Table of Contents

Introduction

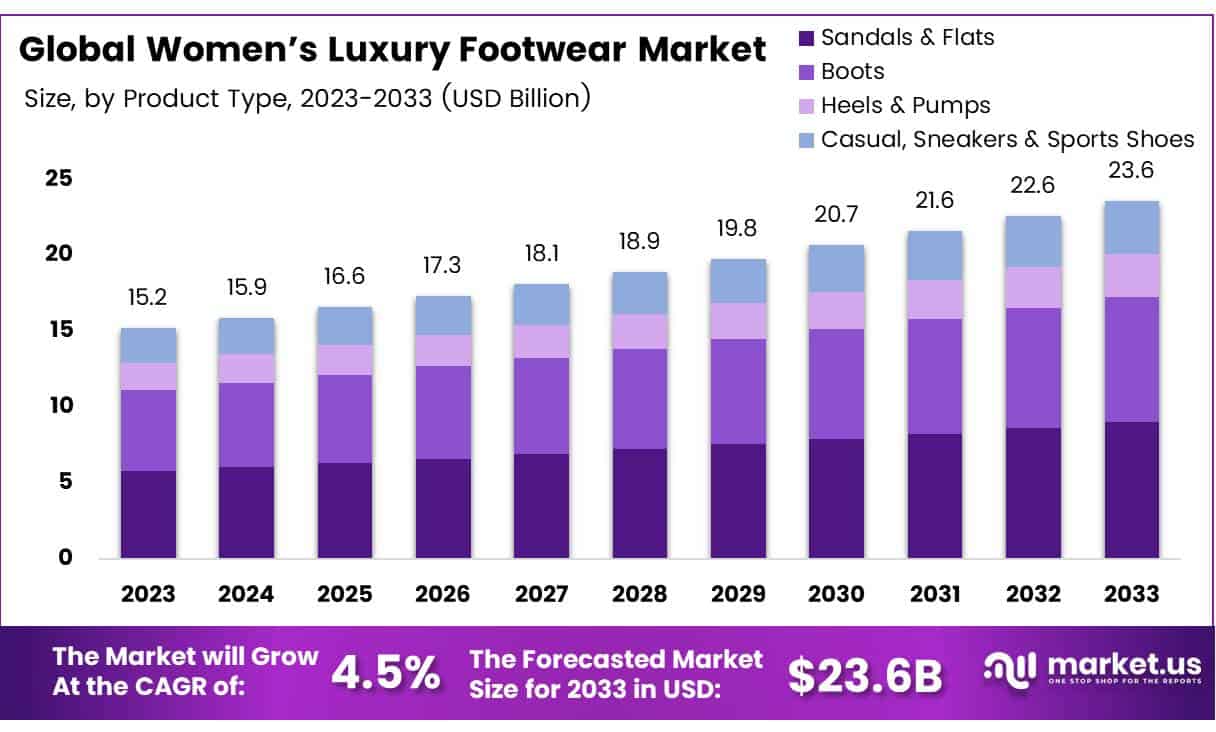

The global women’s luxury footwear market is projected to reach approximately USD 23.6 billion by 2033, up from USD 15.2 billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 4.5% over the forecast period from 2024 to 2033.

Women’s luxury footwear encompasses high-quality, designer shoes that are crafted with superior materials and exceptional attention to detail. These products typically feature exclusive designs, cutting-edge aesthetics, and carry prestigious brand names that cater to an affluent customer base.

Ranging from high heels, flats, and boots to sneakers, sandals, and bespoke collections, these shoes are often positioned at the premium end of the market, delivering not only style and comfort but also a sense of exclusivity and status. They are sought after for their craftsmanship, durability, and brand heritage, which collectively enhance their appeal to discerning consumers.

The Women’s Luxury Footwear Market refers to the global industry that involves the production, distribution, and retail of high-end shoes for women. This market is driven by both established luxury brands and emerging designers, targeting consumers who prioritize luxury, style, and exclusivity. It encompasses a wide array of products including classic footwear, designer collaborations, and limited-edition releases, often sold through boutiques, flagship stores, and online channels.

The market is marked by dynamic trends, with brands constantly innovating to offer new designs, styles, and materials, thereby maintaining consumer interest and loyalty. It operates across various price segments within the luxury sector, from affordable luxury to ultra-premium collections, addressing a diverse range of customer preferences.

