Table of Contents

Introduction

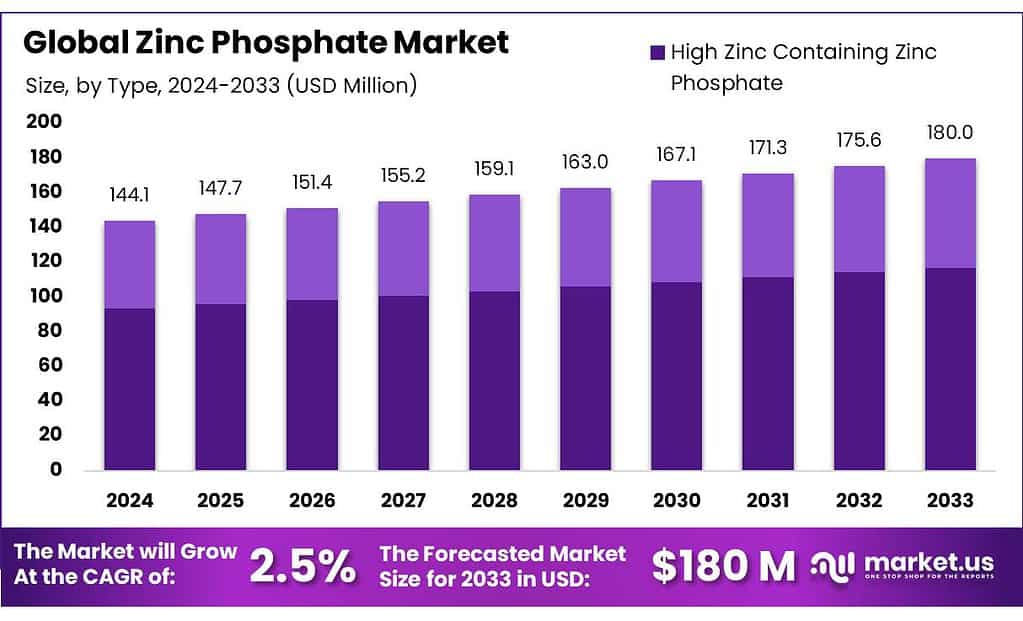

The global zinc phosphate market, valued at USD 144.1 billion in 2023, is anticipated to expand to approximately USD 180.0 billion by 2033, progressing at a compound annual growth rate (CAGR) of 2.5% over the forecast period. This growth can primarily be attributed to the increasing demand for zinc phosphate in corrosion-resistant coatings and paints across various industries, including automotive and construction.

However, the market faces challenges such as stringent environmental regulations regarding the use of phosphates and the availability of substitute compounds. Recent developments in the market include advancements in formulation techniques that enhance the performance characteristics of zinc phosphate coatings, allowing for broader applications. These factors collectively influence the market dynamics, presenting both opportunities and hurdles for stakeholders in the industry.

BASF SE has strengthened its position in the market through strategic partnerships aimed at expanding its specialty chemicals portfolio, which includes zinc phosphate. In 2021, BASF announced an increase in production capabilities at its facility in Germany, enhancing its supply chain efficiency and ability to meet growing global demand.

Delaphos has been at the forefront of innovation within the zinc phosphate market. In 2022, the company launched a new environmentally friendly zinc phosphate coating solution aimed at reducing hazardous by-products. This product has been particularly well-received in the European market, where environmental regulations are stringent.

Ferro Corporation recently completed a merger with a leading coatings manufacturer in Asia, significantly boosting its market share and distribution network in the region. This merger, finalized in 2023, not only expanded Ferro’s product offerings but also its geographical footprint, enabling better access to emerging markets in Asia-Pacific.

Hanchang Industries, based in South Korea, received substantial funding in 2024 to enhance its R&D capabilities. The investment, amounting to $50 million, is targeted toward developing advanced zinc phosphate coatings that provide superior corrosion resistance for industrial applications.

Henkel Corporation has launched a series of new products in the zinc phosphate market, focusing on sustainability and performance. In 2023, Henkel introduced a water-based zinc phosphate primer that significantly reduces VOC emissions during application, aligning with global trends toward sustainable manufacturing practices.

