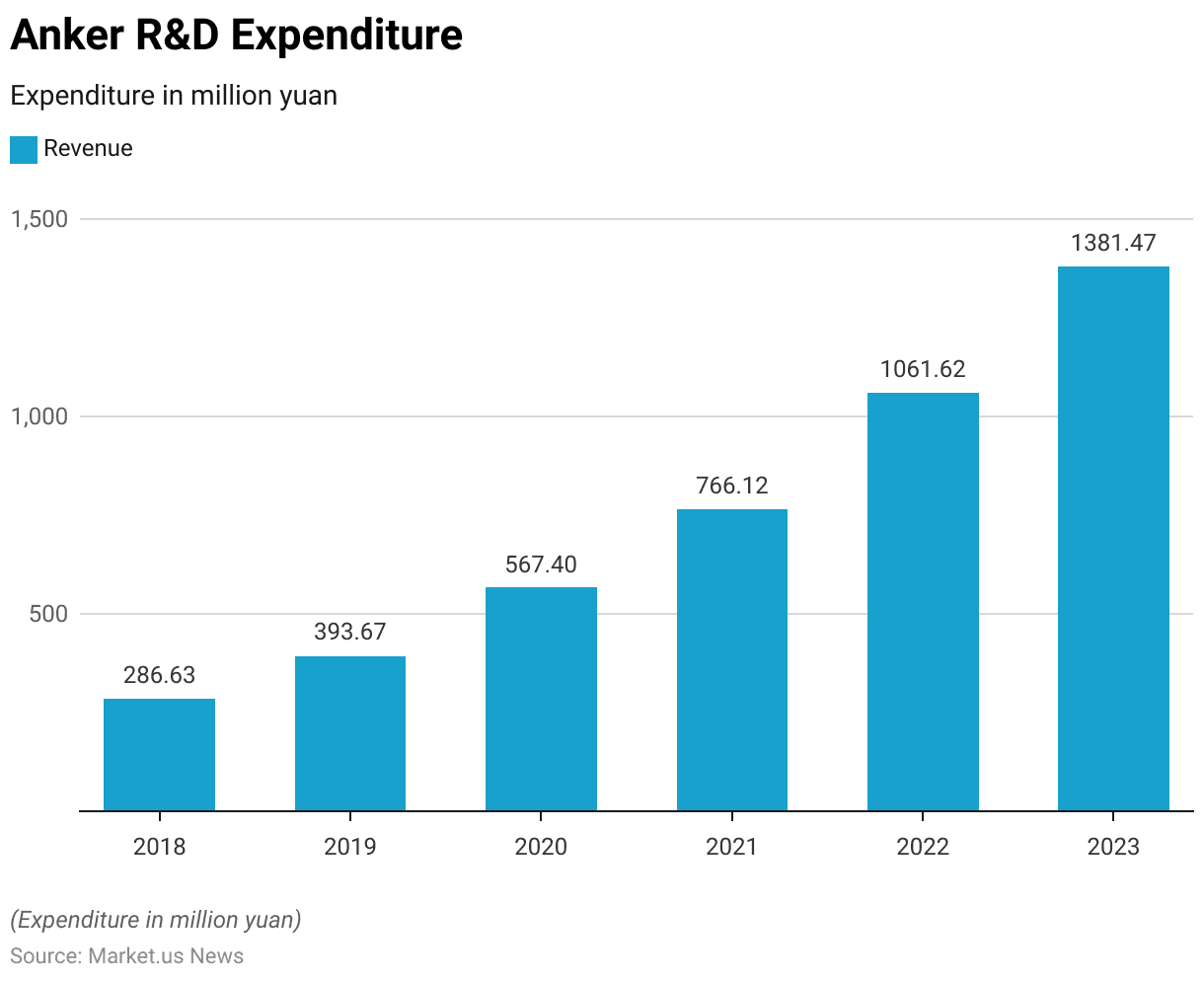

Spending on Research and Development (R&D)

- Anker Innovation Technology’s research and development (R&D) expenses have demonstrated consistent growth from 2018 to 2023, reflecting the company’s increasing focus on innovation.

- In 2018, R&D expenses amounted to 286.63 million yuan.

- This figure rose to 393.67 million yuan in 2019 and further to 567.4 million yuan in 2020.

- The upward trend continued, with R&D spending reaching 766.12 million yuan in 2021.

- By 2022, expenses surpassed the 1 billion yuan mark, totaling 1,061.62 million yuan, and in 2023, the company allocated 1,381.47 million yuan to R&D.

- This growth underscores Anker’s commitment to technological advancement and product development.

(Source: Statista)

Initiatives in Wireless Charging Statistics

- Recent initiatives in wireless charging technology, particularly for electric vehicles (EVs), indicate a significant shift towards more sustainable and efficient transportation solutions.

- Governments and private entities are increasingly investing in this technology to streamline operations and enhance user experience.

- For instance, the U.S. Department of Transportation is setting up a dedicated grant program to fund wireless EV charging infrastructure, which includes an allocation of $250 million for various projects like roads, parking lots, and bus routes.

- This is complemented by significant advancements in the technology itself, such as the dynamic wireless charging systems that allow vehicles to charge while in motion, significantly increasing convenience and reducing range anxiety.