Several factors are contributing to the robust growth of the Women’s Luxury Footwear Market. One of the primary drivers is the rising disposable income among women, especially in emerging markets, which is boosting their purchasing power and willingness to invest in high-end fashion products.

Additionally, a growing trend of “self-gifting,” where women buy luxury items as a form of personal reward, has significantly bolstered sales. The influence of digital marketing and social media campaigns by luxury brands has also played a pivotal role in expanding consumer awareness and access. Furthermore, increasing collaborations between luxury footwear brands and high-profile designers or celebrities have sparked consumer interest and driven demand.

Demand for women’s luxury footwear is driven by evolving consumer preferences, where there is an increasing inclination towards premium, artisanal products that offer a blend of comfort, style, and social currency. Women, particularly millennials and Gen Z, are increasingly looking for footwear that complements their fashion-forward lifestyles.

In addition, the “casual luxury” trend has made designer sneakers and flats popular, expanding demand beyond traditional luxury items like high heels. With more women actively seeking products that reflect their personal style and values, brands that prioritize sustainable practices and ethical sourcing are witnessing higher demand, aligning with the broader trend of conscious consumerism.

The Women’s Luxury Footwear Market presents significant opportunities for growth, particularly through digital expansion and sustainable innovation. E-commerce has opened up new avenues for brands to reach a global audience, making it easier for consumers to access exclusive collections and personalized services. Brands that leverage advanced analytics to better understand consumer behavior can enhance personalization, thereby boosting customer loyalty and sales.

Key Takeaways

- The global women’s luxury footwear market is expected to expand from USD 15.2 billion in 2023 to USD 23.6 billion by 2033, achieving a CAGR of 4.5%.

- Sandals & Flats dominate the market by product type, capturing a 38.1% share in 2023, driven by their comfort and versatility for both casual and formal wear.

- Rubber is the leading material in luxury footwear in 2023, holding a 32.2% market share due to its durability and flexibility, while leather continues to be a preferred premium option.

- Online sales channels lead the distribution landscape, reflecting a shift toward convenience and the adoption of advanced technologies for an enhanced customer experience.

- North America represents a significant market share of 33%, valued at USD 5 billion, fueled by high disposable incomes and a strong presence of luxury brands and e-commerce platforms.

Women’s Luxury Footwear Statistics

- The average women’s shoe size in the US ranges from 7 to 8.5, while in Europe it ranges from 37 to 39.

- Size 8 is the most popular, accounting for 29% of sales; Size 9 follows with 22%-26.7%; Size 11 is the least purchased (5.6%-8%).

- The average American woman owns 19 pairs of shoes 15% own 30 or more.

- Global footwear consumption is expected to rise by 9.2% in 2024.

- Portugal exports over 90% of its footwear production.

- Online luxury footwear sales grew by 23% in 2023 compared to 2022.

- Asia-Pacific is the fastest-growing market, with 15% annual growth in women’s luxury footwear.

- Millennials and Gen Z will represent 45% of the luxury market by 2025; currently, Gen X leads (12.8% women, 9.9% men).

- Interest in sustainable luxury footwear increased by 40%, while the second-hand market grew by 65% in 2023.

- Women make 75% of luxury footwear purchases, averaging 3.2 pairs per year.

- The wedding footwear segment grew by 18%.

- 80% of luxury footwear brands offer installment payment options.

- Sustainable packaging use increased by 55%.

- Direct-to-consumer luxury brands grew by 40%.

- Private shopping appointments increased by 65%.

- AR features led to 32% higher consumer engagement.

- Cross-border luxury footwear sales increased by 25%.

Emerging Trends

- Rising Demand for Premium Fashion: There’s an increasing global appetite for high-end women’s footwear, driven by higher disposable incomes and a desire for exclusive fashion items.

- Influence of Celebrity Endorsements and Social Media: Luxury brands are leveraging collaborations with celebrities and influencers to enhance brand visibility. Platforms like Instagram and TikTok have become pivotal in shaping consumer preferences, especially among younger demographics. For instance, the resurgence of vintage Frye boots among Gen Z consumers has been significantly influenced by social media platforms.