Key Takeaways

- Market Growth: The zinc Phosphate market is expected to reach USD 180.0 billion by 2033 from USD 144.1 billion in 2023, growing at 2.5% CAGR.

- By Type: High Zinc Containing Zinc Phosphate holds over 65.3% market share due to superior corrosion resistance properties.

- By Form: Powder form captures more than 77.3% market share in 2023, valued for ease of handling and application.

- By End-Use Industry: Used extensively in automotive 28.4% market share, aerospace, and marine sectors for corrosion protection.

- APAC leads with a 35% market share in 2023, valued at USD 50.4 million, driven by rapid industrialization.

Zinc Phosphate Properties and Synthesis

- The primers were investigated using the gasometric technique in 5 °C steps of temperature increase from 25 to 50 °C in 1.0 M HCl as corrodent. The PEP of 34.24 percent actives compared with PCP of 56.35 percent actives gave the same inhibition efficiencies of 82.4%.

- The fine crystalline salt layer produced from heavy metal phosphates consists of 95-98% secondary and tertiary water-insoluble zinc or manganese phosphates and 2-5% iron phosphates.

- The corrosion resistance of the coating was evaluated using polarization curves and electrochemical impedance spectroscopy in an aerated 3.5% NaCl solution.

- In the framework of this dissertation, a microwave-assisted synthesis strategy for the production of zinc oxide nanoparticles, at the lower end of the nanoscale, is presented. The radius of these spherical particles can be adjusted by choosing a reaction temperature between 125 °C and 200 °C in the range of 2.6 nm to 3.8 nm.

- In the 1.0 mol% Tb2O3 doped sodium zinc phosphate glass, the 5D4->7F5 green transition exhibits gain linewidth and optical gain values larger than those reported in other phosphate glasses doped with the same terbium content.

Zinc Phosphate Optical and Thermal Characteristics

- The terbium singly doped glass tonality shifts from green to bluish-white and greenish-white by decreasing the Tb2O3 content from 2.0-2.5 mol% to 0.5-1.0 mol% under 350 nm excitation. A 574 nm yellow tonality, close to the warm-white one of 3564 K, is attained in the co-doped glass, wherein the europium emission is sensitized through the terbium excitation at 340 nm.

- Zinc Phosphate Formula has a molecular weight of 386.11 g/mol.

- The zinc Phosphate Formula has a density of 3.998 g/cm³.

- 900°C is the melting temperature of the Zinc Phosphate Formula.

- The TL spectra for both the glow peaks of Zinc phosphate indicated an emission band in the region around 560 nm, while for Zinc phosphide the emission occurred at 575 nm (in the temperature region 200–270°C).

Emerging Trends

- Eco-friendly Solutions: There is a growing shift towards environmentally sustainable practices within the industry. Companies are increasingly developing zinc phosphate coatings that are low in volatile organic compounds (VOCs) and free of heavy metals. These products aim to meet stricter environmental regulations and cater to the rising consumer demand for ‘greener’ alternatives.

- Advanced Application Techniques: Innovations in application technologies are enhancing the efficiency and effectiveness of zinc phosphate coatings. For example, the introduction of nano-zinc phosphate coatings provides better corrosion resistance and adhesion, which is particularly beneficial for the automotive and aerospace sectors.

- Increased Use in Agriculture: Zinc phosphate is gaining popularity in agricultural applications, particularly as a nutrient source in fertilizers. The micronutrient properties of zinc phosphate help improve crop yield and quality, aligning with the global focus on increasing agricultural productivity sustainably.

- Integration with Other Materials: There is a trend towards the integration of zinc phosphate with other materials to create hybrid coatings. These coatings combine the protective properties of zinc phosphate with the aesthetic or functional benefits of other materials, offering customized solutions across various industries.

- Growth in Emerging Markets: The demand for zinc phosphate is rapidly expanding in emerging markets, particularly in Asia and Africa, where industrial and agricultural development is surging. This demand is propelled by infrastructural growth, increasing automotive production, and agricultural modernization in these regions.