- Companies like WiTricity and Electreon are leading these technological advancements, with WiTricity developing magnetic resonance technology that is foundational for global EV wireless charging standards and Electreon deploying operational projects across several countries.

- This technology not only simplifies the charging process by eliminating the need for cables but also reduces total energy costs and operational downtime, particularly in commercial and heavy-duty vehicle applications.

- These developments are creating a robust infrastructure that promotes the widespread adoption of electric vehicles, thereby supporting global efforts to reduce carbon emissions and transition towards greener energy solutions.

- The overall market for wireless electric vehicle charging is expected to see substantial growth, driven by these innovations and supportive government policies.

(Source: The Auto Channel, Taiwan News, Evcandi, Witricity, Mckinsey & Company, Taiwan News)

Regulations for Wireless Charging

- The regulatory landscape for wireless charging is evolving globally, with significant developments particularly noted in China, Europe, the USA, and Canada.

- In China, the Provisional Regulations on Radio Management of Wireless Charging (Power Transmission) Equipment set forth specific technical requirements such as defined frequency bands and power limits for mobile and portable devices, as well as for electric vehicles, effective from September 2024.

- This includes mobile and portable wireless charging devices operating within specified frequencies and not exceeding 80W and wireless charging equipment for electric vehicles operating within other defined frequencies and power limitations.

- In Europe, wireless charging devices must meet stringent EMC (Electromagnetic Compatibility) and safety standards. These devices fall under various directives that regulate their market access, including the CE marking that indicates compliance with EU safety, health, and environmental requirements.

- The USA has updated its standards through the Federal Highway Administration’s National Electric Vehicle Infrastructure (NEVI) program, which includes specifications for EV charging infrastructure.

- This encompasses charging capacity requirements and interoperability standards such as the Open Charge Point Protocol (OCPP) and ISO 15118, ensuring that devices are compliant with new communication protocols.

- In Canada, wireless charging standards align closely with U.S. regulations, focusing on the safety, certification, and interoperability of devices to ensure a unified approach across North America.

- These regulations are critical for manufacturers and stakeholders in the wireless charging market. Compliance impacts not only market access but also the adoption and usability of wireless charging technologies in various regions. Understanding these regulations can aid businesses in navigating the complexities of global market entry while ensuring product safety and efficiency.

(Source: Ib-Lenhardt Ag, Ul Solutions, Foley & Lardner Llp)

Recent Developments

Acquisitions and Mergers:

- Tesla’s Acquisition of Wiferion GmbH: In August 2023, Tesla acquired Wiferion GmbH, a German specialist in wireless charging solutions. To enhance its capabilities in inductive charging technology for electric vehicles.

Product Launches:

- Apple’s 25W MagSafe Charger: In September 2024, Apple introduced a new MagSafe charger capable of delivering a faster 25W wireless charging rate, compatible with iPhone 16 models. This charger is priced at $39 for a 1-meter version and $49 for a 2-meter version.

- Anker’s 633 Wireless Charger: In November 2024, Anker released the 633 Foldable Wireless Portable Charger, now available for $40, down from its original price of $80. This MagSafe-compatible charger features a USB-C to USB-C cable and can charge an iPhone 13 Pro 1.8 times.

Funding:

- WiTricity’s $63 Million Investment: In August 2022, WiTricity completed a new funding round of $63 million to accelerate the productization and commercialization of wireless charging for electric vehicles and other products.

- Resonant Link’s $9.3 Million Seed Round: In February 2022, Resonant Link raised $9.3 million in a seed round led by The Engine, aiming to fuel the commercial deployment of its wireless charging technology in medical devices and electric automotive fleets.

Conclusion

Wireless Charging Statistics – The wireless charging market is experiencing rapid growth, driven by increasing demand for convenient and efficient power solutions across sectors such as consumer electronics, automotive, and healthcare.

Innovations in technologies like inductive and resonance charging have enhanced user convenience by eliminating the need for physical connectors.

In the automotive sector, wireless charging is gaining traction for electric vehicles, while consumer electronics continue to see widespread adoption.

Despite challenges like standardization and energy efficiency, ongoing R&D efforts are expected to drive further advancements.

As a result, wireless charging is poised to become a key component of modern power solutions. Offering significant growth opportunities in the coming years.

FAQs

Wireless charging is a technology that allows devices to be charged without the need for physical cables. It uses electromagnetic fields to transfer energy from a charging pad or stand to a device equipped with a compatible receiver.

Wireless charging works through a process called electromagnetic induction. A charging station contains a coil that generates an electromagnetic field. When a device with a compatible receiver coil is placed on the charger. The field induces a current in the receiver, charging the device’s battery.

Many modern smartphones, smartwatches, earbuds, and even some laptops now support wireless charging. Additionally, wireless charging is increasingly used in electric vehicles and medical devices.

Wireless charging can be slower than some high-speed wired chargers, especially older or lower-power wireless chargers. However, technological advancements have led to faster wireless charging speeds, with some systems offering comparable performance to wired fast chargers.

Wireless charging, when used correctly, does not damage the battery. However, like all charging methods, excessive heat can impact battery health over time. Modern wireless chargers often include temperature regulation features to mitigate this.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)