- Emphasis on Sustainability and Ethical Practices: Consumers are increasingly favoring brands that prioritize sustainability and ethical manufacturing. This shift is prompting luxury footwear companies to adopt eco-friendly materials and transparent production methods. Brands like Stella McCartney are leading the way by incorporating vegan materials and recycled content into their footwear lines.

- Revival of Vintage and Timeless Designs: There’s a resurgence in classic styles, such as loafers and ballet flats, reinvented with modern twists to appeal to contemporary tastes. This trend reflects a broader appreciation for timeless designs that offer both style and comfort.

- Integration of Technology and Customization: Advancements in technology are enabling personalized shopping experiences, with brands offering customization options and virtual try-ons to meet individual consumer preferences. This technological integration enhances customer engagement and satisfaction, allowing for a more tailored shopping experience.

Top Use Cases

- Rising Disposable Incomes and Increased Consumer Spending: The women’s luxury footwear market is witnessing increased demand as a result of rising disposable incomes. As consumers have more financial resources, they are more inclined to spend on premium products, including high-end footwear. This trend is evident across various regions, with growing middle and upper-middle-class segments showing a strong appetite for luxury brands. As income levels rise, women are willing to invest in designer footwear as a form of personal expression and social status.

- Growing Fashion Consciousness and Brand Awareness: The heightened exposure to global fashion trends through digital platforms has cultivated a more fashion-aware consumer base. This has led to a surge in demand for designer footwear, with consumers seeking styles that reflect current trends and personal identity.

- Expansion of E-commerce and Online Retail Platforms: The proliferation of online retail has made luxury footwear more accessible to a broader audience. E-commerce platforms offer extensive collections, competitive pricing, and the convenience of home delivery, contributing to increased sales. Notably, the online distribution channel is anticipated to witness significant growth in the coming years.

- Emphasis on Sustainability and Ethical Practices: A growing segment of consumers prioritizes sustainability and ethical production in their purchasing decisions. Luxury brands that adopt eco-friendly materials and transparent manufacturing processes are more likely to attract and retain customers. For instance, brands like Stella McCartney have introduced footwear lines made from vegan materials and recycled content, aligning with environmentally conscious consumers.

- Influence of Celebrity Endorsements and Collaborations: Partnerships between luxury footwear brands and celebrities or influencers have a notable impact on consumer behavior. These collaborations amplify brand visibility and appeal, particularly among younger demographics, fostering increased demand. For example, in April 2019, Giorgio Armani announced Wu Muye, an international piano artist, as its brand ambassador for Greater China and the Asia Pacific, aiming to enhance brand recognition in the region

Major Challenges

- Economic Uncertainties Affecting Consumer Spending: Economic downturns lead to reduced discretionary spending, impacting the demand for luxury footwear. For instance, during the global financial crisis, luxury goods sales, including high-end footwear, experienced a noticeable decline.

- Prevalence of Counterfeit Products: The market is significantly affected by counterfeit luxury footwear, which undermines brand reputation and results in revenue losses. The Organisation for Economic Co-operation and Development (OECD) reports that counterfeit goods account for approximately 3.3% of global trade, with luxury items being a substantial portion.

- Rapidly Changing Fashion Trends: The swift evolution of fashion trends poses a challenge for luxury footwear brands to keep their offerings current. Failure to adapt can lead to decreased consumer interest and obsolete inventory.

- Heightened Competition from Emerging Brands: The rise of new luxury footwear brands increases market competition, compelling established companies to innovate more rapidly and engage in strategic pricing. This intensified competition can erode market share and profit margins.

- Growing Consumer Demand for Sustainability: An increasing number of consumers prioritize sustainability and ethical production practices. Brands that do not align with these values may face reduced demand, as shoppers opt for products that reflect their environmental and ethical concerns.

Top Opportunities

- Expansion into Emerging Markets: Regions such as Asia-Pacific and the Middle East are experiencing economic growth and a rise in affluent consumers, leading to increased demand for luxury footwear. For example, the Asia-Pacific luxury footwear market is anticipated to witness significant growth, driven by countries like China and India.

- Adoption of E-commerce Platforms: The proliferation of online retail has made luxury footwear more accessible to a global audience. Brands that enhance their online presence can tap into new customer segments. Notably, the online distribution channel is expected to witness significant growth in the coming years.