Use Cases

- Corrosion Resistance Coatings: Zinc phosphate is extensively used in the production of corrosion-resistant coatings. These coatings are crucial for protecting metal surfaces in the automotive, marine, and aerospace industries. The global corrosion protection coatings market, which includes zinc phosphate coatings, is projected to reach a market size of over USD 30 billion by 2025, emphasizing the critical role of zinc phosphate in extending the lifespan of metal structures and components.

- Metal Pretreatment: Before painting, metals are often treated with zinc phosphate to enhance paint adhesion and longevity. This pretreatment process is standard in manufacturing sectors that require high-quality paint finishes, such as automotive and home appliances. The pretreatment chemicals market, with zinc phosphate as a key component, has been growing steadily, driven by stringent quality standards in these industries.

- Agricultural Applications: In agriculture, zinc phosphate is utilized as a source of zinc in animal feed and crop fertilizers. Zinc is a vital nutrient that promotes healthy growth in animals and plants. The global market for zinc in agriculture is anticipated to grow, reflecting an increasing emphasis on nutritional supplements to boost agricultural productivity.

- Dental Cement: In the dental industry, zinc phosphate is used to manufacture dental cement. These cements are employed for permanent dental restorations, such as crowns and bridges. The dental cement market is expected to expand, driven by the growing demand for dental procedures and the ongoing advancements in dental materials.

- Pharmaceuticals: Zinc phosphate also finds applications in the pharmaceutical sector. It is used as an excipient in the formulation of certain drugs, where it facilitates drug delivery and stability. The excipients market size is forecasted to grow, indicating a positive outlook for materials like zinc phosphate that play a supportive role in drug formulations.

Major Challenges

- Environmental Regulations: The use of phosphates, including zinc phosphate, is increasingly regulated due to environmental concerns. Stringent regulations in regions like Europe and North America aim to reduce water pollution caused by phosphates. These regulations force manufacturers to adapt their formulations or face restricted market access, impacting production costs and operational flexibility.

- Competition from Alternatives: Zinc phosphate faces competition from newer, more environmentally friendly alternatives that offer similar or superior properties. For instance, non-phosphate corrosion inhibitors are gaining traction due to their lower environmental impact. The market for these alternatives is growing at a CAGR of approximately 4%, slightly higher than that of traditional phosphate-based products, indicating a shift in industry preferences.

- Volatility in Raw Material Prices: The cost of raw materials required for producing zinc phosphate, such as zinc and phosphoric acid, is subject to global market fluctuations. For example, zinc prices have seen volatility, with changes ranging from $2,200 to $2,800 per metric ton within the past year due to varying supply and demand dynamics. This volatility can affect the pricing and profitability of zinc phosphate products.

- Technical Challenges in Application: While zinc phosphate coatings are valued for their corrosion resistance, achieving uniform coating thickness and adherence to complex geometries can be technically challenging. This can lead to increased costs and production times, particularly in high-precision industries like aerospace and automotive.

- Health and Safety Concerns: The handling and use of zinc phosphate must comply with health and safety regulations, which can impose additional operational burdens. Exposure to zinc phosphate can pose health risks, necessitating stringent handling, storage, and disposal measures. Ensuring compliance with these regulations adds to the operational cost and complexity for companies involved in its production and use.

Market Growth Opportunities

- Expansion in Emerging Markets: As industrial activities expand in emerging economies, the demand for corrosion-resistant coatings and metal treatments is rising. Countries in Asia-Pacific, such as China and India, are experiencing rapid industrialization and urbanization, driving demand for durable infrastructure and automobiles. The Asian corrosion protection coatings market is projected to grow at a CAGR of over 3.5% through the next decade, presenting a significant opportunity for zinc phosphate-based products.

- Innovations in Product Formulation: There is a continuous need for coatings and treatments that are both effective and environmentally friendly. Innovations that can improve the eco profile of zinc phosphate products while maintaining or enhancing performance can capture market share from traditional chemical treatments. For instance, the development of low-VOC and heavy metal-free zinc phosphate coatings could meet stricter environmental standards and appeal to a broader customer base.

- Diversification into Non-Traditional Applications: Zinc phosphate’s properties can be leveraged in non-traditional sectors such as renewable energy, particularly in solar and wind farms where metal structures require protection from harsh environmental conditions. As the global renewable energy market is expected to grow from $928 billion in 2021 to over $1.5 trillion by 2025, the demand for protective coatings in this sector provides a lucrative avenue for growth.