- Emphasis on Sustainability and Ethical Production: Consumers are increasingly prioritizing eco-friendly and ethically produced footwear. Brands that incorporate sustainable practices and materials can attract and retain environmentally conscious customers. For instance, Stella McCartney has introduced footwear lines made from vegan materials and recycled content, aligning with environmentally conscious consumers.

- Influence of Celebrity Endorsements and Collaborations: Partnerships between luxury footwear brands and celebrities or influencers can significantly boost brand visibility and appeal, particularly among younger demographics. For example, in April 2019, Giorgio Armani announced Wu Muye, an international piano artist, as its brand ambassador for Greater China and the Asia Pacific, aiming to enhance brand recognition in the region.

- Customization and Personalization: Offering personalized and customized luxury footwear experiences can attract a niche segment of affluent consumers seeking exclusivity. Brands that provide bespoke services can cater to individual preferences, enhancing customer satisfaction and loyalty.

Key Player Analysis

- Kering: A leading global luxury group, Kering manages renowned fashion houses including Gucci, Saint Laurent, and Bottega Veneta. In the first half of 2024, Kering reported revenues of €10.1 billion, reflecting a 9% growth compared to the same period in 2023.

- Burberry: Established in the UK, Burberry is famed for its iconic trench coats and distinctive patterns. The company has been focusing on expanding its footwear segment, contributing to its overall revenue of £3.1 billion in the fiscal year 2023.

- Capri Holdings Limited: This global fashion luxury group owns brands such as Versace, Jimmy Choo, and Michael Kors. In August 2023, Tapestry, Inc. announced plans to acquire Capri Holdings for $8.5 billion, aiming to enhance its presence in the luxury goods market.

- NIKE, Inc.: Primarily known for athletic wear, Nike has been increasingly focusing on the luxury segment through collaborations and limited-edition releases. In 2023, Nike reported revenues of $46.7 billion, with its luxury segment showing promising growth.

- Jimmy Choo PLC: Renowned for its high-end footwear, Jimmy Choo is a prominent player in the luxury shoe market. The brand continues to maintain its reputation for quality and style, contributing significantly to the luxury footwear sector.

Recent Developments

- In 2024, Jacquemus introduced the ‘double-heel sandal,’ marking one of the most unexpected trends of the Spring/Summer runway season. Known as ‘Les Doubles Sandals,’ these heels come in elegant black and white versions, capturing the attention of fashion enthusiasts. Priced at $1,060 (approximately ₹87,990), they are available for purchase on the brand’s official website.

- In 2024, Sara Blakely, the entrepreneur behind Spanx, ventured into footwear with the launch of Sneex, a luxury hybrid combining elements of a sneaker and a high heel. These innovative shoes range from $395 to $595, blending style and comfort to create a new category of footwear.

- In 2024, American Exchange Group, a prominent player in accessories design and brand development, acquired Island Surf Company, a footwear brand recognized for its coastal-inspired designs. This acquisition aligns with American Exchange Group’s strategy to expand its presence in the lifestyle footwear market.

- In 2023, OOFOS, a leading brand in Active Recovery footwear, completed a growth investment round led by professional athletes Derek Carr, Alex Smith, and basketball coach Dawn Staley. As Carr transitioned from the Las Vegas Raiders to the New Orleans Saints, this investment underscores the athletes’ ongoing confidence in OOFOS’ market leadership.

- In 2023, Arezzo & Co, a Brazilian footwear giant, acquired a 65% stake in the Italian brand Paris Texas for 130 million reais ($25 million). Arezzo & Co plans to inject an additional $10 million into the brand, enhancing its global reach. Founders Annamaria Brivio and Massimo Baltimora will retain a 35% stake, continuing to lead the brand’s operations with strategic backing from Arezzo & Co.

Conclusion

The women’s luxury footwear market is positioned for steady growth over the coming decade, driven by evolving consumer preferences, increased disposable incomes, and expanding digital sales channels. Demand is rising for both classic and innovative designs, particularly among younger, fashion-forward consumers who value sustainability and exclusivity. As brands invest in sustainable practices, e-commerce expansion, and personalized experiences, they are poised to capture a wider market share. However, the market will also face challenges like counterfeiting, rapidly changing trends, and economic fluctuations. Overall, the sector is expected to see growth through strategic adaptation to consumer needs and emerging global opportunities.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)