- Partnerships and Collaborations: Forming strategic partnerships with local distributors and firms in high-growth regions can help manufacturers of zinc phosphate tap into local markets more effectively. Additionally, collaborations with research institutions for product innovation can lead to the development of advanced, application-specific zinc phosphate formulations, creating new market segments.

- Regulatory Compliance as a Competitive Advantage: Companies that proactively adapt their products to meet the latest regulatory standards can gain a competitive edge. By aligning products with international safety and environmental regulations, companies can not only secure their market position but also establish their brands as leaders in sustainable practices.

Key Players Analysis

BASF SE engages significantly in the zinc phosphate sector through its Coatings division, particularly under the Chemetall brand. The company’s Gardo®Flex technology, used in applications like the automotive industry at Renault Trucks, exemplifies BASF’s commitment to innovative, cost-effective, and environmentally friendly corrosion protection solutions. This technology enhances the efficiency and longevity of coatings by operating at lower temperatures and extending bath service life.

Delaphos, a prominent producer of Zinc Phosphate in the UK, specializes in high-purity, cost-effective anti-corrosive pigments primarily used in paint and coatings for the automotive, agriculture, marine, and construction industries. Their products, including various hydrated forms like Delaphos 2 and Delaphos 4, are integral to enhancing the durability and lifespan of metallic goods by inhibiting corrosion. Delaphos maintains its competitive edge by ensuring global distribution and compliance with industry standards like BS5193.

Hanchang Industries, established in 1985 in South Korea, specializes in the production of zinc phosphate, among other chemical products. Their zinc phosphate is noted for high quality, complying with ISO standards, and is a key product in their portfolio, catering primarily to the corrosion control and coatings industry.

Ferro Corporation engages in the Zinc Phosphate market, primarily focusing on producing anti-corrosive pigments. These pigments are crucial for enhancing corrosion resistance, widely utilized in the coatings industry for metal protection. Ferro’s involvement underlines its strategic commitment to delivering high-performance materials for diverse manufacturing needs.

Henkel Corporation actively utilizes a tri-cationic pretreatment process involving zinc, nickel, and manganese for zinc phosphate coatings, enhancing corrosion protection and paint adhesion on diverse metal substrates including steel and aluminum.

Heubach GmbH is a key player in the Zinc Phosphate sector, known for producing Zinc Phosphate ZP 10, a white anti-corrosive pigment designed for protective coatings. This product is lauded for its easy dispersibility, low solubility, and compatibility with both solvent-based and water-based resins, making it versatile for various primer applications. Heubach’s innovations also extend to HEUCOPHOS® ZCP-PLUS, enhancing protective properties in modern resin systems at lower dosages, showcasing the company’s commitment to advancing corrosion protection technologies.

Jiangsu Shenlong Zinc Industry Co., Ltd. is a prominent player in the Zinc Phosphate market, specializing in the production of environmentally friendly zinc products including zinc phosphate. Their products are used in various applications such as ship and container coatings, contributing to their reputation as a key supplier in the industry.

Kunyuan Chemical, a significant player in the zinc phosphate market, has been recognized for its comprehensive product offerings and services. The company’s production metrics between 2019 and 2024 reflect steady growth, highlighting its competitive edge in the sector. With a focus on enhancing rust resistance through robust production capabilities, Kunyuan Chemical stands out for its strategic market presence and technological expertise.

Numinor engages in the production of zinc phosphate, focusing on delivering high-quality products for various industrial applications. Their production strategies from 2019 to 2024 indicate a stable increase in output and market share, positioning Numinor as a robust competitor in the industry.

Nelson Chemicals, established in 1996, has emerged as a leading provider of Zinc Phosphate and other anti-corrosive pigments. Their products are integral to industries like marine, automotive, and construction due to their superior anti-corrosion properties. Nelson’s diverse range includes various formulations of Zinc Phosphate designed to enhance the performance and sustainability of protective coatings, highlighting their commitment to innovation and environmental standards.

Mamta Industries, based in Vapi, Gujarat, manufactures high-quality Zinc Phosphate primarily used as an anti-corrosive pigment in various industrial applications, including anti-corrosive primer paint systems. Established in 2004, the company leverages its expertise to meet diverse customer needs with its range of protective Zinc Phosphate products, securing its reputation for reliability in the sector.

Nubiola, now operating under the Ferro brand, specializes in producing a diverse range of inorganic pigments, including advanced zinc phosphate-based anti-corrosive pigments like Nubirox 106. This product is noted for its ultra-fine, molybdate-modified composition, which ensures cost-effective efficiency and robust performance in both water and solvent-based systems. Nubiola’s expertise extends over a century, solidifying its position as a global leader in pigment technology and corrosion inhibition solutions.

Jiangsu Shenlong Zinc Industry Co., Ltd., founded in 1996 and located in Dainan, China, is a prominent manufacturer specializing in zinc products. The company produces a variety of zinc-based products including environmentally friendly ultrafine zinc powder, zinc oxide, and zinc phosphate. Shenlong Zinc Industry’s zinc phosphate is particularly noted for its excellent anti-rust properties and water resistance, making it suitable for a range of applications from protective coatings for ships and automobiles to industrial machinery and household appliances. The company adheres to rigorous environmental and quality standards, holding multiple ISO certifications.

SNCZ is a leading producer of corrosion inhibiting Zinc Phosphate pigments, offering products like Zinc Phosphate PZ20 and PZW2, suitable for various applications including DIY and more demanding uses like coil coating. Their products are recognized for their stability, low tinting strength, and compatibility with a range of solvent and water-based resins, making them essential for enhancing corrosion resistance in multiple industrial applications.

Société Nouvelle des Couleurs Zinciques (SNCZ) specializes in the development and manufacturing of anti-corrosive pigments, including zinc phosphate, which are integral in coatings for markets like construction, automotive, and aerospace. Their advanced pigments are crafted to enhance the durability of metal products and are distributed worldwide through a robust network, making SNCZ a notable entity in the corrosion prevention industry.

Vanchem Performance Chemicals excels in the production of Zinc Phosphate through its proprietary FOSTEX ZN, a non-metallic zinc phosphate conversion coating. This product is primarily utilized in high-corrosion environments like automotive and military sectors, ensuring optimal paint adhesion and corrosion resistance. Vanchem’s zinc phosphate coatings, known for their stability and durability, make them a preferred choice for industries requiring robust metal finishes.

VB Technochemicals, established in 2010 in Switzerland, specializes in the production of Zinc Phosphate under their “M Family” product line. Their zinc phosphate is a chrome-free, zinc oxide-free orthophosphate tetrahydrate, noted for its lack of soluble salts that could negatively impact anti-corrosive performance. This formulation enhances its stability in various resin systems, making it highly suitable for protective, industrial, marine, and automotive coatings. VB Technochemicals positions itself as a provider of advanced, environmentally considerate chemical solutions across multiple sectors.

Shijiazhuang Xinsheng Chemical Co., Ltd., established in 1993, is a prominent manufacturer in the chemical industry specializing in zinc phosphate products. Known for its high-quality anti-corrosive pigments, Xinsheng Chemical caters to a variety of industries requiring durable and effective corrosion protection, such as automotive, shipping, and rail. The company’s zinc phosphate offerings are integral to anti-corrosive paint formulations, ensuring superior performance and longevity of metal surfaces under harsh environmental conditions.

WPC Technology offers innovative corrosion inhibitive pigments like Wayncor™ 222 and Wayncor™ 224, which are primarily utilized in protective coatings systems. These pigments are valued for their compatibility with a wide range of resin systems and are considered economical alternatives to traditional zinc phosphate, boasting effective performance across diverse applications, including automotive and industrial coatings.

Conclusion

The zinc phosphate market is positioned for steady growth, driven by its critical role in providing corrosion resistance across various industries. Despite facing challenges such as stringent environmental regulations and competition from alternatives, expansion opportunities remain robust, particularly in emerging markets and through technological innovations in product formulations.

By adapting to regulatory demands and exploring new applications in sectors like renewable energy, companies can navigate the complexities of the market and capitalize on growth prospects. As the industry continues to evolve, those who invest in sustainability and innovation are likely to lead the market, ensuring long-term success in the global zinc phosphate landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)